Bitcoin whales have been constantly accumulating BTC for the reason that starting of the yr amidst a bullish future outlook for the crypto trade. These elevated whale holdings confirmed investor confidence, which additionally translated right into a bullish rally for Bitcoin over the previous six months.

Regardless of the latest corrections, on-chain knowledge signifies that whale addresses have doubled down on the buildup, pushing their holdings to ranges we haven’t seen since 2022. Significantly, the overall BTC provide in addresses holding 1,000 BTC or extra has hit a two-year excessive.

What’s Behind The Surge In Whale Bitcoin Accumulation?

Based mostly on the data supplied by IntoTheBlock, Bitcoin whale addresses have just lately achieved a major annual milestone of their quest to build up Bitcoin. When speaking about whales, this knowledge follows Bitcoin addresses holding 1,000 BTC items or extra. This milestone implies that the addresses that fall into this cohort have reached their highest stage in over two years.

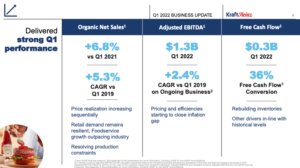

The brand new milestone in whale accumulation is simply a bit of the entire story. In accordance with IntoTheBlock’s chart knowledge, this accumulation shot up massively in January 2024, a interval when the crypto markets kickstarted a full bullish momentum. After months of ready, Spot Bitcoin ETFs had been ultimately launched to the US market, and this was the second when issues actually began to warmth up. These new funding automobiles made it simpler than ever for institutional buyers to spend money on Bitcoin. Consequently, new rich buyers dove in headfirst, accumulating large quantities of Bitcoin.

The buildup by means of Spot Bitcoin ETFs may be reaffirmed by Glassnode knowledge. In accordance with the Glassnode chat under, US spot ETFs have acquired greater than 900,000 BTC in a span of simply seven months. Funds proceed to purchase up BTC even throughout corrections.

One other piece of the buildup puzzle may be traced again to Bitcoin miners, who elevated their holdings all through July by 4,500 BTC, amounting to a worth of $300 million. On the time of writing, Bitcoin addresses holding 1,000+ BTC accounts for 7.9 million BTC. To place this into perspective, that’s round 40% of the circulating provide of 19.7 million BTC.

What Does This Imply For Bitcoin?

Whale accumulation has largely been constructive for the value of Bitcoin and has led to a corresponding value surge. When whales make strikes, the remainder of the market tends to note. Their actions can affect smaller buyers, probably resulting in a domino impact of elevated Bitcoin shopping for. This accumulation milestone may additionally add to bullish momentum, with Bitcoin now approaching the $70,000 value stage once more.

On the time of writing, Bitcoin is buying and selling at $66,715. Bulls are at the moment struggling to interrupt and keep above $67,000.

Featured picture from Shutterstock, chart from TradingView