Taking financial and macroprudential coverage actions includes contemplating trade-offs. The selection is between supporting the financial system by making certain a clean provide of credit score at beneficial situations on the one hand, and containing monetary stability dangers on the opposite. There are additionally important spillovers between the 2 insurance policies since they’re each carried out and transmitted by way of the monetary system. Financial and macroprudential authorities have to take these interactions into consideration when deciding on interventions. Certainly, there are clear benefits of accounting for monetary stability concerns when taking financial coverage choices and limiting the constraints on the sensible implementation of macroprudential coverage.

Macroprudential coverage trade-offs

The target of macroprudential coverage is to scale back the probability of systemic monetary occasions, by limiting the build-up of monetary stability dangers and growing the resilience of the monetary sector. There’s now ample proof that macroprudential insurance policies can certainly be efficient in containing monetary stability dangers (e.g, Cerutti et al. 2018, Ampudia et al. 2021). However in evaluating macroprudential coverage effectiveness, comparatively little emphasis is placed on the potential prices required to decrease the dangers and due to this fact on the potential internet advantages.

Our latest analysis (Laeven et al. 2022), carried out throughout the ECB Analysis Process Pressure, on financial coverage, macroprudential coverage, and monetary stability sheds some gentle on the trade-offs concerned within the implementation of macroprudential measures between lowering systemic danger and supporting financial development. The aim of this column is to spotlight the principle takeaways from the Analysis Process Pressure.

Gadea Rivas et al. (2020) present that there’s a trade-off between the tempo of credit score development and the extent of danger related to it. Economies expertise recurrent expansions and recessions (see Determine 1). Credit score development impacts each the size of expansions (period) and the amplitude (severity) of recessions.1 Speedy credit score development tends to be adopted by deeper recessions, but it surely additionally has a direct constructive influence on the period of expansions and due to this fact on financial development. One of many findings of Gadea Rivas et al. (2020) is that there’s an optimum (intermediate) degree of credit score development that may steadiness the constructive and destructive results on financial development. Therefore, macroprudential insurance policies needs to be used appropriately to handle the steadiness between deeper recessions and longer-term advantages for financial development.

Determine 1 Macroprudential coverage and the enterprise cycle

Supply: Gadea Rivas et al. (2020).

Notice: The determine illustrates the everyday evolution of the financial system over two expansions and two recessions.

In an identical vein, Chavleishvili et al. (2021, 2021) develop a macro-financial stress check framework which can be utilized to evaluate when the online impact of macroprudential interventions is constructive. It accounts for interactions and non-linear results between monetary vulnerabilities, monetary stress, and GDP development.

The proof obtained strongly helps the necessity to appropriately calibrate macroprudential devices to make sure a wise steadiness between the short-term prices of macroprudential insurance policies and their long-term advantages.

Financial coverage trade-offs

Financial coverage measures additionally contain necessary trade-offs between supporting the intermediation capability of banks, and due to this fact making certain a clean transmission of financial coverage, on the one hand, and presumably growing their vulnerabilities on the opposite. The financial coverage stance impacts banks’ risk-taking, with accommodative financial coverage typically inducing extra risk-taking in monetary markets (see Albertazzi et al. 2020 for a assessment of the proof for the euro space). Latest proof on this relationship means that unconventional financial coverage devices, like asset purchases and destructive rates of interest, can have non-negligible uncomfortable side effects on monetary stability.

Low rates of interest typically encourage financial institution risk-taking, with destructive charges having a good stronger impact, which is extra pronounced for banks that rely extra closely on deposit funding (e.g. Ampudia and Van den Heuvel 2018, 2019, Bubeck et al. 2020, 2021, Heider et al. 2019, and Heider and Leonello 2021). Latest empirical proof in Mendicino et al. (2022) reveals that the pass-through of central financial institution coverage fee cuts to rates of interest on company loans is weaker for banks with a low preliminary degree of deposit charges. That is according to the proof in Bittner et al. (2022) of a weaker pass-through to banks’ funding prices and stronger risk-taking incentives when rates of interest on financial institution deposits are at low ranges.

In recent times, central banks have supplied massive quantities of liquidity to the banking sector. Central financial institution liquidity with longer maturities had a useful impact on financial institution lending, as a result of it lowered the funding uncertainty confronted by banks (e.g. Jasova et al. 2021). On the identical time, nevertheless, Jasova et al. (2022) present {that a} important share of the collateral that banks used to acquire central financial institution liquidity was securities issued by different banks. This elevated financial institution interconnectedness and systemic danger within the banking sector.2

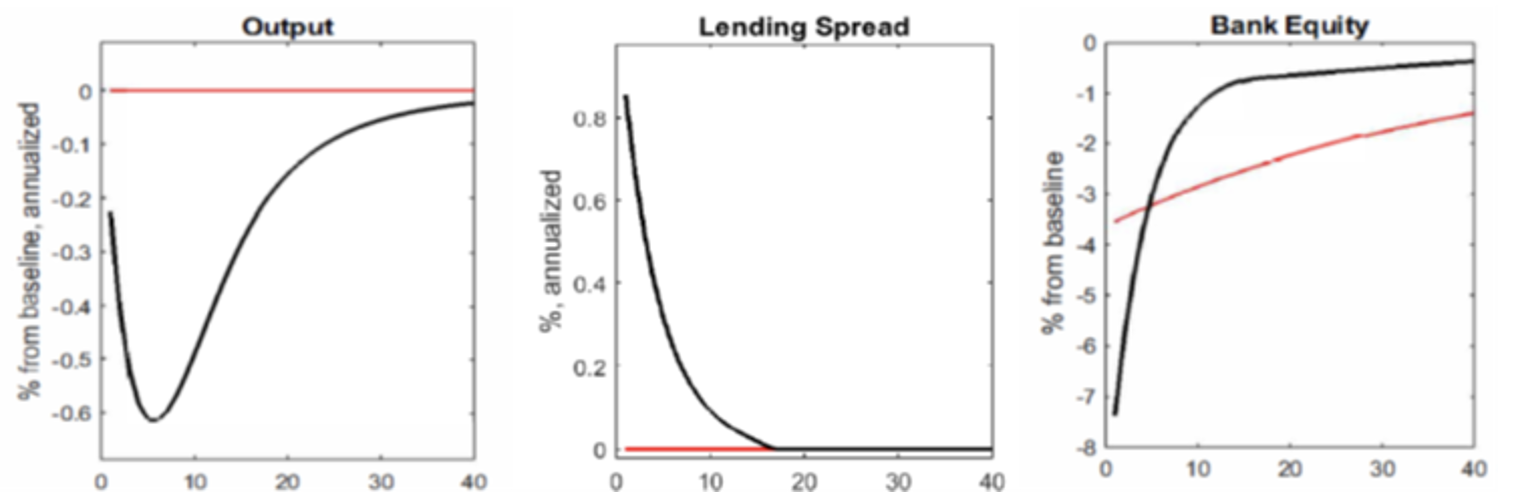

Central financial institution asset purchases can even have necessary penalties for financial institution vulnerability. Karadi and Nakov (2021) argue that asset purchases are efficient in stabilising financial institution lending and financial output in response to monetary shocks. On the identical time, nevertheless, they have an inclination to scale back financial institution profitability and thereby lengthen the time wanted for banks to recapitalise (see Determine 2). Due to this fact, the exit from asset buy programmes ought to ideally be gradual.

Determine 2 Central financial institution asset purchases in response to a monetary shock

Supply: Karadi and Nakov (2021).

Notice: The determine shows the response to a monetary shock with no asset buy coverage (black line) and with an optimum asset buy coverage (purple line). Financial institution fairness is measured at market worth.

The interplay between financial coverage and macroprudential coverage

Usually, the devices of financial coverage and macroprudential coverage each function by way of the monetary system. Due to this fact, there are probably massive interactions between the 2 insurance policies (see Martin et al. 2021 for a assessment of the literature). As an illustration, Van der Ghote (2021a) argues that (typical) financial coverage interventions and macroprudential coverage interventions can each assist to safeguard monetary stability. Nevertheless, macroprudential coverage is extra focused and due to this fact needs to be the primary line of defence towards the build-up of systemic monetary vulnerabilities.

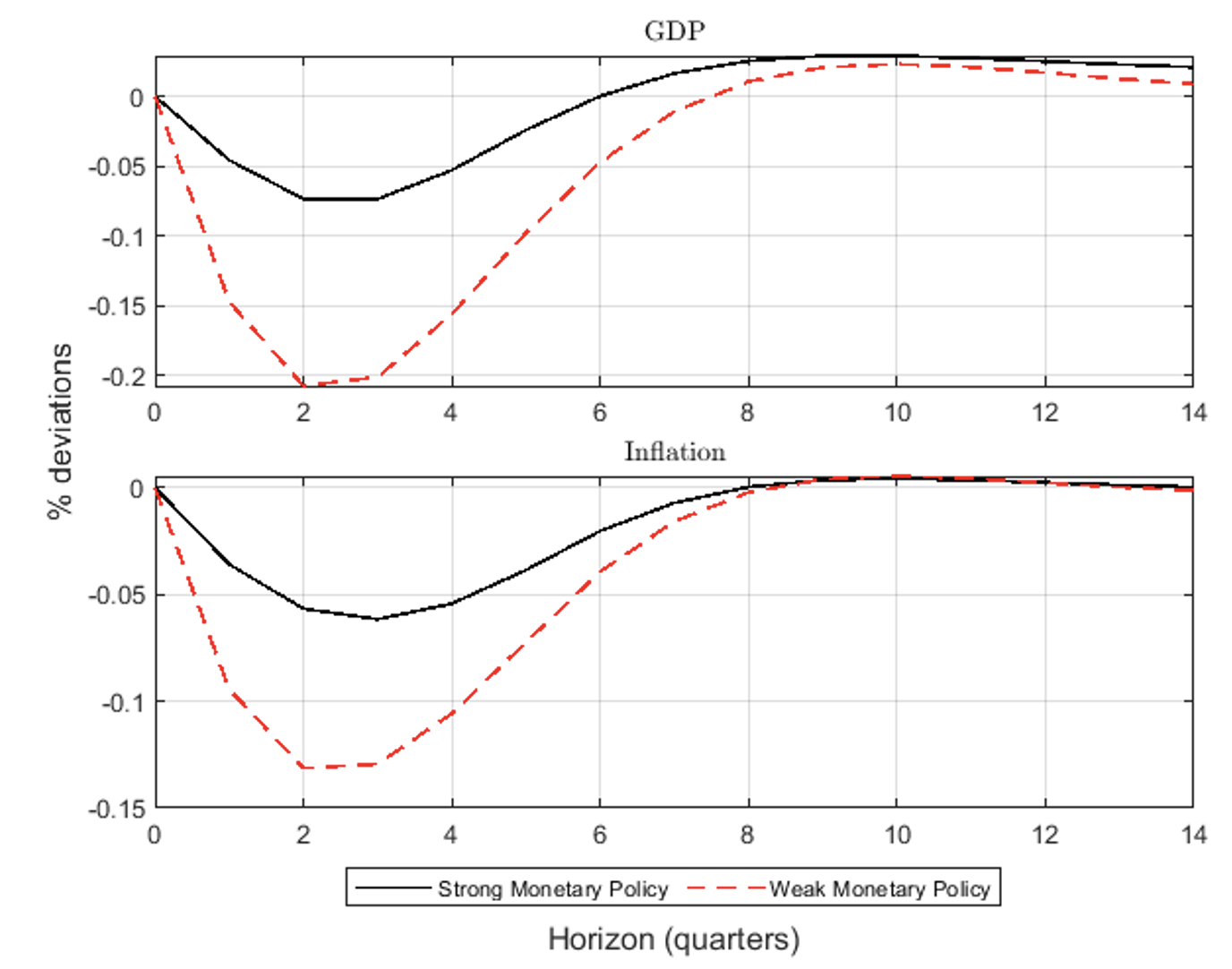

Financial coverage has an influence on the effectiveness of macroprudential coverage. Mendicino et al. (2020, 2021) argue that, whereas greater capital necessities enhance the steadiness of the banking sector and are due to this fact useful for the financial system in the long term, they will constrain credit score provision and restrict financial growth within the brief run. On this scenario, the diploma of financial coverage lodging is vital to clean the destructive results of tighter macroprudential coverage (see Determine 3). When the financial coverage stance is accommodative, capital necessities could be tightened extra with restricted short-run prices for the financial system. Then again, if lodging is someway constrained, for instance due to an efficient decrease certain on the extent of rates of interest (i.e. some extent at which it’s not possible to chop charges additional), the short-run prices of tighter macroprudential insurance policies could also be massive.3

Determine 3 The interplay of financial coverage and macroprudential coverage

Supply: Mendicino et al. (2020).

Notes: The graph shows the consequences of a 1 share level enhance in banks’ capital buffers over time. Accommodative financial coverage is proven by the black strong line, a constrained financial coverage is proven by the purple dashed line.

Macroprudential coverage can even have an effect on the transmission of financial coverage. In low rate of interest environments, by containing systemic danger in monetary markets, macroprudential coverage additionally boosts the pure rate of interest – the rate of interest that helps the financial system at full employment whereas holding inflation fixed – and therefore helps mitigate the depth of ‘liquidity traps’, which come up when money holdings are most well-liked to debt holdings (Van der Ghote 2020, 2021b). As well as, financial institution leverage and danger publicity have an effect on the sensitivity of banks to financial coverage shocks. When their leverage is greater and their property are riskier, banks’ internet value is extra delicate to financial coverage shocks. Conversely, greater capital necessities and a extra resilient banking system dampen the transmission of financial coverage (e.g. Cozzi et al. 2020).

The interplay of financial coverage and macroprudential coverage additionally impacts financial institution lending, leading to robust complementarity between the 2 insurance policies (Altavilla et al. 2020). The consequences of financial coverage easing on financial institution lending and risk-taking are better when macroprudential coverage is accommodative and are notably robust for much less capitalised banks.

General, financial and macroprudential insurance policies can’t be thought of in isolation, as their transmission channels give rise to important spillovers. The diploma of financial coverage lodging has an impact on the short-term influence of macroprudential coverage and due to this fact on the macroprudential coverage house. On the identical time, there’s proof of complementarity of insurance policies in response to a financial coverage easing.

Macroprudential coverage needs to be the primary line of defence towards the build-up of systemic monetary vulnerabilities (e.g. Van der Ghote 2021a). In observe, nevertheless, the activation of macroprudential measures – notably (presumably) unpopular borrower-based measures – might encounter obstacles and implementation lags. These measures are additionally geographically restricted – carried out on the nationwide degree – and goal a subsample of monetary intermediaries. This highlights the significance of lowering limits on the sensible implementation of macroprudential coverage.

Conclusion

Our latest analysis, developed throughout the ECB Analysis Process Pressure, on financial coverage, macroprudential coverage, and monetary stability reveals that financial and macroprudential authorities should take account of necessary trade-offs and interactions when deciding on coverage actions. Substantial progress has been made on growing sensible frameworks of research to evaluate the prices and advantages of macroprudential and financial coverage interventions. On the identical time, measuring excessiveness in risk-taking stays difficult. New state-of-the-art empirical and conceptual frameworks should be developed to evaluate in a well timed method whether or not risk-taking is changing into extreme and resulting in the build-up of systemic danger.

One other side for future consideration is the redistribution channels of the 2 insurance policies. It might be helpful to evaluate the completely different influence of those insurance policies on debtors and savers to offer additional insights into the prices and advantages of interventions that concentrate on particular sectors or teams of financial brokers. This is able to require new frameworks of research for use to determine an important variations within the transmission of insurance policies throughout financial brokers, in addition to the implications of such redistribution channels.

Authors’ notice: This column summarises a number of the key analytical findings and coverage implications which have emerged from analysis by ECB employees carried out as a part of the ECB Analysis Process Pressure (RTF) on financial coverage, macroprudential coverage and monetary stability. The views expressed listed below are these of the authors and don’t essentially signify the views of the European Central Financial institution and the Eurosystem.

References

Albertazzi, U, F Barbiero, D Marqués-Ibáñez, A Popov, C R d’Acri T and Vlassopoulos (2020), “Financial coverage and financial institution stability: the analytical toolbox reviewed”, ECB, Working Paper Collection No 2377.

Altavilla, C, L Laeven and J-L Peydró (2020), “Financial and macroprudential coverage complementarities: proof from European credit score registers”, ECB, Working Paper Collection No 2504.

Ampudia, M and S Van der Heuvel (2018), “Financial coverage and financial institution fairness values in a time of low rates of interest”, ECB, Working Paper Collection No 2199.

Ampudia, M and S Van der Heuvel (2019), “Financial coverage and financial institution fairness values in a time of low and destructive rates of interest”, VoxEU.org, 17 July.

Ampudia, M, M L Duca, M Farkas, G Peréz-Quirós, M Pirovano, G Rünstler and E Tereanu (2021), “On the effectiveness of macroprudential coverage”, ECB, Working Paper Collection No 2559.

Bittner, C, D Bonfim, F Heider, F Saidi, G Schepens and C Soares (2022), “The augmented financial institution balance-sheet channel of financial coverage”, ECB, mimeo.

Bubeck, J, A Maddaloni and J-L Peydró (2020), “Damaging financial coverage charges and systemic banks’ risk-taking: proof from the euro space securities register”, Journal of Cash, Credit score and Banking 52(S1): 197-231.

Bubeck, J, A Maddaloni and J-L Peydró (2021), “Financial institution portfolio danger profiles vs the zero decrease certain”, VoxEU.org, 23 April.

Chavleishvili, S, R F Engle, S Fahr, M Kremer, S Manganelli and B Schwaab (2021), “The danger administration method to macro-prudential coverage”, ECB, Working Paper Collection No 2565.

Chavleishvili, S, S Fahr, M Kremer, S Manganelli and B Schwaab (2021), “A novel risk-management perspective for macroprudential coverage”, VoxEU.org, 5 October.

Cerutti, E, S Claessens and L Laeven (2018), “The growing religion in macroprudential insurance policies”, VoxEU.org, 18 September.

Corradin, S, J Eisenschmidt, M Hoerova, T Linzert, G Schepens and J-D Sigaux (2020), “Cash markets, central financial institution steadiness sheet and regulation”, ECB, Working Paper Collection No 2483.

Cozzi, G, M Darracq Pariès, P Karadi, J Körner, C Kok, F Mazelis, Okay Nikolov, E Rancoita, A Van der Ghote and J Weber (2020), “Macroprudential coverage measures: macroeconomic influence and interplay with financial coverage”, ECB, Working Paper Collection No 2376.

Gadea Rivas, D M, L Laeven and G Peréz-Quirós (2020), “Development-and-risk trade-off”, ECB, Working Paper Collection No 2397.

Heider, F and A Leonello (2021), “Financial coverage in a low-rate setting: Reversal fee and danger taking”, ECB, Working Paper Collection No 2593.

Heider, F, F Saidi and G Schepens (2019), “Life beneath zero: financial institution lending underneath destructive coverage charges”, The Assessment of Monetary Research 32(10): 3728-3761.

Heider, F, F Saidi and G Schepens (2019), “Financial institution lending underneath destructive coverage charges”, VoxEU.org, 17 December.

Jasova, M, C Mendicino and D Supera (2021), “Coverage uncertainty, lender of final resort and the true financial system”, Journal of Financial Economics 118: 381-398.

Jasova, M, L Laeven, C Mendicino, J-L Peydró and D Supera (2022), “Systemic danger and financial coverage: the haircut hole channel of the lender of final resort”, ECB, Working Paper Collection, forthcoming.

Karadi, P and A Nakov (2021), “Effectiveness and addictiveness of quantitative easing”, Journal of Financial Economics 117: 1096-1117.

Laeven, L, A Maddaloni and C Mendicino (2022), “Financial Coverage, Macroprudential Coverage and Monetary Stability”, ECB, Working Paper Collection 2647.

Martin, A, C Mendicino and A Van der Ghote (2021), “Interplay between financial and macroprudential insurance policies”, ECB, Working Paper Collection No 2527.

Mendicino, C, Okay Nikolov, J Suarez and D Supera (2020), “Financial institution capital within the brief and in the long term”, Journal of Financial Economics 115: 64-79.

Mendicino, C, Okay Nikolov, J Suarez and D Supera (2021), “How a lot capital ought to banks maintain?”, VoxEU.org, 24 February.

Mendicino, C, F Puglisi and D Supera (2022), “Past zero: are coverage fee cuts nonetheless expansionary?”, ECB, Working Paper Collection, forthcoming.

Van der Ghote, A (2020), “Advantages of macro-prudential coverage in low rate of interest environments”, ECB, Working Paper Collection No 2498.

Van der Ghote, A (2021a) “Interactions and Coordination between Financial and Macroprudential Insurance policies”, American Financial Journal: Macroeconomics 13(1): 1-34.

Van der Ghote, A (2021b), “Advantages of macroprudential coverage in low rate of interest environments”, VoxEU.org, 15 December.

Endnotes

1 The amplitude and period outline the dimensions of the cumulation which represents the entire achieve in wealth related to the growth/recession.

2 Proof in Corradin et al. (2020) means that ECB asset purchases have additionally affected cash market situations within the euro space.

3 Cozzi et al. (2020) discover the interplay of financial institution capital necessities with financial coverage utilizing a wide range of macro-financial fashions developed on the ECB for coverage evaluation.