Potential homebuyers in Manhattan have been sidelined final month as the speed on a 30-year mortgage topped 7%. Because of this, rents within the borough rose to three-month highs resulting from sliding housing affordability.

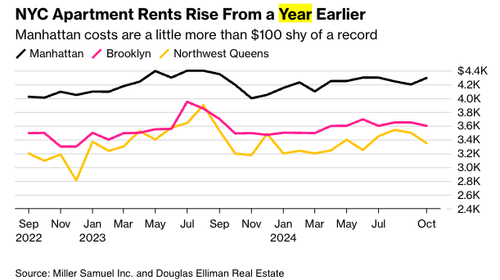

Bloomberg cited new knowledge from brokerage Douglas Elliman Actual Property and appraiser Miller Samuel that confirmed the median Manhattan condominium lease climbed 2.4% from a 12 months earlier to $4,295. This was the primary annual achieve since April.

In different surrounding boroughs, new leases signed in Brooklyn final month averaged round $3,600, up 3.2% from a 12 months earlier. In northwest Queens, median rents have been up almost 5% to $3,350.

In latest weeks, the US 10-year Treasury bond yield, which lenders use as a information to cost dwelling loans, jumped in anticipation of a Trump win. Yields soared even after the Federal Reserve minimize its benchmark rate of interest. That is largely as a result of merchants forecasted elevated inflation below the Trump administration.

Jonathan Miller, president of Miller Samuel, famous that decrease mortgage charges lured some renters to buy properties earlier than the presidential election. Nonetheless, he famous that rents began to re-accelerate as quickly as mortgage charges bottomed in late September and surged via October. He added {that a} 30-year mortgage fee over 7% has pressured rents greater.

“Rents are inclined to observe mortgage charges,” Miller mentioned, including, “The upper the mortgage fee, the upper lease.”

Miller mentioned newly signed leases jumped 24% final month in comparison with one 12 months in the past. He famous that greater charges have sparked a surge in exercise this fall.

“Mortgage charges nonetheless aren’t coming down,” Miller mentioned, stating, “Financial coverage wouldn’t appear to recommend that mortgage charges will fall considerably. If something, rents will keep the place they’re, or rise, transferring ahead.”