Published on March 14th, 2023 by Aristofanis Papadatos

BSR Real Estate Investment Trust (BSRTF) has three appealing investment characteristics:

#1: It is a REIT so it has a favorable tax structure and pays out the majority of its earnings as dividends.

Related: List of publicly traded REITs

#2: It is offering an above average dividend yield of 3.9%.

#3: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

BSR Real Estate Investment Trust’s trifecta of favorable tax status as a REIT, an above average yield, and a monthly dividend make it appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about BSR Real Estate Investment Trust.

Business Overview

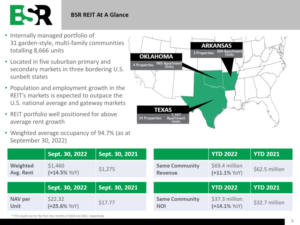

BSR Real Estate Investment Trust is an internally managed, open-ended real estate investment trust that owns a portfolio of 31 multifamily garden-style residential properties located in attractive primary and secondary markets in the Sunbelt region of the U.S. Its residential properties have 8,666 units in total. The REIT was founded in 1956 and became focused on multifamily housing in 1991.

Source: Investor Presentation

Sunbelt markets have enjoyed superior population growth and economic growth for decades and are likely to continue growing much faster than the rest of the country. As a result, BSR REIT is ideally positioned to enjoy above average rent growth in the upcoming years.

BSR REIT has high-quality residential properties that are affordable and thus it enjoys strong demand for its properties throughout all the phases of the economic cycle. In addition, its properties require lower maintenance expenses than typical urban properties.

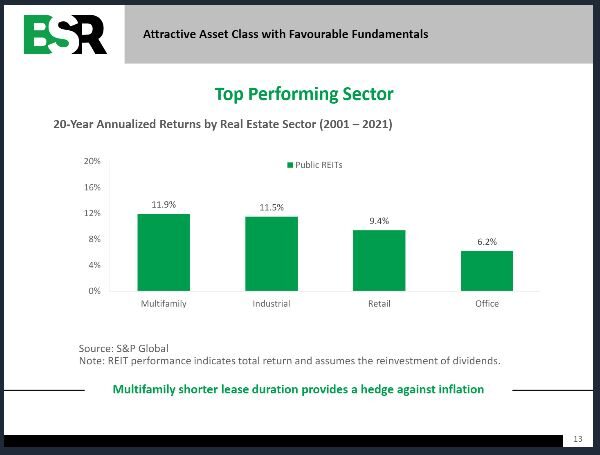

Moreover, multifamily REITs have outperformed most other categories of REITs over the last two decades.

Source: Investor Presentation

As shown in the above chart, multifamily REITs have outperformed retail REITs and office REITs by an impressive margin over the last 20 years. The outperformance has resulted primarily from much less competition in this business as well as strong demand for multifamily housing.

BSR REIT enjoys strong business momentum right now. In the fourth quarter of 2022, its occupancy rate remained flat at 96.0%, but the REIT grew its same-community net operating income by 11.7% over the prior year’s quarter, primarily thanks to material rent hikes. Rental rates for new leases grew 2.1% while rental rates for renewals grew 11.9%, for a total blended increase of 6.0%. As a result, the REIT grew its funds from operations (FFO) per unit 21%, from $0.19 to $0.23. It also posted record FFO per unit of $0.86 in the full year.

Growth Prospects

Millennials have exhibited a greater propensity to rent, as they pursue a more flexible lifestyle. As millennials comprise about 25% of the population in the core markets of BSR REIT, the REIT enjoys strong demand for its properties and has ample room for future growth.

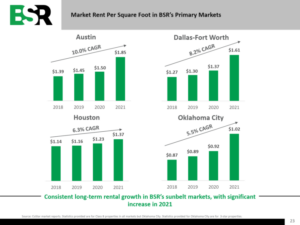

BSR REIT also greatly benefits from the superior population growth and economic growth experienced in Sunbelt markets.

Source: Investor Presentation

Thanks to this characteristic of its core markets, the REIT has been able to enjoy strong rent growth year after year.

It is also worth noting that BSR REIT divested 39 non-core properties during 2019-2021 for total proceeds of $760.5 million. The company thus reduced the average age of its properties from 29 years to 11 years and hence it drastically reduced its capital expenses.

During the last three years, BSR REIT has exhibited a somewhat volatile business performance, primarily due to the pandemic. Nevertheless, it has grown its adjusted FFO per unit by 7.7% per year on average over this period. Thanks to the promising growth prospects of BSR REIT, we expect 5.0% average annual growth of FFO per unit over the next five years.

Dividend & Valuation Analysis

In contrast to many REITs, which cut their dividends in 2020-2021 due to the coronavirus crisis, BSR REIT proved resilient to that downturn thanks to its robust business model. The REIT incurred just a 12.5% decrease in its FFO per unit in 2020 while it kept its dividend flat. Even better, it has now fully recovered from the pandemic.

BSR REIT has a short dividend record, as it initiated a dividend only in 2018. The stock is currently offering a 3.9% dividend yield. Thanks to its solid business model, its healthy payout ratio of 65% and its interest coverage of 3.7, the trust is not likely to cut its dividend.

On the other hand, due to the aggressive interest rate hikes implemented by the Fed in response to high inflation, interest expense is likely to rise significantly in the upcoming years. This is a headwind for the vast majority of REITs, including BSR REIT.

BSR REIT has a somewhat weak balance sheet, as its net debt of $1.07 billion is 142% of the market capitalization of the stock. Therefore, if high inflation persists for much longer than currently anticipated, high interest rates will probably take their toll on the results of BSR REIT.

In reference to the valuation, BSR REIT is currently trading for 16.0 times its adjusted FFO per unit in the last 12 months. Given the somewhat volatile and relatively short performance record of the trust, we assume a fair price-to-FFO ratio of 14.0 for the stock. Therefore, the current FFO multiple is higher than our assumed fair price-to-FFO ratio. If the stock trades at its fair valuation level in five years, it will incur a -3.7% annualized drag in its returns.

Taking into account the 5% annual FFO-per-share growth, the 3.9% dividend and a -3.7% annualized contraction of valuation level, BSR REIT could offer just a 4.8% average annual total return over the next five years. This is a lackluster expected return and hence investors should wait for a more opportune entry point.

Final Thoughts

BSR REIT has the advantage of owning multifamily properties in Sunbelt markets, which are characterized by superior economic growth and strong demand for this type of properties. The REIT also proved fairly resilient throughout the coronavirus crisis, defending its dividend, in sharp contrast to many other REITs. As the stock is also offering a 3.9% dividend yield with a healthy payout ratio of 65%, it is an attractive candidate for the portfolios of income-oriented investors.

On the other hand, investors should be aware that BSR REIT is not a high-growth REIT and hence it is prudent to try to have a wide margin of safety in reference to the valuation of the stock. BSR REIT appears almost fairly valued right now. Therefore, investors should wait for a meaningful correction of the stock, towards $11, before purchasing the stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].