Michael Vi

With volatility raging in full force, it’s a great time for intrepid investors to be on the lookout for bargain deals as long as they can stomach some short-term volatility. In the tech space, many of the highest-quality SaaS companies have come under siege simply from investors de-risking out of their growth portfolios. But even in spite of tightening macro conditions, the drive to modernize systems and processes remains stronger than ever in the post-COVID world, and quarterly results are shining bright for many of these names.

MongoDB (NASDAQ:NASDAQ:MDB) is one such example. This noSQL database platform has continued to grow like a weed even at its >$1 billion annual revenue scale, reflecting the true largesse of its end-market. In spite of this, the stock has lost half of its value year to date, and the perennial question here is: is MongoDB ready to rebound, or is there further pain to be had?

For now, I’m staying neutral and on the sidelines on MongoDB. I view this company as a mixed bag: strong fundamental performance is on one side of this scale, while a still-rich valuation amid a cheapening tech landscape sits on the other.

Here are the positive drivers for MongoDB:

- Growth at scale. Very few companies that have reached a >$1 billion annual run rate are still growing revenue north of >50% y/y, and MongoDB is one of those few. That’s a testament to the all-encompassing, horizontal nature of MongoDB’s product. Almost all companies now have a use for managing unstructured data, and its technology is broadly applicable across a wide variety of use cases.

- Rich gross margin profile. MongoDB is not yet profitable on any metric – GAAP, pro forma, or cash flow. But its >70% gross margins give the company the elastic scalability that we look for in software investments. The company spends heavily to acquire customers, but once locked in, these high-margin recurring revenue contracts provide a steady stream of income for years to come, as opex naturally levers and generates economies of scale.

I’m still keeping close tabs, however, on MongoDB’s valuation. In spite of the stock’s year-to-date correction, it is still trading at rich multiples. At current share prices near $247, MongoDB trades at a market cap of $16.99 billion. After we net off the $1.79 billion of cash and $1.14 billion of debt from MongoDB’s latest balance sheet, the company’s resulting enterprise value is $16.33 billion.

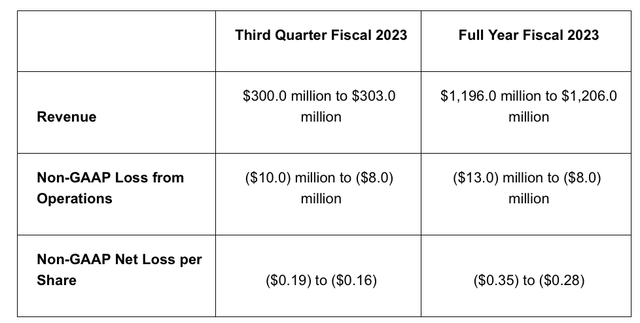

MongoDB outlook (MongoDB Q2 earnings release)

Meanwhile, as shown in the chart above, MongoDB is now guiding to $1.196-1.206 billion in revenue for FY23, representing 37-38% y/y growth (this was a “beat and raise” quarter for MongoDB – its prior outlook had been $1.172-1.192 billion, or roughly three growth points weaker at the midpoint).

And looking ahead to FY24, Wall Street analysts are banking on the company to generate $1.55 billion in revenue, or ~30% y/y growth (data from Yahoo Finance).

This puts MongoDB’s valuation multiples at:

- 13.6x EV/FY23 revenue

- 10.5x EV/FY24 revenue

I’m more comfortable diving into MongoDB at a 9x FY24 revenue multiple, which means I’m still holding out for a price target of $215.

The move here: keep watching this stock closely as it continues to waver, but don’t buy until it enters another major dip to the $215 range.

Q2 download

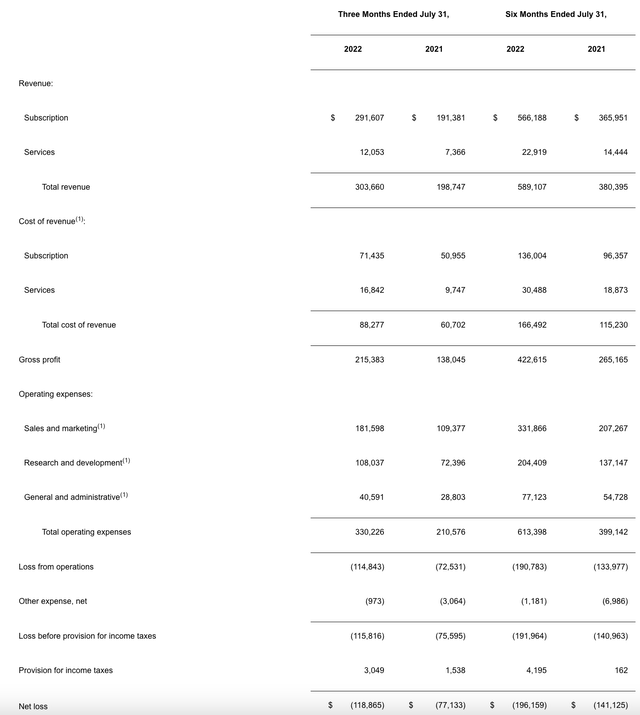

Let’s now go through MongoDB’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

MongoDB Q2 results (MongoDB Q2 earnings release)

MongoDB’s revenue grew 53% y/y to $303.7 million in the quarter, significantly outperforming Wall Street’s expectations of $282.3 million (+42% y/y) by a huge eleven-point margin. We note as well that with first-half revenue growth clocking in at 55% y/y, the company’s full-year outlook calling for just 37-38% y/y growth (and 30% y/y growth for FY24) may seem a bit conservative.

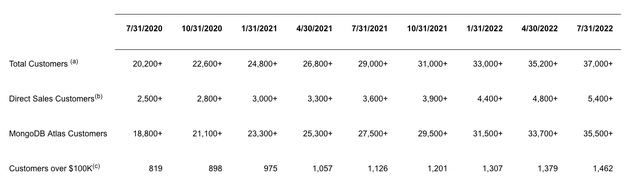

The company grew total customers in the quarter to 37k, driven, as has been over the past several years, by self-service Atlas customers. Equally important to note this quarter is that the count of customers now generating over >$100k in ARR grew by 83 sequentially to 1,462 customers, also up 30% y/y.

MongoDB customer trends (MongoDB Q2 earnings release)

Dev Ittycheria, the company’s CEO, noted on the Q2 earnings call that the macro picture has not at all changed the company’s pace of go-to-market execution:

Overall, we are pleased with our performance in execution in Q2 despite the challenging macro environment. Let me give you a bit more context on what we saw in Q2. The new business environment remains robust as evidenced by our record increase in direct sales customer account. We have seen no change in deal activity in sales cycles. We believe our strong new sales performance is a demonstration of the critical business value our developer data platform delivers and our superior go-to-market execution […]

Furthermore, expansion rates remain strong, further evidence that MongoDB is a non-discretionary spend for our customers.”

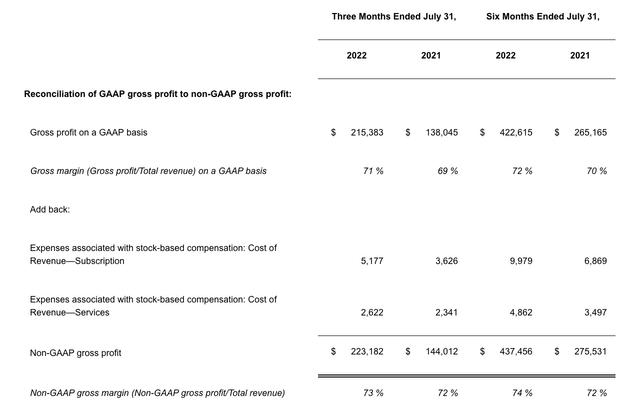

MongoDB gross margins (MongoDB Q2 earnings release)

As seen in the chart above, MongoDB also slightly improved pro forma gross margins by one point to 73%, driven by improved economies of scale in Atlas.

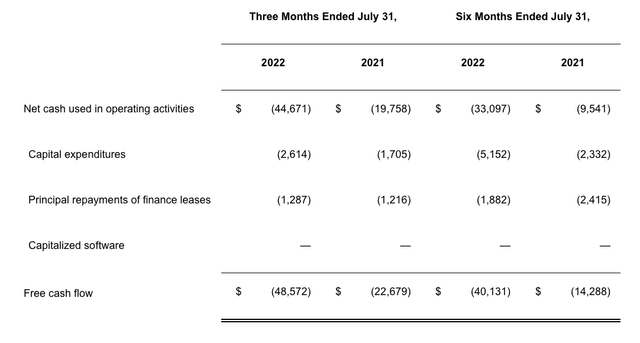

The one potential black eye is that free cash flow burn did widen to -$40.1 million in the first half of FY23, nearly 3x the burn rate in the prior-year first half.

MongoDB FCF (MongoDB Q2 earnings release)

We do note, however, that with $1.8 billion of cash and $0.7 billion of net cash on MongoDB’s books, the company remains well-capitalized to take it through its current hyper-growth phase and into a period where opex starts to scale and profitability begins to improve.

Key takeaways

From a quality standpoint alone, there’s no doubt that MongoDB remains one of the most powerful software stories in the sector. That comes at a price, of course, as MongoDB in spite of its recent correction has been one of the only software stocks to retain a double-digit valuation multiple. Keep a close eye on this stock and buy only on renewed volatility.