Photos By Tang Ming Tung/DigitalVision by way of Getty Photos

Over the past 40 years, Markel Company (NYSE:MKL) has persistently overwhelmed all main American indices and has a monitor report of producing excellent returns for shareholders. Markel has advanced from a basic insurance coverage firm to a diversified holding firm reminiscent of Berkshire Hathaway (BRK.A, BRK.B). Markel is an organization with quite a lot of potential, with high-growth divisions (Markel Ventures), with out debt, and buying and selling within the low valuation vary of latest years. The potential that Markel affords is big, since if it manages to make its line of insurance coverage extra worthwhile, it is going to be capable of make investments all that floating capital in rising at charges larger than these of the remainder of the businesses listed in the marketplace. I personally consider that Markel’s present valuation and low debt make it a really attention-grabbing alternative so as to add to a long-term oriented portfolio.

Firm Description

Markel Company is an insurance coverage & holding firm which operates in area of interest markets similar to specialty insurance coverage and, on the identical time, acquires enterprise and invests in fairness and debt markets utilizing the float supplied by the insurance coverage engine. Over the past years, Markel has grown its revenues at a charge of 12% every year, and its guide worth has elevated in the identical proportion during the last years. Markel buildings its enterprise on three segments, which they name ‘engines’. The three engines that transfer Markel ahead are: Insurance coverage, Markel Ventures and Investments.

Insurance coverage Engine

Markel’s insurance coverage enterprise is split into the next classes: underwriting, insurance-linked securities, and program providers. Although insurance coverage is a aggressive trade, Markel is a extra niche-focused firm which permits them to have larger revenue margins than different firms within the trade similar to Allstate (ALL) or Progressive (PGR). Competitors in insurance coverage area of interest markets is extra centered on different value-added traits similar to experience and providers supplied.

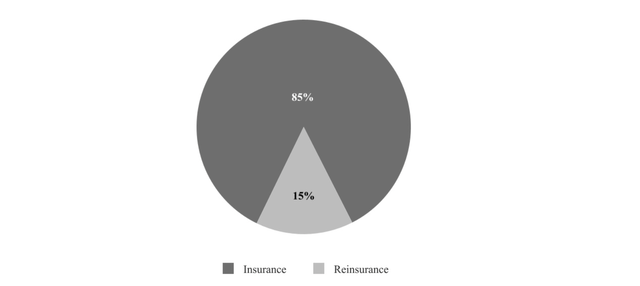

Markel divides its Insurance coverage enterprise into two classes: Insurance coverage and Reinsurance. In case you are fascinated with understanding what reinsurance means, you’ll be able to test it on this web site. The next chart exhibits the proportion of premiums collected by Markel by phase.

Insurance coverage and Reinsurance Premiums (sec.gov)

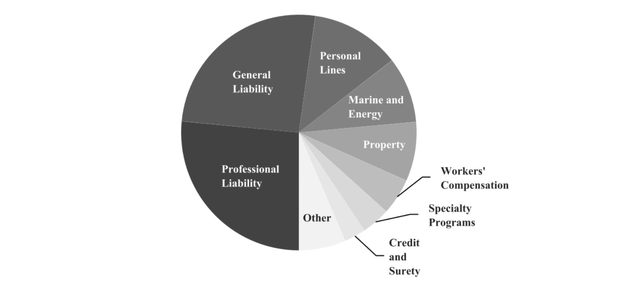

The Insurance coverage phase consists of a extremely diversified and low danger portfolio. Final 12 months it generated earned premiums of $5 billion and an underwriting revenue of $696 million. The policyholders belong to a special vary of classes similar to: Skilled Liabilities (contains extremely specialised professionals similar to accountants, legal professionals, engineers or brokers), Basic Liabilities (retail shops, heavy industrials…), Private Traces (basic vehicles, yachts, classic boats…), Marine and Power (features a portfolio of insurance coverage insurance policies for cargo, power or terrorist dangers) and extra enterprise traces that may be thought of safe investments. Certainly, the corporate has a really diversified insurance coverage portfolio (though extremely depending on skilled providers and normal providers). This makes Markel removed from conventional insurance coverage similar to: life insurance coverage, dwelling insurance coverage or automotive insurance coverage, which have the next chance of being claimed than different area of interest merchandise similar to luxurious autos or terrorist assaults.

Insurance coverage Traces provided by Markel (sec.gov)

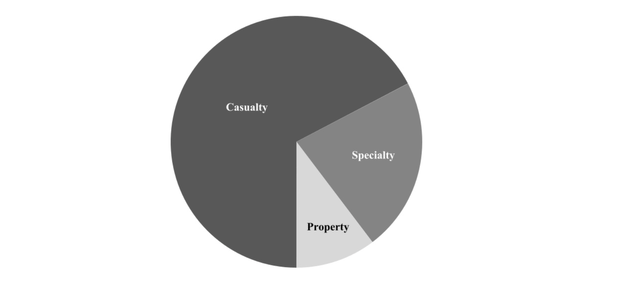

The Reinsurance Phase is made up of casualty, property and specialty and at present generates $1 billion in earned premiums and an underwriting lack of $55 million in 2021. Basically, one of these reinsurance is riskier and is made up of a much less area of interest vary of merchandise, which explains its damaging efficiency in 2021. Nevertheless, it represents a small a part of the premiums earned by Markel.

Reinsurance Phase Traces (sec.gov)

The financials of Markel’s Insurance coverage enterprise have been actually constructive during the last years. Gross premiums earned have grown at a tempo of 10% every year, and the mixed ratio, which is a measure of the profitability of their operations, is decrease than these of their friends, as a result of area of interest markets wherein they function.

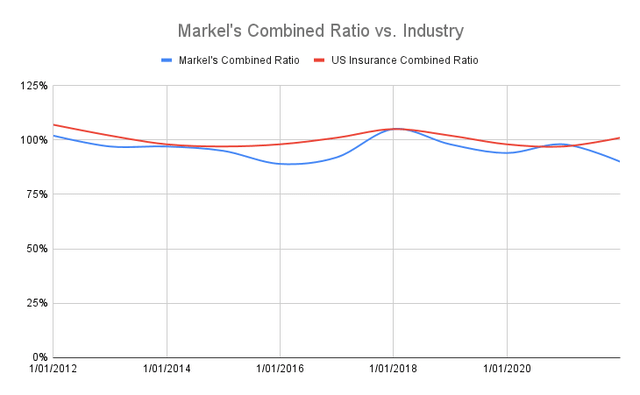

The evolution of Markel’s profitability within the Insurance coverage phase is measured by: the quantity of premiums the enterprise goes to earn much less the claimed premiums from policyholders and different losses or bills. The most effective metric that analyzes the efficiency of an insurance coverage firm in the long run is the mixed ratio, which is outlined because the quotient between bills + incurred losses and the premiums earned by the corporate. Naturally, the corporate will likely be worthwhile if and provided that the mixed ratio stays under 100%. The next chart exhibits the evolution of Markel’s mixed ratio during the last decade (2011-2021).

Markel’s Mixed Ratio vs. Trade (sec.gov and Personal Fashions)

Over the past decade, Markel’s common mixed ratio has been of 96%, while the trade’s common during the last decade has been of 101%. Certainly, Markel has remained worthwhile while different firms haven’t executed so within the final decade. Some years have been notably unhealthy for the trade (2017), when a collection of hurricanes produced a lot of damages in properties all around the American geography. It should be wired that the long run success of Markel’s Insurance coverage Division relies upon closely on:

- Growing the variety of premiums written: to realize this purpose, Markel will enhance the variety of acquisitions they are going to make and on the identical time they are going to broaden the attain of the worldwide operations they make. The target they’ve is to provide $10 billion inside the coming 5 years.

- Sustaining a decrease mixed ratio than the remainder of firms: Markel’s administration workforce can also be conscious of the significance of manufacturing underwriting income in an effort to produce float that may be invested in buying new companies and increasing the bottom of investable property they’ve. The purpose is to realize 90% common mixed ratio within the coming 5 years that, mixed with the $10 billion annual premiums purpose will yield $1 billion of underwriting income. They’re prepared to realize this by exposing themselves much less to pure catastrophes, which has elevated the mixed ratio of the agency greater than they’d anticipated.

Markel’s insurance coverage enterprise is vital to turning into a profitable firm within the coming years. If Markel is ready to enhance the float they generate, the corporate will be capable of make investments extra capital into Investments and Markel Ventures. This can enhance the working revenue of the corporate and its guide worth, resulting in worth technology for shareholders.

Markel Ventures Engine

Doubtless, that is Markel’s crown jewel. The philosophy behind Markel Ventures (MVs) is much like that of Berkshire. Investing in good enterprise with the float generated by the Insurance coverage Engine. At first, MVs was extra centered on buying smaller insurance coverage firms however now that years have come to cross, Markel is open to investing in lots of different companies which will match into their funding universe: good companies with the power to reinvest capital and which are leaders of their respective markets.

If one phrase has to explain the spirit of MVs it might be decentralization. The thought of giving autonomy to the administration groups of the enterprise absolutely acquired by Markel has additionally performed nicely at different firms similar to Berkshire Hathaway and Constellation Software program (OTCPK:CNSWF). Within the phrases of Mark Leonard, CEO and founding father of Constellation:

We proceed to consider that autonomy and duty appeal to and inspire one of the best managers and workers.

The administration groups that function the companies wholly owned work autonomously from Markel’s headquarters, and they’re those answerable for capital allocation choices and funding methods.

Markel seeks to accumulate companies which are worthwhile and Free Money Stream generative and with administration groups that may be relied upon. As well as, capital reinvestment can also be sought, in addition to affordable valuations to accumulate the enterprise. Although Thomas Gayner (co-CEO of Markel) is a follower of ‘high quality investing’, value is a determinant issue to be thought of when buying a enterprise.

MVs is now current in lots of financial sectors outdoors the area of interest market they function within the insurance coverage phase. The corporate needs to hunt diversification and enlargement into different financial sectors which will keep away from the cyclicality of the monetary trade, which is actually delicate to macroeconomic circumstances.

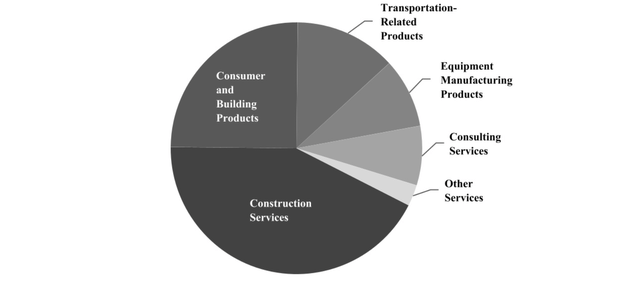

The next picture exhibits the completely different sources of working income of MVs primarily based on the completely different financial sectors they function in.

Markel Ventures Income Traces (sec.gov)

Although these enterprise could also be high-quality companies which are ready to withstand all form of unhealthy financial circumstances, Markel has an excessive amount of publicity to the housing phase, which represents greater than 50% of the income generated by MVs. In their very own phrases:

These companies might expertise income fluctuations over time as a result of cyclical nature of provide and demand within the building trade, which they assist.

However, Markel’s administration has additionally been clever and has expanded the MVs phase into new markets to keep away from the cyclicality produced by their publicity to the housing market. New acquisitions have been made in sectors similar to meals processing tools, consulting providers, healthcare firms and different diversified funding providers.

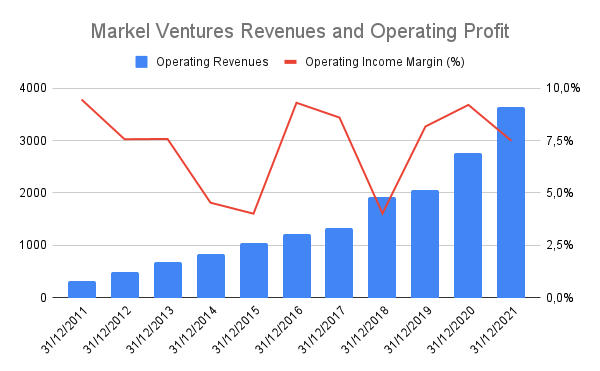

Over the past years, the monetary efficiency of MVs has been outstandingly good, as one can see within the monetary numbers they’ve been reporting 12 months after 12 months. Revenues have grown at a tempo of 25% as a result of many acquisitions made throughout this decade. As well as, this isn’t some enterprise capital experiment, as MVs produces working income with margins that oscillate between 5-9%. The next graph offers testimony of that.

Working Revenues of Markel Ventures (sec.gov, Personal Fashions)

Concerning the evolution of this division, I’ve two issues which will have an effect on the efficiency of this phase within the medium time period. Being so depending on the housing market, I consider the working revenue might come down within the coming years. Month-to-month mortgage funds have skyrocketed in america, and costs might go down as mortgage charges have escalated over 5%. These two elements, alongside with the excessive chance of coming into right into a recession, might influence negatively on MVs. Though this may increasingly look unhealthy within the quick time period, MVs will transfer ahead as a result of: excessive prospects of buying firms at low valuations, larger diversification and a long-term restoration of the US housing market.

Funding Engine

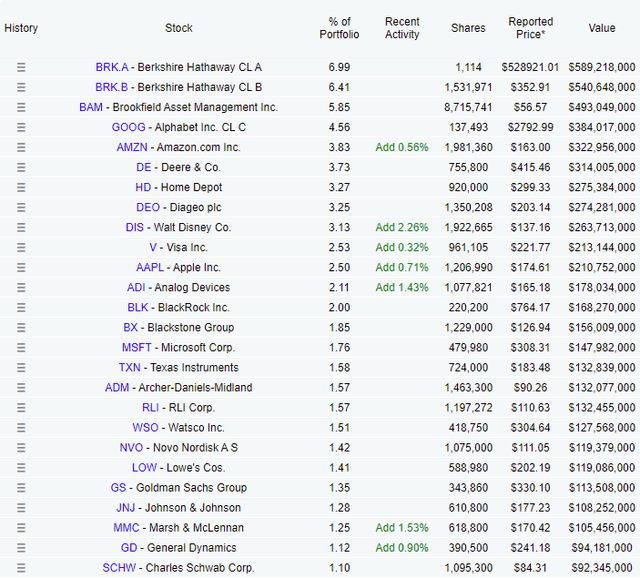

This different phase is considerably much like what Berkshire does when it invests in publicly traded firms similar to Apple (AAPL), Coca-Cola (KO) or American Specific (AXP), amongst others. Along with their fairness investments, Markel’s co-CEOs are conscious of the dangerous nature of Wall Road, and like to have a diversified portfolio that includes debt securities and different fastened revenue investments. Nearly all of the investable property that Markel at present has come primarily from premiums paid by policyholders.

Markel’s fundamental focus when investing in publicly traded firms is searching for worthwhile firms, with sincere and disciplined managements that exhibit capital self-discipline at affordable costs. The perfect holding interval is without end. Markel’s present portfolio of publicly traded firms could be discovered right here.

Markel’s Portfolio (Dataroma)

As well as, Markel’s portfolio is closely diversified (the largest holding is Berkshire Hathaway) and invested in firms that can produce excellent returns within the years to come back.

One other part of Markel’s Funding portfolio is fastened revenue securities and quick time period investments, which they consider to be essential in case they should pay again the claims made by policyholders. The overwhelming majority of premiums paid by policyholders are invested in high-quality authorities, municipal and company bonds which have the identical period of their loss reserves (cash wanted to pay again to coverage holders in case claims are made). This virtually ‘risk-free’ investments permits Markel to gather premiums (curiosity funds of the bonds they maintain) which are used to extend their loss reserves or to fund fairness investments. One other essential half that makes up Markel’s funding phase is money and quick time period investments, that could be wanted in conditions of monetary stress such because the 2008 monetary disaster or the 2020 COVID disaster.

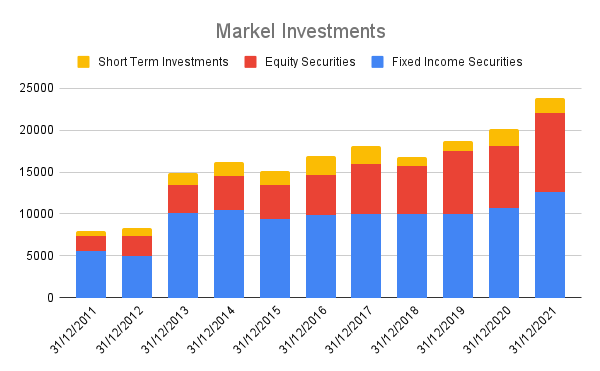

Evolution of Markel’s Investments (sec.gov and Personal Fashions)

This graph clearly exhibits that Markel’s funding portfolio has elevated all around the years, with a transparent desire for equities during the last years. At first of the last decade, equities weighted round 23% of Markel’s portfolio, while now they’ve a weight round 40%.

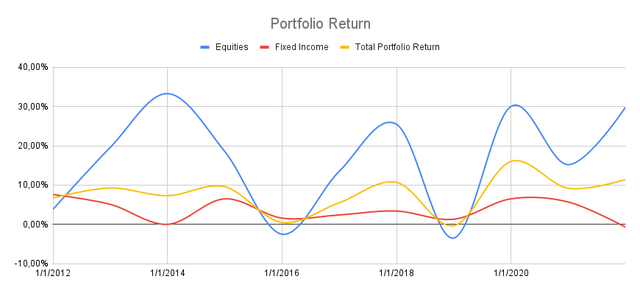

Portfolio Returns (sec.gov and Personal Fashions)

On common, Markel’s Equities have yielded on common a complete return every year of virtually 17% during the last decade, while the fairness portfolio has yielded a return round 3.5% in the identical interval. This two returns mixed yield a complete return every year of seven.8% during the last decade. I consider that returns will diminish over the approaching years, as a result of collapse skilled within the bond market and the present correction that we live within the American Markets. However, the portfolio will continue to grow at charges of round 6-7% within the coming years.

Administration Workforce

Markel is a implausible and excellent enterprise that performs nicely within the completely different segments wherein it operates. However this extraordinary efficiency is as a result of high quality of the administration that leads the corporate.

Thomas Gayner has been co-CEO of the corporate since 1998. He has an funding philosophy much like Buffett and Munger’s, specializing in firms that may deploy capital to compound worth over lengthy intervals of time. Although he’s cautious of excessive valuations, Gayner places extra emphasis on incentives and the skills of administration groups to reinvest income and thus enhance the worth of the shareholders. His distinctive strategy has made Markel appear to be a child Berkshire Hathaway, though the enterprise are a bit completely different. If Gayner continues main the corporate, I consider returns will likely be larger within the years to come back.

Markel – Valuation

Markel will not be a simple firm to worth as a result of its sophisticated holding construction and the completely different elements that make up the enterprise. It’s true that Markel is a diversified monetary holding firm with a major weight within the insurance coverage sector together with investments in fastened revenue and variable revenue. Nevertheless, the a part of Markel Ventures has an increasing number of weight within the holding firm and is troublesome to evaluate valuation utilizing a Worth/E-book Worth metric. That’s the reason, though the Worth/E-book Worth can be utilized as a primary approximation, I believe it’s handy to sum up the elements to accurately worth the corporate.

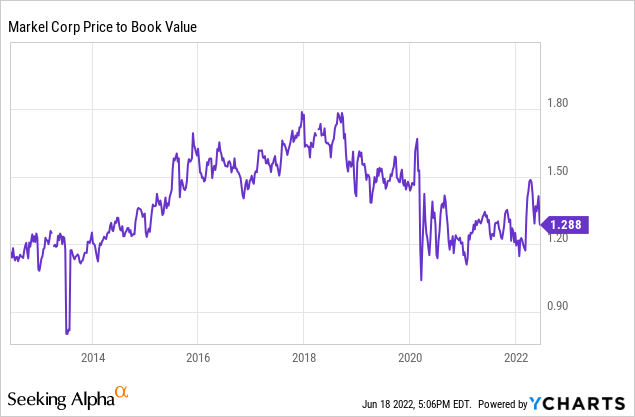

E-book Worth

If we have a look at the Worth/E-book Worth (P/BV) criterion, it may be verified that the P/BV ratio is within the decrease a part of the valuation of the final 10 years, and is at present buying and selling at ranges much like listed holding firms similar to Berkshire Hathaway. Utilizing an inexpensive valuation degree that corresponds to the typical of the final 10 years (1.5x), Markel’s worth may very well be round $1,500 per share, removed from the $1,200 at which it’s at present buying and selling.

Sum Of The Elements

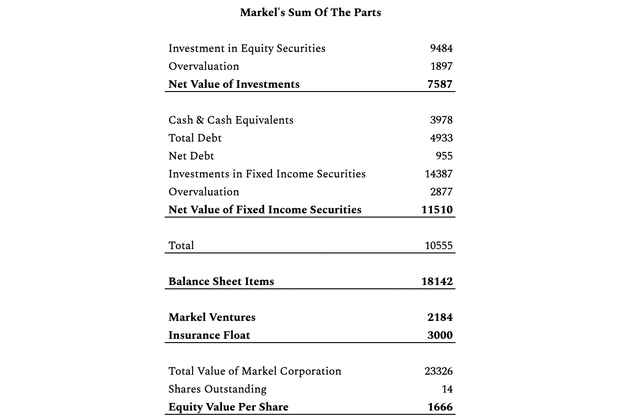

To accurately assess the difficulty of Markel’s valuation, I consider that the Sum Of The Elements technique (SOTP) should be carried out to get a quantity which will inform us what Markel is value. The next desk exhibits my very own estimates of Markel’s Honest Worth utilizing the SOTP technique.

Markel’s SOTP valuation (Personal Mannequin)

The sum-of-the-parts technique consists of independently valuing every of the companies wherein Markel operates: insurance coverage, Markel Ventures and Investments.

The worth of the investments (bearing in mind the overvaluation of the market) is round $7.5 billion, whereas the investments in fastened revenue (which have additionally misplaced worth all through this 12 months) add as much as an approximate worth of $11.5 billion. As a result of present state of affairs of market overvaluation (there’s a very deep correction in lots of indices, NASDAQ (COMP.IND) -30%, S&P 500 (SP500) -20%…), I’ve thought it applicable to normalize the worth of Markel’s investments by making use of a correction of the 20% to the worth of their investments in fastened revenue and listed equities. The overvaluation part within the SOTP Desk corresponds to the accounting extra valuation of investments on Markel’s stability sheet. Discounting the overvaluation from the worth of the property invested, a extra affordable worth is obtained for the investments that the corporate at present has.

Presently the worth of the investments is $19 billion, to which should be discounted the prevailing internet debt, which is round $1 billion. Thus, Markel’s internet investments are round $17 billion. Valuing Markel Ventures at a a number of of about 8x working revenue together with the worth of the float (which I estimate to be round $2-$3 billion), the full worth of the corporate is round $23 billion. Divided by the variety of shares excellent, this arrives at a Markel goal worth of $1,666 per share, giving a security margin from present costs of 30%.

Dangers

Clearly, Markel is on no account a ‘risk-free’ asset. Investing in Markel carries a collection of related dangers that I checklist under:

- Existence of catastrophic occasions: Though Markel has decreased the danger of its portfolio to keep away from issues associated to catastrophic occasions, it’s true that they will proceed to happen. Therefore the significance of Markel shifting in the direction of extra area of interest and specialty insurance coverage markets.

- Exceptional enhance within the mixed ratio: this can be very essential that every one long-term traders in Markel monitor this metric, since it is going to be the one which ensures the profitability of the enterprise and the one which ensures the existence of free float to be reinvested in Markel Ventures and in listed equities.

- Extreme presence of Markel Ventures in the true property sector: I personally consider that Markel ought to focus extra on diversifying the enterprise portfolio as a result of its extreme dependence on the true property sector. This may occasionally expose the corporate to an excessive amount of cyclicality and its income may very well be decreased within the occasion of a extreme actual property disaster within the US.

Conclusion

I consider that Markel is a rare enterprise that may proceed to supply returns above the market common as a result of high quality of its property and the extremely diversified portfolio that it has. Markel is an organization that also has the capability to proceed rising its guide worth at charges higher than 10%, therefore its long-term efficiency on the inventory market will likely be larger than these numbers. As well as, the administration is excellent and can proceed to provide constructive returns for shareholder within the years to come back. I consider that if Markel stays for an extended time period in our portfolios, it should certainly turn into a really worthwhile funding.