Justin Sullivan

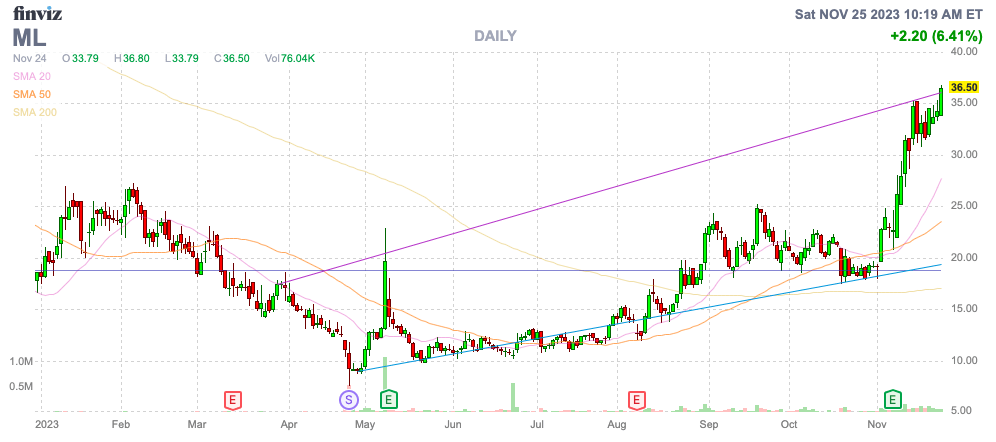

While the OpenAI drama showed Microsoft (NASDAQ:MSFT) as a crucial partner for Sam Altman, the situation proved customers need access to other AI sources. The stock soared to all-time highs on signs of a coup of hiring the King of AI, but a week of drama left Sam back at an OpenAI with a restructured BoD. My investment thesis is more Neutral on Microsoft after the nearly 20% rally in the stock since my previous research and the negatives of the OpenAI drama.

Source: Finviz

OpenAI Dysfunction

Back on November 17, CEO Sam Altman was fired from OpenAI by a BoD claiming he wasn’t candid with the oversight group. Microsoft owns 49% of OpenAI and didn’t appear happy with the move leading to an offer to hire the AI leader and other employees looking to exit the original non-profit firm.

After at least 90% of the employees threatened to leave OpenAI, Microsoft and other economic forces were able to negotiate a return of Sam Altman to the CEO position of OpenAI with a new BoD. The drama lasted 6 days and led to signs of ChatGPT outages.

Even worse, the Chief Scientist was involved in this attempt to oust Mr. Altman following the prior Chief Scientist leaving OpenAI after failing to push him out. The former Chief Scientist and other researchers formed competitor Anthropic back in 2021.

Alphabet (GOOG, GOOGL) recently invested $2 billion more in Anthropic to fund the competitor formed by OpenAI employees dissatisfied with the leadership of Sam Altman. The AI startup will even use TPUs from Google, and Amazon (AMZN) has reportedly invested up to $4 billion in the AI firm. The following OpenAI employees co-founded Anthropic.

- Dario Amodei – CEO, former VP of Research at OpenAI

- Jack Clark – former policy director and communications at OpenAI

- Tom Brown – technical staff at OpenAI

- Sam McCandlish – Research Leader at OpenAI

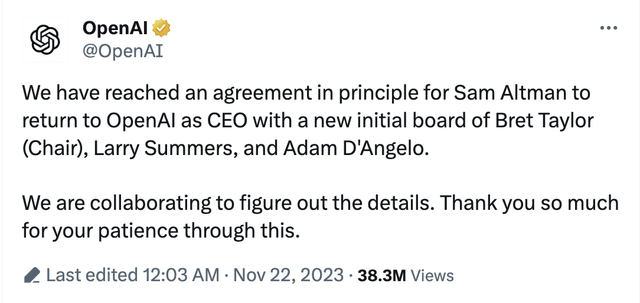

With Sam Altman and President Greg Brockman back running OpenAI, investors need to note a new BoD guiding the organization. Bret Taylor, Larry Summers, and Adam D’Angelo are a more formidable board, though ones unlikely to have the core mission of public safety for AI as the prior BoD.

Source: OpenAI

An unleashed Sam Altman without a BoD structured for public safety and benefiting all humanity might actually further grow generative AI leadership. The board members led by Georgetown Center for Security and Emerging Technology’s Helen Toner and OpenAI chief scientist Ilya Sutskever aren’t around to slow down AI due to safety reasons.

At the end of the day, 100s of customers apparently approached Anthropic, Google Cloud, and AI startup Cohere to pursue alternative AI services. In addition, Microsoft apparently is running into issues in competing with OpenAI in signing up customers even more impacted as Mr. Altman likely pivots even further to commercialization opportunities, unlike the prior structure with efforts to shackle those moves.

Microsoft definitely benefits from the large investment in an OpenAI worth up to $90 billion, but the company also doesn’t fully control the technology. All of the value derived by OpenAI doesn’t exactly flow into Microsoft unless it shows up as revenue for the tech giant.

Steep Value Jump

While Microsoft is full speed ahead with Copilot and other AI products, enterprises are only slowly purchasing new AI software tools. The tech giant only guided to FQ2 revenues of $60.6 billion for 15% growth.

While Microsoft has a huge growth opportunity due to AI, the stock has now rushed ahead of the real world potential. The company already generates $240 billion in annual revenues and an estimated $100 billion AI boost in the next few years is a great boost, but not a monumental move considering the relative size of Microsoft already.

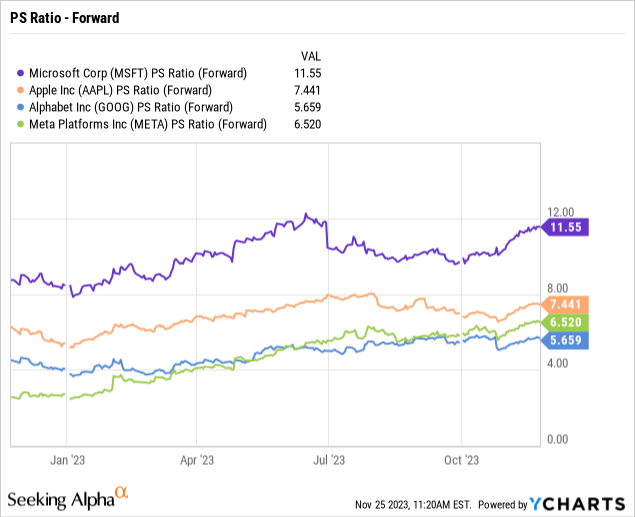

The stock has a market cap of nearly $3 trillion now with FY24 (June) revenues of $243 billion. Revenue is only forecast to grow at a 15% clip while trading at nearly 12x sales. In fact, the stock already trades at 7x FY28 revenue of $405 billion, suggesting the stock price might not rally for the next 5 years. All of the other tech giants now trade at vast discounts to Microsoft with Alphabet and Meta Platforms (META) trading at half the forward PS ratio at only 6x.

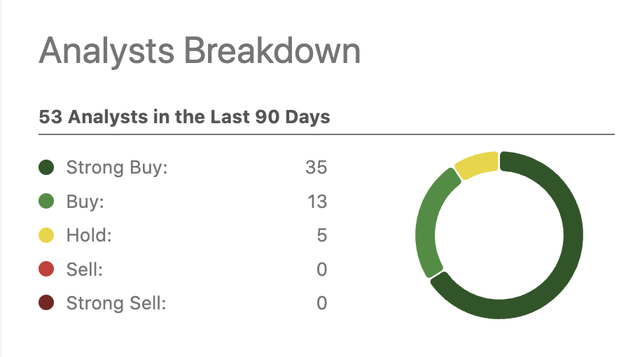

The stock could definitely run much higher in the next few weeks and months. A lot of analysts came out with $400+ price targets. The odd part is that the consensus price target is now only $406 for just 7.6% upside with Microsoft having 35 Strong Buy ratings out of 53 total ratings.

Source: Seeking Alpha

In essence, the majority of analysts are already fully bullish on the stock, offering limited additional upside from here. Investors will want to look at $400 as more of an exit point, not an entry point.

Takeaway

The key investor takeaway is that the OpenAI drama might not harm the AI business, but the drama has definitely made enterprises investigate alternative AI sources. Microsoft already trades at a premium valuation and a stretched valuation to tech peers. Investors should use any further rally toward the consensus price target as an opportunity to exit the stock at the peak and realize this isn’t the starting point for a major AI rally over the next few years.