Updated on February 21st, 2023 by Samuel Smith

ARMOUR Residential REIT Inc. (ARR) is a mortgage Real Estate Investment Trust (mREIT) that offers an appealing 16.4% dividend yield, making it a high dividend stock.

ARMOUR Residential also pays its dividends on a monthly basis, which is rare as the vast majority of companies that pay a dividend, pay them quarterly or semi-annually.

There are currently only 50 monthly dividend stocks in our coverage universe. You can download our full list of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

ARMOUR Residential’s high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payments have been declining over the years.

As with many high-dividend stocks yielding over 10%, the sustainability of the dividend is in question. This article will analyze the investment prospects of ARMOUR Residential.

Business Overview

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae, Freddie Mac. It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

It also includes unsecured notes and bonds issued by the GSE and the United States treasuries, money market instruments, as well as non-GSE or government agency-backed securities.

The mortgage REIT was founded in 2008 and is based in Vero Beach, Florida. It seeks to create shareholder value through careful investment and risk management practices that produce current yield and superior risk-adjusted returns over the long term.

With a market cap of approximately $1.1 billion and ~$107.6 million in annual revenue, it is a significant national player in residential investment.

Source: Investor presentation

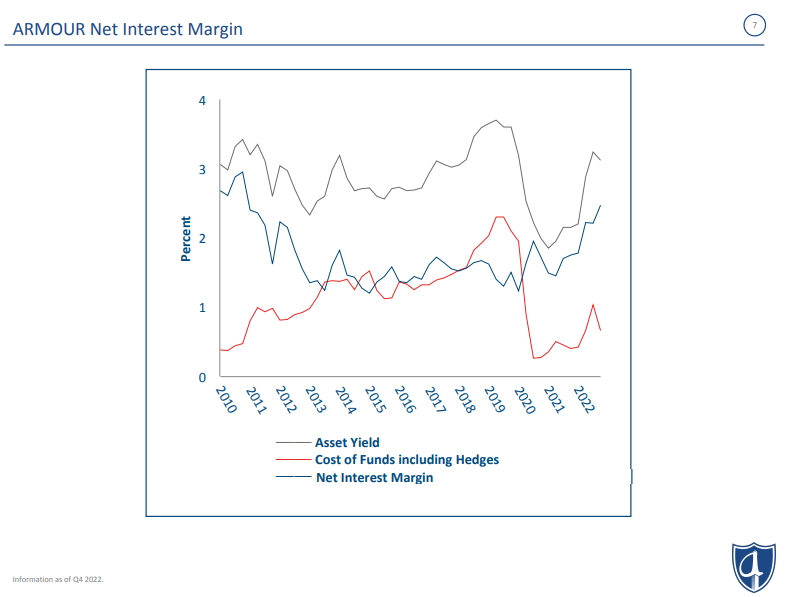

The trust makes money by raising capital through issuing debt as well as preferred and common equity and then reinvesting the proceeds into higher-yielding debt instruments.

The spread (i.e., the difference between the cost of capital and the return on capital) is then largely returned to common shareholders via dividend payments, though the trust often retains a little bit of the profits to reinvest in the business.

Growth Prospects

Recent results at ARMOUR have been mixed. The trust was severely impacted by the COVID-19 pandemic, but was able to meet all of its margin calls and it maintained access to repurchase financing.

ARMOUR reported 2022 fourth-quarter results on February 15th, 2023. Comprehensive income available to common stockholders was $39.5 million or $0.27 per common share. Net interest income was $11.6 million and net interest margin was 2.59%, up 38 basis points from the prior quarter.

Distributable Earnings available to common stockholders was $38.8 million, which represents $0.27 per common share. ARR paid common stock dividends of $0.10 per share per month and raised $174.2 million of capital by issuing 30,721,405 shares of common stock at $5.67 net proceeds per share, after fees and expenses, through an at the market offering program. The REIT repurchased 449,700 shares of common stock, at an average cost of $5.01 per share, pursuant to existing authorization.

Book value per common share was $5.78. Liquidity, including cash and unencumbered agency and U.S. government securities, was $689.2 million. Its portfolio composition was 100.0% Agency mortgage-backed securities (“MBS”), net of To Be Announced (“TBA”) Security short positions. The debt-to-equity ratio was 5.8 to 1 (based on repurchase agreements divided by total stockholders’ equity). Leverage, net of TBA Security short positions, was 6.5 to 1. Implied leverage, adjusted for forward settling sales and unsettled purchases, was 6.8 to 1. Interest Rate swap contracts totaled $6.4 billion of notional amount, representing 87% of total repurchase agreement and TBA Securities liabilities.

Source: Investor Presentation

ARMOUR’s cash flow has been volatile since its inception in 2008, but this is to be expected with all mREITs. Of late, declining spreads have hurt earnings while the economic disruption caused by the coronavirus outbreak disrupted the business model, leading to a sharp decline in cash flow per share, as well as a steep dividend cut. Fortunately, ARMOUR is now seeing a measure of recovery, and should continue to see that recovery manifest itself in the coming quarters and years. Moving forward, we expect the company to grow slowly, though it will likely take a long time for them to rebuild to previous levels of book value and earnings power.

Risk Considerations

While there have certainly been some positive developments at work for ARMOUR, there are still several risks to be concerned about. ARMOUR’s quality metrics have been volatile given the performance of the trust as rates have moved around over the years. Gross margins have moved down since short–term rates began to rise meaningfully a couple of years ago, although it appears most of that damage has been done.

Balance sheet leverage had been moving down slightly, but it saw an uptick again this past quarter. However, we do not forecast a significant movement in either direction from this point. Interest coverage has declined with spreads but also appears to have stabilized, so we are somewhat optimistic moving forward while keeping in mind the significant potential for volatility.

ARMOUR was facing headwinds from the coronavirus outbreak and an overall economic downturn. As a result, a steep dividend cut was necessary to preserve the balance sheet and allow the REIT to reposition itself for survival and future growth.

At the current level, the annualized dividend payout of $1.20 per share will represent more than all of the company’s EPS (we estimate 2023 EPS of $1.12), resulting in a payout ratio over 100%. This is a red flag that the dividend could be at risk of a further reduction if EPS were to fall or stay at this level for too long.

As an example, if the economy were to go into recession, mortgage defaults could surge, leading to steep losses. With the uncertain macroeconomic outlook, this risk is relevant for investors.

Final Thoughts

ARMOUR Residential’s high dividend yield and monthly dividend payments make it stand out to high-yield dividend investors. However, we remain cautious on the stock especially in light of the multiple dividend cuts in recent years.

While the trust is not able to cover its dividend currently, declining interest rates could continue to force the trust ever further out on the risk spectrum to maintain its cash flows as its older mortgages roll off the balance sheet. This sets it up for potentially steep losses if the economy were to slip into a recession.

Therefore, ARMOUR stock carries notably higher levels of risk. This makes the investment highly speculative right now, especially for risk-averse income investors such as retirees. As a result, we encourage risk-averse investors to look elsewhere for sustainable and growing income.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].