Justin Sullivan/Getty Images News

One central theme impacting markets today is the weak performance of many consumer staples companies. Last week, I covered Hormel (HRL), which has lost considerable value after losing profit margins through its failure to pass rising input costs onto its product prices. This is one of many examples seen amongst consumer staples firms, most of which have negative exposure to the inflation we’re seeing today. Specifically, the “supply side” inflation is driven more by labor and raw materials shortages than excess demand.

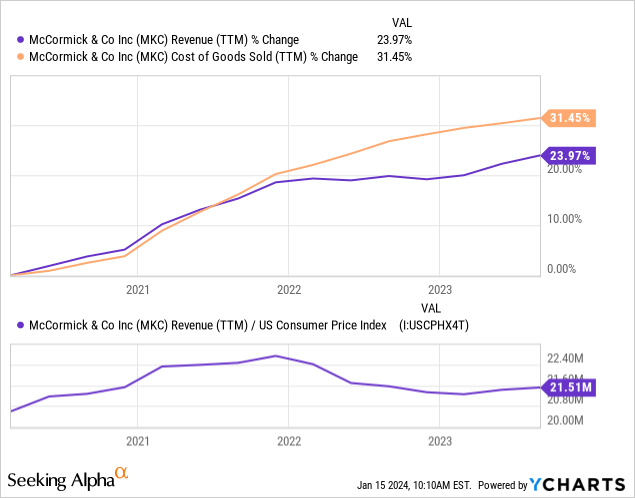

Another similar example of this issue may be McCormick & Company (NYSE:MKC), primarily known for its herbs and spices. The company also sells many condiments, and around 40% of its sales come from non-consumer flavor solutions. Since 2020, the company has managed to expand its sales, but they’re stagnant compared to the price index. More importantly, its gross profit margins and overall operating margins have declined dramatically and are showing minimal signs of recovery.

MKC lost around 18% of its value in 2023 and has decreased by just over 30% since the end of 2021 when inflation began to spike. Its EPS and income outlook have also slipped, though its forward “P/E” valuation remains high at ~25X. The company has also seen a notable expansion in interest expense and a rise in inventories, pointing toward potential balance sheet risks. Still, the company has continued to raise its dividend and has stable revenues. As such, I believe it is an excellent time to look closely at McCormick’s situation today to determine whether it will recover quickly.

McCormick’s Profit Margin Pressures Mounting

Fundamentally, a consumer staples firm can be more risky in certain conditions than the “cyclical” sectors. The situation we’re seeing across many consumer staple firms has less to do with the economic cycle because demand for products like spices and condiments is not particularly cyclical. However, when the prices of those products continue to rise faster than inflation, people are becoming more price-sensitive, looking for lower-cost producers. For the most part, McCormick faces significant competition in the spice and herb categories because shoppers can easily pick out the lowest price item for any herb or spice. That is less true for condiments, but it remains an issue due to rising input costs.

Amid this issue, McCormick has faced some negative publicity due to a study that found potential food safety issues in its spices, resulting in a lawsuit that was dismissed but still resulted in a fair amount of negative publicity for McCormick and a few of its competitors. I believe this may be one partial reason for the company’s struggle to maintain profit margins. However, the broader issue is the sharp price increase from imported flavors due to rising labor costs in producing countries and shipping prices. Since 2020, the company has been unable to expand its sales after inflation and has seen its COGS rise much faster than its prices. See below:

Due to its innovations and acquisitions, McCormick had a fair amount of “real” revenue growth before 2020. Since then, its sales have only kept up with inflation. To be fair, many firms have not seen their sales rise as much as inflation, but McCormick’s sales would likely be lower if it had increased its prices to match rising input costs.

McCormick is exposed to a particularly inflation-exposed and relatively complex supply chain. It sources raw materials from all over the world, but the countries around the Indian Ocean region in particular. In India and many places around those areas, spices have fallen into a significant shortage, with extreme local inflation. Producing herbs and spices, particularly vanilla, is extremely labor intensive. With countries such as India seeing robust economic growth in recent years, it will naturally follow that McCormick will be paying more for products as worker wages increase with the economy.

Further, the natural flavor market is highly exposed to transportation costs, an issue as old as the global shipping industry due to the long voyages the products must take. Thus, higher fuel prices will disproportionately harm McCormick. Even more, trade and shipping issues, such as those in the Red Sea today, are potential issues. Around 20% of the company’s sales come from the EMEA region, meaning it may now be paying much higher costs on those sales as container shipping routes shift around Africa. I would not say this is a massive issue for the company today, but any escalation in conflicts around the Indian Ocean could eventually have massive negative consequences for McCormick. Fundamentally, due to geopolitical and economic troubles in that part of the world, managing a supply chain as complex as McCormick’s will not be easy.

McCormick’s Notable Balance Sheet Issues

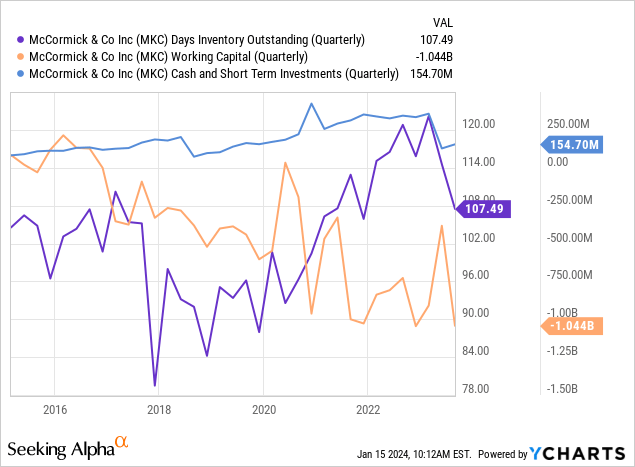

Further, McCormick has seen some increases to its inventory ratio, though that issue began to unwind last quarter. Still, its inventories are a bit high from a seasonal standpoint, which almost always negatively pressures gross margins. The company has a somewhat poor liquidity position, with just $154M in cash and -$1B in working capital. See below:

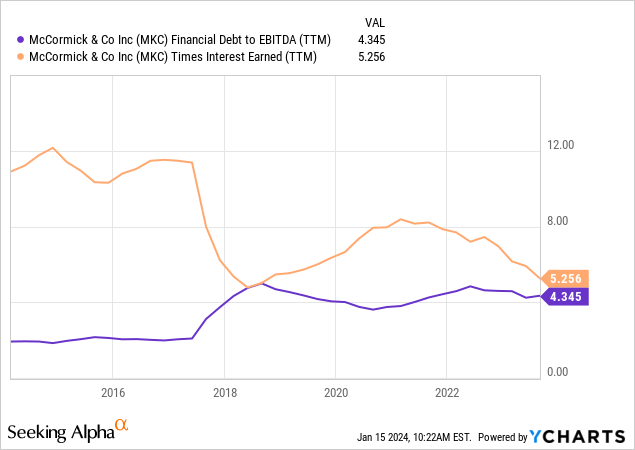

The combination of low liquidity metrics and high inventory points toward another quarter of potentially weakened margins and potential needs for external financing or a reduced dividend. McCormick certainly does not have an ideal balance sheet. Following its series of acquisitions, its leverage level is a bit high, with a financial debt-to-EBITDA ratio of 4.3X and a times interest earned of 5.2X. See below:

Again, neither of these ratios, particularly its Times Interest Earned, is concerning. However, its leverage is elevated, and with interest rates elevated, its TIE will naturally decline, likely taking net profits down and independent of its gross margin pressures. As noted in its last 10-Q, the company faces a $700M maturity of 3.15% notes due in 2024. With its BBB credit rating, refinancing that debt will likely raise the rate to about 6%, theoretically reducing its income by around $20M per year; it is not a huge loss, but it will add to the numerous issues harming its income. Additionally, with its cash position generally low, its interest costs may rise more quickly as it could utilize other borrowings.

Income Outlook Through 2026

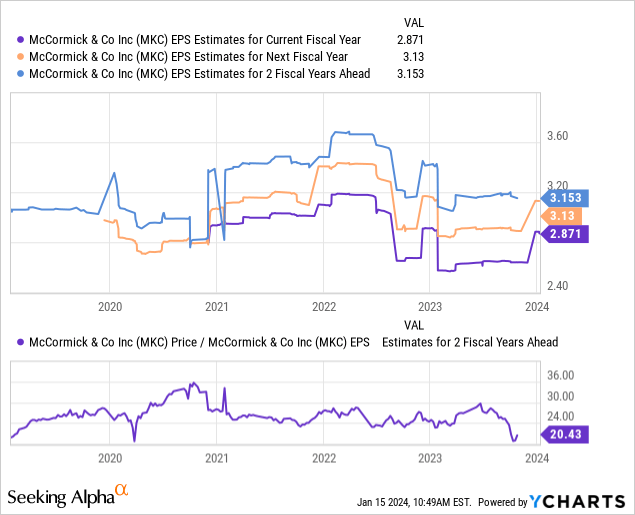

Most MKC analysts believe the company will see a rebound in its EPS, with the figure expected to rise to $3.15 over the next two fiscal years. From a valuation standpoint, which would give MKC the lowest forward “P/E” since its 2020 crash, though its valuation was a bit elevated in recent years. See below:

Personally, even at a 20X “P/E,” I do not believe MKC is a great deal due to its high leverage and exposure to the many supply-side inflationary issues in the world. That is not necessarily the measured US inflation people see on headlines, but the fundamental disproportionate rise in labor and shipping costs in other countries, particularly in developing countries where most of MKC’s products ultimately come from.

Further, I do not see a strong cause pointing to a rebound in McCormick’s income. For one, it will face a rise in interest costs as long as rates remain where or near where they are. Further, its higher inventory ratio indicates some continued struggle to raise prices to match expenses. It may try to do so, but that could put it in an uncompetitive position for shoppers, who exercise more discretion due to rising costs. The same applies to the company’s B2B flavor business, as companies will likely look more toward lower-cost firms to minimize COGS inflation. Indeed, I believe it may be more likely that its EPS will continue to slip by 2026.

The Bottom Line

Overall, I believe there is much reason to be bearish or cautious about MKC today. Since the company is at a relative valuation discount based on its current outlook, I would not bet against it. That said, I am mildly bearish on MKC because I do not believe even this “discounted” valuation is justified compared to its high-income risks.

There are two main issues I see in McCormick today. For one, due to its choice to expand aggressively over the past decade, its debt level is very high, giving it negative exposure to prolonged high interest rates and elevated equity risks associated with its balance sheet. Secondly, outside of the company’s immediate control, many issues in those countries around the Indian Ocean will likely continue contributing to a disproportionate increase in McCormick’s input costs, which may not be easily passed forward as Western buyers become more price-sensitive amid rising costs.

I believe MKC would be more fairly valued at a 15X forward “P/E,” removing the premium given to it as a “low risk” consumer staples firm, given that its EPS risk profile appears to be more similar to that of a consumer discretionary firm. Higher-cost natural flavor items are becoming a luxury or discretionary good, given they’re not nearly as cheap as they used to be and will likely continue to become more expensive due to their supply-side issues. Thus, my price target for MKC is ~$40 per share. That said, I do not expect MKC to fall to that price quickly, as few investors seem to agree with my sentiment that it is losing its “staple” status amid higher prices.