Whitepointer

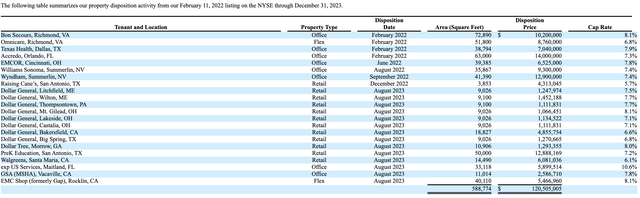

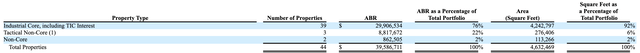

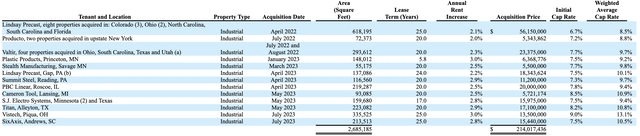

Modiv Industrial (NYSE:MDV) is probably one of the most unique equity REITs I’ve encountered. The internally managed small-cap REIT is focused on acquiring single-tenant net-lease industrial manufacturing properties in the US, with a portfolio of 44 properties at the end of its most recent fiscal 2023 fourth quarter. There has since been a disposition of two non-core assets held for sale, with MDV now finished with its more than two-year long strategic shift away from a portfolio initially heavy on retail and office properties. There has been $121 million worth of dispositions since the REIT listed on the NYSE in February 2022.

Modiv Industrial Fiscal 2023 Fourth Quarter Supplemental Data

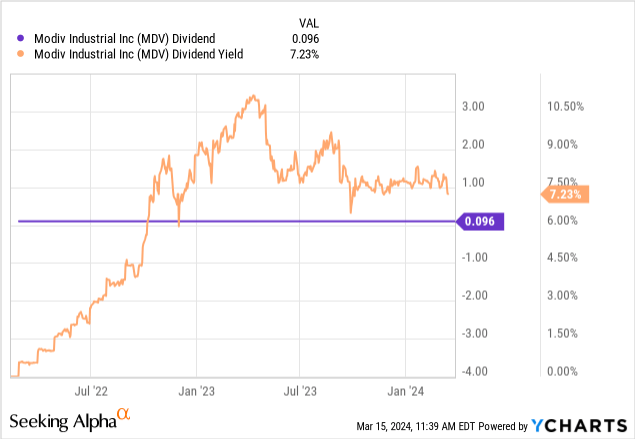

MDV last declared a quarterly cash dividend of $0.0958 per share, kept unchanged from the prior month and $1.1496 per share annualized for a 7.2% dividend yield. The $160 million market cap REIT has kept its monthly payouts flat since it went public with AFFO for its fourth quarter at $0.40 per share, exceeding consensus expectations by 5 cents but down from FFO of $0.68 per share a year ago. The yield has been pulled down on the back of an upward re-rating of the ticker, which is up a remarkable 54% over the last 1 year.

Direct year-over-year comps are difficult due to MDV’s portfolio experiencing intense flux over the period. The REIT is currently swapping hands for roughly 10x its annualized fourth-quarter AFFO with a dividend yield that’s above the average for net lease REITs, but that reflects the enhanced risk profile from a small-cap single-tenant property owner operating within the domestic manufacturing niche that for decades has been characterized by retrenchment. The REIT went public in the most disruptive period for REITs in a generation, with the Fed’s battle with inflation driving up the cost of funds for REITs and tapering growth.

Modiv Industrial Fiscal 2023 Fourth Quarter Supplemental Data

Liquidity, Debt, And AFFO Growth

MDV’s 42 property portfolio is currently geared to generate $44 million of net operating income every year and comes with 2.5% annual rent escalators and a weighted average lease term of 14 years. The REIT generated revenue of $12.29 million during the fourth quarter, dipping by 11% over its year-ago comp. However, the year-ago comp included a $3.8 million early termination fee from a tenant, excluding this fee would have seen year-over-year revenue growth notch 23%. Critically, growth is being driven by MDV’s industrial acquisitions, offset by their non-core dispositions.

Modiv Industrial Fiscal 2023 Fourth Quarter Supplemental Data

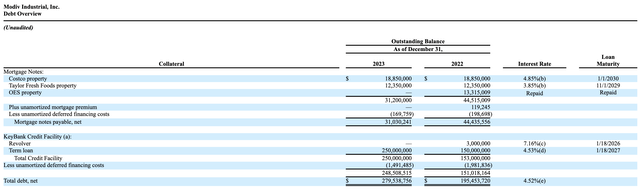

The REIT has spent $214 million on acquisitions since it went public but with no new acquisitions during the fourth quarter and year-to-date. Fourth quarter AFFO grew by 41% versus its year-ago comp with the 2022 lease termination fee excluded. Total debt at the end of the fourth quarter is also extremely well-laddered, with no debt maturities until 2027. The REIT held a cash balance of $17.9 million at the time of its earnings call and an untapped $150 million revolving credit facility.

Modiv Industrial Fiscal 2023 Fourth Quarter Supplemental Data

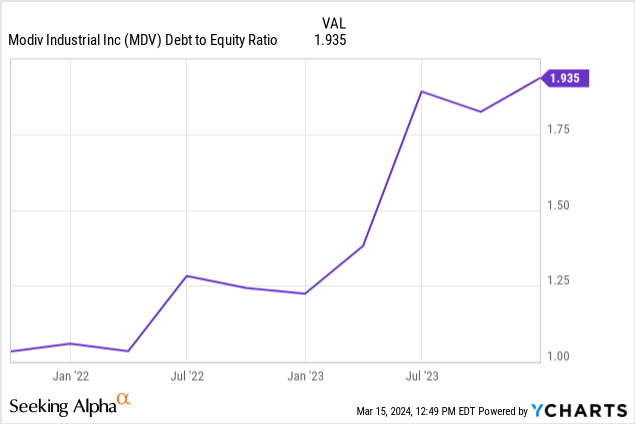

The REIT has also been selling its stock to raise money with 162,063 shares sold in the period from 15 November 2023 to 29 January 2024, at an average price of $15.22 per share for $2.47 million in proceeds. The risks here though are salient. Leverage is high, with MDV’s debt-to-equity ratio at roughly 1.94x as of the end of its fourth quarter, the highest level since the REIT went public. This comes with no near-term debt maturities and pending Fed rate cuts set to scale back the risk posed by elevated leverage. The REIT also has Series A outstanding preferreds (NYSE:MDV.PR.A) which currently offer a 7.6% yield on cost.

MDV has a clear investment pitch that it has built around its acquisition of critical industrial manufacturing properties with long-dated leases. This focus on single-tenant net-lease industrial manufacturers means an outsized exposure to a single industry. Russia’s invasion of Ukraine sparked a wave of inflation, but it also catalyzed a material shift of global supply chains. Foreign direct investment in China has fallen to its lowest level in decades, with US trade policy also witnessing a significant shift towards more protectionism. The 2022 Inflation Reduction Act and the CHIPS and Science Act both have a heavy domestic bias and have both catalyzed a domestic manufacturing boom. Hence, MDV is operating in an attractive space that could be set to see a new, more growth-orientated zeitgeist than it experienced in the decades prior. I think MDV makes sense as an investment here, especially against comments from the Fed, with Powell saying that the process of cutting interest rates “can and will begin” over the course of 2024. I’ll likely take a small position sometime this month on the back of the dividend yield that’s roughly 140% covered by AFFO.