Up to date on April fifteenth, 2022 by Felix Martinez

Actual Property Funding Trusts, or REITs, are a core holding for a lot of earnings buyers attributable to their excessive dividend yields. The coronavirus pandemic was devastating for a lot of REITs. It particularly hit the hospitality {industry} exhausting, together with REITs in that {industry}.

Apple Hospitality REIT Inc. (APLE) is a REIT that pays a month-to-month dividend. Month-to-month dividend shares pay shareholders 12 dividends per yr as an alternative of the extra typical quarterly funds.

We created an inventory of fifty month-to-month dividend shares (together with necessary monetary metrics resembling dividend yields and payout ratios). You’ll be able to obtain the spreadsheet by clicking on the hyperlink beneath:

Apple Hospitality has a 3.4% dividend yield, which is decrease than many different REITs. However excessive high-yielders ought to usually be averted as a result of such high-yielding shares usually have unsustainable dividends.

Enterprise Overview

Apple Hospitality is an organization that owns one of many largest and most various portfolios of upscale, rooms-focused accommodations in america. Apple Hospitality’s portfolio consists of 219 accommodations with greater than 28,700 visitor rooms situated in 86 markets all through 36 states. Concentrated with industry-leading manufacturers, the corporate’s portfolio consists of 94 Marriott-branded accommodations, 119 Hilton-branded accommodations, 4 Hyatt-branded accommodations, and two impartial accommodations.

Supply: Investor Presentation

On February 22, 2022, the corporate reported fourth-quarter and full-year outcomes for the Fiscal Yr (FY)2021. Complete income for the quarter was $250.6 million in comparison with $133.9 million in 4Q2020, or 87.1%. For the quarter, the corporate reported a web earnings of $13.2 million in comparison with a lack of $51.2 million within the fourth quarter of 2020. This was pushed by a mixture of leisure and enterprise calls for, each transient and minor group bookings. Adjusted Resort EBITDA margin was 34% for the quarter, growing 40 foundation factors over the fourth quarter of 2019.

Complete bills had been up 31.8%. The rise in working bills was pushed by operations, lodge administration, and advertising which all three segments noticed nearly double the spending. Nonetheless, working earnings was constructive $28 million in comparison with a lack of $32.8 million in 4Q2020.

Adjusted EBITDA stood at $73.38 million, up considerably from $16.19 million within the year-ago interval. The typical each day charge rose to $131.04 from $97.87 year-over-year, and occupancy stood at 67.5%, up from 46.5% within the year-ago interval. That stated, income per accessible room surged significantly to $88.43 from $45.46 within the year-ago interval.

Supply: Investor Presentation

For the yr, the corporate elevated income from $601.9 million in 2020 to $933.9 million final yr, or 55.2%. Working bills elevated by 18.9% yr over yr. For the reason that firm had a a lot better yr for 2021 than in 2020, working earnings was constructive $87 million for the yr in comparison with a lack of $102 million.

Total, web earnings for the yr was a revenue of $18.8 million in comparison with a lack of $173 million in 2020. Thus, the corporate made Funds From Operation (FFO) of $0.93 per share for the yr, an enormous improve in comparison with what the corporate made in Fy2020. In 2020, the corporate made an FFO of $0.09 per share. Nonetheless, final yr’s FFO continues to be decrease than what the corporate earned in FY2019 when it did $1.63 per share in FFO.

The corporate additionally reinstated its month-to-month dividends for its shareholders, with a March cost of $0.05 per share. The corporate stays intently targeting maximizing long-term worth for its shareholders and is assured it’s well-positioned for extra upside as leisure journey continues to point out power and enterprise journey steadily recovers.

Thus, we anticipate the corporate to make an FFO of $1.38 per share for FY2022. This can symbolize a rise of 48.4% in comparison with 2021.

Development Prospects

Apple Hospitality’s progress prospects will largely come from a rise in rents. They had been additionally, promoting not-so-profitable properties to accumulate extra useful properties. For instance, in 2021, the corporate bought 23 accommodations for about $235 million and bought eight accommodations for roughly $361 million.

Different progress drivers will come from long-term value financial savings. The corporate has an expense discount ratio goal of 0.80 – 0.90. In FY2021, the corporate achieved 0.89. That is completed by a capability to extend the cross-utilization of managers and associates. Additionally, scaling to renegotiate vendor contracts and optimize labor administration software program already in place may help cut back general prices.

If the corporate can think about upscale, room-focused accommodations, it will permit the corporate to extend it’s per night time room charge. If that is executed accurately, extra location and market diversification ought to assist the corporate proceed to develop its FFO for years to come back. This may even permit the corporate to start out growing its dividend.

Dividend Evaluation

The corporate doesn’t have a protracted dividend historical past because it grew to become public in 2015. As talked about above, the corporate pays its dividend month-to-month, which is engaging to many income-looking buyers. In 2016, the corporate did improve its dividend considerably by 50%, from a $0.80 charge to a $1.20 charge. Nonetheless, within the following years, the dividend stayed at that very same charge till 2020, when the COVID-19 pandemic pressured the corporate to chop its dividend and freeze it to a $0.20 charge for the yr.

In 2021, the corporate reinitiated the dividend by paying it each quarter as an alternative of each month because it did earlier than. Nonetheless, beginning March 2022, the corporate is now paying its dividend month-to-month at $0.05 per share.

Concerning dividend security, let’s have a look at FFO and the Free Money Stream payout ratio. In 2021, the corporate’s FFO was $0.93 per share. The full dividend for the yr was $0.04. Thus, the dividend was very properly coved for 2021 with a payout ratio of 4.3%. For your entire yr of 2022, we anticipate the corporate to make an FFO of $1.38 per share. The corporate can pay out $0.50 per share in dividends for the yr, giving us a dividend payout ratio of 33.9%. So the corporate has loads of room to extend its dividend and supply a protected paying dividend.

If we have a look at FCF, the dividend payout ratio for 2021 was 5.3%. We anticipate that the corporate will earn an FCF of $1.26 per share for FY2022. This can give us a payout ratio of 39.7%. Total, the dividend is protected based mostly on the corporate’s FFO and FCF.

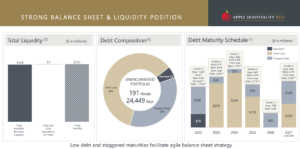

The corporate has a powerful stability sheet. Apple Hospitality has a debt to fairness ratio of 0.5, which is nice for a REIT. Curiosity protection of 1.3 is a little bit low however at a decent stage. The monetary leverage stage is 1.5, in step with the corporate’s previous 5 years. Thus, general the stability sheet is powerful and will give the corporate flexibility to proceed to pay its dividend if a recession hits.

Supply: Investor Presentation

Last Ideas

Apple Hospitality is without doubt one of the strongest gamers within the lodge sector attributable to its sturdy model energy, conservative stability sheet, and high-quality property. The corporate has the potential to start out growing its dividend for years to come back because the world is getting over the COVID-19 pandemic. The dividend payout ratios are low, and earnings are anticipated to develop 1.6% over the following 5 years.

Proper now, the inventory is overvalued. We would like an honest pullback the place we’ll see the dividend yield round 5%. At that time, the corporate can be very engaging to income-seeking buyers. Till then, the inventory earns a maintain at at this time’s costs.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].