To listen to an audio spoken phrase model of this submit, click on right here.

As 2021 drew to an in depth, the Omicron variant was surging. Infections and hospitalizations had spiked to their highest ranges, and a budding sense of normalcy and financial re-opening floor to a halt. We had been fortunate that Omicron was not particularly harmful to the vaccinated and boosted (though Lengthy Covid stays a priority). Masks mandates are ending nearly all over the place, at present. The pandemic appears to be coming into its endemic section, with sufficient preventative measures and viable therapies to show a lethal scourge right into a extra manageable virus.

As a substitute of celebrating this, we’re as a substitute confronted with a day by day parade of televised conflict crimes.

This has shifted our consideration away from re-opening, and in the direction of the Russian invasion of Ukraine. It’s possible dominating your focus nowadays (we mentioned the affect final week), however take into account for only a second the continued financial restoration in the US and the remainder of the world.

However for Putin’s folly, we’d be discussing a 5+% GDP, blowout jobs report, unemployment falling to pre-pandemic ranges, rising retail and housing gross sales, together with a considerable improve in costs.

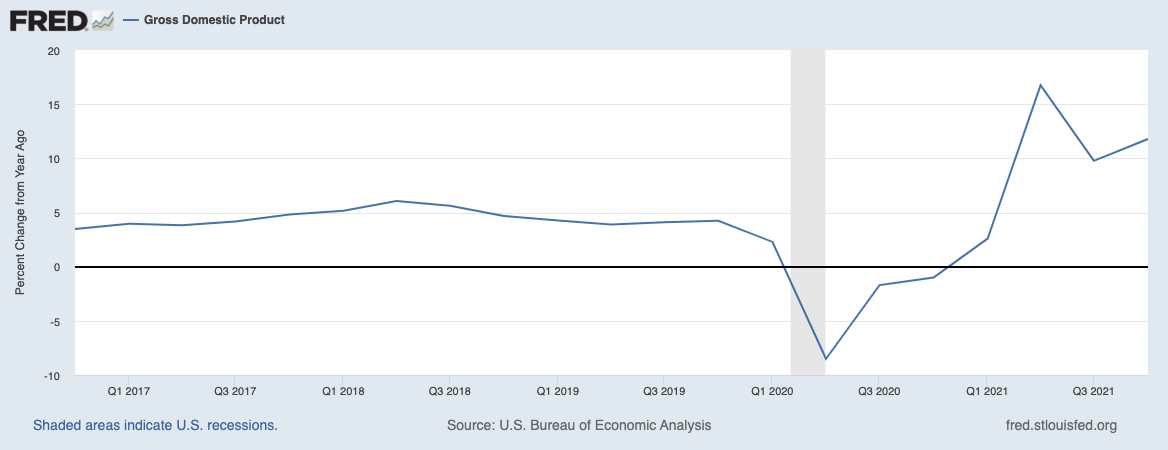

Previous to the initiation of hostilities, there have been 5 distinct phases evident within the U.S. economic system:

1. Comfortable restoration from the Nice Monetary Disaster, which started accelerating within the mid-2010s

2. February/March 2020 collapse into the pandemic, making lows in Q2 2020

3. Reversal from that low rallying to Q2 2021 highs

4. Delta/Omicron variant pullback Q3-This fall of 2021

5. New financial will increase ~Q1 2022

It’s possible that however for the invasion of Ukraine by Russia, International GDP can be accelerating additional, even within the face of rising charges and (transitory?) inflation.

There are limitless unknowns confronting the world at present, however for buyers, the important thing difficulty is which of those world occasions would be the prime driver for the remainder of 2022? I hope that we see a cessation of hostilities ahead of later, and anticipate the worldwide economic system to work previous the conflict.

We are able to ask questions: How is Russia goes to behave in Ukraine, in Europe, and within the world market? What’s going to key gamers within the vitality area like Saudi Arabia and U.S. Frackers do in response to rising costs and falling Russian Oil/Gasoline provides? How will the Federal Reserve alters its rate-hiking plans (if in any respect)? How will world sentiment develop as ongoing Russian aggression turns into extra brutal? How will U.S. customers behave within the face of rising costs, and rising geopolitical uncertainty?

It’s too straightforward to think about the world as having grown extra complicated and harsher over your lifetime: Numerous wars (Viet Nam to Iraq to Ukraine) scandals, (Watergate, Clinton Impeachment, Trump impeachments) September eleventh assaults, the monetary disaster, Covid pandemic, the January sixth revolt, and regardless of the hell comes subsequent. I stay not sure as as to if the world is rising harsher, or if we’re merely turning into much less naive about it. Perhaps with ubiquitous cameras-phones in everyone’s pockets, we’re much less in a position to stay naive concerning the world.

I want we had been discussing a crimson scorching economic system and the corresponding inventory market within the context of inflation and charges; as a substitute, this debate has advanced into an ongoing dialogue of the realignment of Western Liberal Democracies and the affect of the hostilities on costs of oil wheat nickel and rare-earth minerals, and the staggering human toll the conflict is inflicting.

I lengthy wistfully for the less complicated days of debating whether or not inflation is transitory or not . . .

Beforehand:

Exiting Russia (March 3, 2022)

Battle Impacts Shares Lower than You Suppose (March 2, 2022)

Historical past Exhibits Battle Shocks Have a Modest Affect on Equities (BusinessWeek, March 2, 2022)

MSCI: Russia’s Inventory Market is “Uninvestable” (February 28, 2022)

How Geopolitics Impacts Markets: 1941-2021 (February 25, 2022)

Which Issues Extra to Markets, Omicron or Ukraine? (February 22, 2022)

click on for audio