hapabapa

My Strong Buy thesis on Micron Technology, Inc. (NASDAQ:MU) has panned out nicely since my last update in September 2023. I reminded investors not to overindulge in its downcast fiscal fourth quarter, or FQ4’23, report then, as the market is forward-looking. I’ve been pounding the table on MU since August 2022, when I first upgraded it. MU has significantly outperformed the S&P 500 (SP500)(SPX) since then, up nearly 50% relative to the market’s 15% upside over the same period.

As a result, I reminded investors that they could “miss out on a significant profitability growth inflection as Micron emerges from the market malaise.” A recent bearish article pointed out that MU has not emerged from its downturn, as they overspent on CapEx during the pandemic boom. In other cases, another bearish article also referred to MU’s implied “overvaluation” relative to its technology sector peers. Moreover, that implied overvaluation seems so “disturbing” that its TTM EV/Sales approached “its highest level in the last 10 years,” based on a July 2023 bearish article.

You know what? As it turned out, the market ignored all these bearish prognostications as MU recorded a total return of nearly 77% over the past year. So, what happened? Is the market foolish? Is the market wrong? These articles presented interesting arguments, but the market didn’t buy them.

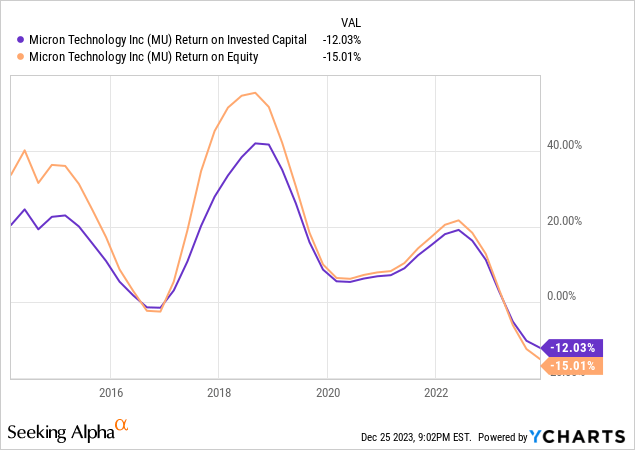

Let me try and help investors understand how to assess the thesis surrounding MU. First, know that Micron is a cyclical semiconductor company. In other words, its profit cycle also goes through a cycle. As seen above, Micron’s GAAP ROIC and ROE still registered negative metrics on a trailing twelve-month or TTM basis.

Yes, the market bottomed out while its ROIC and ROE printed negative on a TTM basis. And that’s the problem with investors trying to pick an entry point using trailing ROIC metrics for MU. ROIC is a solid metric that can (and should) be used to assess competitive moat or sustainable competitive advantages. In Micron’s case, it’s a classic example of why the company is assessed to have no moat, as corroborated by Morningstar. While the semiconductor industry is inherently volatile, the wild swings in Micron’s ROIC over the past five years justify its no-moat rating. Given MU’s massive ROIC swings, investors shouldn’t be surprised that it had a marked impact on the typical revenue and earnings-based valuation metrics. So, what does it mean if you used these metrics to assess MU’s entry point? They are unreliable at best.

Management presented at its fiscal first, quarter, or FQ1’24, earnings conference highlighting the progress made as it continues to ramp production. However, Micron’s commentary suggests that the company is cognizant of the past overspending issues, with a more controlled ramp to meet underlying demand.

Unsurprisingly, the AI chips revolution has also bolstered the HBM memory chips in lifting Micron’s recovery significantly. In addition, Micron is attempting to catch up with HBM leader SK Hynix, targeting a market share of about 20%, in line with its DRAM market leadership. However, it’s also important to note the cyclical and commoditized nature of the memory market hasn’t changed. With top memory leader Samsung (OTCPK:SSNLF) also ramping up, the industry dynamics are still evolving, suggesting the inherent challenges of assessing Micron’s near- to medium-term profitability metrics.

Supply chain sources indicated that Samsung could face difficulties with its internal foundry related to the advanced packaging on HBM. Micron management stressed these challenges, indicating that “HBM products include a logic interface die and have a complex packaging stack that affects yields.” Micron’s advanced packaging partnership with pure-play foundry leader Taiwan Semiconductor (TSM) could give them an early advantage while Samsung is trying to scale its production. However, I expect Samsung to be keen and determined to gain a significant share in this segment, suggesting that the competition could be intense.

A report from “Kiwoom Securities predicts that Samsung’s HBM production could surpass that of SK Hynix in the second half of 2024.” As a result, I believe the HBM competitive dynamics are still in the early stages as the memory leaders battle it out. While the overall near-term demand/supply dynamics favor the memory players now, Samsung’s more aggressive participation could be a game-changer and needs to be watched carefully. It should be noted that Samsung was willing to sacrifice near-term profitability hits over the past year, which likely contributed to the delay in the bottoming cycle of the memory market. With AI chips expected to be a significant growth driver, I expect Samsung to remain aggressive in gaining share, which could impact Micron’s recovery and growth opportunities.

MU last traded at a forward adjusted EBITDA multiple of 10.1x, well above its 10Y average of 5.6x. But remember that MU is a highly cyclical stock. What did Peter Lynch say about such stocks? Lynch:

Buying a cyclical after several years of record earnings and when the p/e ratio has hit a low point is a proven method for losing half your money in a short period of time. Conversely, a high p/e ratio, which with most stocks is regarded as a bad thing, may be good news for a cyclical. Often, it means that a company is passing through the worst of the doldrums, and soon its business will improve, the earnings will exceed the analysts’ expectations, and fund managers will start buying the stock in earnest. Thus, the stock price will go up. The fact that the cyclical game is a game of anticipation makes it doubly hard to make money in these stocks. The principal danger is that you buy too early, then get discouraged and sell. – Beating the Street (p.234) by Peter Lynch.

Timeless Wisdom by Peter Lynch. However, he cautioned that “the fact that the cyclical game is a game of anticipation makes it doubly hard to make money in these stocks.” Investing has always been about anticipation, as the market is forward-looking. You wait for the coast to be clear, particularly for cyclical stocks like MU; you might end up buying at its next cycle high (and possibly just before the crash).

As a result, I urge investors to take two steps forward in assessing MU’s implied valuation. MU is expected to continue its recovery through FY25, registering an estimated adjusted EBITDA of about $15.42B. It represents a nearly 120% YoY growth against FY24’s estimates. It’s also about 92% of its previous cycle-peak FY22 EBITDA of $16.82B. In other words, the recovery could be massive if Micron could execute while fending off Samsung’s competition. Has the market priced in a potentially more aggressive Samsung? Based on MU’s FY25 EBITDA multiple of 6.5x, it seems the market hasn’t priced in a full recovery yet, as it remains above its 10Y average.

That isn’t bad, suggesting investors could still be early in Micron’s cyclical recovery through the cycle. Management maintained its confidence in achieving its “cross-cycle model” of a through-cycle 30% operating margin and at least 10% free cash flow margin. Micron added, “2024 is expected to be a year of recovery, with pricing and profitability improving throughout the year.” In addition, Micron stressed that “once the industry gets past the current downturn and enters the recovery phase, the cross-cycle model will hold. In other words, Micron is assessed to be still early in its growth inflection cycle, heading toward its next cycle peak.

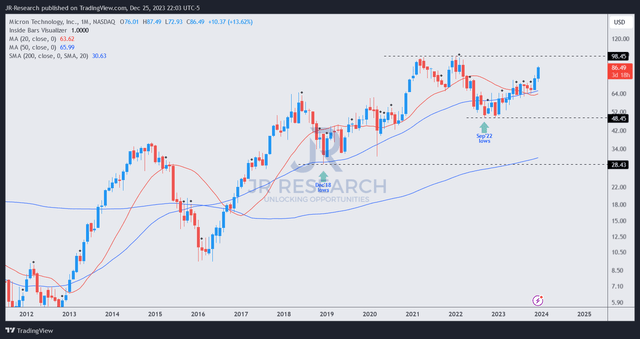

In addition, I believe it might not be as hard as Lynch suggested with the right tools. Let’s look at MU’s price action. Why price action? “Tea leaves” reading, as some non-believers would ascribe, is a way to anticipate the market’s forward intentions. It’s not 100%. There’s no such thing as 100%, as it’s a mathematical impossibility. However, it aims to provide investors with a framework to evaluate high probability or attractive risk/reward setups, giving us an edge to beat the market consistently.

MU price chart (monthly) (TradingView)

With MU assessed to have formed its long-term lows in September 2022 (more than a year ago), investors should better appreciate the elegance and simplicity of “tea leaves” reading. While it’s not designed to undermine nor replace the interesting aspect of fundamentals investing, it helps assess highly attractive risk/reward opportunities, improve our entry levels, and gain a sustainable edge over the market. In other words, it allows us to play the anticipation game that Lynch argued is “doubly hard” to play with enough confidence (and not bailing out too early).

As a result, while the most attractive entry levels on MU are likely over, I have the conviction that it should continue grinding higher (need not be linear) and re-test its all-time highs close to the $100 level. A successful breakout past that level should underpin the medium-term recovery in MU toward another potential new high before the MU cycle possibly peaks (again).

Rating: Downgraded to Buy.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.