Solskin

Investment Thesis

The healthcare sector is a critical component of the U.S. economy, accounting for a significant portion of the GDP and employing millions. Demand for healthcare services is relatively stable, regardless of market conditions, making the sector an attractive option for investors seeking defensive stocks that can provide stability during market downturns. Considering the current economic climate and the appealing valuation of healthcare stocks compared to the rest of the market, I believe that a pair trade between these two would yield attractive returns over the next couple of quarters.

About IHF

The iShares U.S. Healthcare Providers ETF (NYSEARCA:IHF) is an exchange-traded fund that seeks to track the performance of the Dow Jones U.S. Select Healthcare Providers Index. This index is designed to measure the performance of companies that provide healthcare services, such as hospitals, nursing homes, and health insurers, within the United States.

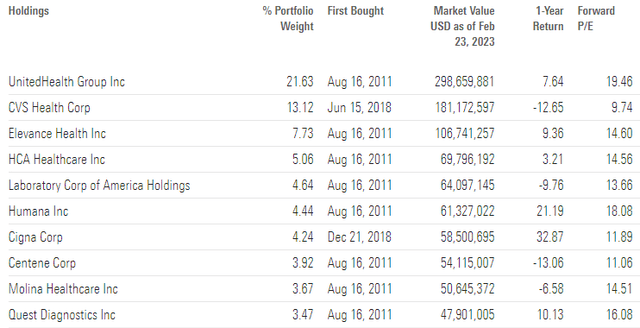

Furthermore, the IHF provides investors with the potential for long-term capital appreciation and income. The companies held in the fund typically generate steady, reliable cash flows from their healthcare services, which can be used to pay dividends to shareholders. As such, the fund may be attractive to income-oriented investors seeking to generate regular cash flow from their investments. Below is a list of the top 10 holdings:

Morningstar

For further details on PHO, please consult the fund’s prospectus.

IHF’s Track Record

IHF has outperformed the SPDR S&P 500 Trust ETF (SPY) over the past five years, with a total return of 71% compared to SPY’s 57%. Additionally, IHF’s focus on U.S. healthcare providers provides additional stability during volatile markets such as the ones we had in late 2018 and 2022. The U.S. healthcare sector is known for being less cyclical and more stable than other sectors, such as technology or consumer discretionary. Perhaps the only notable exception here is the March 2020 crash, where IHF did worse than SPY. However, given the fact that that selloff was mainly driven by an extreme endogenous factor such as a pandemic, I wouldn’t expect the same to repeat over the next couple of quarters.

Refinitiv Eikon

Overall, while past performance is not a guarantee of future results, the defensive nature of the healthcare sector and the diversification benefits provided by IHF’s portfolio make it an attractive option for investors seeking stability during volatile markets.

3 Reasons Why IHT Outshines SPY For Now

Healthcare stocks are a good choice in volatile markets due to their defensive nature, their potential for long-term growth, and their cheaper valuation. Here are three reasons why healthcare stocks may be a good choice during market volatility.

Defensive nature

Healthcare stocks are generally considered to be defensive stocks, meaning they tend to hold up better during market downturns than other sectors. This is because demand for healthcare services is relatively stable regardless of market conditions. During economic recessions, for example, people are still likely to require medical care, prescription drugs, and health insurance. As such, healthcare companies may be less affected by short-term market volatility.

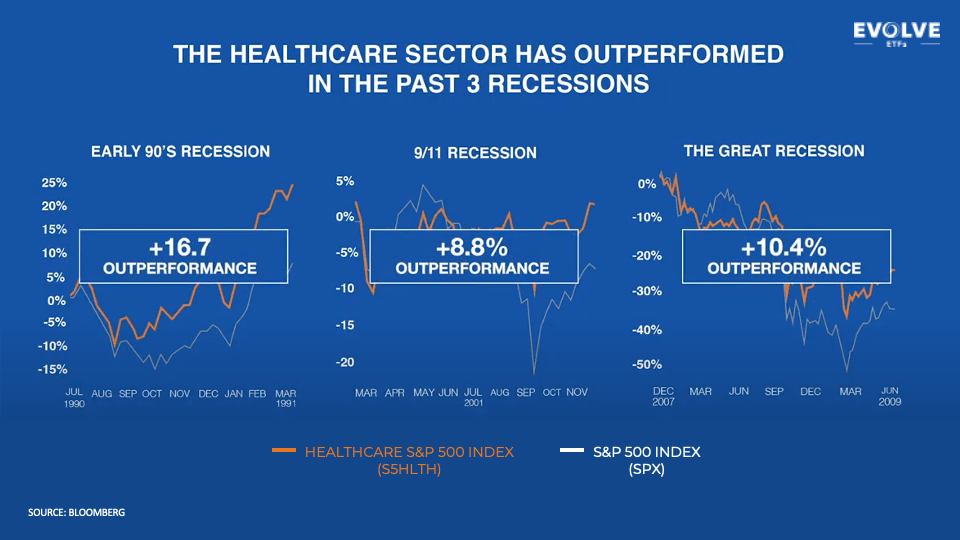

According to a report from Evolve ETFs, the healthcare sector was one of the top-performing sectors during the last three largest market downturns. Over these three episodes of heightened volatility, healthcare companies outperformed the S&P 500 by an average of ~12 percentage points.

Evolve ETFs

While healthcare stocks are not a recession hedge, they do tend to perform relatively better than the broader market during market downturns. This can make them a potentially attractive investment option over the next months for investors running a long/short book looking for relative outperformance.

Potential for long-term growth

While healthcare stocks may be defensive, they also have the potential for long-term growth. Advances in medical technology, an aging population, and increased healthcare spending contribute to the growth potential of healthcare stocks.

For example, healthcare spending in the U.S. is expected to continue to increase due to factors such as population growth, advances in medical technology, and the increasing prevalence of chronic diseases. According to a report from the Centers for Medicare & Medicaid Services, healthcare spending is projected to grow at an average rate of ~5% per year from 2021 to 2030.

Another factor contributing to the strong long-term growth potential of the sector is demographic trends. According to the United Nations, the global population aged 65 and over is expected to triple by 2050, from 703 million in 2019 to 1.5 billion in 2050. As the population ages, there will be an increased demand for healthcare services, such as long-term care and home health services.

Attractive valuations

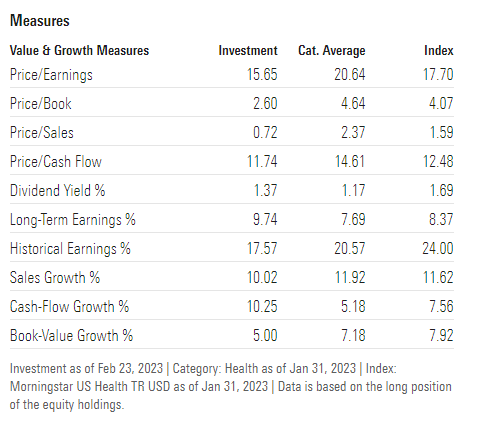

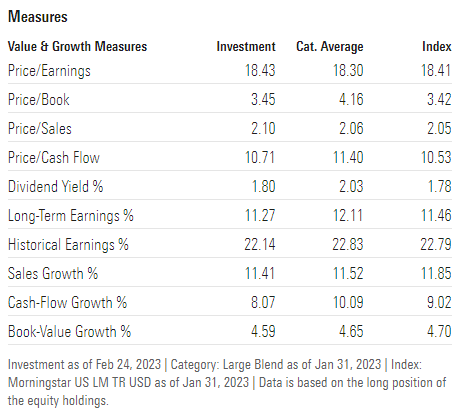

IHF ETF is attractively priced relative to the market. The fund has a price-to-earnings (P/E) ratio of 16x. In contrast, the SPY ETF has a P/E ratio of 18x, indicating that investors are willing to pay a higher premium for the earnings generated by the companies in the S&P 500 index. Similarly, IHF has a price-to-book (P/B) ratio of 2.6x vs 3.45x for SPY.

Morningstar Morningstar

Overall, these valuation metrics suggest that IHF trades at a discount relative to the market, which makes it in my opinion an attractive option for investors looking for exposure to the healthcare sector.

Main Risk Factor

One of the risks associated with pair trading is that the market may not behave as expected, causing losses on both sides of the trade. For example, if an investor takes a long position on IHF and a short position on SPY, with the expectation that the long position will outperform the short position, unexpected market movements could cause both positions to decline in value. To mitigate this risk, the investor could set stop-loss orders to automatically close out the positions if they reach a certain loss threshold.

Key Takeaways

Given the uncertain economic environment and the attractive valuation relative to the rest of the market, I think that IHF and more broadly, healthcare stocks, are a good choice due to their defensive nature, potential for long-term growth, and ability to benefit from demographic trends. That doesn’t mean that IHF will be unscathed if equity markets move lower from here, but I expect the damage to be less severe compared to a broad US equity index like the S&P 500. For this reason, I believe that going long IHF and short SPY would yield attractive results in this environment.