zorazhuang

History of Marathon Petroleum

Marathon Petroleum (NYSE:MPC) was started in 1887 with the combining of several smaller oil companies in the Lima, Ohio region. When the company combined, the new company was called the Ohio Oil Company and was founded in Lima, Ohio. The Lima Oil deposit had just become the most productive oil deposit in the United States as of 1886. The Lima Oil was thick and sulfurous which limited its usefulness, but thanks to advances in chemistry by Herman Frasch, the oil became much more usable and Lima became the largest oilfield in the world just a year later in 1887.

By 1888, Standard Oil already controlled most of the Lima Oil Field and was the primary company that transported oil from the Lima Oil Fields to Chicago and other cities. In 1889, like it did with so many companies, Standard Oil purchased The Ohio Oil Company and moved the company’s headquarters to Findlay, Ohio.

Fast forward to 1911, when the Standard Oil Company was broken up thanks to the anti-trust laws at the time. The separation finalized in 1913 and The Ohio Oil Company was once again an independent company.

In 1930, The Ohio Oil Company acquired the Transcontinental Oil Company which had a brand name called Marathon with a slogan that stated, “The best in the long run.” The 1940s and 1950s was a very innovative time period for oil and gas companies and The Ohio Oil Company was one of the leading companies in innovation and then in 1962, the company officially changed its name to the Marathon Oil Company.

Up until 2011, the Marathon Petroleum Company operated upstream assets as well as downstream assets. However, in 2011, the company chose to spin off its upstream assets into a separate company called the Marathon Oil (MRO) and became named the Marathon Petroleum Company. Therefore, Marathon Petroleum Company only consists of downstream assets such as refineries and pipelines, today.

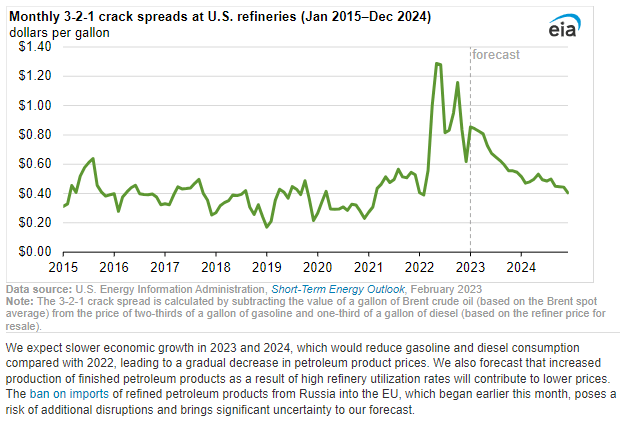

Refining Industry Outlook – Crack Spreads

The outlook for the refining business remains very strong through 2023. In 2022, the business experienced some of the highest crack spreads in recent history. You can see below that the spreads jumped over $1.20 when historically, they hover around $.40.

The EIA, for what it is worth, forecasts that crack spreads will normalize once again over the coming years. Their forecast for after 2023 is shown after the gray dotted line. Will this happen? I would be skeptical if this can return to what it was prior to the pandemic but time will tell.

Crack Spreads Historical and Forecast (EIA)

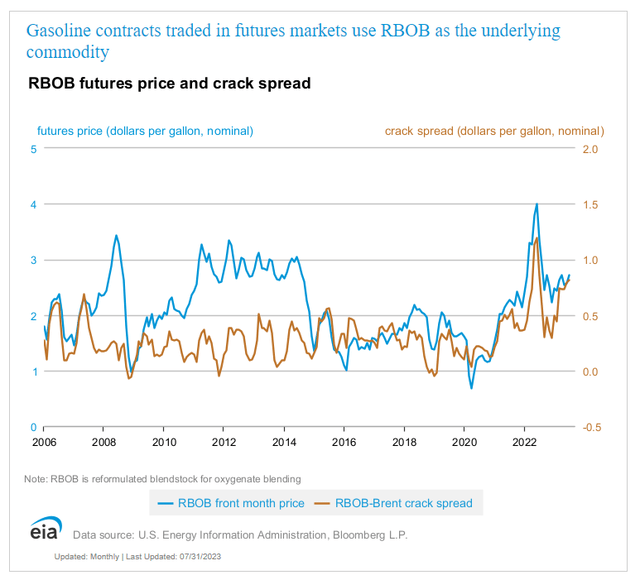

Here is what crack spreads have actually done throughout 2022. Throughout 2023, crack spreads have remained elevated in the range of $.80 per gallon.

Crack Spreads and Futures Price (EIA)

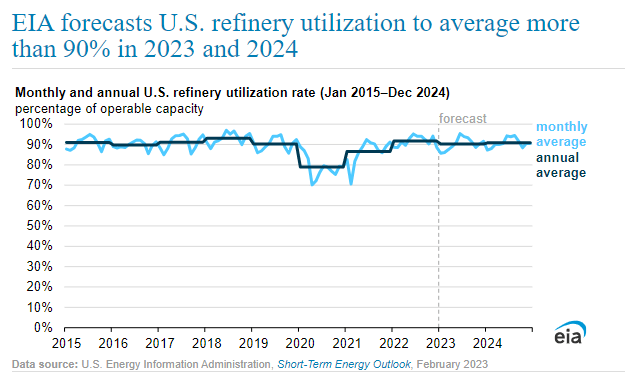

The EIA forecasts that refinery utilization will remain in the 90 percent range in the future, just as it has in the past. In other words, the industry is operating at full capacity and there isn’t going to be any meaningful new refining capacity coming online any time soon. In 2022, Biden approved a large export terminal for the Gulf Coast, but it doesn’t appear there is new refining capacity, only the ability to export oil.

The last, large scale refinery to come online was in 1977 and was the Marathon refinery in Garyville, Louisiana. It came online with 200,000 barrels of capacity and has around 600,000 barrels per day of capacity today. Since then, no new refineries have opened that produce greater than 50,000 barrels per day. New refining capacity does not appear to be a threat to Marathon’s business.

US Refinery Utilization Rates (EIA)

Marathon Petroleum’s Outlook

Marathon’s business remains strong. I would say the industry and Marathon are well-positioned for the future. Given the regulatory environment that is engulfing the oil and gas industry, it should provide large refiners like Marathon with a competitive moat for years to come.

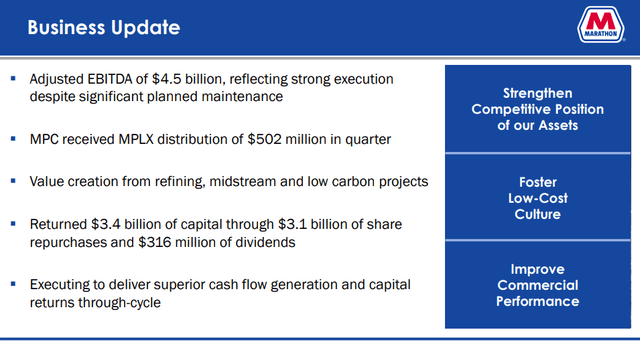

Marathon Company Outlook (Q2 Company Presentation)

Share Repurchases

Since spinning off the Marathon Oil Company, MPC has operated with anywhere between 500 to 600 million shares outstanding. For the past two years, the company has been aggressively buying back shares. This is going to continue to be a bullish signal for Marathon. In 2019, the company had about 664 million shares outstanding. Today, the company has reduced that by over a third, down to roughly 400 million shares outstanding. They were able to reduce shares since the end of 2022 from above 500 million, to where it is today. Year-to-date, as of this writing, the company’s shares are up over 30 percent.

This has been a good strategy for the growth of the share price. However, with interest rates continuing to rise, I would think that capital deployed towards share repurchases becomes a much less effective use of capital and that at some point, it will become more strategic to either strengthen the balance sheet, or find stronger capital projects to invest into.

Balance Sheet

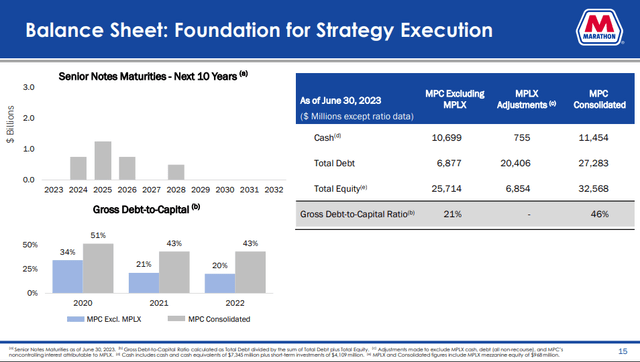

That said, Marathon has a relatively strong balance sheet as most of their debt comes from their holdings of their midstream company, MPLX (MPLX). They own 64 percent of the shares in MPLX.

Marathon Balance Sheet (Q2 Company Presentation)

Here is Marathon’s debt-to-asset ratios over the past 5 years. With some senior notes coming due in 2024 through 2026 (slide above), it will present good opportunities to deleverage the balance sheet, especially if interest rates continue to rise.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Debt-to-Asset Ratio | 51.52% | 56.26% | 64.51% | 64.21% | 57.61% | 62.32% |

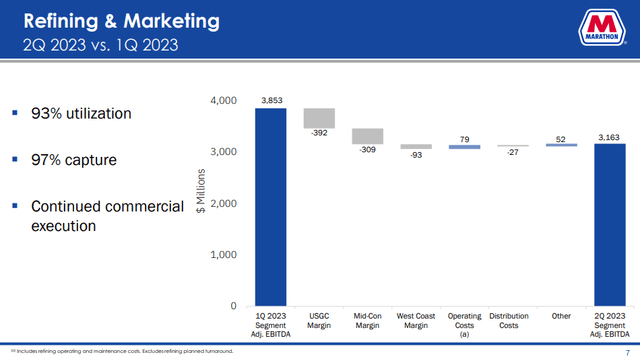

Operations

Here you can see that Marathon is able to operate at a 93 percent utilization rate indicating strong demand remains for refining and that Marathon is operating efficiently despite having significant maintenance downtime in the quarter. This dovetails with the industry outlook above, demonstrating that despite the regulatory monster, demand remains strong.

Marathon Utilization Rate (Q2 Company Presentation)

Conclusion

Strong crack spreads combined with Marathon’s established refining and marketing business creates a strong position for Marathon. Much of how their stock will perform will depend on crack spreads going forward, but with their midstream assets providing some level of diversification, I believe Marathon represents a good value. Crack spreads have remained elevated through 2023 so far and so it represents a risk of buying while crack spreads are high. However, they have remained elevated since 2022 and perhaps this is the “new normal” as many things have remain changed since 2021.

That said, Marathon’s shares have had a very good run in 2023 and it might be prudent to wait for a pull-back in the share price, or dollar-cost average.

Overall, Marathon is a good way to gain access to downstream assets if you believe this is the best way to position yourself to the energy industry. However, I also prefer upstream assets such as EOG Resources (EOG) as they represent greater sources of growth in my opinion. The downstream refinery business’ source of growth will be more at the mercy of crack spreads as it is difficult to bring new refining capacity online in this regulatory environment. And with a dramatic shift continuing in the transportation industry towards electric vehicles, greater refining capacity may not be an extremely prudent investment. There are a lot of variables to consider at the moment but nothing is going to change so quickly to take away Marathon’s current and long-term strategic position inside the energy industry.