Justin Sullivan

Two stocks have loudly led the charge in 2023, Nvidia (NVDA) and Meta Platforms (NASDAQ:META), as both mega cap stocks have increased 225% and 155%, respectively, in 2023. Both stocks are clearly up huge, but both companies still have a huge growth path. In today’s piece I am going to cover why META stock still looks cheap even with the year it has had.

On October 11th, shares of META pushed up against their 52-week high, but after that we saw shares pullback nearly 15% through October 25th. What happened at the close of that very day has changed the trajectory of the stock, as META reported their Q3 earnings, which showed huge improvements in terms of revenue growth but more importantly, spending. CEO Mark Zuckerberg has dedicated 2023 as “the year of efficiency” as he tries to reign in the absurdly high spending that has been taking place in prior years.

In Q3 META reported:

- Revenues of $34.15 billion

- EPS of $4.39 per share

Analysts were calling for revenues of $33.45 billion and EPS of $3.63 meaning the company easily beat analyst expectations. Revenues during the quarter grew 23% over the prior year. Daily Active Users, or DAUs, increased 5% over prior year to 2.09 billion for Facebook.

During the quarter, costs and expenses declined 7% over the same period last year, which resulted in higher operating income and operating margin of 40%, which doubled the operating margin of just 20% last year. This is HUGE improvement and efficiency being put on full display.

For Q4, management is guiding to total revenue of $36.5B-$40 billion, with analysts having an average estimate of $38.87 billion. For the full year, META also kept with the trend and reduced its forecast for total expenses to $87B-$89B from a previous range of $88B-$91B.

Growth Drivers Moving Forward

So on the cusp of an amazing year, where is the growth going to come from for Meta Platforms moving forward and is their much growth left? Let me answer the second part by stating, yes, there is plenty of growth for this company moving forward, which leads into part one of the question asking where growth will come from.

I see all of these being areas of growth for the company:

- Instagram Reels Monetization

- Continued Ad Revenue

- AI Potential

Instagram Reels was actually a segment of the business that was weighing on the company back in 2022, but fast forward to 2023 and the company has not only figured out ways to monetize the popular platform, but also flip it from a headwind to a tailwind.

In March of 2023, Meta announced a plan to expand ads on Reels allowing for more income and for more content creators to earn more money as well, thus pushing more Reels. Although TikTok has seen huge amounts of growth in terms of user growth, Instagram Reels has actually been outperforming in terms of watch rate and reach, making it more valuable in terms of monetization.

According to Emplifi’s Q2 2023 social media behavior and trends report, Instagram Reels generated 55% more interactions than single-image posts and 29% more interactions than standard video posts.

Next, the company has a huge user base. Having a huge user base is great and all, but are they active or not is the question. In Meta’s situation, they are seeing increased usage across various platforms, which further strengthens the growth story around its digital advertising segment of the business. Ad impressions during the quarter exploded over 30% from prior year. Ad prices are down, but a rebound in digital advertising, both in terms of volume and pricing, combined with an active user base could be the perfect recipe for strong results moving into 2024.

Last, but certainly not least is the focus on AI. Zuckerberg was one of the early pioneers pouring billions into AI research, but in the past few years the spending seemingly got out of hand. In 2023, that spending was reigned in and the results are showing. AI is looking to provide growth in terms of products, but it is also being utilized within the various platforms to help keep users on the platform and engaged.

Although META has poured billions into the development of AI, it is already starting to pay off and the runway is long. Last year, META saw its first revenue decline on an annual basis, but now AI is being utilized to re-energize its ad business. AI is allowing the company to better target audiences and optimize ad campaigns. The company is using the technology to better serve its users to help determine what they want to see, and it’s offering advertisers AI tools to develop ad campaigns that fit particular user bases. All of this will undoubtedly lead to better monetization and, ultimately, higher revenue and profit, especially when ad spending ramps back up again.

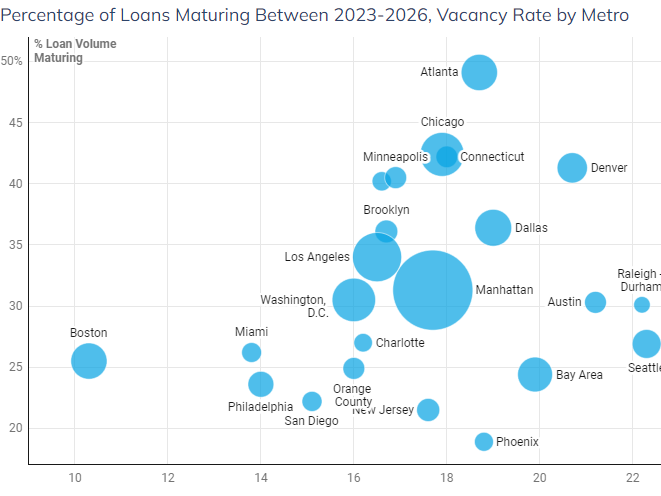

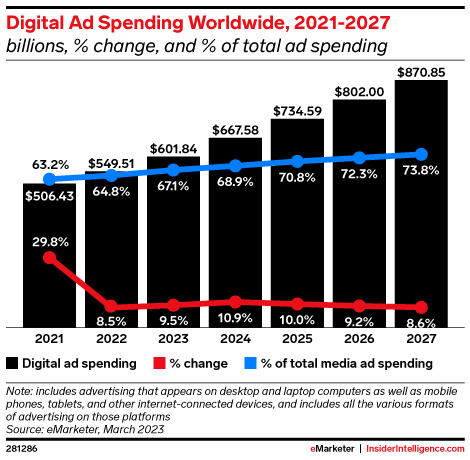

Digital ad spending has slowed, in terms of growth, in 2023, but it is still expected to reach $800 billion by 2026, which will benefit two of the largest digital advertisers in Meta Platforms and Alphabet (GOOGL).

Insider Intelligence

Even After An Amazing Year, Valuation Still Enticing

Expectations and renewed confidence in the social media giant has given Meta Platforms a lot of momentum, something I am optimistic about to close the year and head into 2024.

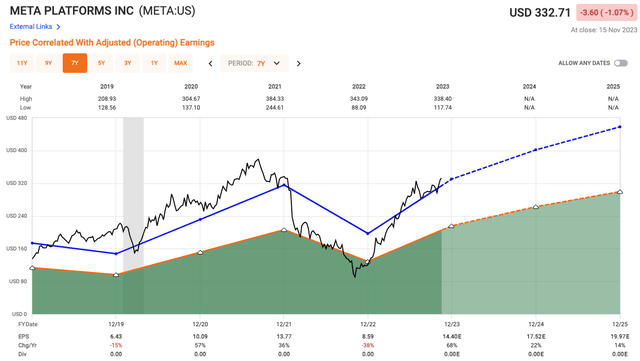

Revenues are expected to grow by more than 30% in 2023 with analysts expecting that growth figure to drop to 13% in 2024. In terms of EPS, the company is expected to grow earnings by 68% in 2023, with growth of 22% in 2024 with analysts estimating EPS of $17.52.

Fast Graphs

Based on the 2024 figures, this has shares of META trading at just 18.25x, which equates to a PEG ratio of 0.83x, suggesting shares are quite cheap. In terms of the P/E, shares of META have a five-year average P/E of 23x, again suggesting shares are cheap.

META has done a nice job improving its free cash flow in 2023, as FCF margins increased from the mid-teens a year ago to 40% in the latest quarter.

Investor Takeaway

META has had a year to remember in 2023, but I do not believe the party is over by any means. The growth is still intriguing as is the valuation. There are plenty of tailwinds for this company, but that does not go on to say that there are no headwinds because their certainly are.

High rates continue to be here, something that is expected to be around longer than anticipated. In addition, softer ad spend is coming, especially if we dip into a mini recession in mid 2024. It will be very important for META’s leadership team to remain committed to its spending discipline.

At an 18x multiple, even with the known headwinds ahead in the near-term, I believe META is a rare mega-cap trading with intriguing value.

In the comment section below, let me know your thoughts on META and its current valuation.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.