pixinoo

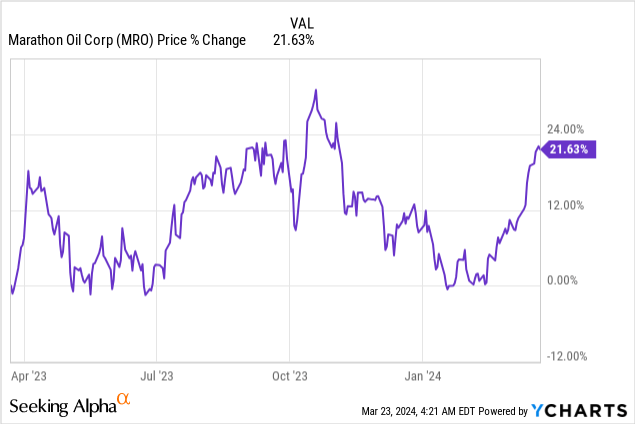

Fundamentals in the U.S. economy continue to support an investment in exploration company Marathon Oil (NYSE:MRO) whose shares have soared more than 20% year to date. The energy company benefits from petroleum prices that have stabilized at around $80 per barrel after OPEC+ members, led by Saudi Arabia and Russia, earlier this month agreed to extend voluntary supply cuts into the second-quarter. Marathon Oil also guided to return at least 40% of its cash flow from operations to shareholders in this high-price market, which could yield a significant reduction in the company’s outstanding shares. I believe that Marathon Oil is a very concentrated resource play for energy investors and the company’s shares are attractively valued based off of earnings!

Previous rating

I rated shares of Marathon Oil a buy in December as I believed the OPEC+’s decision to implement voluntary supply restrictions at the time would boost petroleum prices and support share price gains for the energy company… which is exactly what happened. With a new round of supply cuts coming in Q2’24, I believe shares of Marathon Oil remain attractive as an income investment.

Concentrated E&P play and favorable economic backdrop

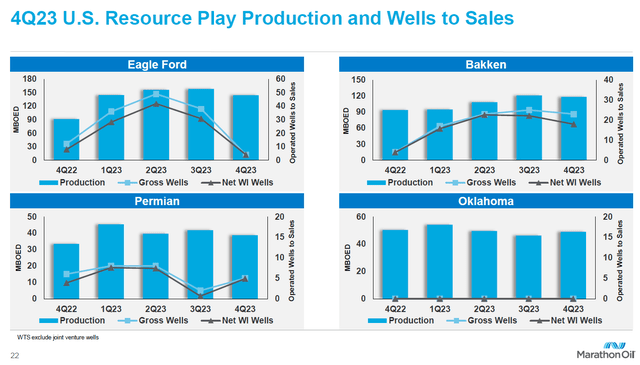

Marathon Oil is a concentrated resource play with major production in the Eagle Ford, Bakken, and the Permian basins as well as in Oklahoma. Additionally, the company owns natural gas development assets in Equatorial Guinea. However, the E&P company is mainly focused on crude oil and grew its oil production 28% in FY 2023. Marathon achieved an average oil production of 190 MBOPD from its main sources of production and the company is set to remain a petroleum-focused energy company going forward.

Marathon Oil

The background for E&P companies generally, as well as Marathon Oil specifically, is favorable: the U.S. economy grew at an annualized rate of 3.2% in the fourth-quarter which fundamentally backed up energy prices. Currently, petroleum prices are hovering around the $80 per barrel mark (for the WTI sort) and the outlook is favorable as well. This is because OPEC+ members earlier this month extended voluntary crude oil supply cuts, amounting to 2.2M barrels of oil equivalent per day. Russia said that it will cut its production by an additional 471,000 barrels per day in the second quarter as well. These trends, a strong U.S. economy and extended supply cuts, are supportive of energy prices which in turn should allow Marathon Oil to return a ton of cash to its shareholders in 2024.

Massive free cash flow returns

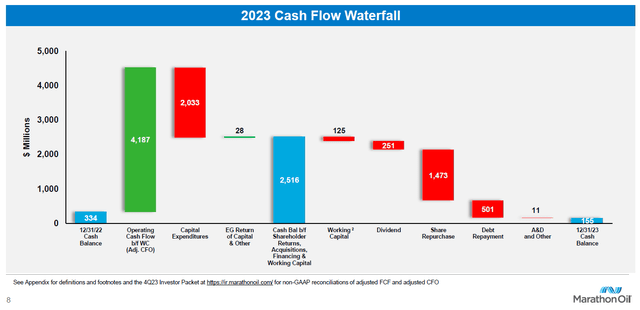

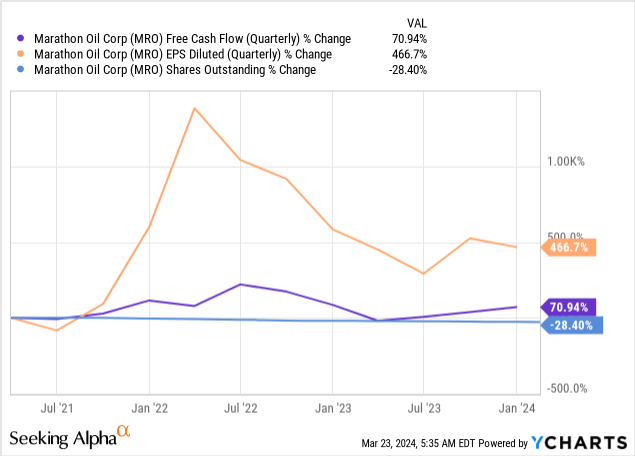

The high-price environment has allowed Marathon Oil to get top dollar for its petroleum products, which in turn has led to a surge in the company’s free cash flow. In FY 2023, Marathon Oil generated $2.2B in (adjusted) free cash flow of which it returned $1.7B to shareholders through stock buybacks and dividends.

Marathon Oil

The majority of free cash flow returns typically happen in the form of stock buybacks (85% in FY 2023) and Marathon Oil returned a total of 78% of its free cash flow last year.

Marathon Oil chiefly focuses on stock buybacks, which gives the company flexibility in the timing of its capital actions. In the last three years, Marathon Oil generated free cash flow in the amount of $8.4B of which the E&P company returned $5.6B to shareholders (both stock buybacks and dividends). The free cash flow return percentage during these three years was not as impressive as the FY 2023 FCF return rate, but still very solid: 66%.

As long as petroleum prices stay around ~$80 per barrel, I expect Marathon Oil to continue to spend cash resources aggressively on the buyback of its own shares in FY 2024.

Marathon Oil

Marathon Oil repurchased 9% of its shares in FY 2023 and more buybacks are on the way in FY 2024. In the last three years, the E&P company bought back so many shares with its soaring free cash flow that it retired approximately 30% of its share count, causing a surge in its earnings per-share in return.

Marathon Oil’s valuation

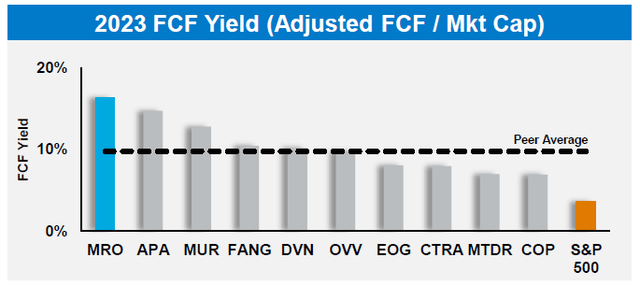

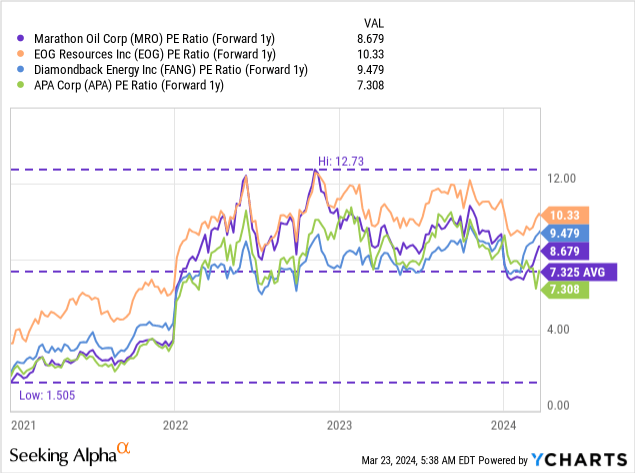

Marathon Oil’s shares are attractively valued based off of earnings and have an attractive risk profile for investors as well, especially those that focus chiefly on free cash flow and cash returns. Marathon Oil is currently valued at a P/E ratio of 8.7X which implies an earnings yield of 11.5%.

The 3-year average P/E ratio was slightly lower, at 7.3X, but shares do have upside potential, in my opinion. The industry group P/E ratio is 8.9X with the industry group including E&P plays like EOG Resources (EOG), Diamondback Energy (FANG) and APA (APA). A 10X P/E ratio is not unreasonable to value Marathon Oil at, in my opinion, considering that the company is retiring a ton of its shares and generating a significant amount of free cash flow. This fair value P/E ratio implies at least 15% upside revaluation potential and a fair value of ~$32.

Risks with Marathon Oil

The biggest risk for Marathon Oil, as I see it, is a potential weakening in the economic setup which could lead to lower WTI petroleum prices which in turn could significantly dent the firm’s potential for free cash flow growth. The company may also have to scale back its stock buybacks which has been a significant driver of EPS growth in recent years.

Final thoughts

Marathon Oil is an E&P company with concentrated production assets in a small number of shale basins in the U.S. The economic backdrop is still quite favorable, in my opinion, which is why I am rating the exploration and production enterprise a buy. OPEC+ countries, led by Russia and Saudi Arabia, this month extended their supply cuts into the second-quarter which implies favorable pricing tailwinds for petroleum markets. Since Marathon Oil is also a petroleum-focused E&P company, the firm stands to benefit from such supply limitations. Marathon Oil is set to generate higher free cash flow in this price environment and would likely spend even more cash on its buybacks!