Ninoon

Because of a larger sell-off at the end of last week, Medical Properties Trust, Inc. (NYSE:MPW) can now be purchased for a yield of around 8%. The dividend yield on Medical Properties Trust is very appealing because it is sustainable based on the trust’s payout ratio, and I am getting a 7.8% yield on my most recent purchase.

The portfolio of the trust is expanding, and the dividend is covered by funds from operations. In addition, I believe the valuation is simply too compelling to ignore.

Large And Growing Hospital Portfolio

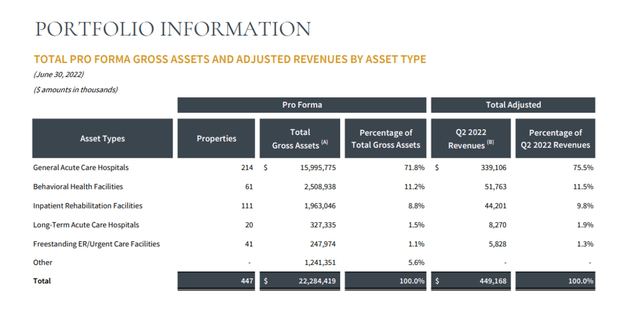

In the second quarter, Medical Properties Trust added 7 properties on a net basis to its portfolio. The trust’s real estate portfolio contained 447 properties as of June 30, 2022, the majority of which were General Acute Care Hospitals (214 properties) and Inpatient Rehabilitation Facilities (111 properties).

Revenues from Medical Properties Trust’s hospitals and care facilities totaled $449.2 million.

Portfolio Summary (Medical Properties Trust)

Medical Properties Trust’s facility base is primarily comprised of General Acute Care Hospitals. This trust’s hospitals account for 72% of its assets and 76% of its adjusted revenues.

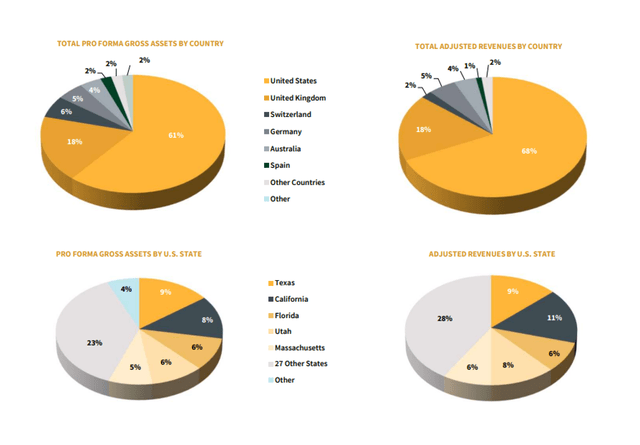

Medical Properties Trust also has real estate holdings in the United Kingdom, Switzerland, Germany, Australia, and Spain. The United States, on the other hand, remains the trust’s largest market, accounting for 61% of real estate assets and 68% of total adjusted revenues.

Texas is the largest state in the United States in terms of real estate location, with a 9% asset and revenue share. The international exposure is a nice feature that the trust provides to investors who want to gain real estate exposure outside the United States.

Assets By Geography (Medical Properties Trust)

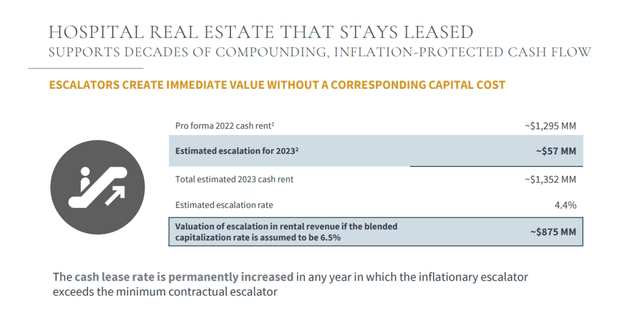

Inflation Protection

Because hospital leases contain rent escalation rates, Medical Properties Trust provides investors with inflation protection. The value of this escalation is estimated to be $57 million for next year, representing a 4.4% increase in annual cash rent. Inflation is obviously a major concern for consumers and investors, and Medical Properties Trust provides some relief in this regard.

Rent Escalation Rates (Medical Properties Trust)

Medical Properties Trust’s Dividend Is Relatively Safe

When I purchase a real estate investment trust, I must be confident that the trust will be able to pay its dividends. It makes no sense to me to buy a REIT at an 8% yield only to have the trust cut its dividend later, lowering my total returns.

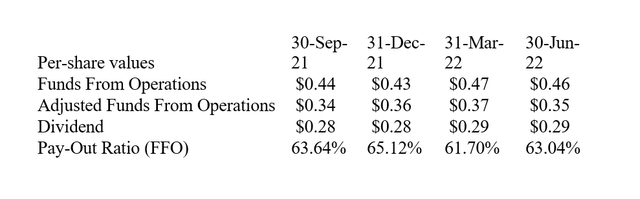

In the case of Medical Properties Trust, I am confident that the trust will be able to maintain its dividend. The reason for this is the low payout ratio, which has consistently been in the low 60% range over the last year.

In 2Q-22, Medical Properties Trust’s payout ratio was only 63%, as the trust’s funds from operations of $0.46 per share easily outpaced its dividend payout of $0.29 per share.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Financials)

Low FFO Multiple

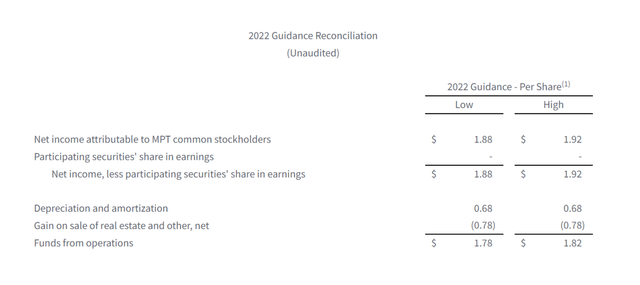

In the second quarter, Medical Properties Trust reaffirmed its 2022 guidance rather than raising it. The trust expects to generate $1.78-1.82 per share in funds from operations this year, representing a 9% YoY increase in funds from operations (“FFO”).

2022 Guidance Reconciliation (Medical Properties Trust)

The dividend yield on Medical Properties Trust is currently 7.8%, based on a stock price of $14.92 and a quarterly dividend of $0.29 per share.

The stock has an FFO multiple of 8.3x based on the trust’s FFO guidance for 2022. Medical Properties Trust traded at an FFO multiple of 13.1x at the beginning of 2022, so I believe the valuation is very appealing for an opportunistic investor right now.

Why Medical Properties Could See A Lower Valuation

A recession is likely Medical Properties Trust’s most serious potential headwind, and it could result in slower future funds from operations growth as well as a lower dividend coverage ratio.

Currently, Medical Properties Trust easily covers its dividend with FFO, and the pay-out ratio is in the low to mid 60% range, indicating that the dividend is reasonably safe.

Having said that, investors may use lower dividend coverage as an excuse to push Medical Properties Trust’s stock down.

My Conclusion

I recently purchased a drop of Medical Properties Trust and am earning a 7.8% yield on my investment.

After reviewing the trust’s payout ratio, I am confident that Medical Properties Trust can afford its quarterly dividend of $0.29 per share as well as a potential dividend increase.

After Friday’s drop, I believe the trust has an appealing valuation.