JM_Image_Factory/iStock via Getty Images

Memory companies are beset with low demand in consumer electronics products such as PCs and smartphones that is morphing to other products like automobiles and data centers. Samsung (OTCPK:SSNLF) just reported preliminary 3Q earnings, and revenues are projected down 34%. DRAM maker Nanya Technology has revised downward its capex target this year after posting a nearly 60% sequential drop in net profits for the third quarter.

Micron (MU) announced plans to cut production growth to 5%, and expects fiscal 2023 capex to be around $8 billion, down more than 30% year-over-year. Additional details are available in my September 8, 2022 Seeking Alpha article entitled “Micron: Memory Chips Won’t Recover Until 2024.”

At the same time, in an effort to curtail China expansion, the U.S. government issued a statement for broad restrictions, which includes memory chips. It is a continuation of previous sanction policies, which restrict China growth but at the same time hurt U.S. and other allied companies. I discussed this issue as well in a September 15, 2022 Seeking Alpha article entitled “Chinese Sanctions Benefitting Chinese As SMIC On Road To 5nm In 2025.”

In this article, I want to address what semiconductor equipment companies will be impacted by the macroeconomic forces impacting memory, and the impact of geopolitical sanctions impacting memory and other topics raised by the U.S. government.

Memory

High inflation and fear of a recession are impacting discretionary purchases of consumer electronics products containing memory and other chips. These “other” chips include CPUs and GPUs, and Advanced Micro Devices (AMD) is a major supplier of these chips.

The meltdown in electronic products affect not only memory companies, but all semiconductor companies making chips that go onto circuit boards that also contain DRAM and NAND memory chips. Many of these chips are manufactured by foundries and not by the chip companies themselves. For example, AMD and NVIDIA (NVDA), which with AMD makes GPU chips for gaming, use Taiwan Semiconductor (TSMC) (TSM) as the foundry to manufacture their chips.

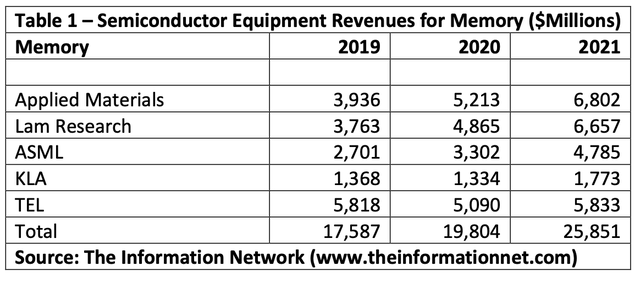

A deep-dive analysis of the impact of this macro-driven consumer product sales deficit needs to show data for equipment companies with exposure to memory.

Table 1 shows semiconductor revenues for memory chips (DRAM and NAND) by equipment company. It is important to note these are equipment sales only, and do not include service or spare parts. Applied Materials (AMAT) generated the largest revenues from equipment sales for memory chip production in 2021 for a total of $6.8 billion in revenues. This was followed by Lam Research (LRCX), Tokyo Electron (OTCPK:TOELY), ASML (ASML), and KLA (KLAC).

The Information Network

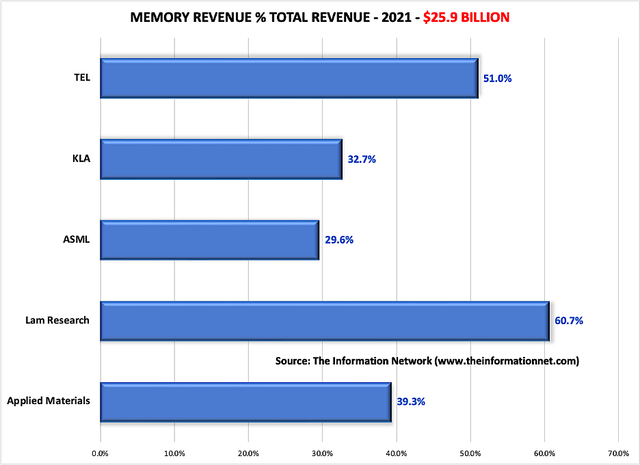

Chart 1 shows revenue from memory companies as a percentage of total revenue for these equipment companies. This chart illustrates how much of an impact purchase cuts would have on total business.

Lam Research generated 60.7% of equipment revenues from memory companies, ahead of TEL at 51.0% and 39.3% of AMAT. The low revenue exposure by ASML is understandable given the fact that its $200 million EUV lithography is not used in NAND and is just starting to be used at SK Hynix (OTC:HXSCL) and Samsung, and in R&D at Micron.

In contrast, Lam’s dielectric plasma etch systems are the go-to equipment for NAND production, despite having a smaller share than TEL of the dielectric etch market, according to our report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.“

Chart 1 (The Information Network)

China New Sanctions

The U.S. government has announced additional restrictions on the Chinese semicon industry, prohibiting the export of production equipment related to 18nm DRAM and 128-layer or higher 3D NAND.

KLA’s legal department stated that effective 11:59 p.m. local time (1559 GMT) on Tuesday, the company shall stop sales and service to “advanced fabs” in China for technology of NAND chips with 128 layers or more, and DRAM chips 18nm and below, and advanced logic chips. To date, I have heard no response from KLA competitor Onto Innovation (ONTO).

AMAT revised its estimates after market close on October 12 that the new regulations will reduce its fourth-quarter net sales by approximately $400 million, plus or minus $150 million. The revised net sales outlook reflects the impact of the new export regulations partially offset by supply chain performance improvements.

According to NH Investment & Securities:

“Recently, Chinese firm CXMT started production of 17nm DRAM, and Chinese company YMTC began production of 192-layer 3D NAND. CXMT is gradually boosting its share of the Chinese (domestic) consumer PC market, and reviews of the product quality are generally favorable. Looking at YMTC, we note that its technology has advanced to the stage that Apple is considering installing YMTC products in its iPhones. YMTC plans to mass-produce 3D NAND with 200 or more layers in 2023. Chinese foundry SMIC recently started production of 7nm semicon chips that are comparable to TSMC’s 7nm chip in gate length, track height, and process.”

I have discussed all of these items in several recent Seeking Alpha articles and refer readers to them for deeper insight on each topic.

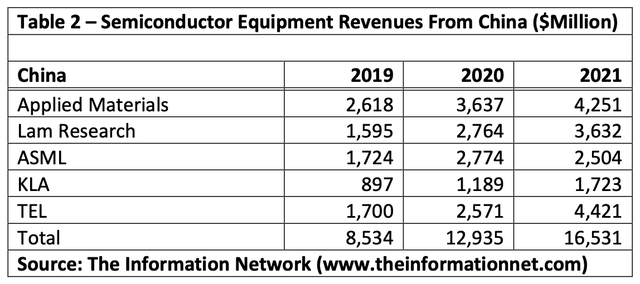

Table 2 shows semiconductor revenues from China by equipment company. TEL and AMAT generated the greatest revenues, with KLAC the lowest.

The Information Network

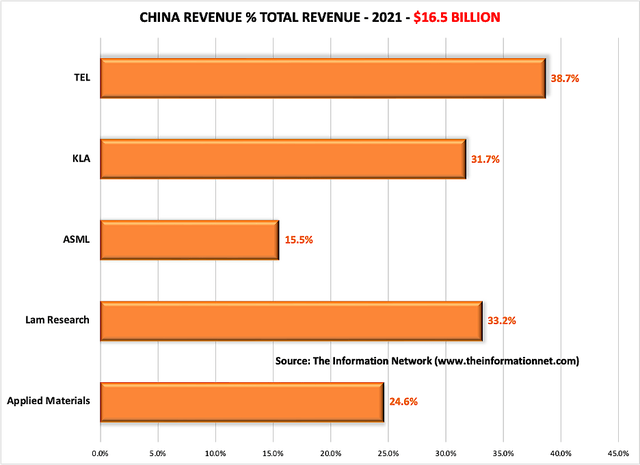

Chart 2 shows that although KLAC’s exposure to China was 31.7% of its total revenues. The need for metrology/inspection equipment increases as semiconductor technology nodes decrease. The reason is that gross profits for a foundry per 300-mm wafer are $2,835 for a 28nm node vs. $8,695 for a 3nm node. At smaller nodes, any defect that could ruin a 3nm wafer represents a bigger loss to the company than a wafer made at 28nm. These killer defects are uncovered during metrology and inspection of wafers using equipment from KLAC.

In contrast, ASML’s share of revenue from China was just 15.5%, primarily due to U.S. sanctions against sales of its EUV lithography systems.

Chart 2 (The Information Network)

Investor Takeaway

There are two headwinds facing equipment suppliers over the next few years.

The first is currently impacting suppliers due to a macro-induced meltdown that started in consumer electronics products such as PCs, and is also affecting memory demand in other applications such as automotive and data center. LRCX has the greatest exposure to a memory slowdown based on percentage of overall sales while AMAT’s large exposure is based on memory revenue.

The second, China sanctions, has been ongoing for several years, but is now expanding. TEL has the greatest exposure to China sanctions based on percentage of overall sales and on memory revenue.

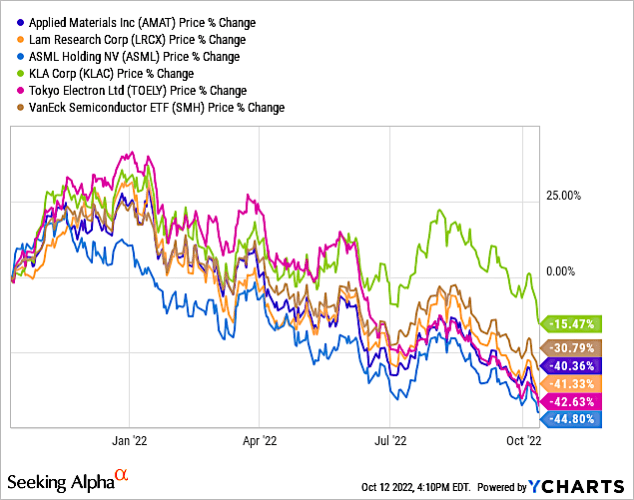

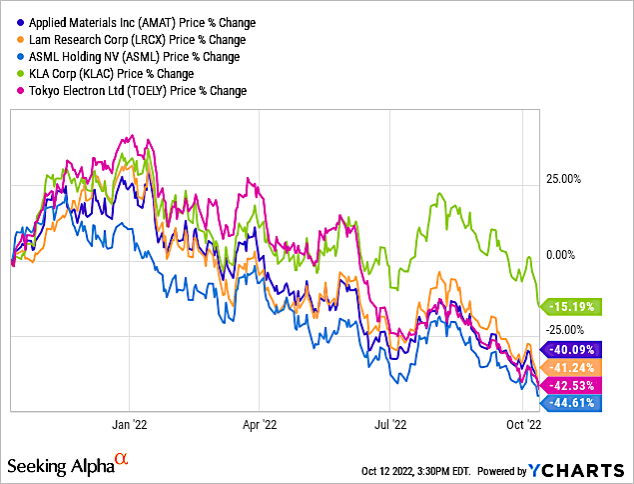

Over the past 1-year period, I show in Chart 3 share performance for these five companies. While all are down in this Fed-driven market, there are two observables:

- KLAC is clearly outperforming its competitors

- The share price spread of the other four competitors is just 4.5%

Chart 3 (YCharts)

The obvious choice among these stocks is KLAC. But the second item raises serious concerns and an important question – how can these four companies, two from the U.S., one from Japan, and one from Europe, have almost identical performance?

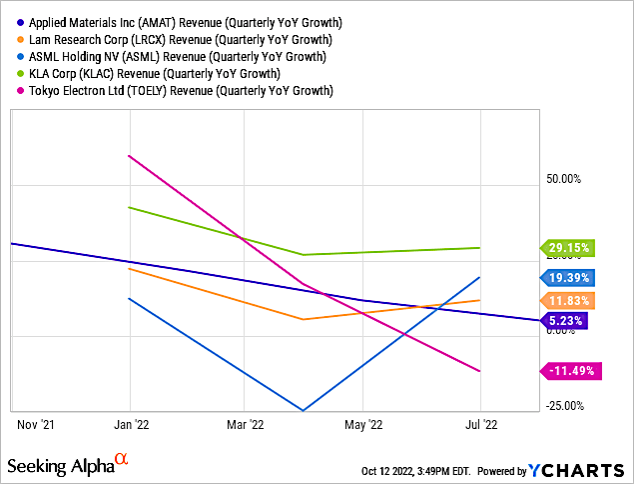

On a revenue basis, Chart 4 shows very different revenue growth over the one-year period. Clearly, KLAC again outperforms its competitors, but the revenue growth spread is large compared to the spread in share performance above.

Chart 4 (YCharts)

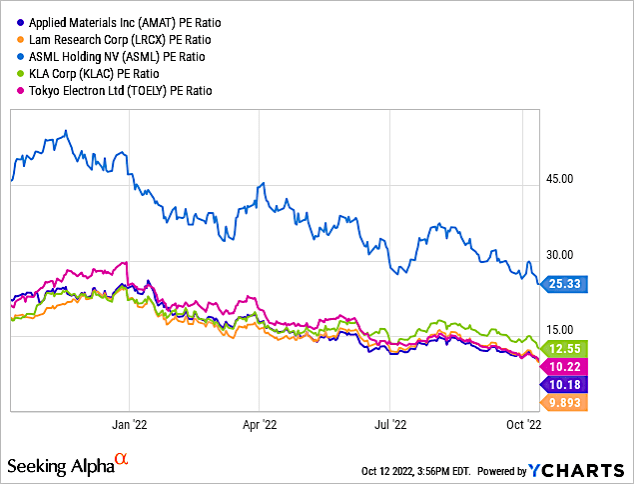

On bottom line performance, Chart 5 shows the P/E ratio of these companies. Except for ASML, which is significantly higher, the spread among the other four competitors is just 3x.

Chart 5 (YCharts)

The fact that share performance among these companies is strikingly similar indicates that they are traded as a sector instead of on an individual basis. AMAT, LRCX, and TOELY have similar product portfolios and compete against each other. That means that what is a positive outcome for one company, such as high revenues, means its competitors lost business to that company and their revenues will be lower. That is obviously not the case.

Thus, in my opinion based on implications of a memory meltdown and China sanctions, although company exposures are different, share price in the past year overrides the negative impact of these issues. Until investors and traders become more knowledgeable about each company, and analysts do a better job of educating clients, individual plaudits for these technology companies have no merit. Investors would be better off with an ETF and let professional managers worry about the portfolio. I show in Chart 6 how the VanEck Semiconductor ETF (SMH) has outperformed all but KLAC in the past year.

Chart 6 (YCharts)