franckreporter/E+ via Getty Images

A Quick Take On Metros Development Co., Ltd.

Metros Development Co., Ltd. (MTDC) has filed to raise $17.25 million in an IPO of its common shares, according to an SEC F-1 registration statement.

The firm operates as a real estate property acquirer and reseller in Japan.

Metros’ topline growth rate has fallen sharply in the most recent reporting period, but its profit and operating cash flow are strong.

I’ll provide a final opinion when we learn more IPO details from management.

Metros Development Overview

Tokyo, Japan-based Metros Development Co., Ltd. was founded to acquire land and properties that are underdeveloped and combines and resells them to property developers.

Management is headed by Chief Executive Officer and Director Mr. Yoshihiro Koshiba, who has been with the firm since 2016 and was previously director of Surftrust Co. from 2009 to 2016 and has worked in the real estate industry for many years prior to that.

The company’s primary offerings include the following:

Land acquisition and combination

Building acquisition and demolition

As of May 31, 2023, Metros Development has booked fair market value investment of $469,439 from investors, including K-ASSET Co., Ltd.

Metros Development Client Acquisition

The company develops relationships with real estate development companies who are seeking new development opportunities in Japan.

Management also plans to use a part of the IPO proceeds to develop a crowdfunding platform ‘to grow our core business’.

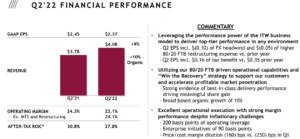

Selling, G&A expenses as a percentage of total revenue have remained stable as revenues have increased, as the figures below indicate:

Selling, G&A | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended May 31, 2023 | 13.1% |

FYE November 30, 2022 | 13.0% |

FYE November 30, 2022 | 13.4% |

(Source – SEC)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A expense, has dropped to 0.4x in the most recent reporting period, as shown in the table below:

Selling, G&A | Efficiency Rate |

Period | Multiple |

Six Mos. Ended May 31, 2023 | 0.4 |

FYE November 30, 2022 | 2.6 |

(Source – SEC)

Metros Development’s Market

According to a 2022 market research report by Plaza Homes, the market in Japan for residential real estate has remained strong despite the recent pandemic, due to a ‘flight to safety’ by investors.

The research firm forecasts that the real estate market in Japan will remain robust in the coming years, due to continued population growth in the Tokyo region and greater strength in the overall economy.

Also, companies are transitioning slowly to a ‘hybrid’ work environment, although existing norms of working at the office remain stronger than in other developed nations.

These trends have resulted in an increase in demand for apartments close to major business districts.

To capitalize on this expected growth, foreign investors can invest in Japanese real estate through a New-Type Entity [NTE].

An NTE is a type of Japanese corporation that is 100% foreign-owned and is exempt from certain restrictions that apply to foreign companies investing or operating in the country.

The rise in e-commerce activity is also benefiting the industrial and logistics property sectors in Japan.

The real estate crowdfunding market is also fragmented, with over 250 companies as of July 31, 2022.

Metros Development Co. Financial Performance

The company’s recent financial results can be summarized as follows:

Growing but decelerating topline revenue

Increasing gross profit and gross margin

Higher operating profit and comprehensive income

A swing to positive cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended May 31, 2023 | $ 291,655,644 | 5.9% |

FYE November 30, 2022 | $ 472,858,985 | 52.8% |

FYE November 30, 2022 | $ 309,378,119 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended May 31, 2023 | $ 81,120,434 | 16.3% |

FYE November 30, 2022 | $ 123,347,433 | 78.8% |

FYE November 30, 2022 | $ 68,990,687 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Six Mos. Ended May 31, 2023 | 27.81% | 2.5% |

FYE November 30, 2022 | 26.09% | 17.0% |

FYE November 30, 2022 | 22.30% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended May 31, 2023 | $ 43,018,514 | 14.7% |

FYE November 30, 2022 | $ 61,639,769 | 13.0% |

FYE November 30, 2022 | $ 27,511,492 | 8.9% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

Six Mos. Ended May 31, 2023 | $ 26,113,539 | 9.0% |

FYE November 30, 2022 | $ 20,743,648 | 4.4% |

FYE November 30, 2022 | $ 9,355,695 | 3.0% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended May 31, 2023 | $ 49,900,607 | |

FYE November 30, 2022 | $ (45,665,390) | |

FYE November 30, 2022 | $ (29,758,668) | |

(Glossary Of Terms) |

(Source – SEC)

As of May 31, 2023, Metros Development had $34 million in cash and $145 million in total liabilities.

Free cash flow during the twelve months ending May 31, 2023, was $10.9 million.

Metros Development Co., Ltd. IPO Details

Metros Development intends to raise $17.25 million in gross proceeds from an IPO of its common shares, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include developing a real estate crowdfunding platform, marketing the new real estate crowdfunding platform, as well as the development and marketing of new services.

We believe that our funds and the net proceeds from this offering will be sufficient to continue our businesses and operations as currently conducted through 2024

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not subject to any material legal proceedings.

The sole listed bookrunner of the IPO is Boustead Securities.

Commentary About Metros Development’s IPO

MTDC is seeking U.S. public capital market investment to fund its various growth initiatives and for working capital requirements.

The company’s financials have generated increasing topline revenue but at a sharply decelerating rate of growth, growing gross profit and gross margin, higher operating profit and comprehensive income and a swing to positive cash flow from operations.

Free cash flow for the twelve months ending May 31, 2023, was $10.9 million.

Selling, G&A expenses as a percentage of total revenue have remained stable as revenue has increased; however, its Selling, G&A efficiency multiple has dropped, indicating reduced efficiency in generating incremental revenue.

Notably, the company pays between 7% and 12% of a project’s gross profit to its purchasing & sales staff as an incentive.

Management’s plan for the crowdfunding initiative is to increase its ability to form capital for the purchase of new land or projects and to diversify its capital sources from its existing borrowing or self-funding options.

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment back into the company’s growth and reinvestment requirements. The company is subject to certain dividend restrictions per Japanese law.

Metros’ recent capital spending history indicates it has spent moderately on capital expenditures as a percentage of its operating cash flow.

The company is an emerging growth company and a foreign private issuer, meaning it may take advantage of reduced reporting requirements to public investors, potentially lowering their visibility into company operations and financial results.

The market opportunity for Japanese real estate remains strong as the Yen has weakened, drawing foreign investors into an already robust market, especially in the Tokyo region.

Business risks to the company’s outlook as a public company include the potential for higher interest rates or financial instability from financial markets.

When we learn more about the IPO’s pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.