Published on April 1st, 2023 by Nikolaos Sismanis

Boston Pizza Royalties Income Fund (BPZZF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 8.1% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all 86 monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render Boston Pizza Royalties Income Fund could be appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Boston Pizza Royalties Income Fund.

Business Overview

Boston Pizza Royalties Income Fund is an open-ended royalty trust whose sole purpose is to receive royalties from Boston Pizza restaurants and distribute them to unitholders in the form of monthly distributions. The fund generates revenue through indirect ownership of trademarks used by Boston Pizza International Inc. This ownership grants the trust a 4% royalty on the gross revenue generated by the Boston Pizza restaurants in the royalty pool.

Additionally, the trust enjoys a 1.5% distribution income based on its ownership stake, linked once more to the top-line sales of the royalty pool participants.

Since the fund’s inflows depend on each restaurant’s gross sales, it is not impacted by the fluctuations in the bottom line of these restaurants or other intermediaries. Essentially, the fund plays no part in the day-to-day running of each restaurant. This translates to two significant advantages.

First, the fund can act as an excellent inflation hedge, benefiting from increased revenue as Boston Pizza restaurants raise their prices over time, irrespective of any impact on each location’s profitability.

Second, the fund’s royalty revenues primarily end up in its bottom line, with only minor expenses associated with its administration. The fund does not make any investments and has zero non-essential expenses that could affect its net income and, thus, unitholder distributions.

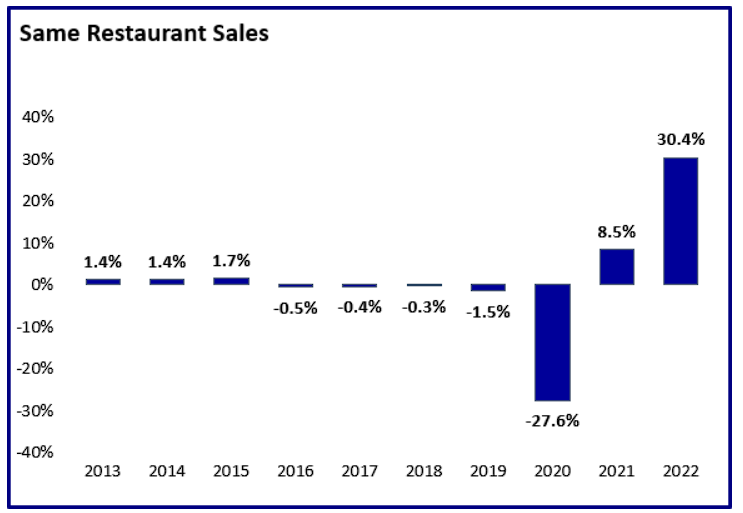

At the end of 2022, the fund had 377 restaurants in its royalty pool, six less than at the end of 2021. Despite the slightly lower restaurant count, same-restaurant sales rose by 30.4% compared to the previous year due to increases in restaurant guest traffic as a result of the easing and eliminating of dining restrictions.

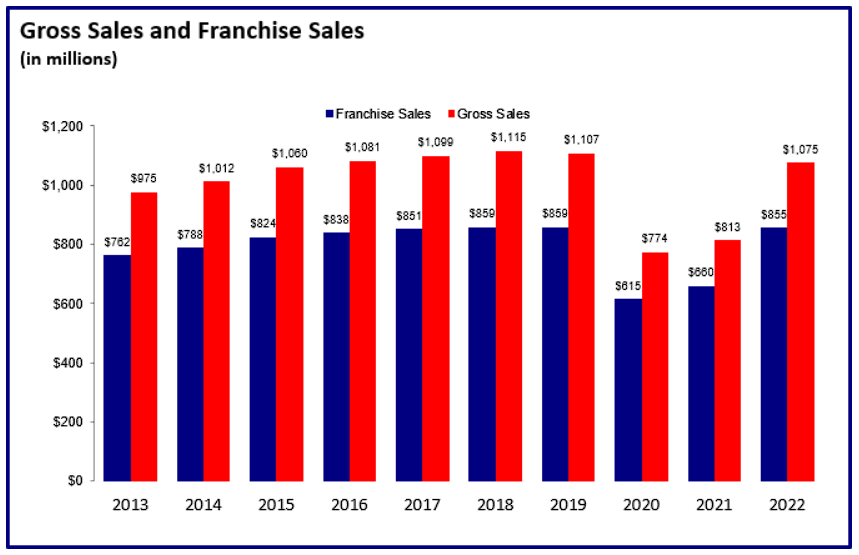

Increased average guest cheques (or tickets) also boosted same-restaurant sales. Thus, in total, Boston Pizza restaurants (franchisee sales) came in at C$855 million, up 29.5% compared to 2021. In line with the fund’s royalty model, it recorded total revenue of C$45.5 million, also roughly 29.5% higher compared to 2021.

Growth Prospects

Due to the nature of its structure, Boston Pizza Royalty Income Fund’s growth prospects are solely determined by two factors. The first is the number of franchised restaurants in its royalty pool, while the other is the rate at which same-restaurant-sales grow.

Regarding the number of restaurants, it has been on a continuous decline since 2018, when the total number of Boston Pizza restaurants peaked at 396. The declining number of restaurants can be attributed to some locations being unprofitable for franchises, as well as the COVID-19 pandemic, which notably impacted all franchises during 2020 and 2021.

While no new restaurant opened in 2022, as of February 8, 2023, BP Canada LP had received seven deposits for new Boston Pizza Restaurants in Western Canada, two deposits for new Boston Pizza Restaurants in Eastern Canada, and two deposits for new Boston Pizza Restaurants in Québec. Thus, the trust royalty pool is likely to increase this year, reversing its multi-year shrinking trend.

Source: Investor Relations

Regarding the second factor, Boston Pizza’s same-restaurant sales have rebounded significantly following their slump in the midst of the COVID-19 pandemic. A notable factor that could keep boosting same-restaurant sales moving forward is Boston Pizza’s inexpensive offerings, which are likely to experience increased demand as consumers opt for more affordable food during an uncertain or recessionary environment.

Source: Investor Relations

Overall, despite the declining number of Boston Pizza restaurants, the n0table increase in same-store sales resulted in near-record franchise sales in 2022, which, as mentioned earlier, came in at C$855 million.

Source: Investor Relations

Dividend Analysis

Over the years, Boston Pizza Royalty Income Fund has averaged a 100% payout ratio, essentially distributing the entirety of its net income to unitholders, in line with its purpose. In 2022, the fund’s payout ratio was 99.4%, paying out C$1.182 in distributions per unit out of the C$1.189 in distributable cash per unit.

Investors should not expect distribution increases or distribution “cuts” but instead expect that each year’s total distributions per unit will vary based on the underlying sales of Boston Pizza franchisees.

Barring unforeseen events like the COVID-19 pandemic, investors can generally expect a stable distribution level year-over-year. This is because Boston Pizza restaurants tend to generate steady sales annually, and the fund does not incur any non-essential expenses that could impact net income and ultimately affect the level of payouts.

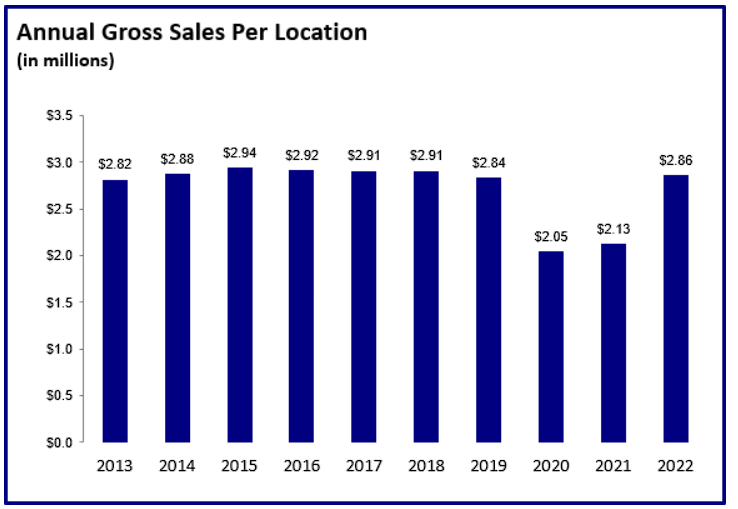

As you can see, annual gross sales per Boston Pizza location tend to be incredibly stable under normal circumstances. The notable decline in 2020 and 2021 was due to severe lockdowns, which is an extreme event. And yet, sales quickly normalized once lockdowns came to an end.

Source: Investor Relations

Additionally, management attempts to distribute available funds equally each quarter to ensure more consistent monthly payouts.

The current monthly distribution of C$0.102 translates to an annualized rate of C$1.224 (or $0.90), implying a yield of 8.1%.

Final Thoughts

Boston Pizza Royalty Income Fund is a unique investment vehicle. Its frictionless revenue model and purpose of distributing the entirety of its earnings, along with the highly attractive frequency of its monthly payouts, make it a highly enticing pick for income-oriented investors.

The 8.1% is not entirely reliable in the sense that extraordinary events could affect the revenues of Boston Royalty Franchisees, along with the fund’s cash flows. That said, excluding such severe events, investors should expect hefty distribution levels and, thus, very high yields, albeit minor variations between quarters.

Finally, we believe the trust could perform very well and continue to distribute substantially during a recession, as consumers are likely to favor its affordable menu. This was demonstrated during the Great Financial Crisis when the fund’s annual distribution levels remained rock-solid.

Overall, we believe that Boston Pizza Royalty Income Fund can be a fitting pick for income investors seeking substantial yields and a lack of correlation with the broader market’s performance.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].