Hugo Grajales

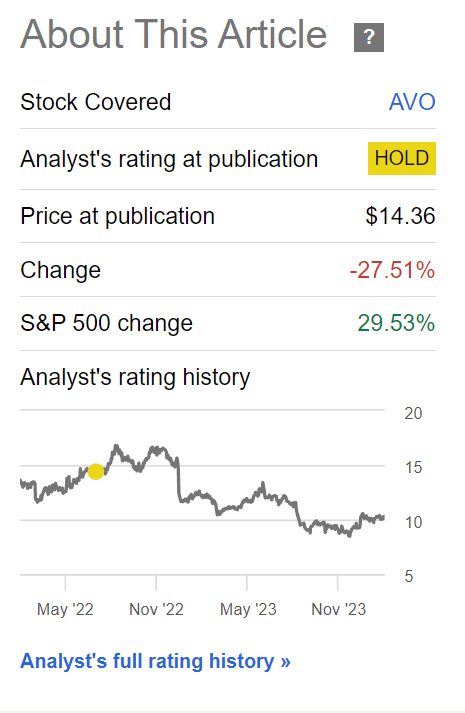

It has been a while since I last analyzed Mission Produce (NASDAQ:AVO), a vertically integrated grower and distributor of avocados. When I last analyzed the company in July 2022, I thought the company’s shares were overvalued relative to a discounted cash flow analysis of the company’s business. Since my article, AVO’s shares have fallen by over 25% while the S&P 500 has rallied 30% for a large performance gap (Figure 1).

Figure 1 – AVO has declined by 28% since July 2022 (Seeking Alpha)

However, in finance, there are usually no bad stocks, just bad prices. Given AVO’s large decline in the past 2 years, is it time to get excited about the company’s prospects?

Global Leader In Avocados

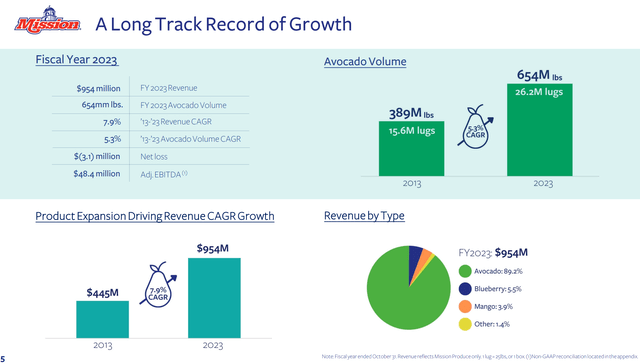

Mission Produce, for those not familiar, is a large global leader in the growing and sale of avocados. In 2003, Mission sold 654 million pounds of avocados, which contributed 89% to AVO’s revenues (Figure 2).

Figure 2 – AVO overview (AVO investor presentation)

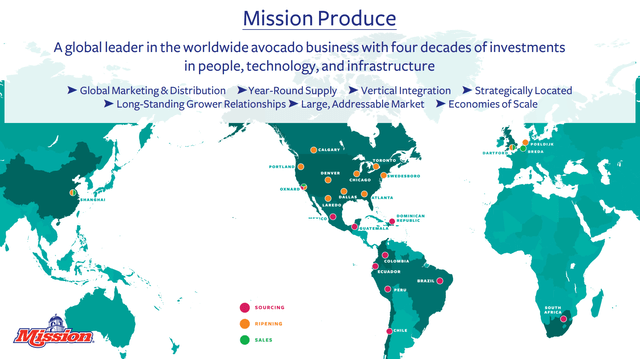

In addition to sourcing avocados from independent farmers in South America, Mission also owns farms in Peru, Guatemala, and Colombia. This allows Mission to earn producer margins in addition to marketing and distribution fees on approximately 15-20% of the company’s avocado sales (Figure 3).

Figure 3 – AVO is a vertically integrated avocado company (AVO investor presentation)

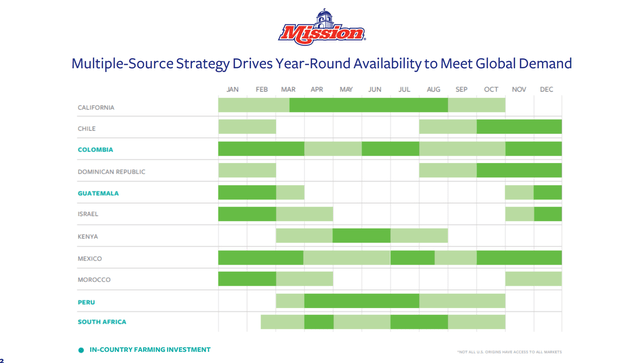

Furthermore, Mission’s multi-source strategy allows the company to source and distribute avocados year-round, meeting growing global demand (Figure 4).

Figure 4 – AVO is able to meet year-round demand from its multi-source strategy (AVO investor presentation)

Avocados Are An On-Trend SuperFood

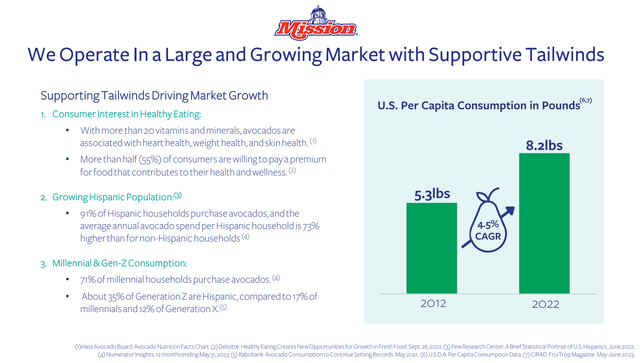

One of the main reasons I have been keeping an eye on Mission Produce and its public peer, Calavo Growers (CVGW), is because avocados are an on-trend superfood that is gaining mass adoption. Avocados are incredibly nutrient dense and contain 20 essential vitamins, minerals, fiber, and phytonutrients. They are also high in healthy fats that can help consumers feel full after eating.

According to the USDA, per capita consumption of avocados have grown at a 4.5% CAGR in the past decade to 8.2 lbs (Figure 5).

Figure 5 – Consumption of avocados have been growing at a steady pace (AVO investor presentation)

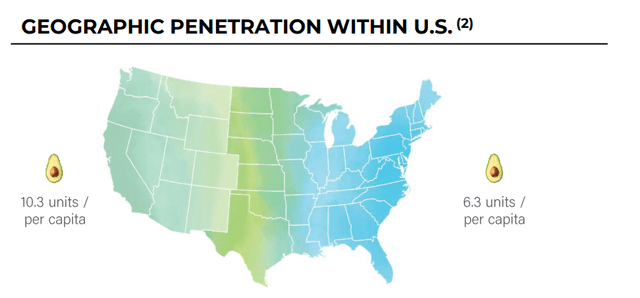

However, in the U.S., there is still a sizeable gap in consumption between the West and the East Coast, suggesting potential for further domestic growth (Figure 6).

Figure 6 – Gap in per capita consumption between East and West coast (Hass Avocado Board via CVGW investor presentation)

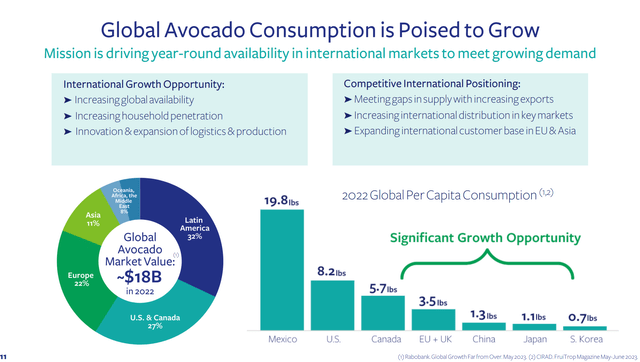

Furthermore, globally, avocado consumption is still very low and represents significant growth opportunities for a global distributor like Mission Produce (Figure 7).

Figure 7 – Global avocado consumption is still very low with room to grow (AVO investor presentation)

Extraordinary Margins Were Unsustainable

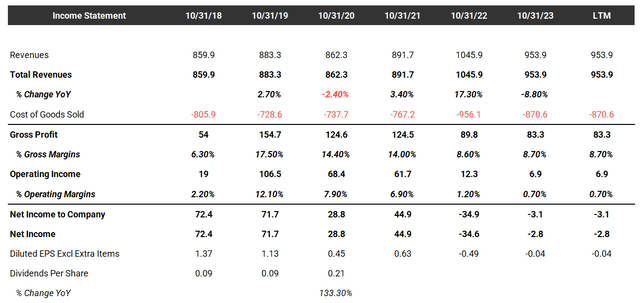

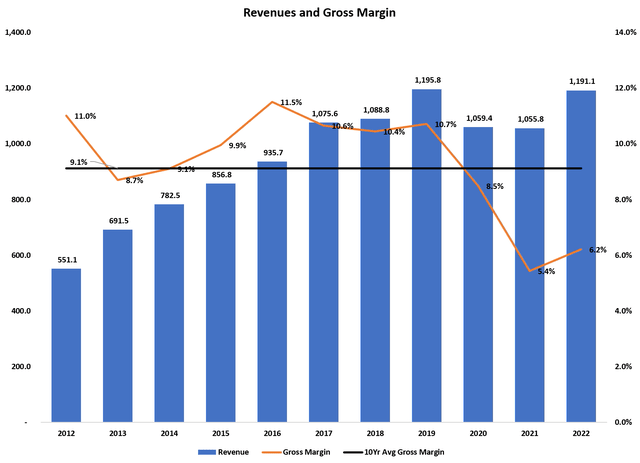

In my prior article, my main concern with Mission Produce was that the company IPO’d in 2020 on the back of an exceptionally strong financial performance in fiscal 2019, when the company recorded gross margins of 17.5% and operating margins of 12.1% (Figure 8). This was far above what Calavo was able to achieve in the same year at 10.7% and 5.8% respectively. Furthermore, it appeared far too high for a commodity business like avocado marketing and distribution.

Figure 8 – AVO financial summary (Author created from tikr.com data)

Unfortunately, I was proven correct, as Mission’s margins have reverted lower in the past few years, with gross margins of 8.6% and 8.7% in 2022 and 2023 respectively. Operating margins also plummeted to just 1.2% and 0.7%.

But Has It Fallen Too Low In Recent Years?

However, for a commodity business like Mission Produce, the key question investors should ask is what is the long-term mid-cycle level of gross margins? Based on Mission’s publicly available financials, gross margins have averaged 11% from 2018 to 2023.

Similarly, CVGW, which primarily operates in the business of marketing and distributing avocados, had average gross margins of 9.1% from 2012 to 2022 (Figure 9).

Figure 9 – CVGW revenue and gross margins (Author created from company reports)

Since Mission grow a portion of its own crops, I believe it should have higher gross margins compared to CVGW’s pure marketing and distribution model, so I think a fair long-term gross margin level for AVO should be ~11%.

Still Overvalued Assuming Normalized Margins

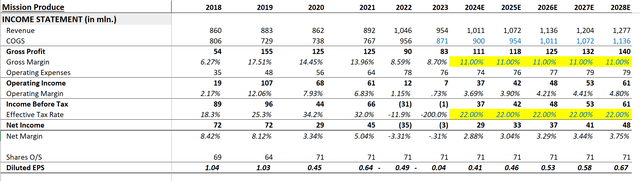

Assuming 11% gross margin and mid-single digit revenue growth (as per management’s long-term guidance), I believe Mission’s financial model could return to profitability levels similar to years 2020 and 2021, when the company delivered $0.45 and $0.64 in diluted EPS respectively (Figure 10).

Figure 10 – AVO financial model (Author created)

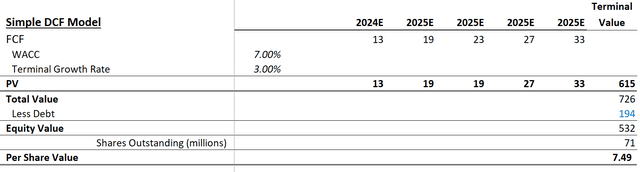

However, using a WACC of 7.0% and long-term growth rate of 3%, I estimate Mission’s DCF value is only $7.50 per share, compared to its current share price of ~$10.35 (Figure 11).

Figure 11 – AVO DCF model (Author created)

So even if we believe gross margins are currently too low and normalizes to ~11%, Mission Produce is likely still overvalued.

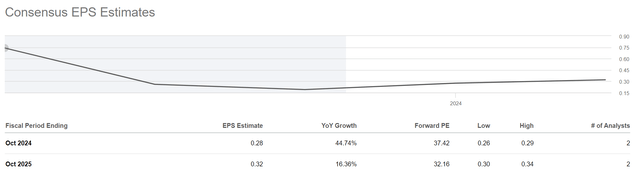

For context, Wall Street analysts currently expect Mission Produce to earn $0.28 and $0.32 / share in 2024 and 2025 respectively (Figure 12).

Figure 12 – Consensus estimates for AVO (Seeking Alpha)

Risks To Mission Produce

In my opinion, the biggest risk to Mission Produce is avocado prices, which can be quite volatile. Even though Mission Produce sold 12% more avocados in 2023 compared to 2022 (654 million lbs vs. 584 million lbs), top line revenues actually declined 8.8% due to volatile fruit prices.

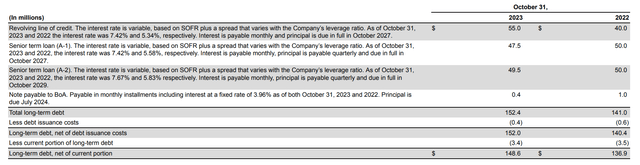

Another risk to Mission is its balance sheet. As I have commented before, Mission Produce carries significant debt of $152 million, plus financial leases (Figure 13). Due to rising interest rates, AVO’s interest expense more than doubled in 2023 to $12 million.

Figure 13 – AVO carries significant debt (AVO 10K report)

On the upside, as Mission Produce is vertically integrated on part of its volumes, if fruit pricing improves, AVO can also deliver outsized financial gains from higher farming margins like in 2019.

Conclusion

Although Mission Produce’s stock price has declined by more than 25% since the last time I reviewed the company in mid-2022, I believe its shares are still overvalued compared to my estimate of the company’s intrinsic value.

Simply put, at mid-cycle gross margins of ~11%, I believe Mission is worth ~$7.50 / share. So I would not be a buyer of AVO’s shares at current levels.