Jean-Luc Ichard

Funding Thesis

On thirtieth July, Microsoft Company (NASDAQ:MSFT) launched its FY24 This fall earnings outcomes. The corporate reported a income of $64.7B, a rise of 15% in comparison with the identical quarter within the earlier yr. Moreover, Microsoft reported a web earnings of $22B, up 10% in comparison with FY23 This fall.

Microsoft introduced diluted earnings per share of $2.95, a rise of 10% in comparison with the identical quarter within the earlier yr, highlighting the corporate’s potential for dividend progress.

Microsoft’s sturdy earnings ends in FY24 This fall reinforce my present purchase ranking for the corporate. Regardless of Microsoft’s barely elevated valuation, I contemplate Microsoft to be pretty valued. That is the case since Microsoft’s present valuation is just barely above its 5-year Common. I’m satisfied that Microsoft must be rated at a premium when in comparison with different corporations within the Data Know-how Sector on account of its strong aggressive place, important aggressive benefits, and powerful monetary well being.

I imagine that the corporate is especially engaging for younger traders who goal to take a position with a protracted funding horizon and who plan to learn from the corporate’s sturdy dividend progress potential (underlined by Microsoft’s 10-Yr Dividend Progress Charge [CAGR] of 10.60%).

It’s value highlighting that final week, on twenty third July, Microsoft competitor Alphabet Inc. (GOOG)(GOOGL) aka Google had already reported its newest earnings outcomes. Alphabet introduced quarterly revenues of $84.7B, which was a rise of 14% year-over-year, underlying the corporate’s constructive progress outlook.

Each Microsoft and Alphabet are key gamers in The Dividend Earnings Accelerator Portfolio, successfully contributing by optimizing the portfolio when it comes to threat and reward. I additionally anticipate each corporations to considerably contribute to the portfolio’s dividend progress potential within the years forward.

I notably recommend youthful traders ought to obese Microsoft in an funding portfolio and preserve a long-term funding focus to learn from the corporate’s engaging risk-reward profile and its sturdy means to contribute to your portfolio’s dividend progress potential. Nonetheless, given the corporate’s elevated draw back threat, which is a results of its elevated valuation, I suggest setting an allocation restrict of 5% in relation to your total funding portfolio. This strategic method means that you can improve the chance of reaching a constructive Complete Return together with your total portfolio.

Microsoft’s Present Valuation

I imagine that Microsoft is at present pretty valued. That is the case for the reason that firm’s P/E [FWD] Ratio of 35.39 is just barely above its common from the previous 5 years (which is 31.22) and solely barely above the Sector Median of 29.48.

Nonetheless, it is very important spotlight that I imagine Microsoft must be rated with a premium when in comparison with most of its opponents within the Data Know-how Sector. That is as a result of firm’s sturdy aggressive benefits, its broad and diversified product portfolio, and its main market place inside its sector. Subsequently, I imagine that Microsoft is at present pretty valued, although its valuation is barely above the Sector Median.

Microsoft’s Progress Outlook

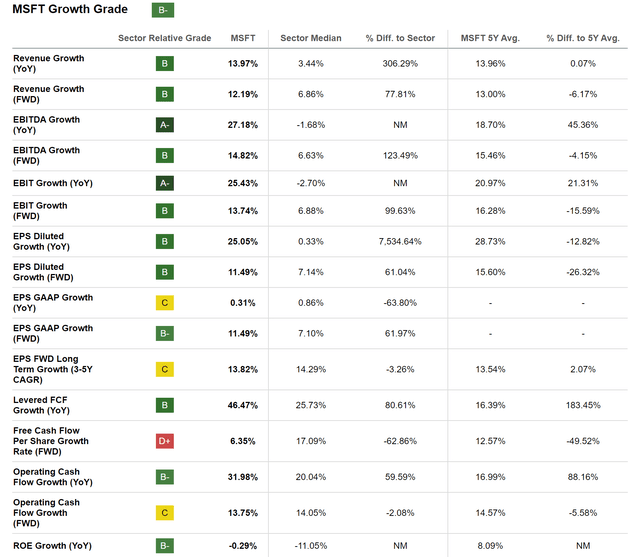

Microsoft’s constructive progress outlook is underlined by a Looking for Alpha Progress Grade of B- for the corporate. This confirms Microsoft’s glorious progress prospects and underscores my present purchase ranking for the corporate.

Microsoft’s EBITDA Progress Charge [FWD] stands at 14.82%, which is 123.49% above the Sector Median. This means that Microsoft has been capable of improve its earnings greater than its opponents.

It’s also value highlighting Microsoft’s EPS Diluted Progress Charge [FWD] of 11.49%, which is 61.04% above the Sector Median, underscoring Microsoft’s sturdy potential to extend its dividend.

Supply: Looking for Alpha

Microsoft’s Dividend Progress Potential and the Projection of its Dividend and Yield on Price

I’m satisfied that Microsoft nonetheless has sturdy potential for dividend progress within the years forward. This isn’t simply based mostly on the corporate’s 10-Yr Dividend Progress Charge [CAGR] of 10.60% but in addition on its EPS Diluted Progress Charge [FWD] of 11.49%.

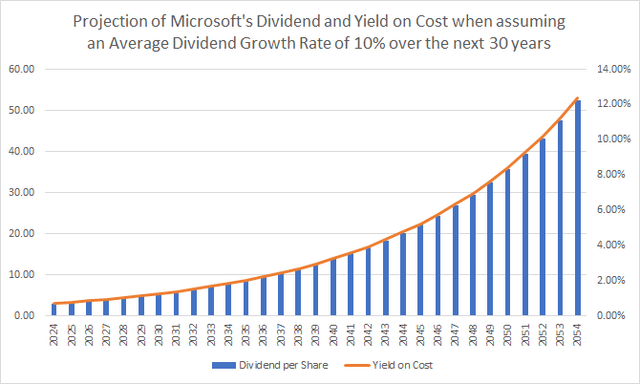

The chart under illustrates a projection of Microsoft’s Dividend and Yield on Price whether it is assumed that the corporate was capable of elevate its dividend by 10% per yr for the next 30 years (which relies on the above progress charges).

Supply: The Writer

Assuming these dividend progress charges and that you just spend money on Microsoft on the firm’s present inventory value of $423.78, you can probably attain a Yield on Price of 1.84% in 2034, 4.76% in 2044, and 12.35% in 2054. These numbers underline Microsoft’s sturdy dividend progress potential.

These dividend enhancements might be a possible driver for the corporate’s rising inventory value within the years forward. In such a case, you’ll profit not solely from the corporate’s steadily rising dividend funds but in addition from capital appreciation.

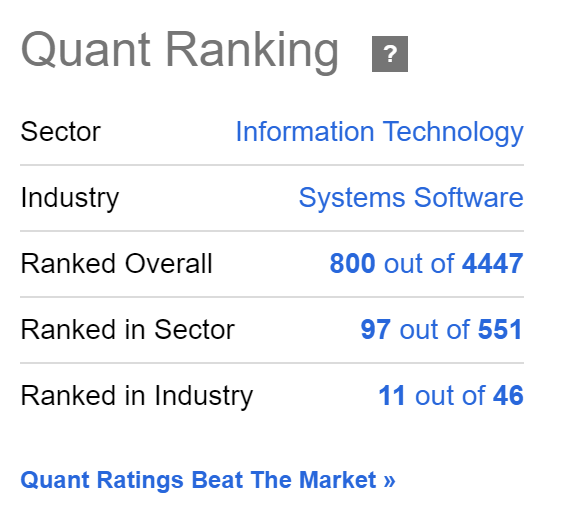

Microsoft, in accordance with the Looking for Alpha Quant Rating

In response to the Looking for Alpha Quant Rating, Microsoft is presently ranked eleventh out of 46 throughout the Techniques Software program Business. The corporate can be ranked 97th out of 551 throughout the Data Know-how Sector and 800th out of 4,447 throughout the total rating. The Looking for Alpha Quant Rating for Microsoft underlines my purchase ranking for the corporate.

Supply: Looking for Alpha

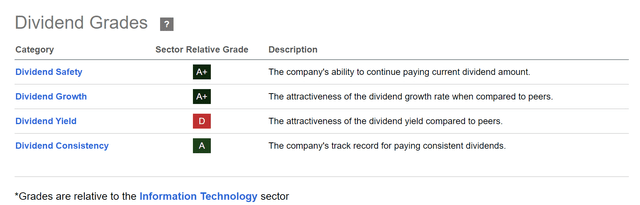

Microsoft, in accordance with the Looking for Alpha Dividend Grades

The Looking for Alpha Dividend Grades reinforce my perception that Microsoft is a superb choose for these traders specializing in dividend progress. The corporate receives an A+ for Dividend Security and Dividend Progress and an A for Dividend Consistency. For Dividend Yield, Microsoft receives a D ranking.

Supply: Looking for Alpha

Why I’ve added Microsoft to The Dividend Earnings Accelerator Portfolio

About 11 months in the past, I began constructing The Dividend Earnings Accelerator Portfolio. I’m continually documenting and optimizing the portfolio right here on Looking for Alpha to make sure a continually lowered portfolio threat degree, which permits us to have a excessive chance of reaching engaging funding outcomes.

The portfolio’s main goal is reaching a steadiness between dividend earnings and dividend progress, serving to traders generate a sexy dividend earnings for right this moment whereas continually elevating this quantity.

Microsoft is a crucial factor of The Dividend Earnings Accelerator Portfolio, at present representing 1.94% of the general portfolio. I added Microsoft to the portfolio on account of its means to supply the portfolio with important dividend progress (evidenced by the corporate’s 10-Yr Dividend Progress Charge [CAGR] of 10.60%), its monetary well being (Aaa credit standing from Moody’s), sturdy aggressive benefits, and its constructive progress prospects, which have been underscored by Microsoft’s sturdy FY24 This fall earnings outcomes.

It’s additional value highlighting that Microsoft competitor Alphabet, which reported its newest earnings outcomes final week, can be a strategically important core factor of The Dividend Earnings Accelerator Portfolio. Like Microsoft, I imagine that Alphabet is a sexy risk-reward alternative for traders and can contribute to the portfolio’s dividend progress potential. I anticipate each corporations to contribute considerably to the portfolio, reaching a sexy Complete Return.

The Principal Danger Issue When Investing in Microsoft and How you can Cut back This Danger

In my view, the primary threat issue Microsoft traders ought to contemplate is the corporate’s barely elevated valuation. At the moment, the corporate displays a P/E [FWD] Ratio of 35.39, indicating that elevated progress expectations are priced into the corporate’s share value. This results in an elevated draw back threat for Microsoft’s inventory value that traders ought to concentrate on.

To scale back this elevated draw back threat of Microsoft’s inventory value, traders ought to make investments over the long run, with an funding horizon of a minimum of 5 years. This ensures a discount within the affect of any potential decline within the firm’s inventory value, which may outcome if Microsoft does not meet its progress expectations.

I imagine that traders who goal to prioritize dividend progress of their funding portfolios ought to contemplate overweighting Microsoft inventory and positioning the portfolio for elevated dividend progress potential.

Nonetheless, I recommend setting the allocation restrict to five% for the Microsoft inventory in relation to your total funding portfolio. This lets you scale back the portfolio’s draw back threat and the portfolio’s company-specific allocation threat, thereby rising the chance of constructive funding outcomes.

A further threat issue contains Microsoft’s intense competitors with different tech corporations comparable to Alphabet, Amazon.com, Inc. (AMZN) and Apple Inc. (AAPL). Particularly, Microsoft’s cloud computing platform Azure is in intense competitors with the Amazon Internet Companies Platform and the Google Cloud Platform, which may adversely have an effect on Microsoft’s monetary outcomes, particularly within the quick time period, highlighting my long-term funding method.

Conclusion

Microsoft’s sturdy FY24 This fall earnings outcomes have strengthened my perception in at present ranking the corporate as a purchase. Microsoft launched diluted earnings per share of $2.95, a rise of 10% when in comparison with the identical quarter within the yr earlier than.

Regardless of Microsoft’s barely elevated valuation, I imagine that the corporate remains to be pretty valued. Microsoft’s present valuation is just barely above its 5-Yr Common.

I notably recommend that youthful traders aiming to take a position with a protracted funding horizon contemplate overweighting the Microsoft place of their funding portfolio to place their portfolio for elevated dividend progress potential. This method helps to extend the annual dividend fee you obtain from the chosen corporations in your portfolio to the next diploma.

Nonetheless, traders must be conscious that Microsoft’s elevated valuation represents a draw back threat for an funding portfolio, notably over the quick time period. This underscores the significance of a long-term funding method and an allocation restrict. I like to recommend a 5% allocation restrict for the Microsoft place. This ensures the discount of the draw back threat of your total funding portfolio.

Microsoft is just not solely a part of The Dividend Earnings Accelerator Portfolio. It’s also among the many largest positions in my private funding portfolio. The identical is true for Alphabet, which reported its earnings outcomes per week in the past.

When following a long-term method, I’m satisfied that each Microsoft and Alphabet may be essential strategic core positions on your funding portfolio, contributing to important dividend progress and capital appreciation.