Key Takeaways

- MicroStrategy acquired a further 55,500 BTC as a part of its technique to extend Bitcoin holdings.

- Bernstein tasks MicroStrategy’s Bitcoin holdings may attain 830,000 BTC by 2033, valued at $1 million per coin.

Share this text

MicroStrategy mentioned Monday it had acquired a further 55,500 Bitcoin for $5.4 billion at a mean value of $97,862 per coin. The announcement comes after the corporate efficiently accomplished its senior word providing final Friday.

MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per #bitcoin and has achieved BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hodl 386,700 $BTC acquired for ~$21.9 billion at ~$56,761 per bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

Having added over 130,000 BTC to its portfolio this month, MicroStrategy now holds a complete of 386,700 BTC, valued at roughly $38 billion at present market costs. The newest acquisition of $5.4 billion is the corporate’s largest buy up to now.

MicroStrategy is forward of schedule in its plans to lift $42 billion over the following three years to finance its Bitcoin acquisitions. The corporate has already secured $3 billion in convertible debt and $6.6 billion in fairness this month.

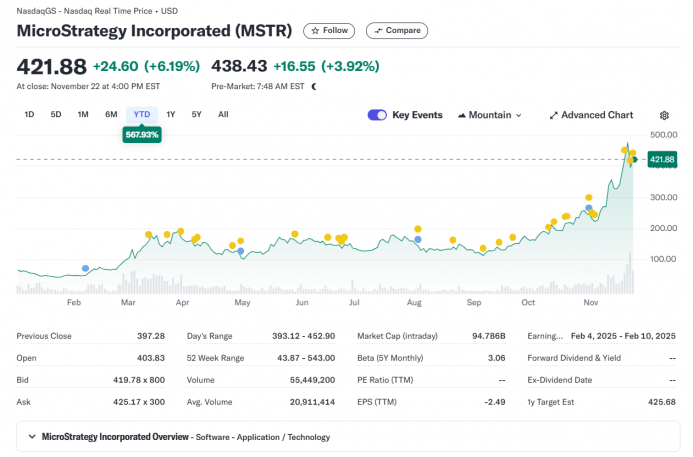

Bernstein analysts predict MicroStrategy’s Bitcoin holdings will improve from 1.7% to 4% of the circulating provide by 2033. Analysts increase their value goal for shares of MicroStrategy (MSTR) to $600 by the top of 2025.

The replace follows a fast inventory value improve pushed by the corporate’s aggressive Bitcoin funding technique. MicroStrategy inventory has soared over 560% this yr, outpacing most S&P 500 indexes, in response to information from Yahoo Finance.

Bernstein tasks MicroStrategy may maintain roughly 830,000 BTC by the top of 2033, valued at $830 billion at a value of $1 million per coin.

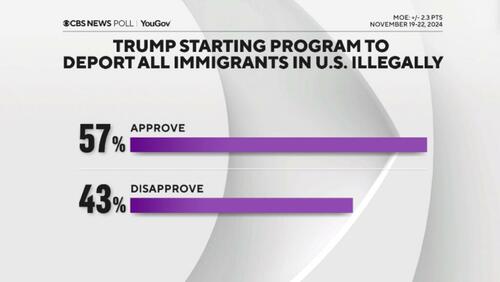

Analysts consider that favorable regulatory circumstances underneath the incoming Trump administration, rising institutional adoption, and macroeconomic components corresponding to low rates of interest and inflation dangers help a sustained bull marketplace for Bitcoin.

Share this text