cemagraphics

Today I want to write about MDU Resources Group Inc (NYSE:MDU) because I’ve got a pretty substantial (for me) stake in the company, and I want to know what to do with the investment on the eve of upcoming earnings. I’ll decide whether it makes sense to buy more, hold, or sell my stake. In case you forgot for some reason, I took an initial stake in this stock way back in April of 2020 based on the valuation and the dividend sustainability, in a very creatively titled article called “MDU Resources Is A Buy Because of Valuation and Dividend Sustainability.” The investment has done well since then, having returned about 46% against a gain of 48% for the S&P 500. Since then I’ve been more neutral on the stock, preferring to sell put options to investing more capital in the equity. A crop of puts that I sold last May have just expired worthless, and that’s boosted my returns here. In my view, the returns I earned from selling deep out of the money puts are superior in some way to the returns I earned on the stock because they came with much less risk.

So today I want to review the name again, because an investment in a stock priced at $30.40 is, by definition, a more risky investment than the same stock when it’s priced at $22.70. I’ll decide whether to buy more, hold, or sell by looking at the most recent financial history, and by looking at the valuation. Additionally, I wouldn’t be me if I didn’t write about my experience with short puts here and use that as an example of yet another didactic lecture about the risk reducing, yield enhancing power of short put options.

Every one of my articles comes with its own handy “thesis statement” paragraph, which gives you a deeper understanding than you’d get from reading only the bullet points above, while not forcing you to wade through 1,600 words of my sometimes tiresome prose. You’re welcome. Anyway, I’ll be taking profits in MDU Resources today. Although it’s still quite profitable, this is far less attractive a company than it was when I first bought the shares. The capital structure has deteriorated massively, for instance. In spite of that, the valuation is pretty rich, and the dividend yield is materially lower than what an investor can earn on a risk free 10 Year Treasury Note. In the relativistic game of investing that matters a great deal in my view. I’m in the mood to preserve capital at the moment, so for that reason, I’ll be taking my chips off the table, and will buy back in if the price drops to a reasonable level again. Finally, although I’ve done well with short puts previously, there’s no opportunity there at the moment. That written, I think it makes sense to familiarise yourselves with these instruments if you aren’t yet aware of what they can do for your risk adjusted returns.

Financial Snapshot

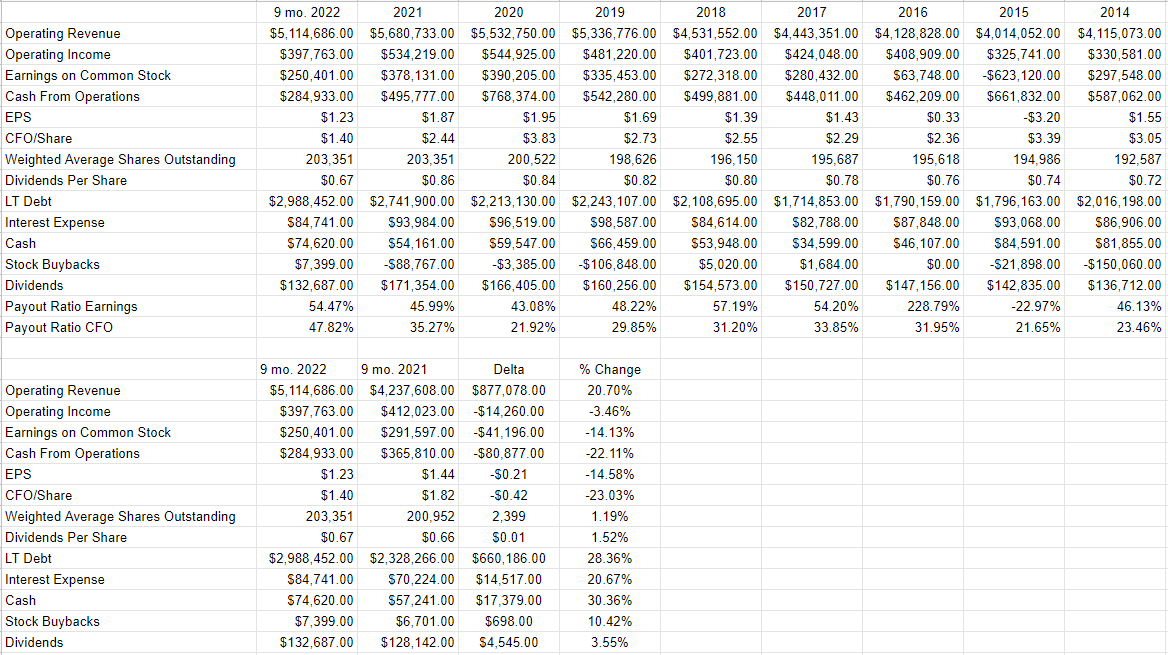

I’m not too impressed by the most recent financial performance here. The one, and only, bright spot is the fact that revenue rose from 2021. Everything else, from net income, to cash from operations, to the capital structure has deteriorated relative to the same period last year. Admittedly, much of this is no fault of the company’s but that doesn’t really change the reality of the situation in my view.

Specifically, relative to the same period in 2021, revenue was higher by about 21%. Operating income and earnings on common stock were down by 3.5% and 14% respectively. The reason for this is that costs rose at a faster pace than revenue. For instance, non regulated pipeline, construction & materials expenses were up by 23.4%. Purchased natural gas sold expenses were up by 58.4%. Interest expenses grew by 21% relative to the same period a year ago, on the back of a $660 million uptick in long term debt over the past year. So, long term debt has gone from about $2.32 billion at the end of Q3 2021 to $2.988 billion most recently. That is a huge (28%) uptick in risk in my view.

The company remains profitable, though, and the dividend remains reasonably secure. For that reason, I’m comfortable actually buying more of the stock at the right price.

MDU Resources Financials (MDU Resources investor relations)

The Stock

If you read my stuff regularly, you know that I consider the company and the stock to be very different things. The company is in the business of delivering energy, with all of the complexities that entails. The stock, on the other hand, is a traded instrument that reflects the crowd’s long-term views about the strength of the business. Additionally, the stock is affected by a number of variables that have little to do with the business, including changing interest rates, the crowd’s desire to own “stocks” as an asset class etc. In my experience, the only way to profit trading stocks is to spot discrepancies between the crowd’s views and subsequent reality. If the crowd is too pessimistic, for instance, it makes sense to buy and then ride the price higher as new information is eventually digested. This is what I did in April of 2020 with MDU stock and the results are reasonably good. If the crowd is too optimistic about a company’s future, it’s best to avoid the name in my view. The level of optimism or pessimism in a stock is reflected in the valuation. If the crowd is optimistic, the shares are not cheap and are likely not a great investment in my view.

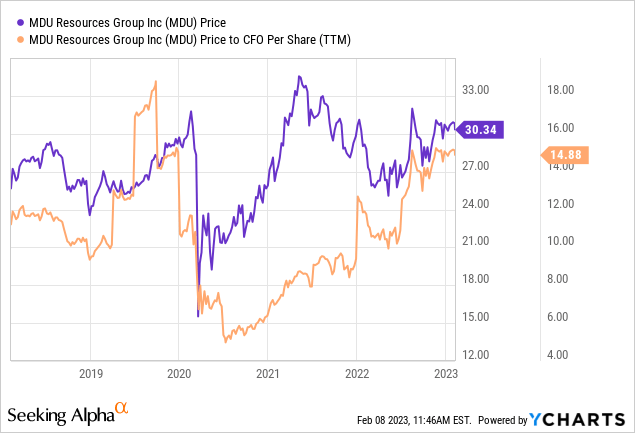

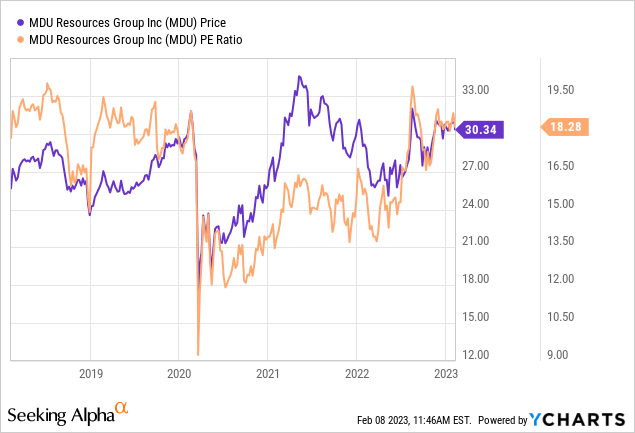

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of market price to some measure of economic value, like earnings, sales, and the like. I want to see the shares trading at a discount to both the overall market, and their own history. In case you don’t remember, in my most recent article on the name I decided to not buy because the price to CFO per share was a relatively high 10.42 and the shares were trading at about 15 times earnings. The shares range between 22% and 42% more expensive per the following:

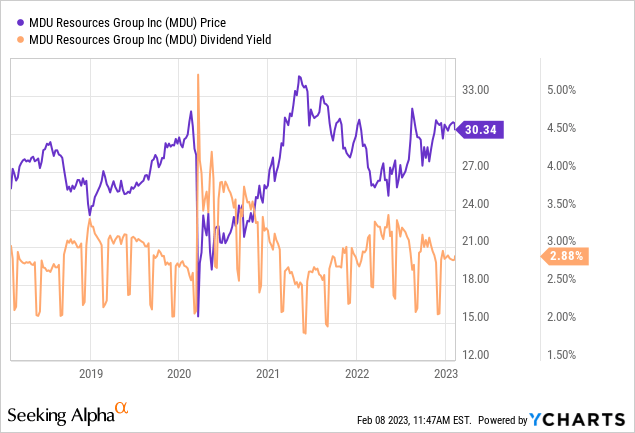

Additionally, the dividend yield is currently about 70 basis points lower than the risk free 10 year treasury note. By buying the stock, investors are taking on much more risk than they would in a 10 year note, and they’re getting paid about 70 basis points less. None of the above fills me with a warm, fuzzy feeling.

My regulars also know that in addition to looking at ratios, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit too thick, you might want to crack the spine on “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future. Applying this approach to MDU at the moment suggests the market is assuming that this company will grow at a rate of about 7.5% in perpetuity from current levels, which I consider to be a very optimistic forecast. Given the above, I’m going to sell my stake in the business. I’ve made a great deal of money on this investment over the past few years, but I’m in the mood to preserve what I’ve got, and in that spirit, I’m going to sell.

Options Update

In my previous missive, I sold 10 January 2023 puts with a strike of $22.50 for $.80 each. These expired worthless, which was gratifying. It would have been equally pleasant if I were exercised at this price, because a net entry price of $21.70 is quite attractive in my view. This is why I consider selling deep out of the money puts to be a “win-win” trade.

While I like to repeat success when I can, there’s no opportunity to do so here at the moment in my view. This is because the premia on offer for acceptable strike prices on MDU Resources puts are way too thin. For instance, the July MDU put with a strike of $22.50 is currently bid at $0. I think “zero” is too little compensation for taking on any risk, so I’m going to pass until prices drop to a more typical level.

Just because there’s no opportunity to generate decent premia at the moment here does not mean that these are not great tools to generate great returns over time. When you sell a deep out of the money put for a decent yield, either you’ll collect only that decent yield and move on, or you’ll collect that decent yield and buy a great company at an attractive price. Thus, I’m of the view that if you aren’t yet aware of how these instruments work, I would recommend becoming so.