Morningstar blames “mistimed purchases and sales;” Carl Richards calls it the “Behavior Gap.” Vanguard’s Fran Kinnery describes the cure as “Advisors Alpha.” Whatever phrase you select, the persistent gap between investors’ performance and the assets they hold is a substantial drag on returns.

I mention this in case you missed this Morningstar report “Mind the Gap: A report on investor returns in the U.S.” on the topic; it snuck by during the dog days of summer. I only noticed it because Robin Wigglesworth highlighted it last week.1

The Executive Summary gives you the flavor of the timing issue:

“The persistent gap between the returns investors actually experience and reported total returns makes cash flow timing one of the most significant factors—along with investment costs and tax efficiency—that can influence an investor’s end results.

In this report, we dig into these nuances and explore how differences in the timing of cash flows, sequence of returns, and asset size can impact this gap. In addition, our research imparts a few lessons on how investors can avoid these gaps and capture more of their fund holdings’ total returns.”

Morningstar’s key observation: Over the most recent 10-year period (2013-22), fund investors lagged the very funds they owned by 1.7% annually. Considering those funds averaged a 7.7% annual return, that is a 22% annual shortfall.

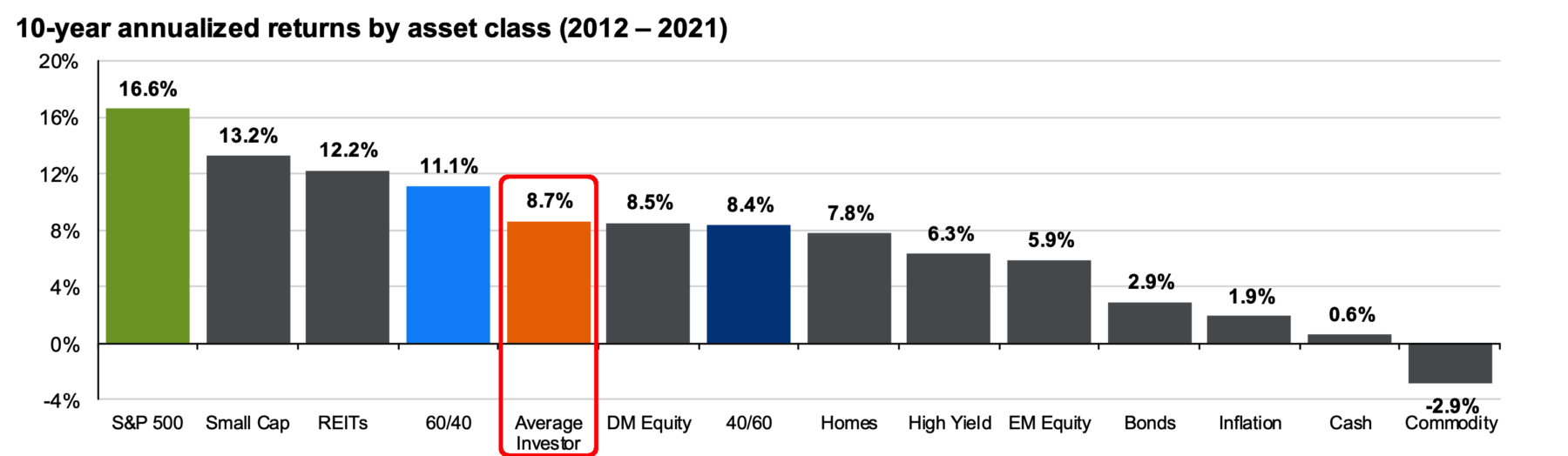

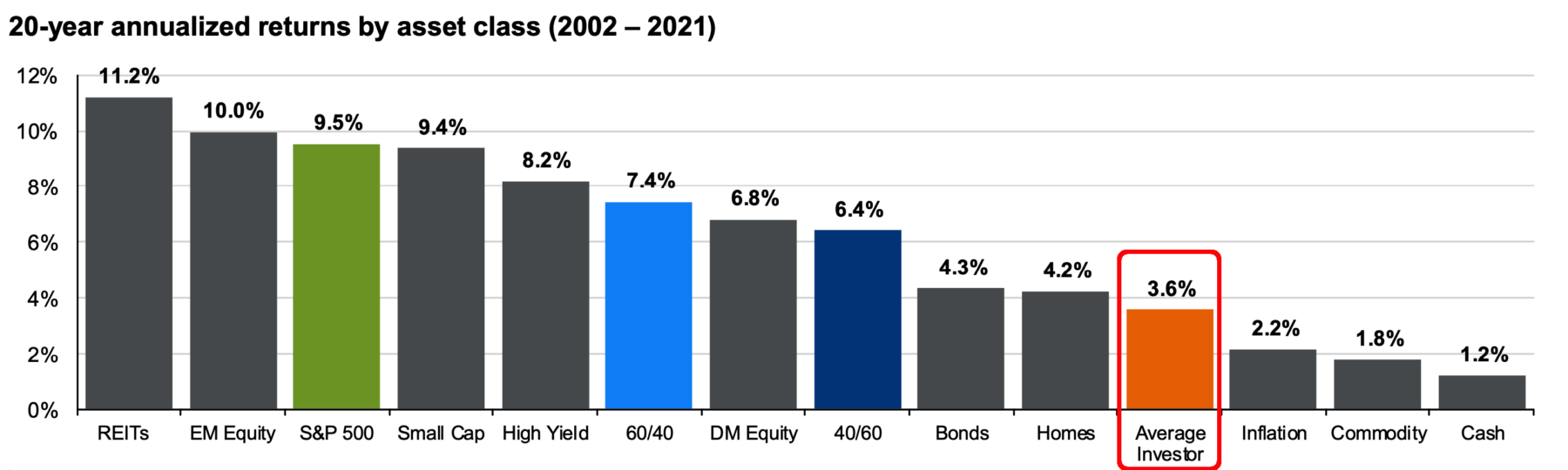

Worse still, this lag compounds over time. Consider the charts below (via J.P. Morgan’s Quarterly Guide to the Markets); the impact over 10 or 20 years is substantial, and the longer the time period examined, the greater the gap becomes.2

Different studies blame different sources for the lag; Morningstar points to poor timing; Vanguard suggests it is a lack of professional planning; Carl Richards says it is all behavior. Neurologist and investor Bill Bernstein goes even further, finding the evolutionary cognitive source in our limbic system:

“To the extent that you succeed in finance, you succeed in finance to the extent that you can suppress the limbic system, your system one, which is the very fast moving emotional system that we have. If you can’t suppress that, you’re probably going to die poor…”

Like so much in life, the more satisfying answer is that the causes are nuanced and complex, with numerous interrelated factors combined to lead to an undesirable outcome.

Give this some time over the long weekend to read. Your portfolio will thank you…

Source:

Mind the Gap: A report on investor returns in the U.S.

Jeffrey Ptak, Amy C. Arnott

Morningstar, July 31, 2023

See also:

Timing is hard

by Robin Wigglesworth

FT Alphaville, August 25, 2023

Previously:

Investing is the Study of Human Decision Making (August 23, 2023)

Underperforming Your Own Assets (July 24, 2023)

Simple, But Hard (January 30, 2023)

Investing is a Problem-Solving Exercise (January 31, 2022)

____________

1. As noted in July in Underperforming Your Own Assets, this is the sweet spot of my own confirmation bias.

2. I know, it’s not an exact apples-to-apples comparison; there are other factors contributing to the gap, such as active vs. passive underperformance. Even still, it shows the impact of the compounded performance gap (regardless of cause) over longer holding periods…

JPM charts from my July 24, 2023 post, Underperforming Your Own Assets:

Over 10 years, (2012-2021) the SPX generated 16.6% annual returns, but the average investor only gained 8.7% per year. Over that period, the typical investor garnered about half of what the markets generated:

Where things really went off the rails were the 20-year returns,w which included most of the dot com implosion, and all of the Great Financial Crisis. Over that volatile era, the SPX returned 9.5% annually while investors garnered about 3.6% per year — barely a third of the index.