Chonlatee Sangsawang/iStock via Getty Images

A Quick Take On Momentive Global

Momentive Global Inc. (NASDAQ:MNTV) recently reported its Q2 2022 financial results on August 6, 2022, slightly missing expected revenue and EPS estimates.

The company provides software technologies to companies seeking customer and stakeholder feedback at scale.

With Momentive producing low revenue growth and making no progress toward operating breakeven, my outlook on the stock is on Hold for the near term.

Momentive Global Overview

San Mateo, California-based Momentive Global was founded in 1999 as Survey Monkey to provide companies with a way to better understand their customers.

Management is headed by CEO Zander Lurie, who has been CEO of the firm since January 2016 and was previously SVP Entertainment at GoPro (GPRO).

The company provides a number of functionalities as part of its modular system:

Surveys

Market Research

Online Payments

Tech Promoter Score

Marketing Creation

Apps and Plugins Marketplace

Momentive Global’s Market & Competition

According to a 2017 market research report from ResearchandMarkets, the global online survey market is expected to grow from $4.1 billion in 2017 to $6.9 billion by 2022.

This represents a significant CAGR of 11.25% during the forecast period, although from a relatively small baseline.

Key elements driving this expected growth include the increase in adoption of digitalization solutions among organizations, the growth of e-commerce function within companies and the need to communicate directly with customers to constantly improve service offerings.

Major competitive vendors that provide online survey services include:

Google

Zendesk

Qualtrics

Medallia

Confirmit

Inqwise

Campaign Monitor

Zoho

Momentive’s Recent Financial Performance

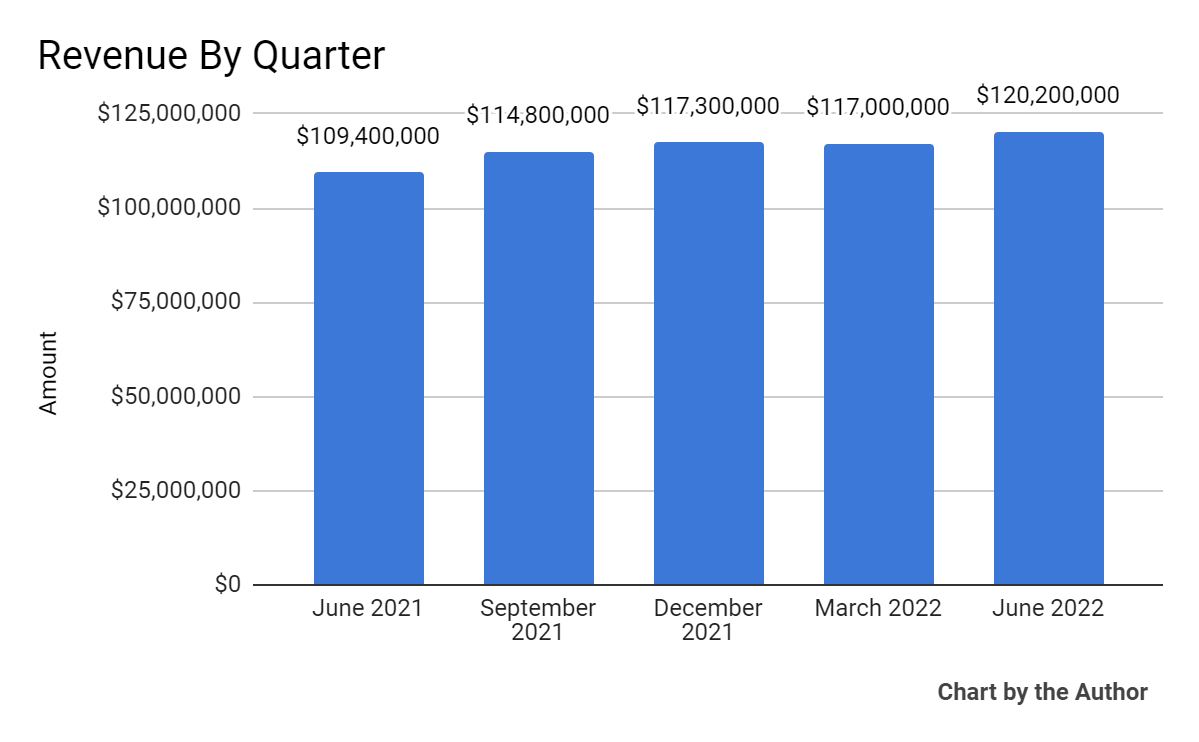

Total revenue by quarter has grown moderately over the past five quarters:

5 Quarter Total Revenue (Seeking Alpha)

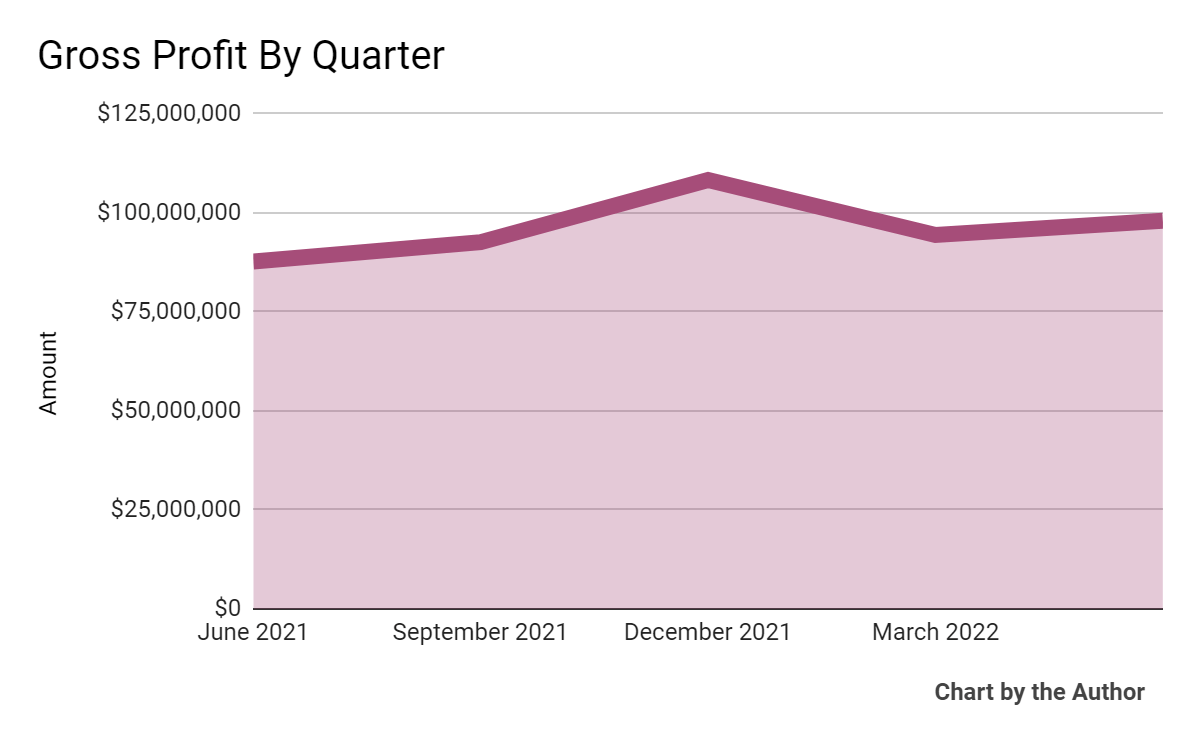

Gross profit by quarter has followed a similar trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

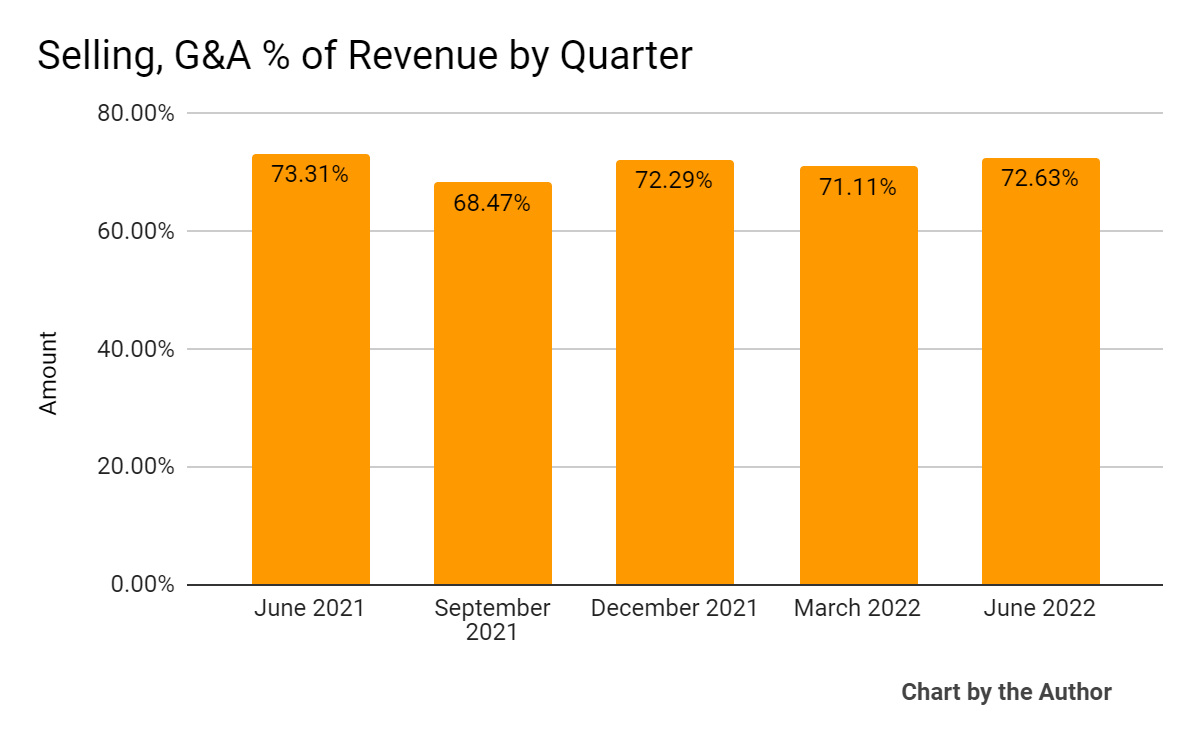

Selling, G&A expenses as a percentage of total revenue by quarter have remained elevated and within a fairly narrow range in the past five quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

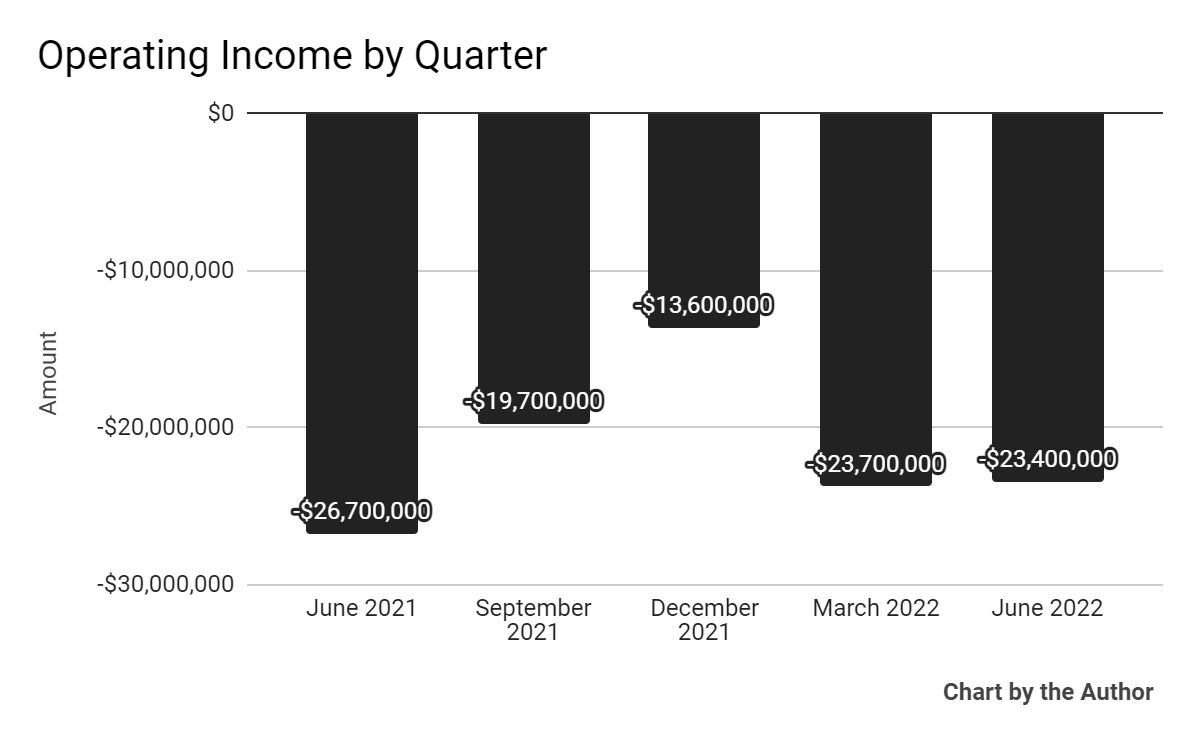

Operating income by quarter had remained materially negative in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

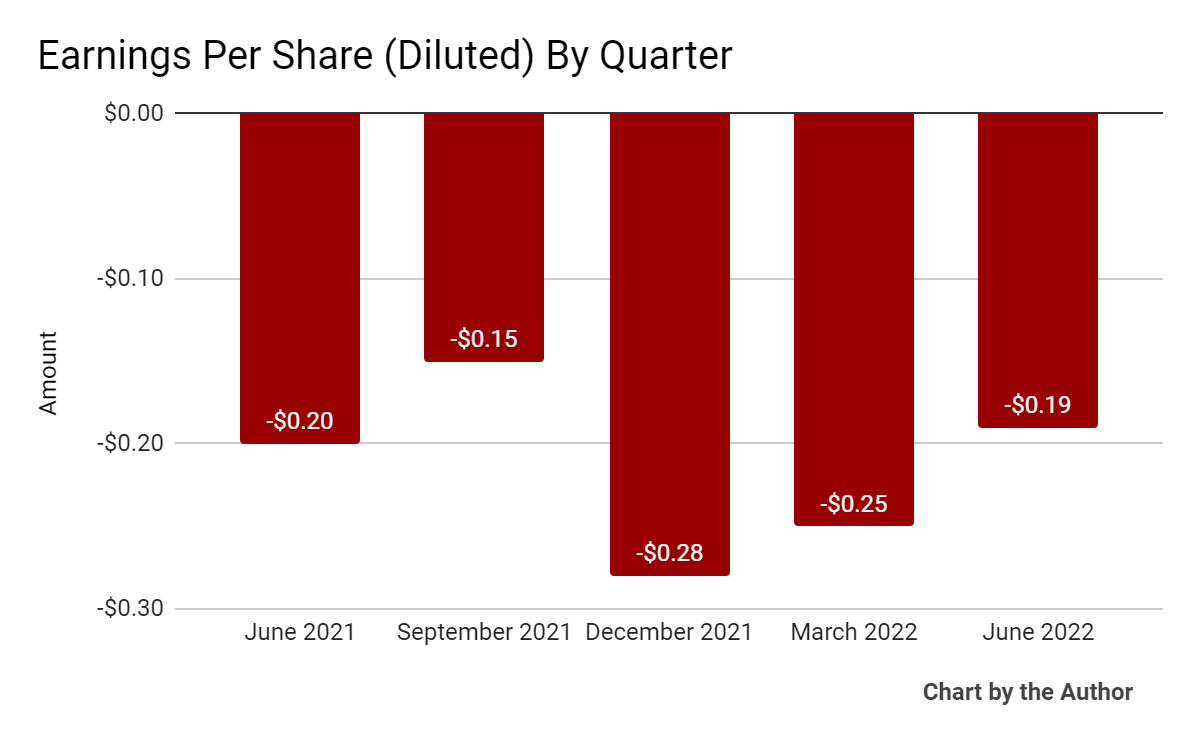

Earnings per share (Diluted) have also remained substantially negative, as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

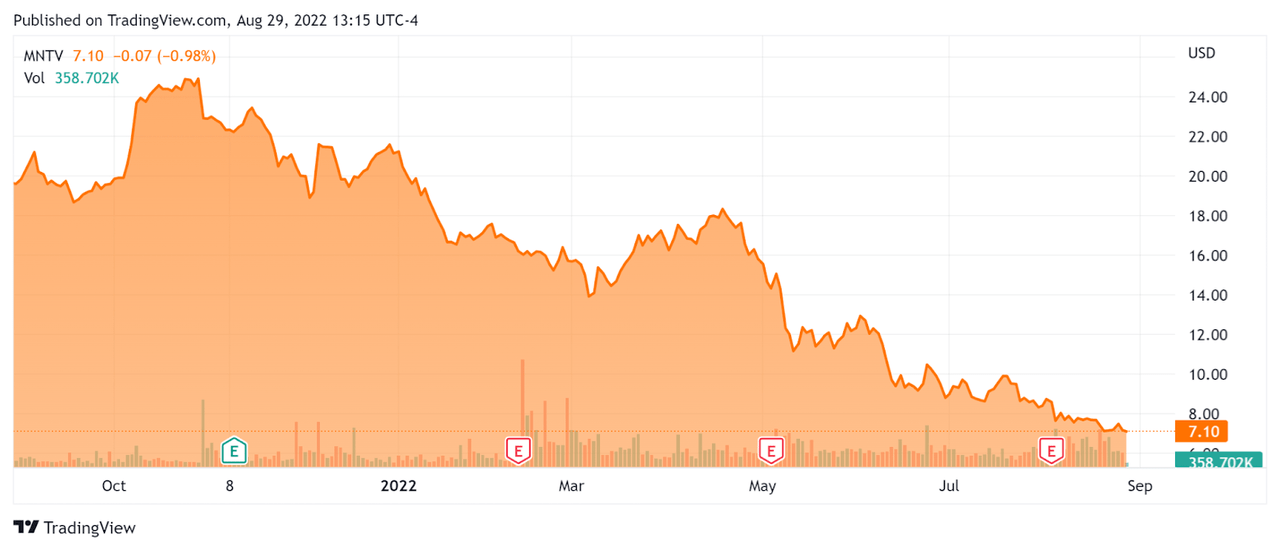

In the past 12 months, MNTV’s stock price has dropped 63.7% vs. the U.S. S&P 500 index’ fall of around 10.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Momentive Global

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 2.31 |

Revenue Growth Rate | 15.0% |

Net Income Margin | -27.8% |

GAAP EBITDA % | -0.14% |

Market Capitalization | $1,060,000,000 |

Enterprise Value | $1,090,000,000 |

Operating Cash Flow | $12,960,000 |

Earnings Per Share (Fully Diluted) | -$0.87 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Qualtrics (XM); shown below is a comparison of their primary valuation metrics:

Metric | Qualtrics | Momentive Global | Variance |

Net Income Margin | -91.2% | -27.77% | -69.6% |

Revenue Growth Rate | 43.1% | -0.1% | -100.3% |

Operating Cash Flow | $37,240,000 | $12,960,000 | -65.2% |

Enterprise Value / Sales | 5.2 | 2.3 | -55.2% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MNTV’s most recent GAAP Rule of 40 calculation was only 14.8% as of Q2 2022, so the firm needs improvement in this regard, per the table below:

Rule of 40 – GAAP | Calculation |

Recent Rev. Growth % | 15.0% |

GAAP EBITDA % | -0.1% |

Total | 14.8% |

(Source – Seeking Alpha)

Commentary On Momentive Global

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted revenue growth within guidance despite a number of economic headwinds including inflation, currency volatility and late quarter demand softness.

The company ended the quarter with around 15,700 customers, representing growth of 67% year-over-year. More than 2,200 customers spend over $25,000 annually and 900 customers use multiple products from the firm’s offerings.

However, MNTV saw a negative sales impact from external headwinds reducing customer budget allocations for its market research product, now called Market Insights.

Notably, the company’s self-serve channel produced only 1% growth year-over-year.

As to its financial results, total revenue rose by 10% year-over-year. Of that, revenue from its sales-assisted channel grew by 30%, with strong sales in April and May before experiencing a slow down in June.

The company’s net dollar retention rate for customers with at least one multi-seat product was 110%, indicating good product/market fit and reasonably strong sales & marketing efficiency.

However, GAAP operating losses remained substantial and the stock has received no love from investors in a higher cost of capital environment.

For the balance sheet, the firm finished the quarter with cash and equivalents of $209 million, while producing free cash flow of $1.3 million and purchasing $32 million of stock.

Looking ahead, management guided to $482 million in revenue at the midpoint for the full year.

Regarding valuation, the market is valuing MNTV at an EV/Sales multiple of around 2.3x.

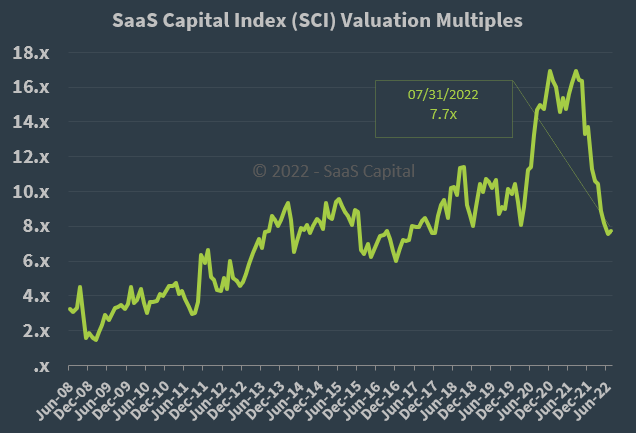

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, MNTV is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may lengthen its sales cycles and flatten its revenue growth trajectory.

MNTV is one of many money-losing enterprise software companies that have been thoroughly beaten down in the current stock market as investors have assigned lower valuation multiples as the cost of capital rises.

With Momentive producing low revenue growth and making no progress toward operating breakeven, my outlook on the stock is on Hold for the near term.