vitranc/E+ by way of Getty Photos

Funding Thesis

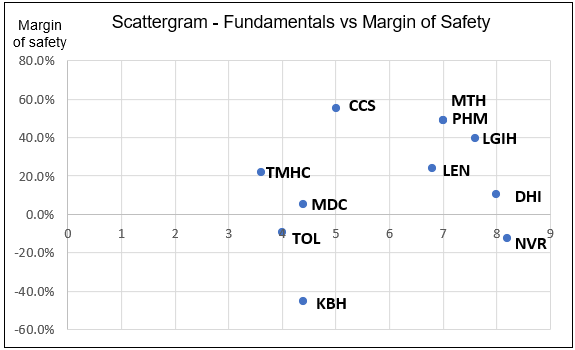

I’m taking a look at this high pair commerce from the basic perspective. I checked out 2 elements – enterprise fundamentals and margin of security. I’m trying to find a pair commerce from the homebuilding sector in order that all the businesses face the identical financial scenario.

The lengthy place is the homebuilder with the very best mixture of excellent fundamentals and the very best margin of security. The brief place is the house builder with the worst fundamentals and no margin of security.

The outcomes of such evaluation present that you should purchase Meritage Properties Company (NYSE:MTH) and brief KB Dwelling (NYSE:KBH). The rationale is that the value of MTH would go up as worth buyers pile in. Given the present financial scenario and the information concerning the doable recession, buyers in KBH would search to get out.

Figuring out the pair

I hunted for the pair amongst these homebuilders with about 10,000 or extra houses delivered in 2021, as reported of their respective Type 10ks. Eleven firms met this criterion.

For every of the 11 firms, I decide the respective elementary efficiency in addition to the margin of security.

- The basic performances have been assessed based mostly on 5 metrics.

- The margins of security have been computed by evaluating the market worth as of 23 June 2022 with the respective Earnings Energy Worth (EPV).

I then plotted the outcomes on a scatter-gram. Think about a matrix the place the enterprise fundamentals are plotted on the x-axis and the margins of security are plotted on the y-axis. For the x-axis, the worst elementary is on the left-hand facet with the very best on the right-hand facet. For the y-axis, the worst margin of security is on the underside whereas the very best is on the highest.

The lengthy concept is to be discovered within the high proper nook of the matrix ie a mix of the very best fundamentals and greatest margin of security. The brief concept is on the underside left nook of the matrix ie the mixture of worst fundamentals and worst margin of security.

Chart 1 exhibits the scatter-gram of the 11 firms. I’ve recognized MTH because the one with the very best mixture of fundamentals and margin of security. I suggest that you simply purchase this. The one with the worst mixture of fundamentals and margin of security is KBH. I suggest that you simply brief this inventory.

Chart 1: Scatter-gram of Fundamentals vs Margin of Security (Creator)

Notice to Chart 1: MTH and Pulte have been represented by the identical level within the chart. They’ve the identical fundamentals rating and their margins of security have been very shut.

No-growth Cyclical sector

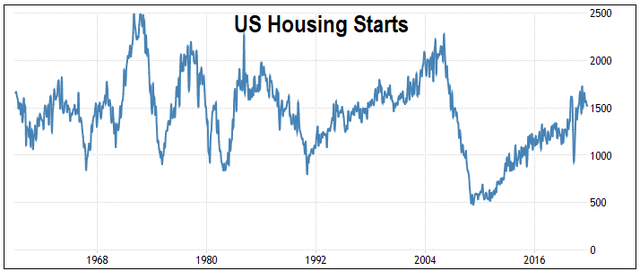

The homebuilding sector is a cyclical one, as illustrated by the long-term Housing Begins chart.

Chart 2: US Housing Begins (Buying and selling Economics)

Aside from being cyclical, you may see that there was no development within the long-term common annual Housing Begins of 1.5 million models. In order for you additional particulars of my evaluation of the homebuilding sector, seek advice from “Proof Would not Counsel That D.R. Horton Is A Development Inventory. Do not Worth It As Such.”

The homebuilding sector is a cyclical one, and as such any elementary evaluation must be based mostly on the efficiency over the cycle. On the similar time, there is no such thing as a development within the long-term common annual Housing Begins. As such, any valuation must be pegged to this long-term common degree. Given the no-growth scenario, I computed the margin of security by evaluating the market worth with the EPV.

Fundamentals

I used the next metrics to find out the basic efficiency.

- Common gross profitability. Gross profitability = gross revenue/whole belongings. In line with Professor Novy-Marx, this has the identical energy as Value E book in explaining returns.

- Common ROE.

- 2021 Debt Fairness ratio

- CAGR in income from 2011 to 2021.

- Common Money move from Operations. I then scaled this by the respective variety of shares excellent in 2021.

To find out the efficiency over the cycle, I computed the common based mostly on the respective knowledge from 2011 to 2021. I couldn’t begin from an earlier yr as two of the panel firms had Type 10k knowledge solely from 2011. The yr 2011 additionally represented the trough to the present Housing Begins cycle as per Chart 1 whereas 2021 is at concerning the peak.

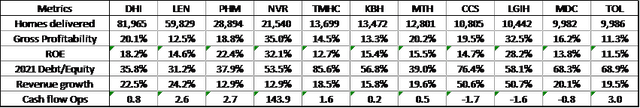

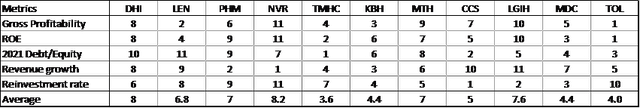

The outcomes are summarized in Desk 1.

Desk 1: Efficiency of the panel firms (Creator)

Notice to Desk 1:

a) The common ROE was computed from 2012 as one of many panel firms didn’t have the 2011 knowledge.

b) Information for the evaluation have been extracted from TIKR.com.

c) The Housing Begins grew at a CAGR of 10 % from 2011 to 2021. So reaching 13% to 16 % CAGR in income isn’t one thing distinctive.

To find out the general efficiency, I used a easy scoring scheme as follows:

- For every metric, I ranked the efficiency of the 11 firms.

- One of the best-ranked firm was given a rating of 11. The subsequent greatest rank had a rating of 10. This the worst-ranked had a rating of 1.

- The general efficiency was the common rating of the 5 metrics.

- Notice that for the Debt-Fairness ratio, the very best efficiency was the corporate with the decrease worth. However for the opposite metrics, the very best was the corporate with the upper worth.

The outcomes are summarized in Desk 2.

Desk 2. Efficiency rating (Creator)

Notice to Desk 2: The variety of houses delivered as per Desk 1 was just for figuring out the panel firms and was not utilized in computing the general efficiency.

Valuation

I made up my mind the EPV utilizing the Free Money Circulation to the Agency (FCFF) mannequin. I then derived the fairness worth by deducting the Minority Pursuits, Debt and including again Money based mostly on the LTM values.

EPV = FCFF / WACC

The place:

FCFF = EBIT (1-Tax)

EBIT = GP – SGA

GP = Income X GP margin

SGA = Income X SGA margin

Income = Lengthy-term common income based mostly on 1.5 million Housing Begins. I computed this by taking the respective 2021 income and scaling it by (1.5/1.6) the place 1.6 represented the 2021 Housing Begins.

GP margin and SGA margin = common 2011 to 2021 values, i.e., the efficiency over the cycle.

Tax = assumed nominal tax fee of 21%.

WACC = Based mostly on CAPM the place the Threat-free fee (3.0%), Beta (1.01), and Fairness danger premium (4.51) have been based mostly on the common values for 2005, 2009, and 2021. This was to mirror the common long-term perspective. Information for these have been extracted from Damodaran’s dataset.

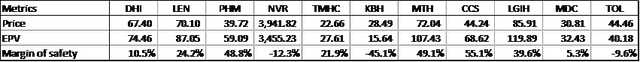

I computed the respective margins of security by evaluating the EPV with the market worth as of 23 June 2022. The outcomes of the evaluation are proven in Desk 3.

Desk 3 Margin of security (Creator)

I then plotted the scatter-gram of the common elementary rating and margin of security as proven in Chart 1.

Selecting the pair

As will be seen from the scatter-gram as per Chart 1, the worst inventory when it comes to fundamentals and damaging margin of security was KBH.

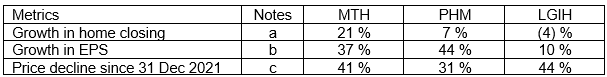

However when it got here to the very best fundamentals and greatest margins of security, there have been 3 firms within the high right-hand nook of the scatter-gram. These have been MTH, PHM, and LGIH.

To pick amongst these 3, I thought of the next further metrics.

Desk 4: Further metrics (Creator)

Notes to Desk 4:

a) 2022 steering c/w 2021

b) 2022 estimates as per Yahoo Finance c/w 2021

c) Present market worth c/w worth at 31 Dec 2021

Based mostly on Desk 4, I chosen MTH because the inventory to go lengthy as this has the higher development prospects and the very best worth decline. I’m assuming that the value enhance potential is the same as the value decline.

Dangers

Along with the chance of shoring a inventory, there are 3 different dangers to think about: funding horizon; market habits; and analytical dangers.

In line with Investopedia, “Buying and selling on fundamentals is extra intently related to a buy-and-hold technique moderately than short-term buying and selling.” Thus, this beneficial pair isn’t meant for day buying and selling. The funding interval might be going to be longer than a number of weeks. The danger is then related to holding the brief place for months. The holding interval for the lengthy place might even be longer given the present market scenario.

Secondly, the funding thesis assumes a sure market habits. I assumed that the market would have the ability to discern the undervalued shares from the overvalued ones and re-rate them accordingly. I’m suggesting that there are enough elementary buyers to counteract the affect of those who commerce based mostly on sentiments. In mitigation, the costs of the homebuilders have dropped by greater than 30% over the previous 6 months. As such, I believe that a lot of the sentiments buyers have exited the market. So, the chance will not be so nice.

In the case of the analytical dangers, there are 3 points:

- The standard elementary evaluation covers each qualitative and quantitative evaluation. Nevertheless, for the pair buying and selling, I’m taking a look at solely the quantitative evaluation.

- I’m assuming that the 5 metrics chosen are ok to distinguish the efficiency of the 11 firms.

- I’m assuming that my scoring scheme is sweet sufficient to distinguish the efficiency of the businesses.

As will be seen from Chart 1, there are 3 firms within the high right-hand nook of the matrix. I’ve chosen MTH. The selection could also be totally different if a special set of metrics or scoring scheme was used. The nice factor is that the inventory to brief is obvious as I see shorting as an even bigger monetary danger.

As for the shorting danger, the priority is whether or not the value of KBH rise after declining by about 36 % since finish Dec 2021? Given the present information about excessive inflation and the robust prospects of a recession, there will not be that many constructive information to drive worth greater. So shorting KBH will not be as dangerous as throughout “regular” instances particularly provided that its poor fundamentals.

Conclusion

The most typical technique to commerce is to base it on some technical indicators. I’ve chosen to not comply with this method as I consider that for an investor to generate profits, it’s important to suppose in another way. I’ve thus chosen a elementary technique to establish the buying and selling pair.

I’ve chosen the homebuilding sector because the market costs of this sector have declined by greater than 30% over the previous couple of months. There are thus alternatives to have constructive margins of security based mostly on the EPV.

To find out the pair, I’ve used a mix of fundamentals and margin of security. Consistent with the basic method, the lengthy inventory is one with the very best mixture of fundamentals and margin of security. The one to brief is the one with the worst fundamentals and damaging margin of security.

Because the homebuilding sector is a cyclical one, trying on the present efficiency can be deceptive. As such, I’ve analyzed and valued the shares based mostly on the efficiency the important thing over the cyclical.

I’m a price investor and I’m very assured which you can generate profits shopping for lengthy on MTH. The problem is whether or not you may make cash from shorting KBH. The value of KBH has dropped by 36% since finish Dec 2021? Can it drop additional?

I’m assured it would, because the market has overpriced KGB even in December 2021. That is due to its poor fundamentals over the cycle. Because the variety of Housing Begins start to say no, KBH’s poor monetary outcomes can be extra obvious. KBH aptly suits what Warren Buffett stated: “Solely when the tide goes out do you uncover who’s been swimming bare.” However we could have to attend until the tip of the yr for the primary signal of this.