EvgeniyShkolenko

I just lately got here throughout a information article from CNN exhibiting Russian ships allegedly stealing Ukrainian grain, and I used to be amazed by the detailed satellite tv for pc pictures from the article. Apparently, the pictures had been taken by Maxar Applied sciences Inc. (NYSE:MAXR)’s satellites, and my curiosity was piqued.

Maxar within reason valued for its current operations, buying and selling at 16.4x P/E on LTM earnings. Shares look enticing if we assume Maxar is profitable in launching its fleet of latest imaging satellites, with probably 50% upside. I’d suggest traders slowly accumulate shares forward of the scheduled launch of the satellites in September. Keep in mind the inventory has massive 1-day strikes, so risk-averse traders could wish to think about a smaller place dimension.

Overview Of Maxar

Maxar has greater than 60 years of expertise in designing and manufacturing satellites and spacecraft parts for communications, Earth remark, exploration and on-orbit servicing and meeting. It has two working segments: Earth Intelligence and Area Infrastructure.

The Earth Intelligence enterprise phase offers prospects with high-resolution satellite tv for pc pictures and analytics. Maxar at the moment operates 4 in-orbit satellites, which have mixed collected over 137 petabytes of pictures over 20 years (Determine 1). Maxar can be designing and constructing a fleet of 6 new satellites known as “Worldview Legion” that’s anticipated to launch in The Fall. Clients for the Earth Intelligence phase embrace the U.S. authorities, different worldwide authorities companies, and enterprise prospects.

Determine 1 – Maxar’s in-orbit satellites (Maxar 2021 annual report)

The Area Infrastructure phase present options for communications, Earth remark, distant sensing, on-orbit servicing, robotic meeting and house exploration. Maxar primarily designs and manufactures satellites and house parts for industrial satellite tv for pc operators and authorities companies worldwide. Over time, greater than 287 customized Maxar-built spacecraft, together with 81 low Earth orbit (“LEO”) satellites, have launched with a mixed 2,850 years of service.

Maxar Has Had Many Points Just lately

Investing in Maxar inventory is certainly not for the faint of coronary heart. In simply the previous 5 years, the corporate has skilled a short-seller assault in mid 2018, a satellite tv for pc failure, a brand new CEO, a serious write-down and dividend reduce, a close to escape from insolvency, a sale of an necessary enterprise to repay debt, and a bunch of delays to the launch of its subsequent era picture satellites, simply to call just a few.

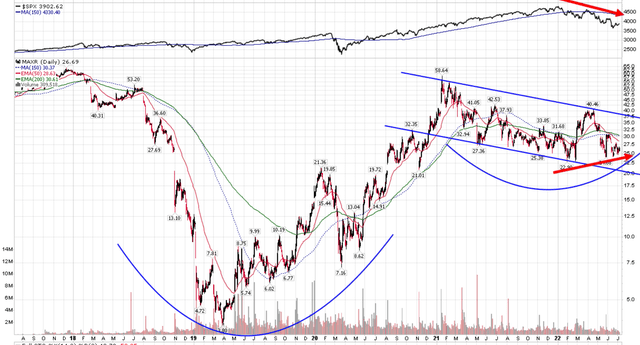

Determine 2 exhibits the inventory worth efficiency of Maxar. Discover the chart is stuffed with massive 1-day gaps, some as a lot as 35%. Whereas the day-to-day worth motion in Maxar may be uneven, the long run chart does present a possible for a big cup+deal with formation, with notable relative power in latest weeks in comparison with the market.

Determine 2 – Maxar shares are unstable (Creator created with worth chart from stockcharts.com)

Monetary Efficiency Has Been Unstable

One of many explanation why Maxar’s inventory worth has been so unstable is as a result of its enterprise mannequin depends on contract wins and could be very lumpy. It is extremely tough for analysts to precisely predict Maxar’s earnings. Earnings per share shock can vary from -460% to +550% (Determine 3). Even when revenues stunned by +24% in This autumn/2019, EPS ended up shocking by -300%!

Determine 3 – Maxar earnings are unstable. (In search of Alpha)

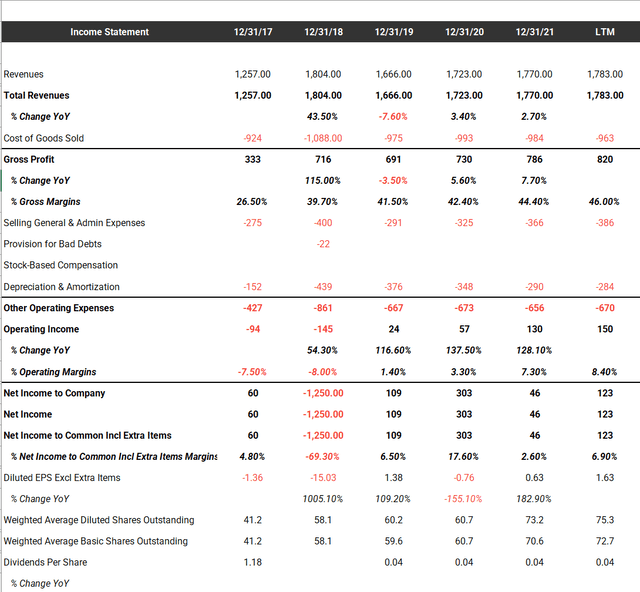

Lumpiness apart, the underlying enterprise has been steadily enhancing for the reason that near-death expertise in 2019 (Determine 4). Despite the fact that revenues had been nonetheless decrease in 2021 than 2018, gross margin expanded by 470bps, which led to a dramatic turnaround in working revenue from a lack of $145 million in fiscal 2018 to an working revenue of $130 million in 2021.

Determine 4 – Abstract financials (Creator created with knowledge from tikr.com)

Worldview Legion A Key Upcoming Catalyst

A key upcoming catalyst for Maxar is the scheduled launch of its subsequent era satellites, “WorldView Legion.” Worldview Legion might be a fleet of six excessive efficiency satellites that can enable re-snapping of pictures of quickly altering areas as much as 15 occasions per day, a rise from 4 occasions per day at the moment, which can greater than triple Maxar’s capability to gather 30 cm decision pictures and enhance Maxar’s total capability in excessive demand areas.

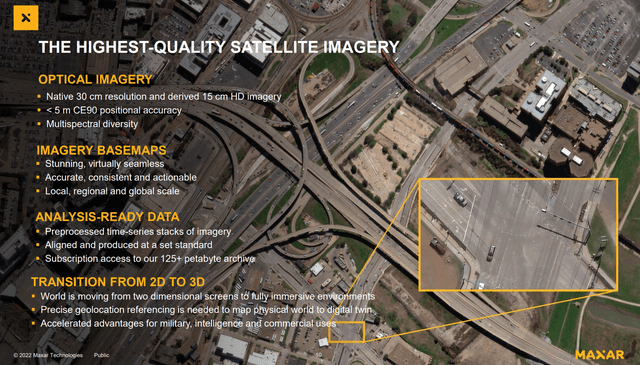

Determine 5 highlights Worldview Legion’s capabilities in additional element. Worldview Legion can have native 30 cm decision and may derive 15cm HD pictures utilizing knowledge analytics. Worldview Legion will even be capable of seize a lot bigger single swath pictures, 672 sq km per swath at sub 50cm decision in comparison with opponents that may solely seize single picture dimension of 26 sq km at 78 cm decision.

Determine 5 – Worldview Legion capabilities (Maxar investor presentation )

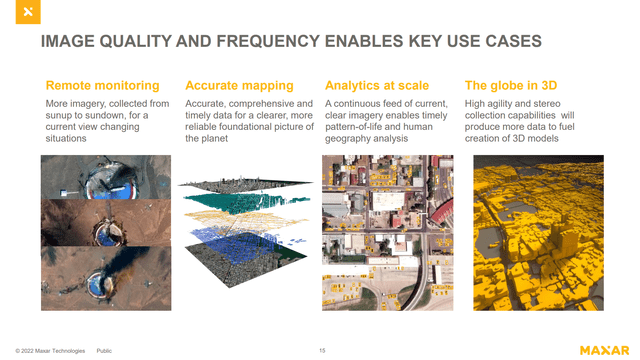

Worldview Legion’s enhanced capabilities will enable Maxar to supply novel use circumstances resembling distant monitoring for top demand areas, correct multilayer mapping, well timed pattern-of-life and human geography evaluation, and correct 3D fashions of the world (Determine 6).

Determine 6 – Key use circumstances (Maxar investor presentation )

Actually, some analysts had been so enamored with the brand new fleet of satellites that they estimated Worldview Legion can reignite topline development for Maxar and drive the corporate to ship $360 million of free money circulate by 2023. Clearly, the above evaluation by Kerrisdale capital needs to be seen with the 1-year delay within the satellites’ launch in thoughts.

Valuation Affordable With Upside

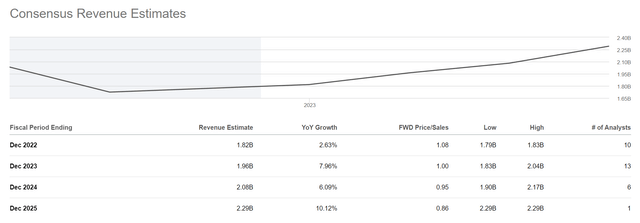

With LTM EPS of $1.63, shares are at the moment valued at 16.4x P/E, about inline with the market. The place it will get fascinating is as Worldview Legion comes on-line within the subsequent few quarters, Wall Avenue analysts estimate a big ramp up in Maxar’s revenues from $1.8 billion in 2022 to $2.1 billion in 2024 (Determine 7).

Determine 7 – Consensus revenues (In search of Alpha)

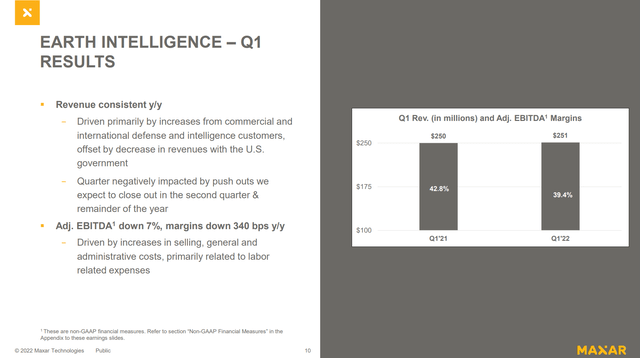

As we had talked about above, Wall Avenue analysts are notoriously dangerous at estimating EPS for Maxar because of the lumpy nature of its enterprise. Assuming the additional $300 million in extra income is from extra satellite tv for pc pictures and that it comes at a 40% EBITDA margin (Determine 8), much like the present Earth Intelligence enterprise, we may very well be a further $120 million in EBITDA.

Determine 8 – Satellite tv for pc imagery EBITDA margins (Maxar Q1/2022 presentation )

If we worth this $120 million in extra EBITDA at 8.5x (Maxar has traded between 7x to 13x EV/EBITDA, most just lately at 8.4x), this might add $1 billion to Maxar’s market cap or virtually 50% upside (Determine 9).

Determine 9 – Maxar EV / EBITDA valuation (Tikr.com)

Dangers To Maxar Story

Worldview Legion Launch Date Largest Close to Time period Threat

The most important near-term threat is one other delay within the launch of the Worldview Legion fleet of satellites. Initially, Legion was set to launch in mid-2021. Then it was delayed to the spring of 2022. In Could, when Maxar launched Q1 outcomes, it delayed the launch once more to September of this yr. There isn’t any assure that Legion will launch within the Fall.

Satellites Can Malfunction

One other key threat is that in-orbit satellites can malfunction. In face, in January 2019, the Worldview 4 satellite tv for pc malfunctioned and Maxar misplaced 50% in worth over two days despite the fact that Maxar had absolutely insured its fleet of satellites.

Excessive Debt Load

Lastly, the difficulty that nearly pushed Maxar into insolvency in 2019 was its excessive debt load. Though greater than $1 billion has been repaid, Maxar nonetheless carries round $2.1 billion of long-term debt. This equates to 4.8x Debt / EBITDA. Excessive debt can restrict Maxar’s operational flexibility or pressure the corporate to divest belongings, prefer it did when it bought the MDA phase again in 2019.

Fortuitously, Maxar’s interval of excessive capital expenditures needs to be coming to an finish as soon as the Worldview Legion is in operation, and debt needs to be quickly paid off from free money flows that the satellites will generate.

Conclusion

In conclusion, I believe traders ought to think about accumulating Maxar shares forward of its launch of the Worldview Legion satellites, now penciled in for September. Its valuation is cheap, and has appreciable upside as soon as the brand new satellites are in operation. Nonetheless, Maxar isn’t a inventory for the faint of coronary heart, as its enterprise is inherently lumpy and the inventory worth is liable to massive 1-day strikes. Buyers ought to preserve this in thoughts when sizing their place.