Leon Neal

Introduction

My thesis is that Meta (NASDAQ:META) faces challenges with capital allocation as prominent investors question their metaverse approach. Overall, Meta has tremendous earning power but it is important that this isn’t wasted with poor capital allocation decisions. Meta needs to make the right capital allocation decisions at the right time in terms of reinvesting in the business, making acquisitions, buying back stock and issuing dividends.

The Numbers

The 2021 10-K shows that operating income for the Reality Labs segment went from $(6,623) million on revenue of $1,139 million in 2020 to $(10,193) million on revenue of $2,274 million in 2021. Meanwhile, operating income for the Family of Apps segment went from $39,294 million on revenue of $84,826 million in 2020 to $56,946 million on revenue of $115,655 million in 2021.

Looking at 6-month numbers through June 2021 vs June 2022 from the 2Q22 release, the Reality Labs segment went from operating income of $(4,259) million on revenue of $839 million to operating income of $(5,766) million on revenue of $1,146 million. Meanwhile, the Family of Apps segment went from operating income of $28,004 million on revenue of $54,409 million to operating income of $22,647 million on revenue of $55,583 million.

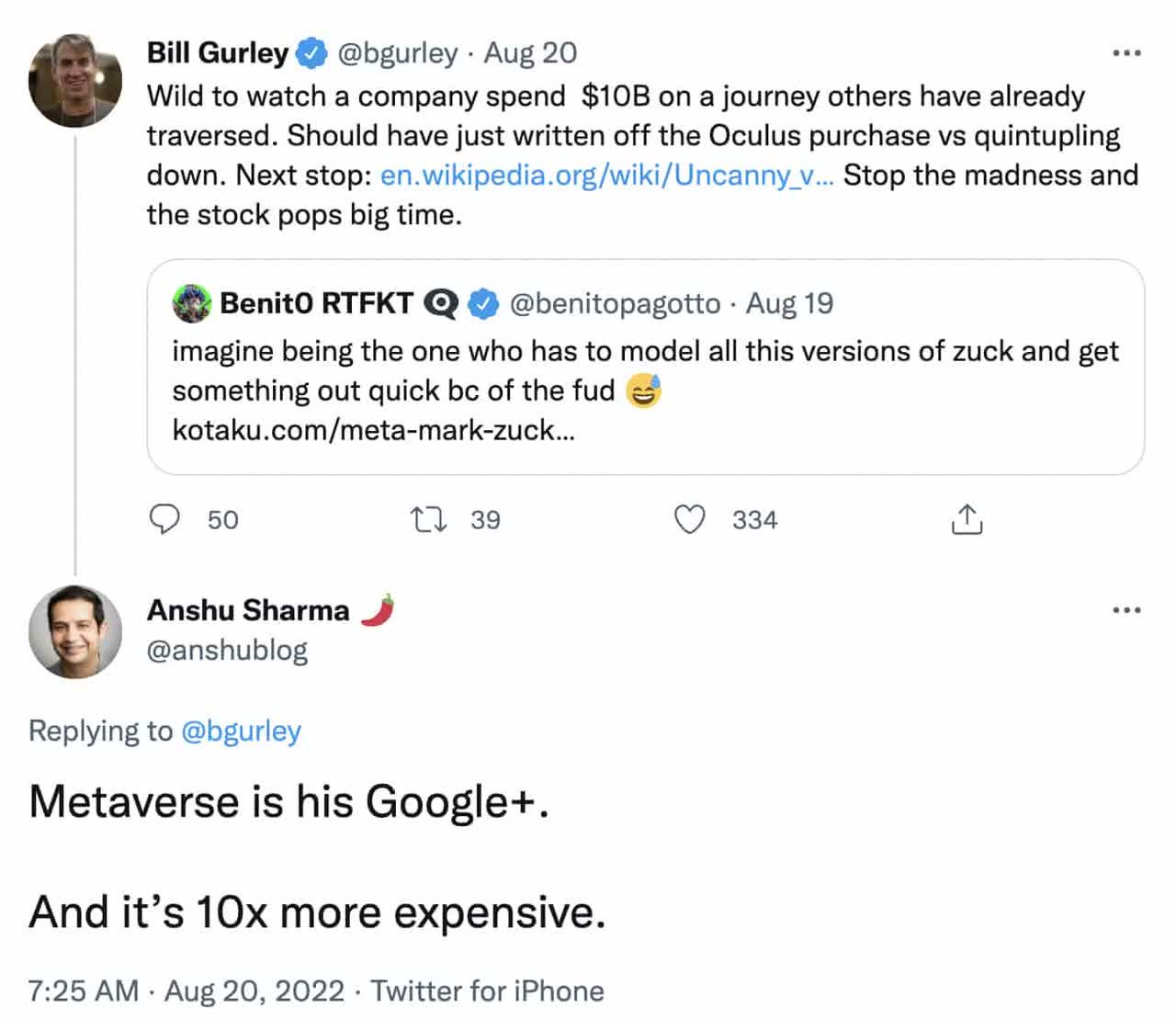

These operating losses from the Reality Labs segment are staggering, coming in at a cumulative $22.58 billion from January 2020 to June 2022 [$6,623 million + $10,193 million + $5,766 million]. It’s scary that these losses increased by $3.57 billion from 2020 to 2021. Meta has tremendous earning power but their capital allocation choices involving the Reality Labs segment are being questioned. Famed investor Bill Gurley recently tweeted about Meta spending $10 billion on a journey that he says should have written off:

Meta Oculus (Twitter)

I believe Meta should consider issuing a small dividend. The payout ratio doesn’t need to be high but the business is mature enough to return some money to shareholders this way. Some say that companies stop innovating when they have to return capital on a regular basis via dividends and Apple (AAPL) is cited as an example. I disagree with this premise as some of the most innovative companies in the world like ASML (ASML) and TSMC (TSM) regularly return capital to shareholders with dividends.

Apple’s 10-K through September 2021 shows dividend payments of $14.5 billion in the cash flow statement on net income of $94.7 billion and cash flow from operations less stock-based compensation (“SBC”) and capex of $85 billion. Meta’s 2021 10-K shows net income of $39.4 billion and cash flow from operations less SBC and capex of $29.9 billion. I think Meta should commit to a relatively small dividend payment of $1 billion per year. This low figure would still leave them with plenty of cash for reinvesting in the business, making acquisitions and buying back stock.

If Meta committed to a dividend policy of at least $1 billion per year then management would be slightly more confined than they are now in terms of financial decisions. Restricting CEO Zuckerberg’s capital allocation decisions can be fatuous seeing as those who doubted his $1 billion Instagram acquisition look silly now. However, times have changed and a small dividend of $1 billion per year would still give him plenty of firepower to do what he thinks is best for shareholders with the remaining cash that is generated annually.

Valuation

Looking at the 2Q22 10-Q and the 2021 10-K, trailing-twelve-month (“TTM”) net income is $33,630 million or $14,152 million + $39,370 million – $19,892 million. Given the way Meta has demonstrated the ability to increase net income rapidly over the years, I believe the company is worth a high multiple of TTM net income. A multiple of 18 to 22 times net income seems reasonable implying a valuation range of $605 to $740 billion.

The 2Q22 10-Q shows 2,280,672,002 Class A shares and 406,876,470 Class B shares outstanding as of July 22nd for a combined total of 2,687,548,472. Multiplying this by the August 19th share price of $160.32 gives us a market cap of $431 billion. The enterprise value is less than the market cap seeing as cash and marketable securities more than outweigh debt and leases. Given these considerations, I believe the stock is a long-term buy if management can avoid making poor capital allocation decisions.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.