Maddie Meyer

Moderna, Inc. (NASDAQ:MRNA), a front-runner in the COVID-19 vaccination race, has been under the investor spotlight for some time now. However, a closer look at the company’s recent performance and technical analysis indicates that further downside is likely for its shares. Despite the promising clinical trial results from its cancer vaccine mRNA-4157 developed in collaboration with Merck (MRK) and potential future earnings, the stock faces significant bearish pressure. This article extends the technical analysis introduced in the previous piece, which discussed the bearish tendencies of the stock. As of now, the stock is nearing a critical support region.

Moderna’s Potential Through Cancer Trial Data

Moderna, alongside its big pharma collaborator Merck, recently delivered promising clinical-trial outcomes, signaling the potential for more personalized cancer treatments. Their personalized cancer vaccine, referred to as mRNA-4157/V940, demonstrated impressive results. The vaccine starts with a genetic profile of an individual patient’s resected tumors and results in an immune system ready to target new cancer cells before they can establish themselves. Recent trial results suggest that mRNA-4157/V940 could increase the efficacy of Merck’s popular immunotherapy, Keytruda, in more patients. Despite this potential, discerning the data from cancer trials is a complex task, which may make investment in Moderna seem premature at this stage.

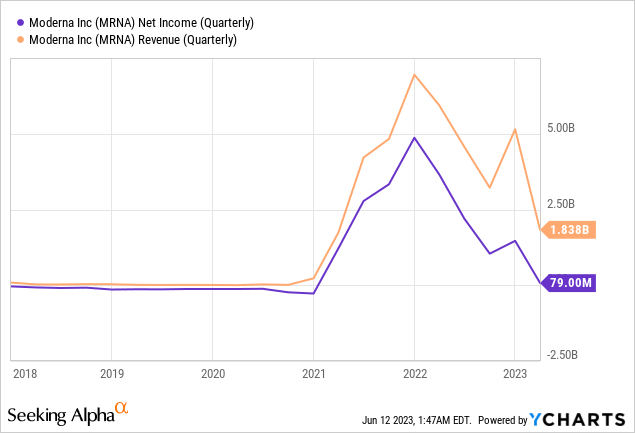

Promising results from a phase 2 trial with melanoma patients certainly put Moderna and Merck in the spotlight. If these findings can be replicated in a larger phase 3 trial, mRNA-4157/V940 could become a novel treatment option for multiple types of solid tumors post-surgery. The intention to commence a larger phase 3 trial and an expansion of Moderna’s program to include lung cancer indications and additional tumor types are promising developments. However, it’s worth noting that the journey to prove a cancer drug’s efficacy in reducing disease recurrence can be long and arduous. For instance, the phase 2 study producing current data began in 2019. Although there is potential for Moderna’s stock price to rise in the future, the company is currently witnessing a drop in revenue. In the first quarter of 2023, Moderna reported revenue of $1.84 billion, a significant decrease from the $5.08 billion reported in the final quarter of 2022. Moreover, the net income for the first quarter of 2023 amounted to just $79 million.

The current share price of Moderna is trading at around 8.5 times forward-looking earnings expectations, a low multiple that could lead to market-beating gains for long-term investors even if profits stagnate. However, without growth drivers to offset declining COVID-19 vaccine sales, even maintaining current profits could be challenging. Furthermore, the expected submission of Moderna’s application to the U.S. Food and Drug Administration (FDA) for its respiratory syncytial virus (RSV) vaccine isn’t likely to see approval until mid-2024, by which time competitors’ RSV vaccines will likely be well-established. Despite compelling medical results from Moderna’s cancer vaccine, it may not be the right time to buy its stock just yet. Observing Moderna’s trajectory from a safe distance could be a more prudent strategy for now.

Persisting Bearish Pressure in Moderna

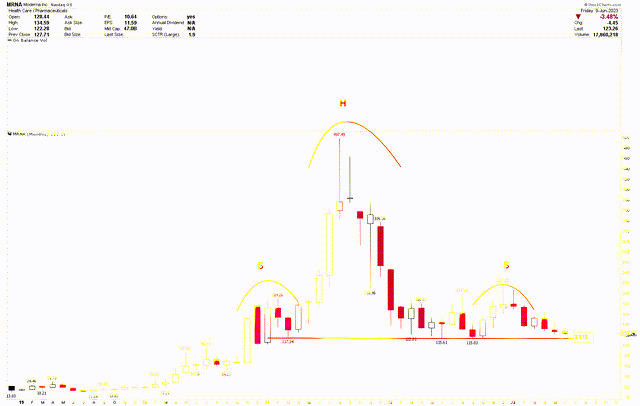

The technical analysis of Moderna further strengthens the bearish view of Moderna. The stock price of Moderna exhibits a bearish tendency in the long term, as demonstrated by the monthly chart below. The chart forms a classic head and shoulders pattern with the neckline situated at $115. The head is at $497.49, while the shoulders are located at $189.26 and $217.25. This pattern will be activated upon a monthly close below $115. Currently, the market continues to face pressure with no evident reversal signs from the $115 robust support. The price appears to be on a downward trajectory.

Moderna Monthly Chart (stockcharts.com)

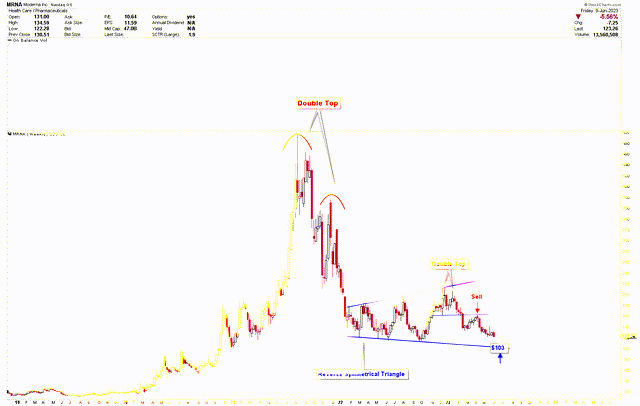

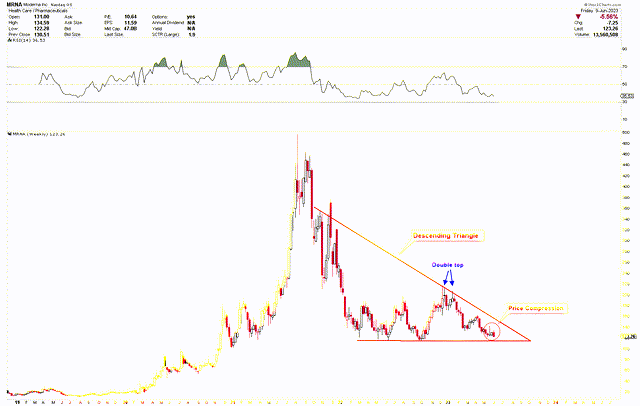

To deepen the understanding of this scenario, the weekly chart discussed in our previous article serves as a useful reference. Moderna’s prices have already shown a decline and seem likely to further deteriorate in the coming days. The updated weekly chart below shows double top formations from 2021. The appearance of a reverse symmetrical triangle following the double tops bolsters the bearish perspective. As the sell signal at the double top’s neckline has been triggered again, the price seems poised for further weakness. Although $115 appears to be the monthly chart’s support, the price might continue its descent to hit the reverse symmetrical triangle’s blue support line at $103. It is at this level that Moderna’s stock price may exhibit resilience, potentially resulting in a price bounce. However, a buy signal will only be confirmed after Moderna’s price rebounds from $103 and achieves higher closing levels.

Moderna Weekly Chart (stockcharts.com)

Investor Considerations

In previous discussions, Moderna’s stock was marked as a sell, and the price has since dropped and remained weak. Presently, the price is forming a descending triangle on the weekly chart, as depicted below. The price compression within the triangle’s narrow terminal range has produced inside week bars. A double top at the descending triangle’s trend line signifies the continuation of bearish pressure for Moderna, prompting investors to exercise caution at current levels. Since the price hovers perilously close to the supports of $115 and $103, there might be potential for a price bounce. However, even if Moderna’s price hits the $103 support, a buy signal will not be generated until the price closes at higher levels on a monthly basis. The overall bearish patterns—head and shoulders on the monthly chart and double top on the weekly chart—persist, tempering any overly optimistic investment strategies.

Moderna Weekly Chart (stockcharts.com)

Final Words

In conclusion, despite Moderna’s promising clinical trials and potential future earnings, the company faces several challenges that put significant bearish pressure on its shares. The declining sales of the COVID-19 vaccine, uncertainties surrounding approval for its upcoming RSV vaccine, and the complex nature of cancer trial data analysis all contribute to this downward trajectory. Technically, the appearance of various bearish patterns also highlights potential further downside risks. Therefore, investors are advised to tread cautiously, keeping a close watch on Moderna’s performance and developments. While the company’s journey towards innovating cancer treatment is indeed exciting, it’s vital to balance optimism with the realities of stock market dynamics. A move below the previous week’s low would initiate another drop in Moderna with $115 and $103 as strong support.