jittawit.21

To win one hundred victories in one hundred battles is not the acme of skill. To subdue the enemy without fighting is the acme of skill.”― Sun Tzu, The Art of War

Today, we put Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM) in the spotlight for the first time since our initial article on the promising small biopharma concern back at the end of 2021. At that point, we gave the name a ‘thumbs up‘ soon after the company garnered its first FDA approval. The stock is up some 70% since that piece ran. Is Mirum still in the ‘buy zone‘ after that rise? An updated analysis follows below.

Company Overview:

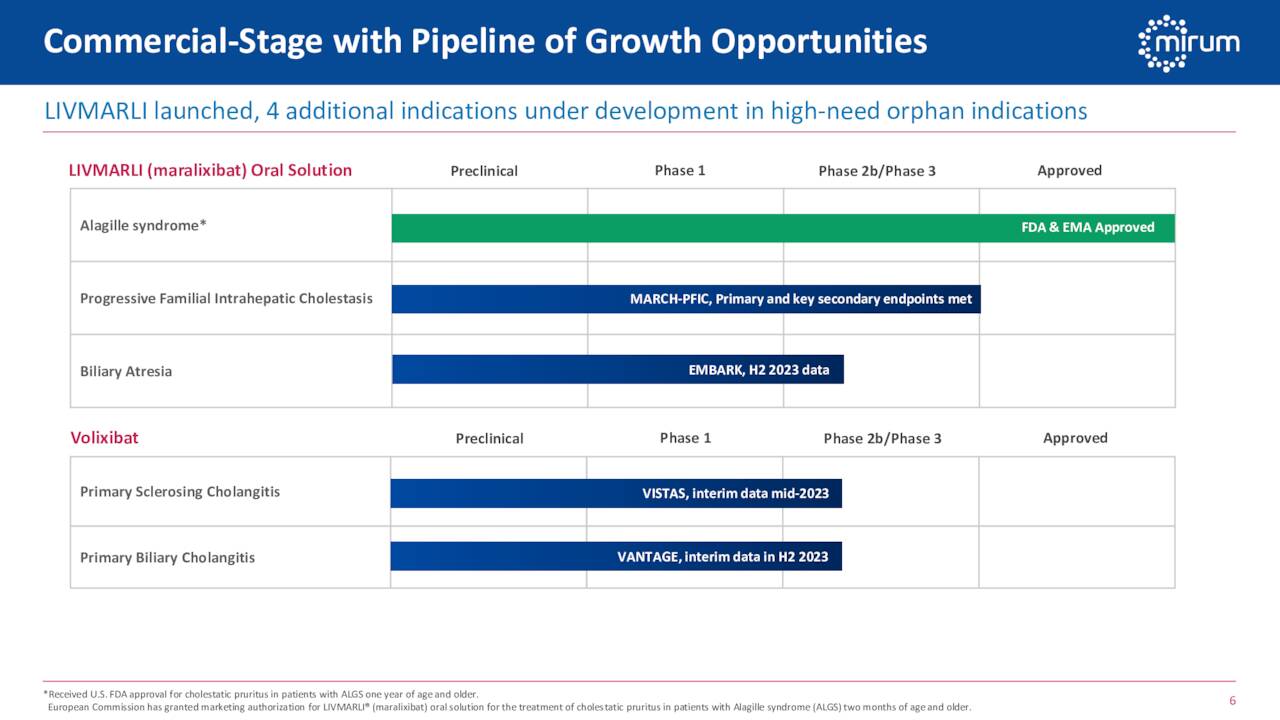

This Golden State headquartered biopharma concern focused on the development of treatments for rare liver disease. Its core asset is called maralixibat which also goes by the brand name Livmarli. This oral solution is FDA approved for the treatment of cholestatic pruritus for Alagille syndrome or ALGS patients over the age of one year old. The stock currently trades for just under $27.00 a share and sports an approximate market capitalization of $1 billion.

Livmarli was approved in the United States late in the third quarter of 2021 and got the nod for Europe just over a year later. Alagille syndrome or ALGS is a genetic disorder that affects primarily the liver and the heart. Most problems associated with the disorder become evident in infancy or early childhood. The estimated prevalence of Alagille syndrome is 1 in every 30,000 to 1 in every 40,000 live births.

January 2023 Company Presentation

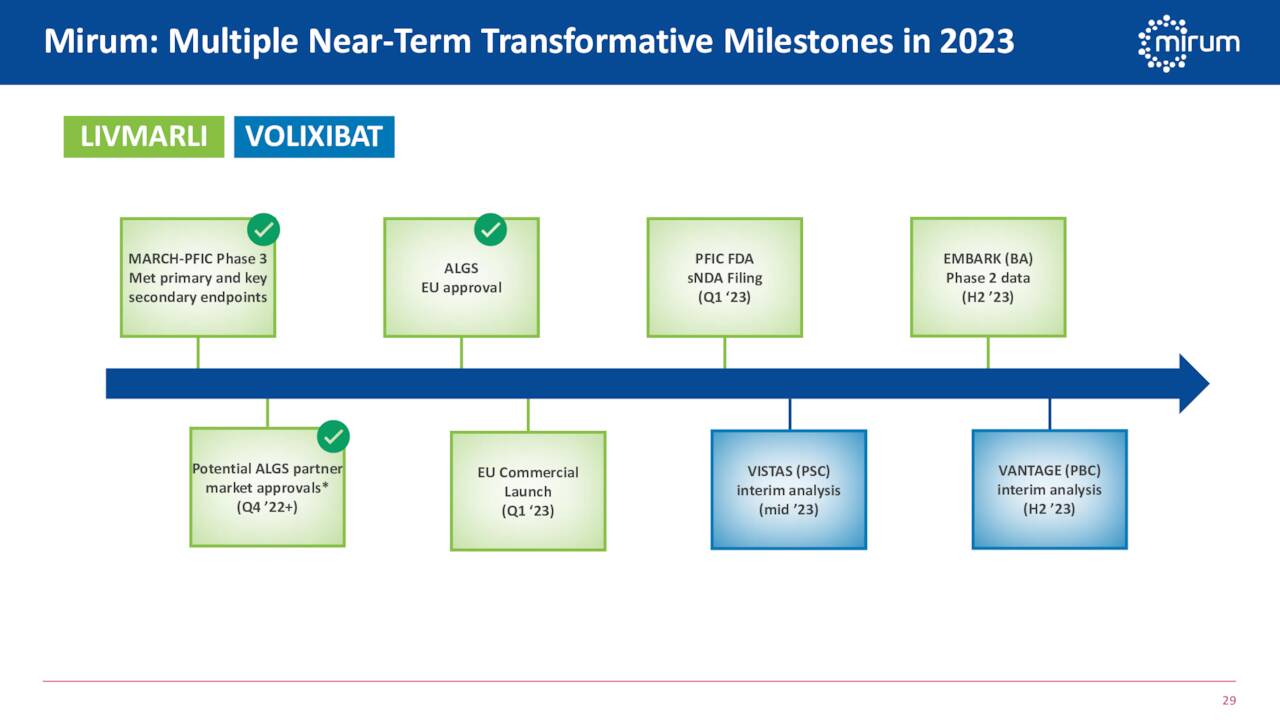

In mid-February, Mirum filed a supplemental New Drug Application or sNDA seeking expanded approval of Livmarli to treat cholestatic pruritus in patients two months of age and older with progressive familial intrahepatic cholestasis or PFIC. Data from a study called MARCH support this application.

January Company Presentation

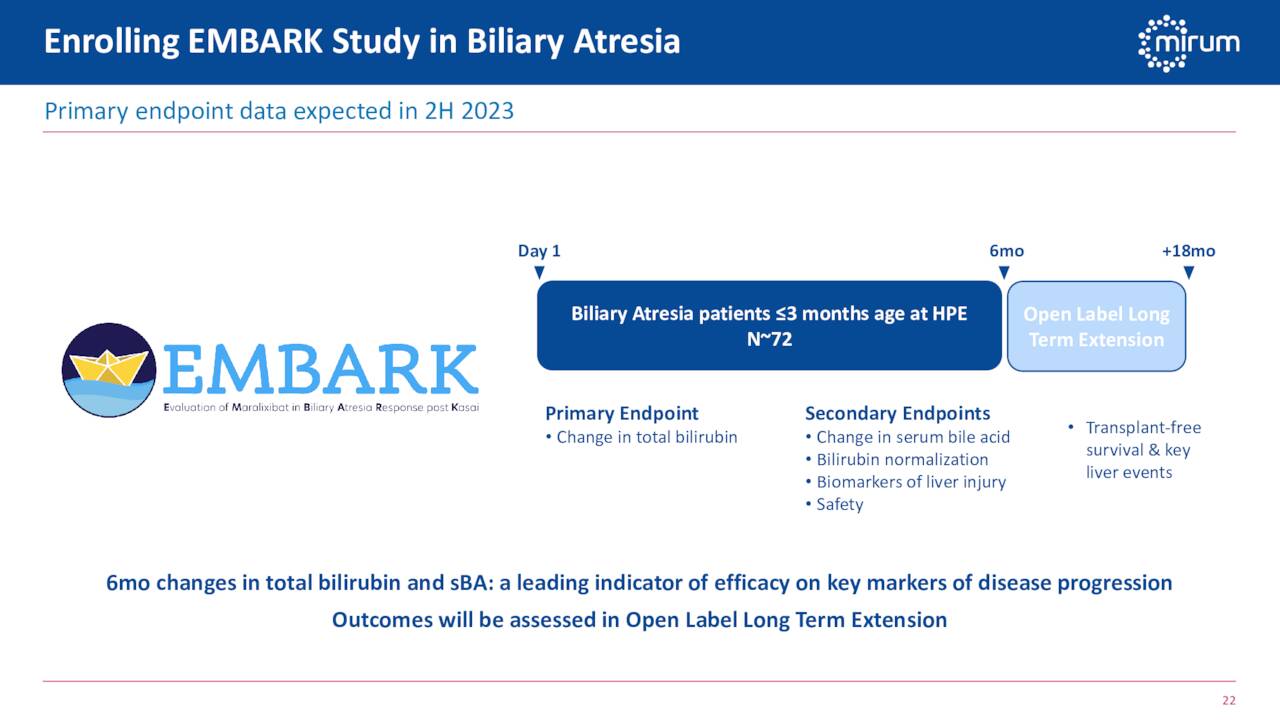

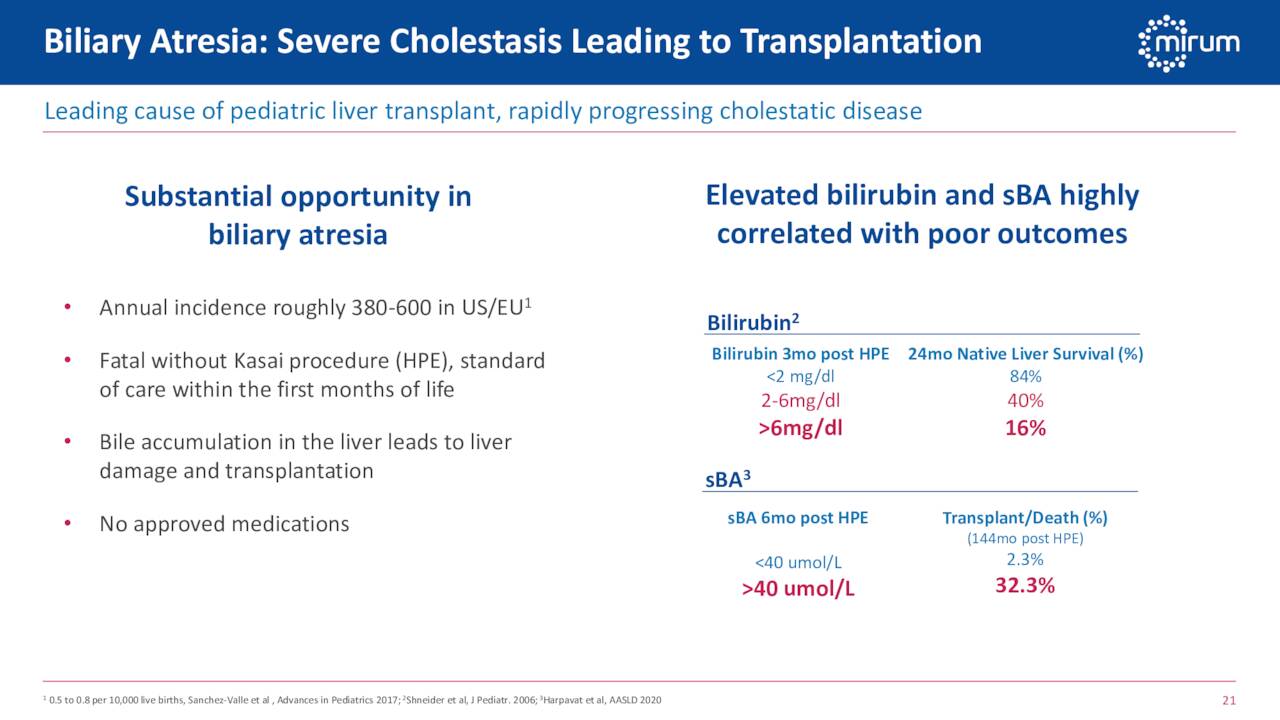

The company also is evaluating Livmarli to treat biliary atresia in a trial called EMBARK. Initial data from that pivotal trial will be out sometime in the second half of this year.

January 2023 Company Presentation

Biliary atresia is a childhood disease of the liver in which one or more bile ducts are abnormally narrow, blocked, or absent. This condition can be either be congenital or acquired. Biliary atresia has an incidence of one in 10,000-15,000 live births in the United States.

January Company Presentation

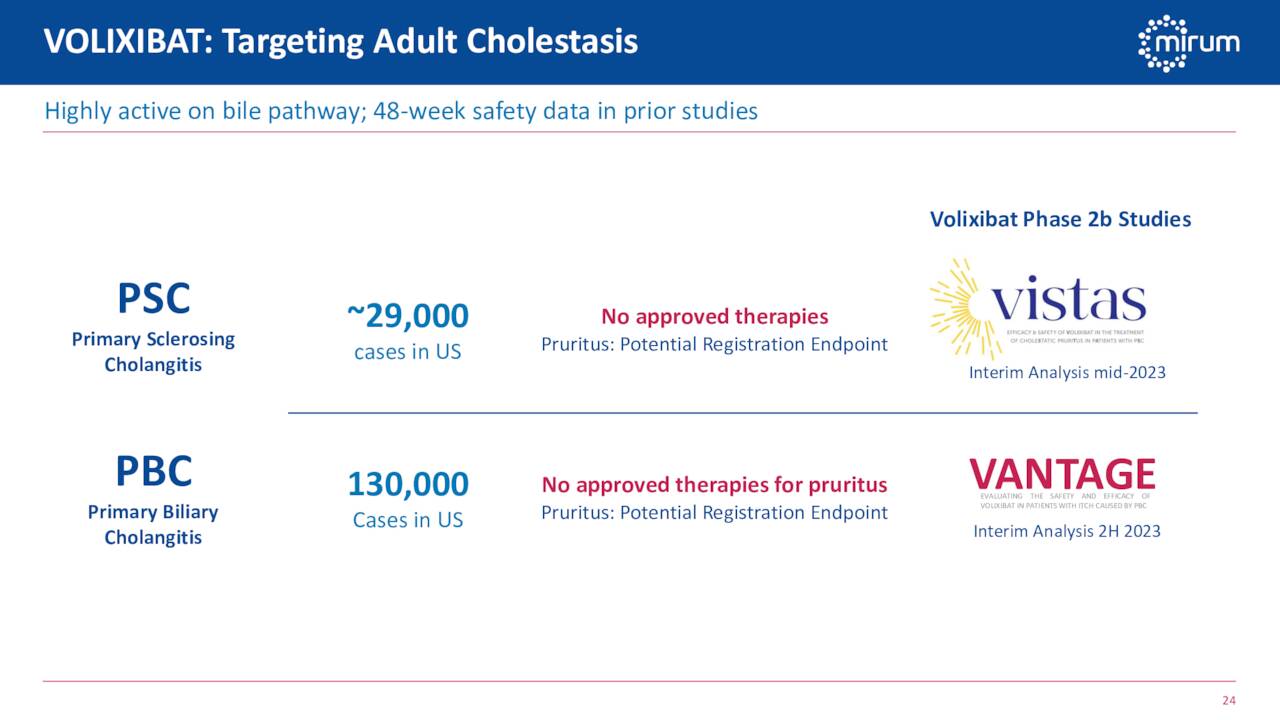

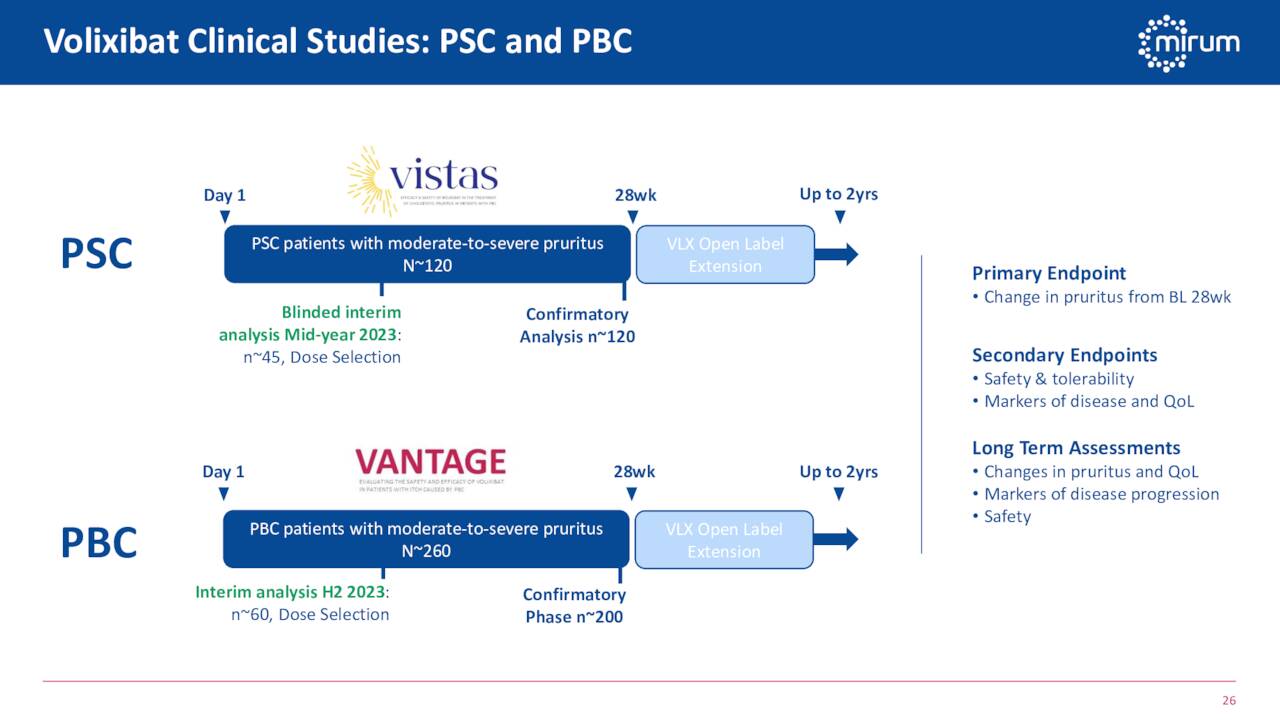

Mirum is also working on a compound called Volixibat which is targeting Adult Cholestasis. Interim analysis from a study targeting primary sclerosing cholangitis should be out mid-year. Interim analysis from another targeting primary biliary cholangitis will be out sometime in the second half of this year.

January 2023 Company Presentation

Recently Quarterly Results:

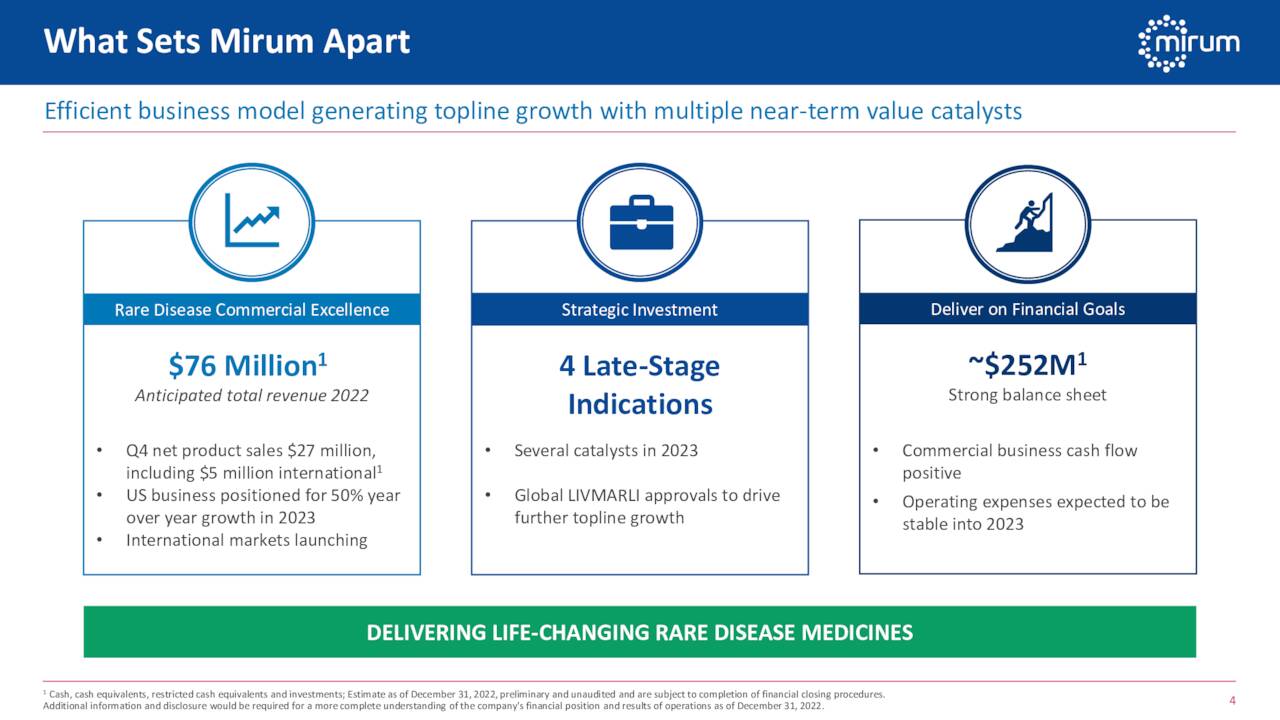

Mirum Pharmaceuticals reported preliminary, unaudited first quarter results on April 12th. Mirum had revenues of $31.5 million for the quarter. On March 8th, the company posted its official fourth quarter numbers which showed revenues of $27.9 million. Revenues came in nearly $3 million over expectations.

This also represented 48% sequential growth from the third quarter of 2022. For the year, sales totaled $75.1 million in FY2022. Mirum only had $3.1 million in revenues in FY2021 as Livmarli wasn’t launched until the fourth quarter of 2021. Management guided to 50% sales growth for the United States in FY2023.

Analyst Commentary & Balance Sheet:

Since late March, five analyst firms have reiterated Buy/Outperform ratings on the stock including Citigroup and Raymond James. Price targets proffered range from $34 to $81 a share. Just over 10% of the overall float in the stock is currently held short. There has been no insider activity in the stock so far in 2023. The company ended the first quarter with just over $230 million in cash and marketable securities on its balance sheet. The company also raised $275 million via convertible notes in the second week of April. Prior to that issuance, the company had no long-term debt.

Verdict:

The current analyst firm consensus has the company losing just over three bucks a share in FY2023 even as revenues rise 70% to just over $130 million. Sales growth is expected to slow only slightly in FY2024 to 65% while losses are predicted to be cut by just over 50%.

January 2023 Company Presentation

The company has several potential catalysts/milestones. These include planned LIVMARLI launches in additional international markets. As well as potential label expansion into PFIC and data milestones for their other late-stage clinical programs such as Volixibat.

January 2023 Company Presentation

The company has made considerable progress since we last visited the investment thesis around it. Mirum has had a successful initial rollout of Livmarli and on its way to expanding approved indications and markets for that franchise. Volixbat also seems to hold considerable promise. Mirum also has recently addressed its funding needs and enjoys strong analyst coverage. While some years away from profitability, the stock merits a position in a well-diversified biotech portfolio. Finally, given both Livmarli and Volixbat are wholly owned compounds, a buyout at some point in the future appears to be a potential scenario as well. After all, a competitor was purchased earlier this year.

The only victories which leave no regret are those which are gained over ignorance.“― Napoleon Bonaparte