izusek

The COVID-19 Investment Thesis May Already Be Over

We previously covered Moderna (NASDAQ:MRNA) in December 2022, discussing its mixed prospects as the demand for its COVID offerings decelerated from the hyper-pandemic peak.

While the biotech company might report a robust balance sheet and zero debt then, we also believed that the stock might be over-valued with a minimal margin of safety for next-decade portfolio growth.

For now, MRNA has recorded underwhelming COVID-19 vaccine sales of $293M in FQ2’23 (-83.9% QoQ/ -93.5% YoY), naturally impacting its gross margins to -212.5% (-269.9 points QoQ/ -283.4 YoY) and operating margins to -542.7% (-523 points QoQ/ -594.2 YoY).

While the company has yet to rely on debt, its cash/ short-term investments of $8.45B (-5.2% QoQ/ +7% YoY) appear to be insufficient to support the management’s guidance of annual R&D expenses at approximately $2.5B through 2027, due to the impacted profitability thus far.

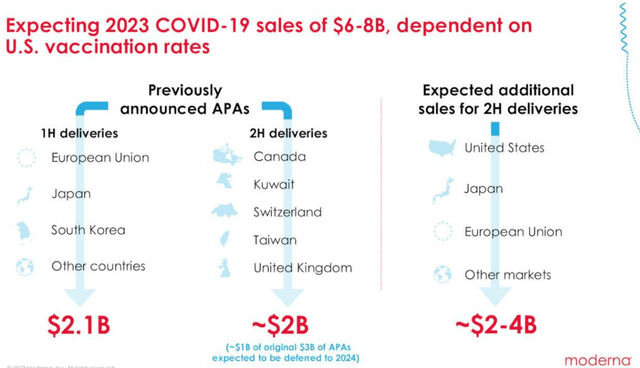

MRNA’s H2’23 Guidance

Seeking Alpha

While the MRNA management has been hopeful of the COVID-pipeline commercialization in H2’23, we prefer to reserve judgement until we actually see the previously announced APAs of $2B and up to $4B in additional sales recorded.

The sentiments surrounding COVID-19 vaccines appear to be pessimistic as well, based on Pfizer’s (PFE) commentary in the recent JPMorgan US All Stars Conference.

PFE has estimated that only 24% of the US population may choose to be vaccinated in 2023. This percentage seems to be overly optimistic, in our view, since only 17% have opted for booster shots last year.

Combined with MRNA’s choice of winding down its production in Switzerland, it appears that the end of the hyper-pandemic windfall is here.

MRNA’s Pipeline Is Unlikely To Replace The COVID-19 Pipeline Anytime Soon

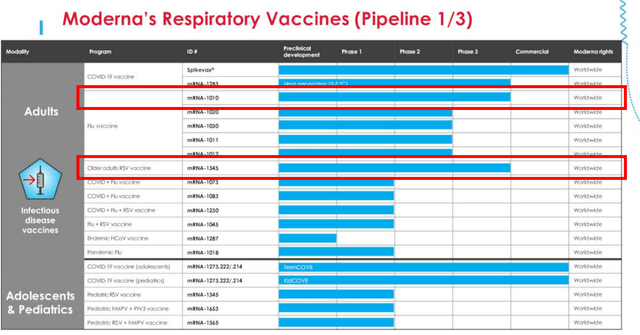

MRNA’s Pipeline Discussion

Seeking Alpha

If we are to look at MRNA’s first page of pipeline from the FQ2’23 earnings call, there are two programs already in the Phase 3 clinical trials, namely the Flu vaccine and RSV vaccines.

These two programs are part of the management’s near-term pipeline projected for FDA approval by 2025, including the flu-COVID combo vaccine and the next gen COVID vaccine, with a projected respiratory revenues of up to $15B annually by 2027.

These numbers seem to be rather aggressive for now, since it suggests MRNA’s market leading share in the global respiratory market.

This is based on the management’s guidance of FY2023 COVID pipeline sales of up to $8B, the global flu vaccine market size of $7.28B in 2022 (with the potential to expand to $12.4B by 2030, expanding at a CAGR of +6.83%), and the RSV global market size of $942.9M in 2022 (expanding to $1.97B by 2030, at a CAGR of +9.7%.)

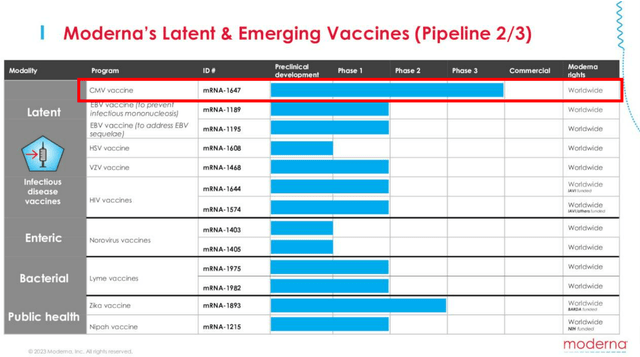

MRNA’s Pipeline Discussion

Seeking Alpha

If we are to look at its second page in pipeline, the other program at Phase 2 is MRNA’s CMV vaccine.

Based on the management’s commentary in the latest earnings call, they are looking to complete Phase 3 enrollment by the end of 2023, with clinical studies likely to take at least another year, if not up to four years, based on the AbbVie Clinical Trials.

Even then, the global CMV treatment is only worth $228.8M in 2022, while only expected to grow at a CAGR of +6.1% to $326M by 2028. As a result, we believe the CMV vaccine is unlikely to have a significant impact on MRNA’s long-term financial performance.

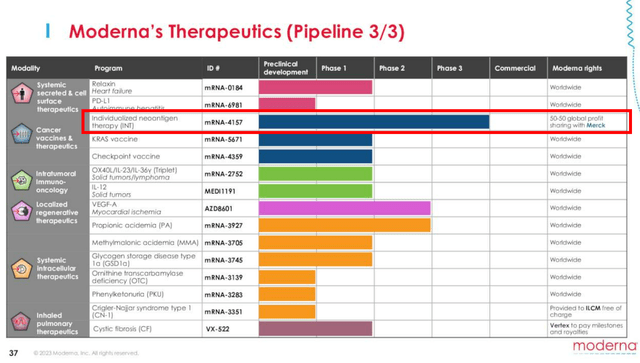

MRNA’s Pipeline Discussion

Seeking Alpha

If we are to look at its third page in pipeline, MRNA has partnered with Merck’s Keytruda (MRK) on the mRNA-4157, as an Investigational Personalized mRNA Cancer Vaccine.

Investors may want to note that Keytruda is MRK’s blockbuster cancer drug with $25.08B in annualized FQ2’23 revenues (+8.2% QoQ/ +19.4% YoY), comprising 41.7% of the top-line (+1.8 points QoQ/ +5.8 YoY).

With MRNA expected to share 50% of the eventual global profits with MRK, we may see its top and bottom lines drastically boosted moving forward, potentially exceeding the COVID-19 vaccine windfall.

Unfortunately, MRNA investors may want to temper their intermediate term expectations, since latest reports suggest that the current stage 3 clinical trials may only be completed by October 2029.

The same has been suggested by the management, with these pipelines likely to be launched between 2026 and 2028, projected to contribute another $15B in revenues by then.

Therefore, even if successful FDA commercializations occur, it is unlikely that we may see any contribution on its top and bottom lines over the next few years.

Therefore, while the MRNA management believe that they may “launch up to 15 products in the next five years,” in the MRNA R&D Day on September 14, 2023, it is apparent that its top-line will continue to suffer through 2024, if not H1’25, without the benefit of the US FDA Fast Track Designation that the previous COVID vaccine has enjoyed in 2020.

So, Is MRNA Stock A Buy, Sell, or Hold?

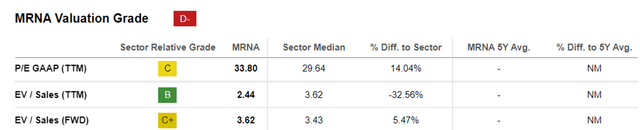

MRNA EV/Sales and P/E Valuations

Seeking Alpha

For now, MRNA trades at FWD EV/ Sales of 3.62x and FWD P/E of -17.42x, compared to its TTM valuations of 2.44x and 10.66x, respectively.

Then again, investors may want to note that these numbers are subject to change, whenever the biotech company introduces new pipelines/ obtains new FDA authorizations/ when an M&A event occurs, especially since MRNA only has a successful commercialized pipeline for COVID-19.

Even so, the industry’s actual success rate from clinical trials to the eventual approval is only ~8%, implying that a pipeline remains a pipeline until efficacy has been proven and FDA authorization has been obtained.

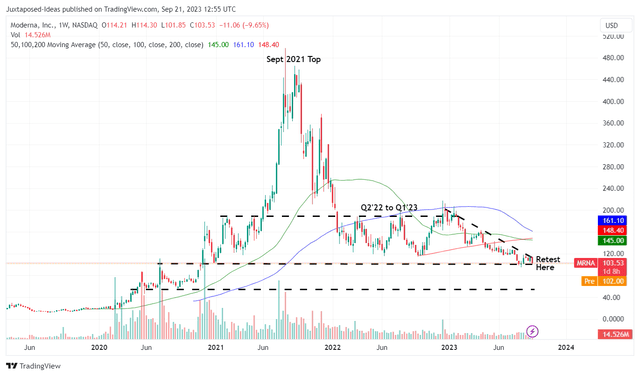

MRNA 5Y Stock Price

Trading View

As a result of MRNA’s mixed prospects over the next few years, we are not certain if it is wise to add the stock here, especially with it currently retesting the critical support levels of $100s.

With the stock already recording lower highs and lower bottoms since the December 2022 top, we may see another retracement to its next support level of $80s, implying another downside of -20% from current levels.

As a result of the potential volatility, we prefer to rate the MRNA stock as a Hold (Neutral) here. Interested investors may want to observe the situation for a little longer.