Key Takeaways

- Microsoft shareholders to vote on Bitcoin proposal as Michael Saylor pitches trillion-dollar alternative.

- Microsoft board pushes again on Bitcoin funding proposal, urging shareholders to vote towards it

Share this text

Michael Saylor, CEO of MicroStrategy, earlier at present directed a publish on X to Microsoft CEO Satya Nadella, suggesting that if Microsoft needs so as to add one other trillion {dollars} in worth for its shareholders, it ought to contemplate including Bitcoin to its treasury.

Hey @SatyaNadella, if you wish to make the subsequent trillion {dollars} for $MSFT shareholders, name me. pic.twitter.com/NPnVvL7Wmj

— Michael Saylor⚡️ (@saylor) October 25, 2024

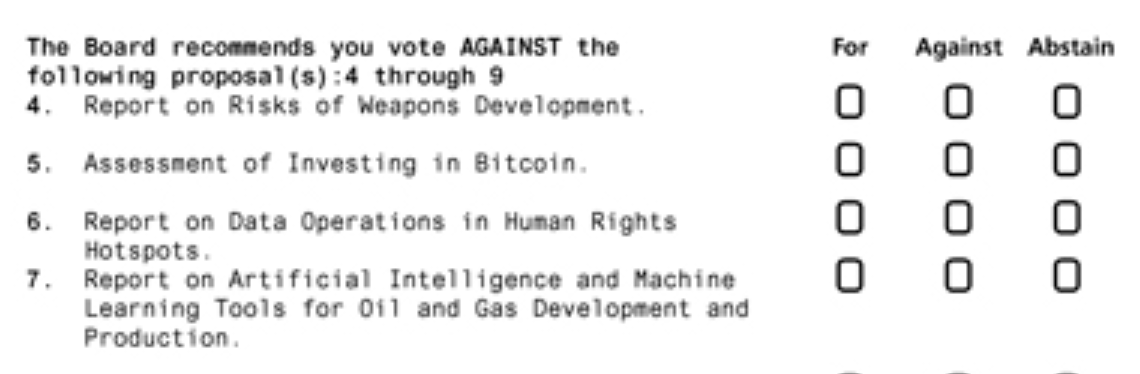

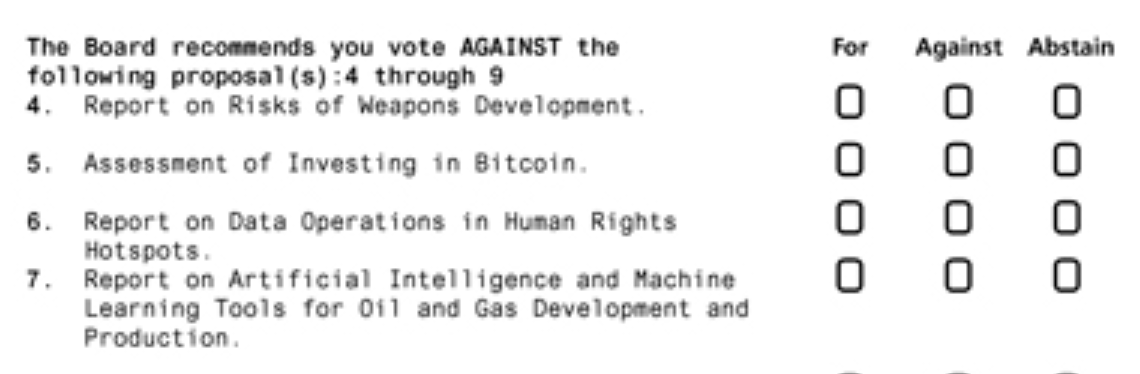

Saylor’s remark follows Microsoft’s newest SEC submitting, which outlines a shareholder proposal titled “Evaluation of Investing in Bitcoin” set to be voted on throughout the firm’s annual assembly in December.

Constructing on current efficiency, MicroStrategy’s Bitcoin-heavy portfolio has led its inventory to outperform Microsoft’s by 313% this 12 months, regardless of the corporate’s comparatively smaller scale within the tech business.

Microsoft acknowledged this of their report, noting the numerous features some corporations have made by holding Bitcoin.

Though they acknowledge Bitcoin’s current outperformance, Microsoft’s board has advocated that shareholders vote towards this proposal.

Within the submitting, the board said that conducting a Bitcoin funding evaluation was pointless, emphasizing that Microsoft’s administration “already rigorously considers this subject.”

The board emphasised that Microsoft’s World Treasury and Funding Companies workforce recurrently evaluates various belongings, specializing in sustaining liquidity and minimizing financial danger whereas guaranteeing long-term shareholder features.

Whereas Microsoft acknowledges that Bitcoin has been thought of in previous assessments, its portfolio is presently dominated by US authorities securities and company bonds—a technique aimed toward stability and regular returns.

Microsoft’s warning aligns with the volatility related to Bitcoin, some extent they highlighted within the submitting. They famous that belongings for company treasury functions ought to be predictable and steady to help operations successfully.

Share this text