Updated on February 24th, 2023 by Felix Martinez

Real Estate Investment Trusts, or REITs for short, are a core holding for many income investors due to their high dividend yields. The coronavirus pandemic was devastating for many REITs, but not all struggled in 2020. Agree Realty (ADC) sailed through 2020 with multiple dividend increases, and the company has returned to funds-from-operations growth in 2021 and beyond.

Agree Realty is also a rarity among REITs in that it pays a monthly dividend. Monthly dividend stocks pay shareholders 12 dividends per year instead of the more typical quarterly payments.

We created a list of 50 monthly dividend stocks (along with important financial metrics such as dividend yields and payout ratios). You can download the spreadsheet by clicking on the link below:

Agree Realty has a 3.9% dividend yield, which is lower than many other REITs. But extreme high-yielders should generally be avoided because such high-yielding stocks often have unsustainable dividends.

Agree Realty’s dividend yield is well above the S&P 500 average. And it has a high level of dividend safety, along with the potential for high dividend growth in the coming years.

Business Overview

Agree Realty is a retail Real Estate Investment Trust. As of December 31st, 2022, it owned and operated a portfolio of 1,839 properties located in 48 states covering approximately 38.1 million square feet of gross leasable area. As of the 2022 fourth quarter, the portfolio was about 99.7% leased and had a weighted average remaining lease term of approximately 8.8 years. The stock has a market capitalization above $6.6 billion.

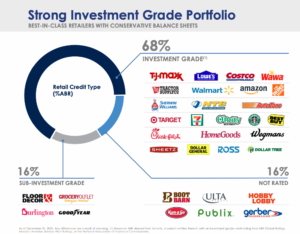

It has a diversified property portfolio, as its top 3 tenants comprise less than 16.2% of the annual base rent. Properties span a number of different industry groups, including grocery stores, home improvement retailers, auto service, and convenience stores.

Source: Investor Presentation

At the same time, Agree Realty has high-graded its portfolio by reducing its exposure to tenant groups most at risk from the current challenges, specifically the coronavirus pandemic. For example, Agree Realty derives just 2% of its annual base rent from health clubs and fitness centers and just 1% of ABR from movie theaters. In all, Agree Realty generates two-thirds of its ABR from investment-grade tenants.

This portfolio quality is reflected in the company’s strong fundamentals. Agree Realty continues to post impressive results in an extremely challenging period for many REITs, particularly those operating in the retail industry.

In the most recent quarter, adjusted Funds From Operation increased by 3.9% to $84.4 million. FFO-per-share increased 4.9% to $0.86 for the quarter, compared to last year’s quarter.

For the full year of 2022, Adjusted FFO increased 28.7% to $304 million, while on a per-share basis, adjusted FFO rose 9.1%. Per-share AFFO growth was much lower than overall AFFO growth due to the dilutive impact of share issuances. Still, the company has generated strong growth for 2022, even on a per-share basis.

Growth Prospects

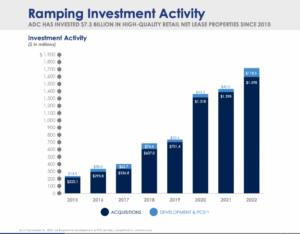

Agree Realty grew adjusted funds from operations by an average of just over 6% in the past five years. We estimate the trust can continue growing AFFO on average at the mid-point of 4.5% into 2028. We see Agree Realty being able to grow AFFO through its three-pronged growth strategy revolving around acquisitions, development, and partner capital solutions.

As Agree Realty continues to invest in new properties, future growth is likely. Agree Realty invested approximately $404.9 million in 131 retail net lease properties in the fourth quarter. Looking back further, it has invested over $5 billion in properties since 2015.

Source: Investor Presentation

The company recently raised its full-year acquisitions target to $1.1 billion-$1.3 billion. Rent increases will also provide FFO growth.

Agree Realty, like most REITs, is highly reliant on the solvency of its tenants, so any headwind or recession within the economy will directly affect it. To combat this, the corporation emphasizes a balanced portfolio with exposure to counter-cyclical sectors and retailers with solid credit profiles.

Additionally, they avoid retailers relying on private equity sponsors and prefer to partner with leading operators with strong balance sheets.

Dividend Analysis

Prior to 2021, Agree Realty had paid a quarterly dividend like the vast majority of dividend stocks. But in 2021, the company switched to the monthly dividend schedule.

Agree Realty currently pays a monthly dividend of $0.24 per share. On an annual basis, the $2.88 dividend payout represents a 3.9% current yield. Considering the S&P 500 Index currently yields just 1.7%, Agree Realty stock is an attractive option for income investors. And the company grows its dividend regularly. Agree Realty increased its dividend by approximately 6.8% per year in the past five years.

The dividend is also highly secure. Based on the expected AFFO of $3.95 in 2023, Agree Realty has a projected dividend payout ratio of 74.9% for the entire year. Agree Realty’s payout ratio has remained highly consistent in the last decade, around the mid–70s, and we see this has very slowly grown to nearly 80%. This is a healthy payout ratio for a REIT, which must pay out the majority of its earnings to shareholders.

The company operates a healthy balance sheet with a net debt-to-equity ratio of 0.5x, well below many other REITs. Keeping a manageable level of debt is very important for REITs to keep the cost of capital down. The company’s financial leverage ratio is also low at 1.6x. The company maintains investment-grade credit ratings of BBB.

Final Thoughts

Real Estate Investment Trusts are popular for their high dividend yields, but extreme high-yielders should be avoided. Investors should not ignore REITs with somewhat lower yields, as these REITs often have superior fundamentals. Agree Realty is an example of this; although it has a 3.9% yield that trails many other REITs, it makes up for this with a high dividend safety and growth rate.

As a result, we view it as a solid pick for income investors, particularly those interested in dividend growth.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].