Sean Anthony Eddy

Investment Summary

A thoughtful analysis of the future involves thinking in first principles.

Despite Wall Street’s strong conviction on the company’s stock price, the outlook is less optimistic for ModivCare Inc. (NASDAQ:MODV) in my informed opinion. Nothing has changed from my last publication on MODV in November last year. Less so in first principles.

MODV has underperformed the market over the long-term and may continue to do so going forward without major changes.

Chiefly, it hasn’t recycled capital well. A dollar is more valuable in the investors hand versus in the company’s hand. Because of its growth investments, MODV hasn’t beaten the hurdle rate. You need a measure (earnings growth) to show where a firm is growing in value, and the market is a fairly good judge of fair value over time. Firm’s growing economic profits will grow at higher multiples, making good use of investor capital by growing ahead of the market.

In that vein, it’s important to understand what investors have priced into MODV’s stock, and is this correct. Understanding the range of probabilities then enables an investor to observe any deviances from the consensus of expectations. With respect to MODV, I believe the market has got it priced correctly and note there’s a fair bit of pessimism in the name, which could be attractive from a contrarian’s view, however there aren’t the existing fundamentals to close this gap. Net-net, reiterate MODV is a hold.

What are the expectations in MODV’s stock price?

The quote of a company’s stock price is more or less a set of expectations aggregated to form a price range. That, combined with demand/supply and opportunity cost factors, ultimately decide price levels. Intelligent investors tend to believe the market does a good job at deciding fair value over time. So they key is to know what’s in the price, and if there is any reason to believe the expectations are wrong.

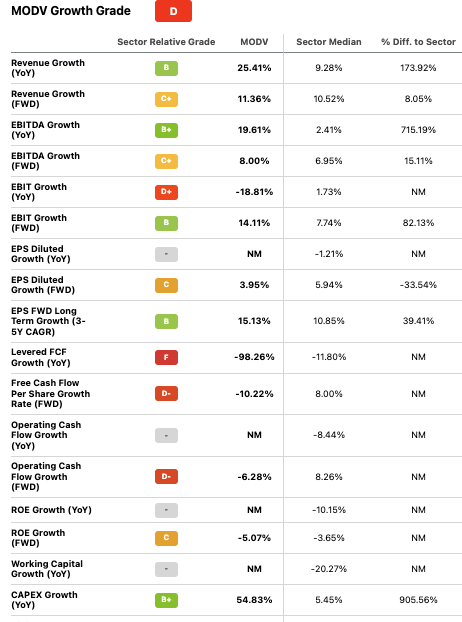

The market has been generous to investors of MODV pricing it at 8.8x forward EBITDA and 9x forward P/E. On this basis, it is cheap and could offer some upside with a reversion to the long-term mean (5-year avg. P/E 24x, EV/EBITDA 12.7x). For this, consensus believes the company will to $2.6–$2.8Bn in revenues and ~$7.50 in earnings. A few key points for consideration, however. If you look at the market-implied forward growth rates, it calls for 14% YoY growth in operating income, but also a decrease in FCF per share and ROE of 10% and 5%, respectively.

Fig. 1

Data: Seeking Alpha

The question is, has the market figured the MODV story out completely or not. Looking at the Q4 earnings call, management said “[t]e company’s goal to create shareholders is to “build for scale and grow our business”. It sounds fairly simple as well – scale up by using technology and grow by selling point solutions “more effectively”. Except it will take a lot more, especially to guide top-line revenues to $2.6Bn this year. Consider a few points:

- FY’22 P&L was strong – $2.5Bn at the top, 25% YoY growth with upsides in all operating segments.

- It pulled this down to $103mm adj. earnings, of $7.32/share, adj. EBITDA margin of 8.9%.

- After investing heavily in FY’20 and FY’21 ($1.8Bn over two years cumulatively), MODV pared this back to $153mm last year. On this, incremental returns on new capital have been 14%, in FY’20, negative 4.6% in FY’21, negative 2.7% in FY’22. Looking ahead, the return on new capital could average 0% to 6% in my opinion.

- This, as the 2-year returns on existing capital have ranged down from 12% in 2020 to 4.8% last year.

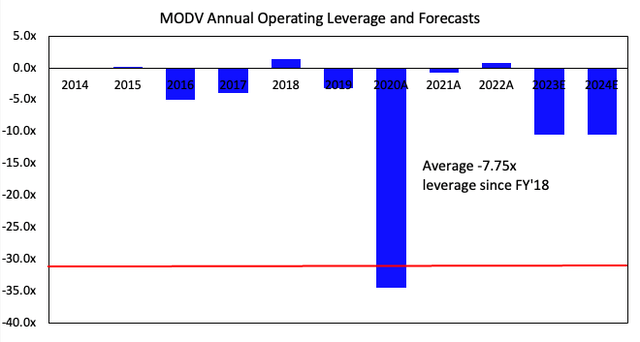

If the market expects ~11% YoY in top-line growth and 14% EBIT upside the firm needs to hit $2.6–2.8Bn, but I believe 5% is a more cautious figure and project $2.6Bn in revenue. That would call for $100mm in operating income and could be a stretch. Especially the operating leverage – revenue growth of 11% for 14% at the operating line, this is well above the historical range for MODV. Enjoyed some Sleight of hand last year, [Figure 2] but my numbers suggest operating leverage could be light going forward. This is important to address, because the market is looking to see the capital their company retains (in retained earnings) is being put to use and being invested at a rate above the market’s return to create value. If it doesn’t see capital best placed for growth in MODV, then its share price won’t catch a bid.

Fig. 2

Data: Author, MODV 10-Ks

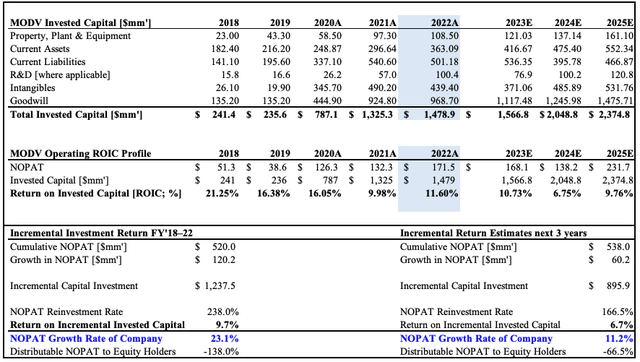

Finally, the ability to create value looking ahead. Intelligent money is attracted to companies that generate returns on the business’ capital higher than the market’s expected return. If a company generates high return on its growth investments, above the market’s return, this growth is quickly translated into higher valuations in the marketplace. The company’s growth/ROIC is a measure of the investment’s return. So if the return on equity (“ROE”) and ROIC numbers are strong, chances are the market will reward this with higher multiples. That means, investors will pay a higher cost for $1 of MODV’s earnings. Several observations here:

- Spanning back to FY’18, return on incremental capital was 9.7% for the 5-years. MODV invested $1.23Bn and generated additional $120mm additional post-tax earnings.

- MODV still reinvested very heavily at the incremental return (238% of NOPAT) and compounded its valuation by 23% over that time. Even though this is impressive, it came at a heavy net cost to shareholders (238% of earnings at 9.7% rate of return).

- Further, the $1 test there was no value created ($120/0.1=$1,200, $37mm below the investment).

- This could be why MODV trades at 9.4x forward P/E, 60% off the 5-year average of 24x.

- Looking forward, in one scenario MODV could invest $895mm incremental capital and get $60mm additional post-tax earnings for this. If the opportunity cost is 10% (risk-free rate + forward earnings yield S&P 500), this doesn’t pass the $1 test ($60/0.1=$600 ; less than $895, need >$900).

- It would need to generate at least $90mm on a $895mm investment to grow its valuation at a meaningful rate ($90/0.1=$900).

- If MODV can’t/doesn’t generate a return on its growth investments that is above the market’s return, it won’t create additional market value, and won’t catch a bid from buyers. So these numbers would seriously need improving.

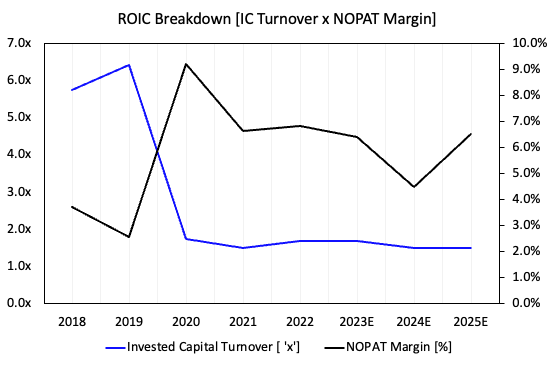

For this to happen, capital intensity would need to remain flat at 1x turnover and post-tax profits would have to rise to 7-8% margin, but my estimates have the firm to incur some pressure at the margin [Figure 4].

So the earnings power of MODV will depend largely on its ability to increase gross-to–operating margin and pull this down to earnings growth for shareholders. If the capital it decides to invest in is unproductive, we could be looking at sub-par returns. Hence, a ROIC of 10% or greater would be ideal, and here, I’ve got 6-7% which is a risk factor. You can see the potential of outcomes in Figure 3 and Figure 4. Note the potential ROIC rates, in addition to the incremental rates of return. MODV would need to see some upside on these, in my opinion.

Fig. 3

Data: Author, MODV 10-Ks

Fig. 4

Data: Author, MODV 10-Ks

In that vein, I believe the market has identified the major risks and priced MODV accordingly. The stock price peaked in FY’21 and has pushed south ever since, now down 7% in the last 5-years. As seen above, $1.2Bn additional investment into growth capital corresponded with a $231mm change in market value.

That equates to $0.19 in market value created for each $1 in investment the company made. Conversely, the S&P 500 total return index has returned $0.40 for every $1 investment in that time. Quite a wide spread – MODV is 52% below that benchmark.

So you could have bought MODV who generated 5.4% CAGR in market value on an 18.9% compound reinvestment rate, or the index for 11.9% CAGR. However, if forward growth is 5% YoY growth, the numbers suggest a $1.05Bn market value, $75/share. Contrasted to an 11% growth in market value, this would add $360-$370mm in market cap for MODV to $1.36Bn, or $97 per share. That’s not terrible, and adds potentially 38-40% upside on the current market price.

But these mechanics certainly do explain why the underperformance in the first place. Take the past 3-5 years. Both returns on capital and growth rates were below where they needed to be. If investors are to allocate capital in the first place, why should they to anywhere else if they can get the UST 10-year yield and the U.S. equity benchmark. And, if the attraction is compared to these instruments, 9.7% incremental return over 5-years isn’t going to shift the dial. Looking forward, I’ve projected 6.7% return on incremental capital, which I doubt will surpass the required rate of return. Hence, this supports a neutral view.

Valuation and conclusion

I’ve discussed why I believe the market has correctly priced MODV stock at a discount. As to what’s already in the price, I’d say most of the downside has been recognized, but it’s difficult to say it it’s all been priced in. Further, bad news happens in down trends – get used to it. Any negative updates from MODV are therefore an outsized risk.

You could pay 9.4x forward P/E ($9.40 for every $1 of earnings) for MODV and potentially receive 11% in forward earnings yield. That’s actually attractive value. But you’ve got to ask what’s in store going forward. If you’re going to allocate equity capital, you’d want the business you invest in to do the hard work for you, by investing cash and generating a return on this above the hurdle rate. Otherwise, there’s no incentive to take on that kind of risk, with benchmark yields summing to ~10%. My estimates have MODV to do 6-7% return on incremental capital next few years, and I believe there are other businesses out there that can do a better job than this.

At 9.4x my FY’23 earnings estimates of $79.1mm, this derives a price target of $52, downside risk to the current market price. I believe MODV is worth 12x earnings right now, price target $70. Hence, this is supportive of a neutral viewpoint.

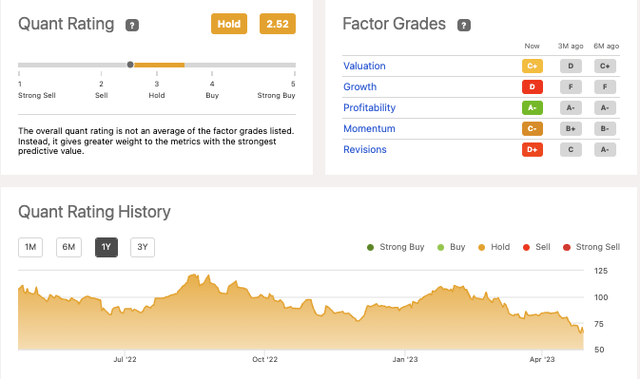

Moreover, there is quantitative evidence that MODV is a hold. Looking at the graphic below, using analysis across a composite of graded measures indicates there are risks to growth and valuation, in-line with findings above. This warrants a hold rating. The quant grading system is a terrific measure to objectively view all of the features in the investment debate.

Fig. 5

Data: Seeking Alpha

What I’d like to see looking ahead from MODV is effort to build more arteries of income to its business pump in order for 1) grow earnings, 2) grow margins, 3) without one jeopardising the other. Forward returns on capital will be the keystone of it all in my opinion. Now tight money and violently reactive markets, those firms growing post-tax earnings from recycled capital and retained earnings will remain in the front seat in my opinion. MODV has some work to do here, relative to other top-notch firms. Reiterate hold.