Published on April 7th, 2023 by Aristofanis Papadatos

Bridgemarq Real Estate Services (BREUF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 9.6% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render Bridgemarq Real Estate Services appealing to income-oriented investors. In addition, the company has a strong business model, with most of its revenues being recurring in nature. In this article, we will discuss the prospects of Bridgemarq Real Estate Services.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Business Overview

Bridgemarq Real Estate Services provides various services to residential real estate brokers and REALTORS in Canada. It offers information, tools, and services that assist its customers in the delivery of real estate services. The company provides its services under the Royal LePage, Via Capitale, and Johnston and Daniel brand names. The company was formerly known as Brookfield Real Estate Services and changed its name to Bridgemarq Real Estate Services in 2019. Bridgemarq Real Estate Services was founded in 2010 and is headquartered in Toronto, Canada.

Bridgemarq generates cash flow from fixed and variable franchise fees from a national network of nearly 21,000 REALTORS operating under the aforementioned brand names. Approximately 81% of the franchise fees are fixed in nature, and thus they result in fairly predictable and reliable cash flows. Franchise fee revenues are protected via long-term contracts.

Bridgemarq has a solid business relationship with its partners, and thus it enjoys remarkably high renewal rates. The company has historically achieved a 98% renewal rate whenever a contract has expired.

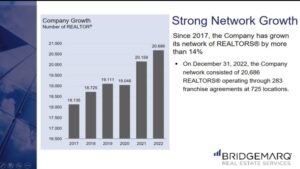

Source: Investor Presentation

Moreover, the franchise agreements of Royal LePage, which comprise 94% of the REALTORS of the company, are 10-20 year contracts, and hence they provide great cash flow visibility.

Bridgemarq has a dominant business position in Canada. To be sure, through its immense network of REALTORS, the company participated in 72% of the total home resales that took place in Canada in 2022. The brands of Bridgemarq attract franchisees thanks to their reputation and the technological advantages they provide to them.

Despite its strong business model, Bridgemarq was severely hurt by the fierce recession caused by the coronavirus crisis in 2020. The real estate market of Canada faced an unprecedented downturn that year. Consequently, the company saw its earnings per share plunge 47%, from $0.34 in 2019 to $0.18 in 2020.

However, the recession proved short-lived thanks to the immense fiscal stimulus packages offered by the Canadian government and the massive distribution of vaccines. As a result, Bridgemarq recovered strongly from the pandemic in 2021.

In 2022, Bridgemarq grew the number of REALTORS from 20,159 in 2021 to 20,686. However, the revenue of the company slipped 0.6% over the prior year, as a weaker real estate market offset the growth in the number of REALTORS. As a result, distributable cash flow per share dipped by 4% but still marked one of the best years in the history of the company.

Growth Prospects

Bridgemarq pursues growth by continuously increasing the number of its partners.

Source: Investor Presentation

Since 2017, the company has grown the number of REALTORS by more than 14%. As a result, it now has 20,686 partners operating through 283 franchise agreements at 725 locations.

As mentioned about, the vast majority of the franchise fees of Bridgemarq are fixed, and hence they render the cash flows of the company fairly predictable. However, this is easier said than done.

Bridgemarq has exhibited a somewhat volatile performance record over the last nine years due to the experienced volatility in the conditions of the real estate market as well as the swings of the exchange rate between the Canadian dollar and the USD. Nevertheless, the company has been able to more than double its adjusted earnings per share, from $0.35 in 2013 to $0.92 in 2022.

Given the strong business position of Bridgemarq, its long-term performance record, and some growth limitations due to the company’s size, we expect approximately 4.0% average annual growth of earnings per share over the next five years.

Dividend & Valuation Analysis

Bridgemarq is offering an exceptionally high dividend yield of 9.6%, six times the 1.6% yield of the S&P 500. The stock is thus an interesting candidate for income-oriented investors but U.S. investors should be aware that the dividend they receive is affected by the prevailing exchange rate between the Canadian dollar and the USD.

Bridgemarq has a payout ratio of 61% and has a healthy balance sheet. Its interest expense consumes 32% of its operating income, while its net debt is $80 million, which is just 60% of the stock’s market capitalization. Overall, the dividend of the company is not likely to be reduced significantly in the absence of a severe recession.

On the other hand, investors should be aware that the dividend has remained essentially flat over the last nine years. It is thus prudent not to expect meaningful dividend growth going forward.

In reference to the valuation, Bridgemarq is currently trading for 12.0 times its earnings per share in the last 12 months. We assume a fair price-to-earnings ratio of 14.0 for the stock. Therefore, the current earnings multiple is lower than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will enjoy a 3.1% annualized gain in its returns.

Taking into account the 4.0% annual growth of earnings per share, the 9.6% dividend yield and a 3.1% annualized expansion of valuation level, Bridgemarq could offer a 13.5% average annual total return over the next five years. This is an attractive expected total return and hence we advise investors to consider buying the stock around its current price.

Final Thoughts

Bridgemarq has a dominant position in its business and enjoys fairly reliable cash flows thanks to the recurring nature of most of its fees. It is also offering an exceptionally high dividend yield of 9.6%, with a decent payout ratio of 61%. As the company also has a healthy balance sheet, it is attractive for income-oriented investors.

Moreover, Bridgemarq seems attractively valued right now, as it has an expected 5-year annual total return of 13.5%. The cheap valuation of the stock has resulted primarily from a deceleration in the business momentum lately but we expect the company to return to growth mode in the upcoming years thanks to its consistent record of growing the number of its partners. Therefore, investors should take advantage of the cheap valuation of Bridgemarq and wait patiently for business momentum to accelerate again.

On the other hand, Bridgemarq is characterized by extremely low trading volume. This means that it may be hard to establish or sell a large position in this stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].