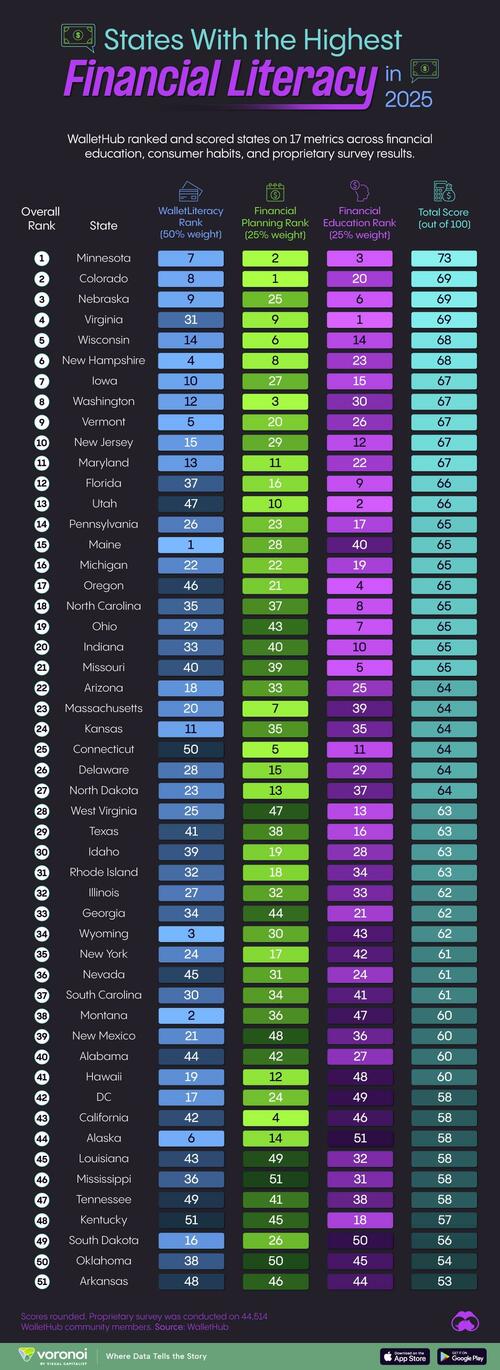

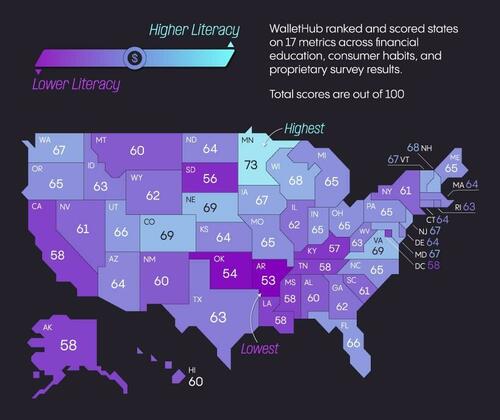

How effectively are People managing their cash, and the way does it differ between the states?

This monetary literacy map, by way of Visible Capitalist’s Pallavi Rao, makes an attempt to reply each questions utilizing 2025 knowledge from WalletHub, a private finance companies firm.

They ranked and scored states on three important benchmarks: monetary training, monetary planning (or shopper habits), and the way Wallethub’s personal customers carried out on their monetary literacy survey.

ℹ️ These benchmarks are additional subdivided into 17 metrics (credit score rating, financial savings, private finance programs, and so forth.) and are weighted otherwise. Please learn the supply’s methodology part for a full breakdown.

The Most Financially Savvy U.S. State

Minnesota is probably the most financially literate U.S. state with 73 factors, based on WalletHub’s newest evaluation.

Right here’s some sub indicators the place Minnesota outperformed the remainder of the nation.

- Excessive-schoolers should take at the least one private finance program.

- Solely 15% of the surveyed Minnesotans spent greater than they made—the bottom throughout all states.

- Highest median credit score rating within the nation (751).

And right here’s how every state scores out of 100. Figures are rounded.

| Rank | State | State Code | Complete Rating (Out of 100) |

|---|---|---|---|

| 1 | Minnesota | MN | 73 |

| 2 | Colorado | CO | 69 |

| 3 | Nebraska | NE | 69 |

| 4 | Virginia | VA | 69 |

| 5 | Wisconsin | WI | 68 |

| 6 | New Hampshire | NH | 68 |

| 7 | Iowa | IA | 67 |

| 8 | Washington | WA | 67 |

| 9 | Vermont | VT | 67 |

| 10 | New Jersey | NJ | 67 |

| 11 | Maryland | MD | 67 |

| 12 | Florida | FL | 66 |

| 13 | Utah | UT | 66 |

| 14 | Pennsylvania | PA | 65 |

| 15 | Maine | ME | 65 |

| 16 | Michigan | MI | 65 |

| 17 | Oregon | OR | 65 |

| 18 | North Carolina | NC | 65 |

| 19 | Ohio | OH | 65 |

| 20 | Indiana | IN | 65 |

| 21 | Missouri | MO | 65 |

| 22 | Arizona | AZ | 64 |

| 23 | Massachusetts | MA | 64 |

| 24 | Kansas | KS | 64 |

| 25 | Connecticut | CT | 64 |

| 26 | Delaware | DE | 64 |

| 27 | North Dakota | ND | 64 |

| 28 | West Virginia | WV | 63 |

| 29 | Texas | TX | 63 |

| 30 | Idaho | ID | 63 |

| 31 | Rhode Island | RI | 63 |

| 32 | Illinois | IL | 62 |

| 33 | Georgia | GA | 62 |

| 34 | Wyoming | WY | 62 |

| 35 | New York | NY | 61 |

| 36 | Nevada | NV | 61 |

| 37 | South Carolina | SC | 61 |

| 38 | Montana | MT | 60 |

| 39 | New Mexico | NM | 60 |

| 40 | Alabama | AL | 60 |

| 41 | Hawaii | HI | 60 |

| 42 | District of Columbia | DC | 58 |

| 43 | California | CA | 58 |

| 44 | Alaska | AK | 58 |

| 45 | Louisiana | LA | 58 |

| 46 | Mississippi | MS | 58 |

| 47 | Tennessee | TN | 58 |

| 48 | Kentucky | KY | 57 |

| 49 | South Dakota | SD | 56 |

| 50 | Oklahoma | OK | 54 |

| 51 | Arkansas | AR | 53 |

In the meantime, Arkansas examined the worst, with 53 factors. Its rating is impacted by having the second-worst efficiency on WalletHub’s monetary literacy survey.

And right here’s every state’s rank throughout the three important benchmarks.

| Rank | State | WalletLiteracy Rank (50% Weight) | Monetary Planning Rank (25% Weight) | Monetary Data Rank (25% Weight) |

|---|---|---|---|---|

| 1 | Minnesota | 7 | 2 | 3 |

| 2 | Colorado | 8 | 1 | 20 |

| 3 | Nebraska | 9 | 25 | 6 |

| 4 | Virginia | 31 | 9 | 1 |

| 5 | Wisconsin | 14 | 6 | 14 |

| 6 | New Hampshire | 4 | 8 | 23 |

| 7 | Iowa | 10 | 27 | 15 |

| 8 | Washington | 12 | 3 | 30 |

| 9 | Vermont | 5 | 20 | 26 |

| 10 | New Jersey | 15 | 29 | 12 |

| 11 | Maryland | 13 | 11 | 22 |

| 12 | Florida | 37 | 16 | 9 |

| 13 | Utah | 47 | 10 | 2 |

| 14 | Pennsylvania | 26 | 23 | 17 |

| 15 | Maine | 1 | 28 | 40 |

| 16 | Michigan | 22 | 22 | 19 |

| 17 | Oregon | 46 | 21 | 4 |

| 18 | North Carolina | 35 | 37 | 8 |

| 19 | Ohio | 29 | 43 | 7 |

| 20 | Indiana | 33 | 40 | 10 |

| 21 | Missouri | 40 | 39 | 5 |

| 22 | Arizona | 18 | 33 | 25 |

| 23 | Massachusetts | 20 | 7 | 39 |

| 24 | Kansas | 11 | 35 | 35 |

| 25 | Connecticut | 50 | 5 | 11 |

| 26 | Delaware | 28 | 15 | 29 |

| 27 | North Dakota | 23 | 13 | 37 |

| 28 | West Virginia | 25 | 47 | 13 |

| 29 | Texas | 41 | 38 | 16 |

| 30 | Idaho | 39 | 19 | 28 |

| 31 | Rhode Island | 32 | 18 | 34 |

| 32 | Illinois | 27 | 32 | 33 |

| 33 | Georgia | 34 | 44 | 21 |

| 34 | Wyoming | 3 | 30 | 43 |

| 35 | New York | 24 | 17 | 42 |

| 36 | Nevada | 45 | 31 | 24 |

| 37 | South Carolina | 30 | 34 | 41 |

| 38 | Montana | 2 | 36 | 47 |

| 39 | New Mexico | 21 | 48 | 36 |

| 40 | Alabama | 44 | 42 | 27 |

| 41 | Hawaii | 19 | 12 | 48 |

| 42 | District of Columbia | 17 | 24 | 49 |

| 43 | California | 42 | 4 | 46 |

| 44 | Alaska | 6 | 14 | 51 |

| 45 | Louisiana | 43 | 49 | 32 |

| 46 | Mississippi | 36 | 51 | 31 |

| 47 | Tennessee | 49 | 41 | 38 |

| 48 | Kentucky | 51 | 45 | 18 |

| 49 | South Dakota | 16 | 26 | 50 |

| 50 | Oklahoma | 38 | 50 | 45 |

| 51 | Arkansas | 48 | 46 | 44 |

There’s some additional insights to clarify some noticeable geographic tendencies.

- Colorado and Nebraska additionally require private finance training in highschool.

- Kentucky, Oklahoma, and Arkansas have the bottom share of adults with emergency money.

- A better share of Southern state residents borrow from non-bank lenders, affecting their monetary planning rating.

The Neglected A part of Monetary Literacy: Managing Debt

Whereas investing within the markets is all the fad—notably with the rise of no-fee platforms—WalletHub’s benchmarks prioritize an usually missed a part of cash administration: debt.

America’s bank card debt collectively crossed $1 trillion in 2023, and it’s solely been rising since.

On common, American households have about $5,000 in excellent bank card balances, which may take anyplace between one to 2 years to repay relying on month-to-month incomes.

In fact, managing expenditures to keep away from or cut back debt has been notably troublesome within the a number of years of post-pandemic inflation.

Want extra money administration insights about the USA? Try: America’s Common Financial institution Account Stability, by State for a fast overview.