Maskot/DigitalVision by way of Getty Photos

Medifast, Inc. (NYSE:MED) is making important efforts to supply GLP-1 remedy together with the motion of coaches and weight reduction proprietary formulation. For my part, the latest settlement with LifeMD (LFMD) and the acquisition of LifeMD shares might improve the demand for the inventory. Furthermore, the latest provide chain reorganization initiatives just like the closure of the Maryland Distribution Heart and additional potential bulletins may deliver FCF margin progress. Given earlier fairness progress, FCF progress within the final decade, and up to date investments in advertising, I anticipate enterprise progress to proceed within the close to future. I don’t suppose that the present inventory worth represents the inventory worth potential within the inventory valuation.

Supply: Looking for Alpha

Medifast

Medifast reviews greater than 40 years of historical past in its sector, and claims to supply scientifically developed merchandise and life-style plans bolstered by unbiased Coaches and a big group.

For my part, probably the most related concerning the firm is its entrepreneurial spirit and the connections that MED builds with unbiased coaches. In accordance with the corporate’s paperwork, MED is an knowledgeable in growing new relationships with prospects and remodeling earlier prospects into coaches. These ongoing connections appear to create a cycle of progress that can also be bolstered by financial incentives. For my part, the corporate’s packages are profitable due to the monetary progress. The point out made by Monetary Instances about MED being considered one of The Americas’ Quickest Rising Firms can also be fairly spectacular.

Medifast sells quite a few weight reduction proprietary formulation that embrace bards, cereal, drinks, shakes, tender bakes, and plenty of different dietary merchandise. A few of these merchandise are authorised and controlled by the Federal Commerce Fee, the Client Product Security Fee, america Division of Agriculture, and america Environmental Safety Company. For my part, the corporate’s accrued know-how and the experience in coping with the prevailing regulatory framework function a aggressive benefit over new entrants within the sector.

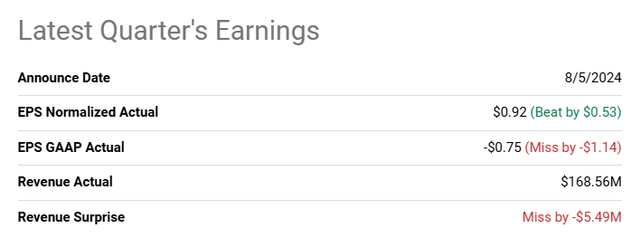

Decrease EPS Than Anticipated, However Improve In The Guide Worth Per Share

Within the final quarter, the corporate reported decrease than anticipated EPS GAAP figures, and fewer quarterly income than anticipated. The monetary figures anticipated for 2024, and 2025 are additionally not that helpful.

Supply: Looking for Alpha

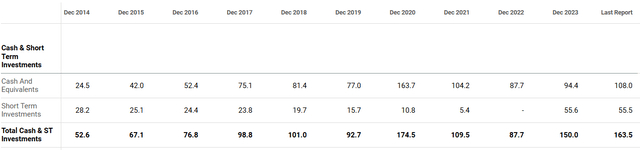

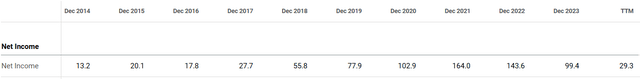

With that, concerning the firm’s most up-to-date monetary statements, I took a take a look at the numbers delivered within the final ten years. For my part, the figures reported within the final decade are extra consultant and considerably higher than these from the newest enterprise historical past.

Within the final ten years, the corporate reported a formidable enhance within the whole amount of money, will increase within the quantity of fairness, and a big enhance within the guide worth per share. For my part, in some unspecified time in the future, traders could take the time to have a look at these figures, and the inventory worth could development greater.

Supply: Looking for Alpha Supply: Looking for Alpha

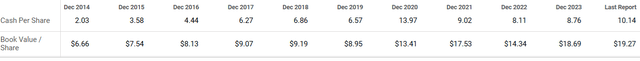

Web Earnings Progress, And FCF Progress

If we take a look at the corporate’s internet earnings progress, MED does appear to be executing a confirmed enterprise mannequin. The corporate went from reporting damaging internet earnings to report optimistic internet earnings in the newest historical past. I do settle for that the web earnings, lately, didn’t enhance as up to now. Nonetheless, I don’t see why with the experience accrued within the trade and the money in hand, MED could not efficiently spend money on new enticing enterprise fashions in the long run.

Supply: Looking for Alpha

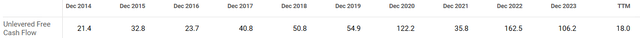

The rise in free money circulation reported within the final decade can also be important. Within the final decade, free money circulation elevated virtually yearly, and I didn’t see damaging free money circulation within the final seven years.

Supply: Looking for Alpha

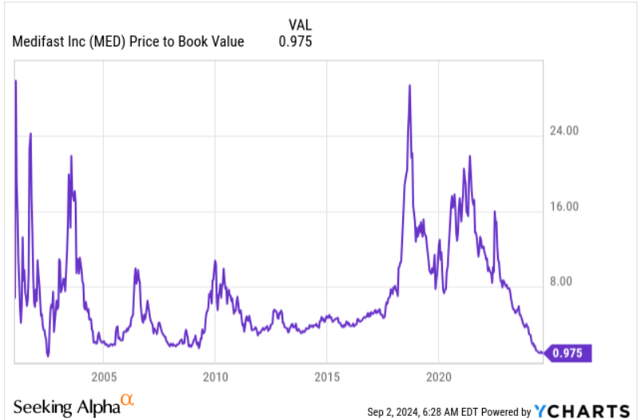

In sum, I do probably not perceive the skepticism concerning the firm’s enterprise progress. The inventory worth doesn’t appear correlated to the guide worth per share, however MED appears to know what it does. I took into consideration earlier free money flows to design future free money circulation forecasts.

YCharts

The New Collaboration With LifeMD, And Opponents

The corporate signed a collaboration settlement with LifeMD, which might, for my part, deliver new purchasers, who’re presently taking solely medical weight reduction choices.

The corporate’s coach-guided method, together with LifeMD healthcare offering GLP-1 medicines, seems to characterize a big benefit over different rivals not providing built-in choices. In addition to, for my part, an important is the truth that MED brings a plan that would decrease, beneath sure circumstances, the GLP-1 remedy unintended effects like muscle loss.

As well as, due to LifeMD, MED’s new mixed presents deliver blood work in addition to prescription and insurance coverage assist. In my monetary mannequin, I assumed that these new merchandise will most definitely speed up future free money circulation progress.

On this regard, for my part, it’s fairly outstanding that MED lately famous the acquisition of shares from LFMD. In sum, if we purchase MED shares right this moment, we’re additionally shopping for publicity to the enterprise mannequin of a digital main care supplier. For my part, additional acquisition of fairness from LifeMD might have a helpful impact on the inventory. The valuation of well being care operators seems to be considerably greater than that of MED.

Through the fourth quarter of 2023, the Firm entered into an settlement with LifeMD, Inc (Nasdaq: LFMD), a number one supplier of digital main care, to buy shares of frequent inventory of LifeMD for $10 million. Supply: 10-Q

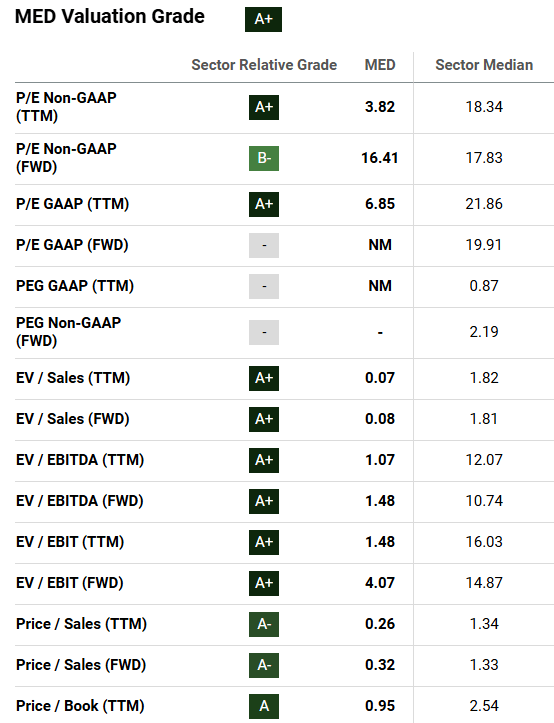

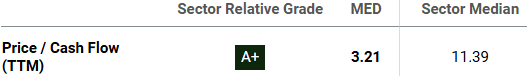

I don’t suppose market individuals did take a look on the numbers of different rivals. Friends report greater PE TTM GAAP, and EV/ TTM EBITDA figures than MED. Opponents commerce at 21x TTM GAAP earnings. MED trades at 6x TTM GAAP earnings.

Supply: Looking for Alpha

New Advertising Efforts And New Provide Chain Optimization Initiative May Speed up Web FCF Progress

Within the final quarterly report, MED promised significant investments in advertising efforts to reinforce model visibility about its new holistic presents. For my part, model consciousness, enhancement of consumer conversion, the corporate’s experience in launching omnichannel campaigns, and digital experience will most definitely speed up FCF progress from 2025.

Through the three months ended June 30, 2024, the corporate additionally famous a brand new provide chain optimization initiative, which might have a helpful impact on future FCF margin progress. Amongst latest initiatives, there’s the closure of the corporate’s Maryland Distribution Heart. In addition to, MED seems to be assessing choices for the disposition of land and constructing. MED already situated a number of provide chain belongings that won’t be used sooner or later, so we might anticipate new bulletins quickly. For my part, profitable change within the firm’s provide chain community couldn’t solely deliver monetary flexibility and money, however we might additionally anticipate FCF progress.

My Free Money Move Expectations

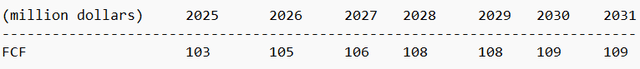

With a purpose to design my free money circulation expectations, I took under consideration earlier monetary statements and my very own assumptions concerning the settlement with LifeMD, profitable investments in advertising, and the brand new provide chain optimization initiative. My monetary mannequin contains small free money circulation progress as a result of I attempted to be as conservative as attainable. My numbers will not be very completely different from the figures reported from 2014 to 2024.

Supply: Looking for Alpha

I additionally revised the expectations that market individuals anticipate for the GLP-1 market. In accordance with UBS, from 2023 to 2029, we could possibly be speaking about gross sales CAGR of 30%. MED may gain advantage from the market progress.

GLP-1 progress has predominantly been pushed by the most recent merchandise from key trade gamers within the pharmaceutical sector. UBS estimates international GLP-1 mannequin forecasts 40m individuals on GLP-1s by 2029, with 44% within the US. This interprets into $126bn gross sales by 2029, a 2023-2029 gross sales CAGR of 30%. Supply: UBS World

In addition to, I used a WACC of 9% and a terminal EV/2031 FCF of about 1.5x. Given the valuation of rivals, and that of MED, I believe that the buying and selling a number of used is sort of conservative.

Supply: Looking for Alpha

My free money circulation forecasts, and the outcomes obtained, are proven within the desk beneath. I obtained a goal worth of $72 per share, implied fairness valuation of $773 million, and whole enterprise worth of $628 million.

Supply: My Expectations

- NPV of FCF @ 9%: $538.79 million

- NPV of TV @ 9% = $90.16 million

- Complete EV $628.94

- Web Debt: -$144.4 million

- Fairness: $773 million

- Shares: 10.7 million

- Goal Value $72

The corporate repurchased shares up to now, and reported an authorization to amass 1,323,568 shares. Given the present whole share depend, I believe that potential acquisition of shares might deliver demand for the inventory. In consequence, I believe that we might see inventory worth will increase within the coming years. Given the present valuation of the corporate and ongoing inventory repurchases, for my part, new traders could also be within the firm.

As of June 30, 2024, there have been 1,323,568 shares of the Firm’s frequent inventory eligible for repurchase beneath the Inventory Repurchase Plan. Supply: 10-Q

Dangers From The Decline In The Complete Quantity Of Coaches, Failed Advertising, Or Model Deterioration

For my part, the most important dangers come from a big discount within the variety of coaches. Within the final annual report, the corporate famous a decline within the variety of coaches from 60k in 2022 to 41k in 2023. Additional decline on this quantity might have fairly a detrimental impact on the corporate’s internet gross sales progress and free money circulation progress.

The corporate works with unbiased coaches, involving quite a few dangers. Misconduct of coaches or sure actions might harm the corporate’s model, and destroy the corporate’s FCF progress. Failed introduction of latest merchandise and failed multi-level advertising methods is also fairly detrimental for MED’s future internet gross sales progress. The corporate mentioned a few of these dangers within the final annual report.

The expansion and sustainability of our community of OPTAVIA Coaches can also be topic to dangers which can be outdoors of our management. These embrace: potential misconduct or improper claims by OPTAVIA Coaches; damaging public perceptions of multi-level advertising; basic financial circumstances; failure to develop progressive merchandise to fulfill client calls for; antagonistic opinions of our merchandise, companies, or trade; and regulatory actions in opposition to our Firm, rivals in our trade, or different direct promoting corporations. Supply: 10-k

Modifications In The Regulatory Framework Or Actions By The FTC May Decrease Future Web Gross sales Progress

Previously, the FTC enacted actions in opposition to corporations working multilevel advertising campaigns. I can not say whether or not the corporate won’t obtain the eye of the FTC. As well as, coaches might launch lawsuits in opposition to the corporate, which might additionally set off FTC investigations. Beneath sure circumstances, MED is probably not fined by the FTC, nevertheless damaging publicity about lawsuits or authorized claims in opposition to MED might deliver decrease internet gross sales progress. As per the final annual report, MED might additionally undergo from lawsuits from prospects due to the corporate’s advertising methods or issues associated to client safety legal guidelines.

Lack Of Provide Of Components Or Interruption Of Provides May Be Fairly Detrimental

The corporate receives elements from america and different worldwide markets. For my part, shortages within the provide of sure elements, provide chain points, distribution issues, and modifications in tariffs or worldwide commerce legal guidelines might deliver quite a few issues. In consequence, if the corporate has to pay extra for sure elements, MED could ship decrease internet earnings progress than anticipated. In addition to, beneath sure circumstances, the corporate might undergo from manufacturing decreases, which can additionally have an effect on future internet gross sales progress. In sum, decrease monetary efficiency might push the corporate’s inventory valuation down.

Conclusion

Medifast’s most up-to-date settlement with LifeMD and the acquisition of LifeMD shares will most definitely have a helpful impact on the corporate’s enterprise progress. For my part, the mix of weight reduction proprietary formulation, the motion of coaches, and GLP-1 remedy characterize a holistic method that would deliver new FCF progress. In addition to, I anticipate additional progress coming from the corporate’s lately introduced investments in model consciousness. As well as, MED’s latest provide chain optimization initiatives together with the closure of the Maryland Distribution Heart and different new initiatives which may be introduced might deliver additional FCF margin will increase. General, I believe that the corporate is considerably undervalued. I did conduct a DCF mannequin, which revealed an implied honest worth of near $72, and implied fairness valuation of $773 million. In sum, the inventory seems fairly undervalued.