Up to date on August nineteenth, 2022 by Bob Ciura

AGNC Funding Corp (AGNC) has a really excessive dividend yield of almost 11.5%, which is one thing this inventory is definitely recognized for. By way of dividend yield, AGNC is close to the highest of our listing of high-yield dividend shares.

As well as, AGNC pays its dividend every month, quite than on a quarterly or semi-annual foundation, as is the case with most dividend shares.

Month-to-month dividends give buyers the power to compound dividends even quicker. There will not be many month-to-month dividend shares, as the executive burden on the businesses paying the dividends is greater than paying quarterly, for instance.

Certainly, there are solely 49 shares that presently pay month-to-month dividends. You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yields and payout ratios) by clicking on the hyperlink under:

That mentioned, additionally it is necessary for buyers to evaluate the sustainability of such a excessive dividend yield, as yields in extra of 10% are generally an indication of basic challenges dealing with the enterprise. This text will focus on AGNC’s enterprise mannequin, and whether or not the inventory is interesting to earnings buyers.

Enterprise Overview

AGNC was based in 2008 and is an internally-managed REIT. Whereas most REITs personal bodily properties which can be leased to tenants, AGNC has a unique enterprise mannequin. It operates in a distinct segment of the REIT market: mortgage securities.

AGNC invests in company mortgage-backed securities. It generates earnings by accumulating curiosity on its invested belongings, minus borrowing prices. It additionally information good points or losses from its investments and hedging practices.

The belief employs important quantities of leverage to put money into these securities to be able to enhance its means to generate curiosity earnings. AGNC borrows totally on a collateralized foundation by means of securities structured as repurchase agreements.

The belief’s said objective is to construct worth by way of a mixture of month-to-month dividends and internet asset worth accretion. AGNC has performed nicely with its dividends over time, however internet asset worth creation has generally confirmed elusive.

Certainly, the belief has paid over $44 of whole dividends per share since its IPO; the share worth as we speak is simply over $12. That type of observe file is extraordinary and is why some buyers are drawn to the inventory.

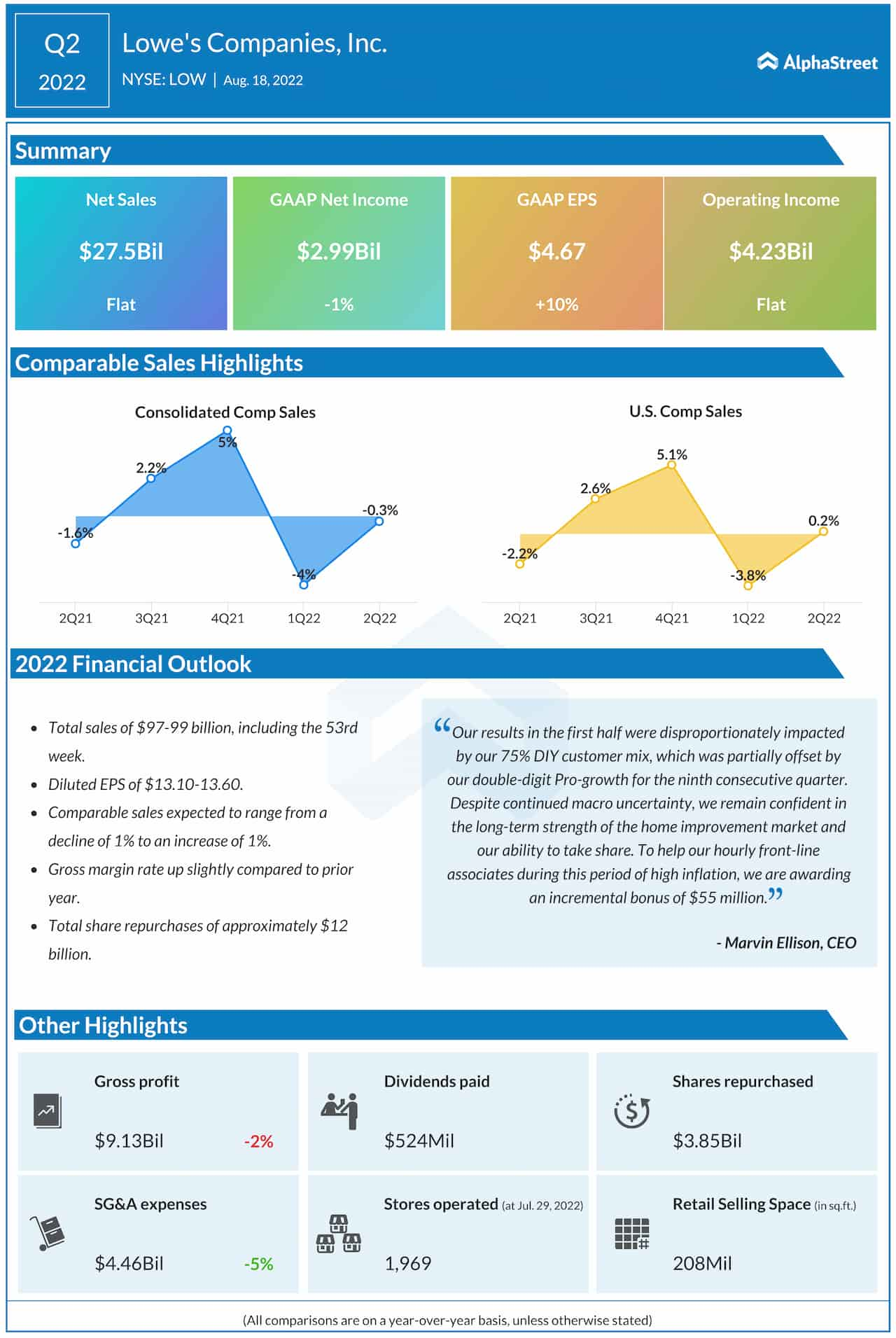

AGNC reported its Q2 2022 outcomes on July 25, 2022. Q2 internet unfold and greenback roll earnings per share stood at 83 cents, up from 72 cents sequentially. Tangible internet ebook worth stood at $11.43 as of June 30, 2022. Financial return on tangible frequent fairness stood at -10.1% in comparison with -14.4% sequentially. AGNC additionally reported a internet loss per frequent share of $(0.87). The corporate’s funding portfolio as of June 30, 2022, stood at $61.3 billion.

A extra detailed breakdown of AGNC’s second-quarter efficiency may be seen within the picture under:

Supply: Investor Presentation

Moreover, the belief at a median repurchase worth of $10.78 per share repurchased 4.7 million frequent shares. In the meantime, money and unencumbered company MBS amounted roughly $2.8 billion at quarter finish.

Development Prospects

The main downside to mortgage REITs is that the enterprise mannequin is negatively impacted by rising rates of interest. AGNC makes cash by borrowing at short-term charges, lending at long-term charges, and pocketing the distinction. To amplify returns, mortgage REITs are additionally extremely leveraged.

In a rising rate of interest setting, mortgage REITs sometimes see the worth of their investments decreased. And, greater charges normally trigger their curiosity margins to contract. This double-impact is what buyers skilled most just lately in 2018 when spreads contracted and ebook worth fell.

Nevertheless, as rates of interest as soon as once more fell beginning in 2019, AGNC noticed the profit as its spreads stabilized as nicely, permitting it to provide financial earnings.

Rates of interest are as soon as once more again on the rise, because the Federal Reserve has hiked charges a number of occasions in an try to scale back inflation.

Total, the excessive payout ratio and the risky nature of the enterprise mannequin will hurt earnings per share progress. We additionally imagine that dividfinish progress shall be anemic for the foreseeable future.

Dividend Evaluation

AGNC has declared month-to-month dividends of $0.12 per share since April 2020. This implies AGNC has an annualized payout of $1.44 per share, which equals a excessive present yield of 11.3% primarily based on the current share worth.

Supply: Investor Presentation

Excessive yields generally is a signal of elevated threat. And, AGNC’s dividend does carry important threat. AGNC has decreased its dividend a number of occasions over the previous decade, together with dividend cuts in 2020 and in 2021.

We don’t see a dividend minimize as an imminent threat at this level on condition that the payout was pretty just lately minimize to account for unfavorable rate of interest actions and that AGNC’s internet asset worth seems to have stabilized. Administration has taken the required steps to guard its curiosity earnings, so we don’t see one other dividend minimize within the close to time period.

Nevertheless, with any mortgage REIT, there may be at all times a major threat to the payout, and that’s one thing buyers ought to be mindful, significantly given the risky habits of rates of interest lately.

Remaining Ideas

Excessive-yield month-to-month dividend paying shares are extraordinarily engaging for earnings buyers, a minimum of on the floor. That is significantly true in an setting of low-interest charges. AGNC pays a hefty yield of almost 11.5% proper now, which could be very excessive.

We imagine the REIT’s excessive yield to be protected for the close to future, however that is hardly a low-risk scenario given the corporate’s enterprise mannequin and rate of interest sensitivity. Whereas AGNC ought to proceed to pay a dividend yield many occasions greater than the S&P 500 Index common, it’s not a beautiful possibility for risk-averse earnings buyers.

If you’re curious about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].