The housing market noticed vital “softening” in February, with stock rising, demand shrinking, and patrons regaining extra management whereas sellers discover themselves in a tricky place. Why is that this occurring now, particularly as mortgage charges proceed to dip? With recession fears and financial tensions operating excessive, People fear what’s coming subsequent, inflicting a lot of the financial system to shift. With value declines already occurring in some markets and extra doubtlessly on the horizon, when is the appropriate time to purchase?

We’re again with a March 2025 housing market replace, going over what’s occurring within the nationwide housing market, which states are seeing the most popular (and coldest) housing demand, what’s occurring with mortgage rates of interest, and why the market is noticeably softening.

However the actual query stays: How can YOU proceed constructing wealth whereas others concern the worst? Is that this your “be grasping when others are fearful” second? Dave is giving his take and sharing how he’s tailoring his personal investing technique in 2025.

Discover investor-friendly tax and monetary specialists with BiggerPockets Tax & Monetary Providers Finder!

Click on right here to hear on Apple Podcasts.

Hearken to the Podcast Right here

Learn the Transcript Right here

Dave:

Your actual property shopping for window is open. Effectively, possibly that’s proper. The housing market is softening after a number of years of supreme vendor energy. Potential value declines is usually a boon for actual property traders seeking to negotiate, however additionally they create threat when you purchase on the mistaken second. So which means is the housing market heading and how are you going to take most benefit in your individual portfolio? In the present day I’m supplying you with my March, 2025 housing market replace. Hey everybody, it’s Dave head of Actual Property investing at BiggerPockets, and if you realize me, I consider being a profitable investor is about studying and constantly bettering in your expertise. Issues like deal discovering, tenant screening, managing rehabs, all that stuff is tremendous essential. However you additionally want to know the broad tendencies which might be occurring within the housing market to be able to optimize your portfolio to seek out one of the best offers and to keep away from any pointless ranges of threat.

For that reason, I like to offer a abstract of what’s going on within the housing market and I additionally like to offer my private evaluation and skim on the state of affairs. I’ll even let you know what I’m eager about and doing with my very own portfolio. That is for March, 2025. So tendencies could also be completely different when you’re watching this just a little bit additional into the long run. Now I need to simply say that I’ve been analyzing the housing marketplace for a really very long time. I’ve been an investor for 15 years. I’ve been working at BiggerPockets for 9 and proper now issues are altering just about as shortly as they ever have and that makes it extra essential than ever to know what’s occurring on your personal portfolio and reaching your monetary targets. Alright, so let’s speak about this softening market and what it really appears like within the numbers and naturally what it means to you.

Now when you have a look at sure web sites like Redfin, you’ll see that residence costs are up 4% 12 months over 12 months in accordance with what information they’ve collected and once they seasonally regulate it. While you have a look at among the different information sources, there’s a supply referred to as the Case Schiller Index and that makes use of a special methodology the place it principally tracks how the worth of the identical residence change over time. And what you see once you have a look at the case Schiller is it’s a lot nearer to flat. And so we’re most likely in someplace in between these two. There’s no excellent measure, however we’re most likely flat-ish housing costs possibly up just a little bit relying on what market that you simply’re taking a look at. So that’s on no account any kind of correction or crash at this level. It’s additionally not likely thrilling information by way of appreciation, however I believe the essential factor right here is that the development is simply actually flat or just a little bit down.

We’re not likely seeing appreciation or value progress begin to speed up once more. And so that is simply one of many causes I’m saying that the market’s flat. Now to know if this development goes to proceed or if we’re going to see the market reverse in some kind of means, we to dig in just a little bit deeper, go one degree decrease to attempt to perceive why the market is considerably flat. And I at all times speak about this, however we have now to do it. We bought to speak about provide and demand. That’s what dictates costs within the housing market. And so we have to see what’s occurring with provide, which is simply what number of houses are on the market at any given level or how many individuals are itemizing their houses. And we bought to have a look at demand. How many individuals need to purchase houses? Let’s begin with the provision aspect.

There’s actually good information about this. It’s just a little bit simpler. So we’re going to speak first about one thing referred to as new listings. This can be a measurement of how many individuals put their properties up on the market in any given month, and that’s up 12 months over 12 months. It’s up 6% in accordance with Redfin, which is nice in some methods, nevertheless it’s not loopy, proper? Now we have seen actually low stock and to return to a more healthy housing market, there must be extra properties listed on the market. And so having that go up, at the least within the brief time period is mostly seen as an excellent factor, however you need to look not at simply how many individuals are itemizing their properties on the market. You even have to have a look at how lengthy these properties are staying available on the market as a result of in the event that they’re getting listed and going shortly, then costs can preserve going up.

But when extra issues are getting listed this 12 months than final 12 months and so they’re simply sitting there and not likely promoting, then costs are most likely going to go flat or go down as a result of as property house owners who need to promote their property are seeing their properties simply sit there available on the market week after week or month after month, they decrease their value or they’re prepared to supply concessions. And that’s what finally pushes costs down. And what’s occurring proper now could be that energetic listings are up 10% 12 months over 12 months. And once more, that’s not loopy as a result of we have now to have a look at the historic context right here. So that you may know this, however again in 2019, energetic listings had been averaging someplace round 2.3, 2.4 million. Then throughout the pandemic they went all the way down to 1.6. We really bottomed out at 1.1 million and though they’re going again up proper now, they’re nonetheless at 1.5 million, they’ll most likely go up over the summer season and get someplace near 1.9 million.

So that they’re going up, however they’re nonetheless not at pre pandemic ranges. And that’s one of many most important issues as we speak concerning the housing market that that you must keep in mind is once we evaluate what’s occurring now to what was occurring throughout the pandemic, it’s not one of the best comparability truthfully, as a result of what occurred throughout the pandemic was simply so uncommon. So to say, oh my god, stock has gone up in comparison with the pandemic. After all it did as a result of it was like in any respect time lows. I personally like to have a look at that also, however in comparison with 2019, and so we’re seeing issues come again nearer to pre pandemic ranges, however we’re not there but. And so that is the rationale why I’m saying that the market is softening. It’s again to the place it was. I might even say it’s simply kind of a normalization of the market, however as a result of we’ve gotten used to this tremendous heated market that’s very tight, there aren’t numerous issues available on the market, there are nonetheless numerous demand.

And so issues are shifting actually shortly. That’s why I’m saying it’s softening as a result of we’re simply shifting again to a extra balanced housing market. So that you positively see that within the energetic listings numbers. You see that in another information you could have a look at for this stuff like days on market, these are going again up or months of provide. These are simply different methods to measure the housing market. We don’t must get into them as we speak, however what you must most likely know is that all the measures of housing market well being are simply saying that we’re getting nearer again to pre pandemic ranges of the stability between provide and demand. Now in fact, what I’ve been speaking about to this point is concerning the nationwide housing market, however there are large regional variations. We’re really seeing numerous indicators that the market is sort of splitting. Some markets are rising in a single route, others are going within the different route. So we’re going to interrupt down these regional variations in only a minute. However first we have now to take a fast break. And this week’s larger information is delivered to you by the Fundrise Flagship Fund, put money into non-public market actual property with the Fundrise Flagship fund. Try fundrise.com/pockets to be taught extra.

Welcome again to the BiggerPockets podcast. We’re right here doing our March housing market replace. Earlier than the break, we talked about how numerous the information means that the nationwide housing market is shifting to a extra balanced market, a extra purchaser’s market, however that’s not occurring all over the place within the nation. So let’s simply take a minute right here and speak about how stock modifications are completely different in numerous areas of the nation. First issues first, what that you must know is that each single state within the nation is experiencing will increase in stock besides North Dakota. North Dakota is down 2%, all over the place else is up. That is simply 12 months over 12 months since 2024 in February to 2025 in February. And once more, I’m recording this in early March. So the final month that we have now information for is February. The state that has the best shift in stock over the past 12 months is Nevada.

We see California at 44%, Arizona at 41%. Vermont is up there, Hawaii is close to 50%. In order that’s occurring all over the place the place if you wish to know regionally the place issues are occurring within the least, it’s largely within the northeast and the Midwest. So I stated North Dakota, that’s sort of an outlier, however New York for instance, solely up 3%. New jersey’s 9%, Illinois is 9%. So it’s kind of a continuation of the tendencies the place the most popular or the strongest housing markets, I ought to say are within the Midwest and the Northeast. A few of the weaker ones are within the mountain west and west coast and the southeast as effectively. Georgia’s up 37%, Florida’s up 34%. That’s simply at a state degree. However given what I used to be saying earlier than concerning the utility and usefulness of evaluating information from this previous 12 months to the 12 months prior, it’s useful. We have to comprehend it as a result of that you must know the way the market’s altering.

However I additionally like to offer this context of how issues have modified since earlier than the pandemic as a result of that can actually give us some clues about the place costs are heading in any given market. And once you have a look at the information this manner, it is rather, very completely different. Keep in mind I simply stated that all the things’s going up 12 months over 12 months as a result of it was tremendous low. However once we have a look at how February, 2025 compares to February, 2019, it’s a fairly completely different story. Now we have sure markets the place we’re nonetheless nowhere even near the degrees of stock that we had been at in 2019. After I have a look at a state like Pennsylvania, it’s down 50%, nonetheless over 2019. Maine is down 61%. New Hampshire, 61%, Illinois, 63%, virtually all of it’s concentrated within the Northeast and the Midwest. So Wisconsin, Michigan, Virginia, all of those states are actually down. Truly Alaska’s down too.

That’s sort of the one one which’s on the market aside from North Dakota. Once more, these are kind of probably the most considerably down, however even all through the remainder of the nation, most states are nonetheless down in comparison with pre pandemic ranges. If we have a look at the Carolinas, California, Nevada, Washington, Oregon, all of them are nonetheless down. So that’s kind of the massive image factor that you must take into account is that though stock is returning, most states are nonetheless down in comparison with pre pandemic. So that they’re nonetheless not again to what could be thought-about a standard market. There are 4 states, nevertheless which might be above pre pandemic ranges. The primary with probably the most stock progress above pre pandemic ranges is Texas. It’s 15% above the place it was in 2019. Then comes Florida with 9% above Colorado at 7%, and Tennessee really with 2% as effectively. So once more, the regional variations actually matter, and I’m speaking about states.

I can’t get into each particular person metro space on the podcast, it’s simply an excessive amount of to do. However what my advice for all of you is to have a look at these two issues on your particular person market as a result of even inside Texas which has rising stock, there are particular markets and there are particular neighborhoods the place stock continues to be down. Or when you have a look at Pennsylvania, which has 50% declines in stock, I’m positive there are nonetheless neighborhoods in areas the place stock is rising. So I actually suggest you have a look at two issues in your market. Go and evaluate stock ranges proper now in February of 2025 to the place it was final 12 months, see how a lot that’s rising after which evaluate it to 2019 and also you’ll get a way of how shortly the market is shifting from that actually robust sellers market. That was sort of common for years again to what could be a extra regular kind of stability sort of market.

So what does this all imply? The stuff I stated and the analysis you must most likely be doing by yourself as effectively. Any market the place stock goes up quickly has the largest possibilities of value progress slowing. And in some markets that imply it would go from 10% appreciation to five% appreciation. In some markets which may imply six to 2. Some markets it would imply going from flat to unfavorable. And so it actually relies on the size of the stock modifications and what’s occurring in your specific market. However as a complete, simply going again, zooming again out to the nationwide degree, I do suppose that given stock is rising and demand hasn’t picked again up, at the least within the final couple of months, we’re going to see additional softening. And that is a type of explanation why I’ve stated repeatedly that I do suppose costs will probably be possibly modestly up this 12 months or someplace close to flat, particularly once you evaluate these issues to inflation, they is perhaps just a little bit unfavorable primarily based on the information that we’re seeing right here as we speak.

Now once more, that’s not going to occur in each market and what which means for actual property traders is just not as apparent as you suppose. Declining costs aren’t essentially a foul factor. Lots of people, I’d say possibly even most traders suppose that’s really an excellent factor. So we’ll speak extra about what a softening market means, however we kind of have to deal with one different huge factor earlier than we get into what you must do subsequent, which is in fact mortgage charges. Mortgage charges have been within the information so much and as of this recording, they’ve dropped down to six.64% for a 30 12 months repair, which is down almost 0.6% from the place they had been. That they had shot up all the best way to 7.25%. They’ve come down so much and that’s usually excellent news for actual property traders. However in fact the rationale that is occurring is as a result of there’s dangerous financial information.

So we have now to dig into this just a little bit and kind of unpack what’s occurring and what this implies. So why have charges fallen a lot over the past couple of weeks? We’ve talked about this in different episodes, you possibly can go hear about it in additional element, however we’ve seen a bunch of sentimental financial information. The very first thing was we had low client sentiment. We really had the largest month over month drop in 4 years. It’s not like that is going loopy, it’s decrease than it was over the previous few months, nevertheless it’s just about in step with the place it’s been from 2022 to 2025. However after the election, client confidence had been rising and that has reversed itself over the past couple of weeks, and that decline in client confidence worries traders. And so we’ve seen some weak point within the gentle market. I’ll get to that in a second.

The opposite factor that we’ve seen is an uptick in unemployment claims. There are many methods to measure unemployment. That is one I wish to measure as a result of it principally appears on the variety of layoffs. And so we’ve seen layoffs begin to tick up. Once more, nothing loopy, however these are simply small issues that begin to spook the market, proper? And what we’re speaking about once we speak about mortgage charges is actually how bond traders and inventory traders are reacting to all this information. And proper now, given the extent of uncertainty on the earth, given the extent of uncertainty within the markets, individuals are very delicate. They’re reacting fairly dramatically forwards and backwards to all of the information that they’re getting. And so little modifications in unemployment claims, little modifications in client sentiment are most likely impacting markets greater than they’d if this was 10 years in the past in the course of only a regular financial cycle.

So that’s two issues which might be occurring. And so there’s really one factor that has occurred over the past simply two weeks that I believe has additional spooked traders, not tariffs. These are kind of apparent. That’s positively one thing that’s been weighing on folks’s thoughts. However one thing that I believe bought misplaced within the shuffle over the previous few weeks is that there’s this instrument referred to as the GDP Now instrument. It’s put out by the Atlanta Fed, and it principally predicts the place gross home product goes to go for the present quarter that we’re in. Should you don’t know what GDP is gross home product, it’s principally the whole measurement of financial output and it’s tremendous essential, proper? If the financial system is rising, that’s usually an excellent factor for america. If the financial system contracts, which means folks’s high quality of life spending energy is mostly happening.

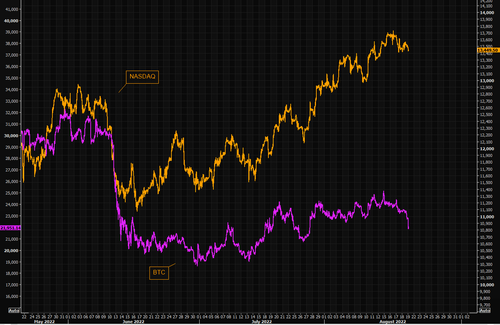

And anyway, what occurred was the Atlanta Fed instrument, which has confirmed to be very correct traditionally, has modified its prediction. Simply two weeks in the past it was predicting 2% progress for GDP, which isn’t nice. It’s not like a tremendous quarter, nevertheless it’s not dangerous. It’s sort of similar to a standard sort of quarter. It principally plummeted and the estimate now went to about unfavorable 2.5% and has held there for 3 consecutive weeks. And so now they’re predicting that GDP is definitely going to say no right here within the first quarter of 2025, and that’s tremendous vital for all the explanations that I simply talked about. So between softer client sentiment and uptick in unemployment claims, softer GDP projections, uncertainty round tariffs, this has simply principally spooked traders and it has led to a big inventory market selloff. We’ve seen the NASDAQ was down 10% at sure factors, which is correction territory.

That’s a big decline. We’re principally seeing your entire enhance within the inventory market that we noticed after the Trump election erased we’re again to principally the place we had been earlier than the election. And what occurs for actual property traders for mortgages is when folks unload their inventory market, sometimes what they do is that they take their cash and so they put it in bonds. And I’m not speaking about me. If I offered off a few of my inventory, I most likely wouldn’t go do that, however we’re speaking concerning the huge cash movers. Individuals who handle pension plans or hedge funds, they should put that cash someplace. And so once they take it out of inventory market, they sometimes put it into bonds as a result of they’re seen as protected once they’re spooked about what’s occurring within the inventory market or the financial system as a complete, they take the cash, they put it in bonds, and that will increase demand for bonds as a result of everybody desires them.

And that pushes down yields, proper? If lots of people need to lend cash to the federal government, the federal government can borrow that cash at a decrease rates of interest. That’s yields coming down. And since yields and mortgage charges are virtually completely correlated, that can take mortgage charges down with them. And so that’s the reason mortgage charges have come down. After all, nobody is aware of for positive what’s going to occur, however I’ll offer you at the least my opinion and what I’m eager about and doing with my very own portfolio. However first, we have now to take a fast break. We’ll be proper again. Should you’re wanting to get began in actual property investing, a sensible first step is to accomplice with an investor pleasant monetary planner who might help you get your home so as and make sure you’re arrange for monetary success from the get go to biggerpockets.com/tax finder to get matched with a tax skilled or monetary planner in your space.

Welcome again to the BiggerPockets podcast. We’re right here doing our March housing market replace and the place we left off, I used to be going to attempt to make sense of this entire state of affairs and share with you what I believe this all means. Now, all the information, all the things that I’ve shared with you, the long run and route of the housing market to me is admittedly about financial sentiment. And that principally simply sucks as a result of it’s arduous to foretell, proper? I’m sorry, however I do know different influencers, creators, they’re going to let you know definitively what’s going to occur, however they’re deceptive. I’m an analyst and the one factor I can let you know with certainty is that proper now issues are significantly unsure and that’s crucial factor to recollect. It’s okay on your investing thesis or speculation to be that it’s unsure. It’s higher to confess that than to behave on a false interpretation or false certainty since you don’t actually know.

However right here’s how I’m personally seeing this. It appears to me that financial pessimism is gaining steam and other people could have completely different opinions about what’s going to occur sooner or later. I’m taking a look at information, I’m taking a look at tendencies, and that is what the information reveals. It reveals that investor confidence is down, the inventory market is popping, the housing market is beginning to soften, and does that imply we’re going to a recession? I don’t know. I believe it’s far too early to say that the GDP now factor is only one estimate, however I’m simply telling you that the change from the place we had been in January to the place the information was in February is fairly vital. There was numerous financial optimism in December and January that has shifted in February and it would shift again, however proper now it does really feel like financial pessimism is gaining steam.

And for me, there are a pair issues to remove from this. The very first thing that has been coming to my thoughts just lately is that if we enter in a recession, and once more, that may be a huge if, however one thing I’ve been eager about is might this form as much as be what’s type a traditional financial cycle the place actual property is the quote first in first out, when you haven’t heard of this, there’s this sample that has existed in numerous recessions prior to now the place issues are going off nice, we’re in an enlargement, companies are booming, the inventory market’s going up, all the things is nice, individuals are taking out debt. At a sure level, the financial system begins to overheat and that results in inflation. At that time, the Federal Reserve raises rates of interest, proper? Sound acquainted? That is what’s been occurring. And when the Federal Reserve raises rates of interest, it impacts actual property first.

And I’m not saying this simply because it is a actual property podcast, however actual property is simply principally probably the most leveraged asset class. And really as we’ve seen over the past a number of a long time, it’s turn out to be actually kind of by itself in how leveraged it’s, which principally means it makes use of probably the most debt. And positive folks take out debt to finance buildings and manufacturing and expansions for companies, however actual property is admittedly extremely leveraged. And so that you see actual property bear the brunt of a recession really at first else. And when you’re on this business, you’ve been most likely saying this and screaming that we’re in an actual property recession for the final two or three years, transaction quantity has been down, costs have been largely flat, proper? We’ve kind of been in an actual property recession for some time. However what’s been wonderful is that different elements of the American financial system has remained resilient regardless of these larger rates of interest.

And for one purpose or one other, possibly that resilience is cracking proper now and it’s reverting again to what we might’ve anticipated that the remainder of the financial system is beginning to really feel among the ache of upper rates of interest. In order that’s kind of the traditional begin of a recession, proper? Actual property comes first after which the remainder of the financial system comes second. However then what occurs when the remainder of the financial system begins to decelerate? Effectively, the Federal Reserve desires to stimulate the financial system. They’re now not as afraid of inflation, so that they decrease rates of interest, and that provides a stimulus first to actual property, proper? As a result of it’s a leveraged asset class. In order these charges begin to come down, it kickstarts financial exercise, significantly in the actual property part, and that may really assist lead your entire financial system out of a recession. And actual property is large enough.

It’s a large enough a part of our financial system to each assist deliver the financial system right into a recession. And out of it, it’s estimated to be about 16% of GDP. That’s large for anyone business. Now, when you’re considering that’s not what occurred in 2008, that’s positively true. It’s kind of the exception to this sample, and we don’t know what’s going to occur. However the perception amongst most economists is it didn’t occur in 2008 as a result of in contrast to this present time in 2008, housing was the issue. That’s what created the recession within the first place. Whereas proper now, housing is just not the issue. Housing, numerous the basics are essentially sound. What’s occurring with housing is mostly a response to rates of interest. And so what I see rising is doubtlessly this primary in first out state of affairs. That’s most likely what I believe is the probably state of affairs as we’re taking a look at it as we speak.

I believe there are two different issues which might be attainable that I’ll simply point out, however I believe they’re much less doubtless. So the second factor that may occur is possibly that is only a blip in financial information and there’s really going to be robust progress and other people regain their confidence, through which case we’ll most likely see mortgage charges return up just a little bit. I don’t know in the event that they’re going to return as much as 7.25, however they’ll most likely return up once more. Wherein case, I believe the housing market will proceed on its present softening trajectory. Once more, I don’t suppose which means a crash. It most likely means corrections in sure markets the place different markets are going to continue to grow. However I believe we’ll proceed on the development that we’ve been on for the final couple of months. So that may be a second chance. It’s not that unlikely, it simply doesn’t seem to be the probably state of affairs.

After which the third one, I don’t suppose that is so doubtless proper now, however really once you have a look at among the information, there’s a little little bit of threat proper now of what’s often known as stagflation. And once more, I don’t suppose that is what’s occurring simply but, however I simply need to name it out as a result of it’s attainable. Stagflation is when the financial system slows down, however inflation goes up. That is principally the worst case state of affairs for the financial system, however we have now seen inflation go up just a little bit then it’s kind of flat, so it’s not tremendous regarding simply but. However there’s a world the place inflation goes again up on account of tariffs. And the GDP now instrument is right and GDP declines, through which case we might have a extremely tough financial state of affairs the place the financial system is contracting, however inflation goes up, and that’s principally the worst case state of affairs.

Spending energy goes down, however wages aren’t going up, the inventory market goes down. And so though that’s attainable, I wouldn’t fear about that simply but. It’s simply one thing that I wished to say that we’ll control within the subsequent couple of months. In order we do these updates each single month, I’ll replace you and allow you to know if that’s a priority. There may be some information tendencies that recommend it’s attainable, however I believe we’re nonetheless a far means off from concluding that that’s occurring. So let’s simply return to what I believe is the probably state of affairs, which is sort of this primary in first out state of affairs with actual property. Does that imply that it’s doubtlessly an excellent time to purchase actual property, proper? As a result of don’t get me mistaken, when markets are softening like they’re, that comes with threat.

There may be additional threat that costs are going to say no. And I’ve stated it earlier than, however there’s numerous rubbish on the market. There’s numerous dangerous offers, overpriced stuff on the market, and issues might worsen earlier than they get higher. However there’s additionally a case that in at the least some and possibly many regional markets {that a} shopping for window could emerge. Take into consideration the circumstances that we’d have over the subsequent couple of months. Extra stock coming available on the market results in value softness, which supplies you negotiating leverage, proper? As a result of if you realize that costs are gentle and so they is perhaps declining extra, that’s one thing that you ought to be utilizing in your bid technique. And once you’re providing on properties, attempt to purchase under asking value or what you suppose the market may backside out at. So that provides you negotiating leverage. Keep in mind I stated softening it sounds scary, however that really means we’re in a purchaser’s market.

Patrons have the ability. In order that’s one good factor you may not need to purchase even in a purchaser’s market, when you suppose that that purchaser’ss market’s going to proceed for a very long time and we’re going to have this kind of protracted interval of costs happening. However keep in mind that costs have been largely flat or rising modestly over simply the final couple of years. And so we’ve seen this for some time. And if the present financial temper is right and that we’re going to see a contracting financial system, that signifies that charges may keep as little as they’re now and so they might go down just a little bit extra. And if that state of affairs occurs, that might deliver demand again into the housing market. Individuals typically suppose that if the financial system is doing poorly and there’s a recession that causes decrease housing demand, however that’s not at all times the case.

Housing demand is sort of at all times tied to affordability. And so sure, when you don’t have a job, you’re not going to be going on the market and shopping for a house. However for individuals who really feel safe of their jobs, this may really result in higher housing affordability. If the market softens and charges go down, which means extra individuals are going to have the ability to afford extra houses. That drives up demand and will really reignite value appreciation within the housing market. That’s not what occurred in 2008, keep in mind, that’s an outlier. However that is what typically occurs. So it’s one thing I’ll be holding an in depth eye out for, and I like to recommend you do too. Personally, I’ve been on the lookout for offers. I’m at all times on the lookout for offers. I haven’t discovered something to this point but this 12 months. I’ve supplied on some, haven’t been in a position to make it work, however I’m possibly unusually optimistic concerning the potential for deal move over the subsequent couple of months and within the second half of this 12 months.

I believe that proper now, we’ve been speaking so much this 12 months about this potential for upside. And whereas there’s threat, don’t get me mistaken, there’s threat in these sorts of markets. That upside is there and may even really be rising all through 2025 as a result of if charges do come down and you’ve got the chance to barter higher costs on homes, that might set the stage for actually good upside and future progress. In order that’s how I’m seeing it. I might love when you’re watching this on YouTube to tell us how you might be decoding this housing market and what choices you make about your individual portfolio. Thanks all a lot for listening to this episode of the BiggerPockets podcast. I hope this housing market replace was helpful to you. We’ll see you subsequent time.

Watch the Episode Right here

Assist Us Out!

Assist us attain new listeners on iTunes by leaving us a ranking and evaluation! It takes simply 30 seconds and directions could be discovered right here. Thanks! We actually admire it!

In This Episode We Cowl:

- Why the housing market is beginning to noticeably “soften” in 2025

- Hottest/coldest housing markets in america with probably the most/least stock

- Are value declines coming? Whether or not we’ll finish this 12 months with unfavorable value progress

- Why mortgage charges are dropping, however housing demand isn’t rising

- Why actual property might be the “First In, First Out” funding of 2025’s wild financial system

- Whether or not or not now could be the time to purchase and what might trigger a reversal of those worrying tendencies

- And So A lot Extra!

Hyperlinks from the Present

Focused on studying extra about as we speak’s sponsors or changing into a BiggerPockets accomplice your self? E mail [email protected].