Urupong

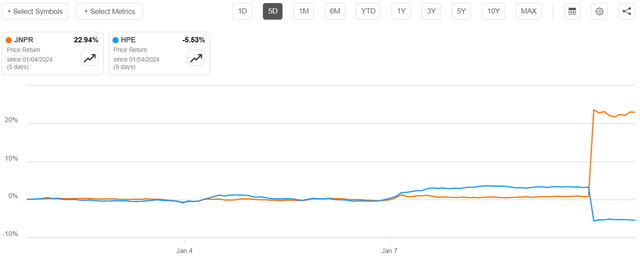

According to an update by Seeking Alpha on January 9, Hewlett Packard Enterprise Company (NYSE:HPE) has confirmed it is acquiring Juniper Networks, Inc. (NYSE:JNPR) for about $14 billion. Now, since news of a potential combination hit the market, the networking company’s stock has jumped by more than 20% as illustrated in the orange chart below whereas the acquirer’s shares have dipped which may constitute an investment opportunity.

Comparing price returns (seekingalpha.com)

My objective with this thesis is to make sense of this deal in light of the increasingly competitive landscape where vendors are now banking on the AI differentiator amid a resurgence in M&A activities in the IT networking industry. At the same time, I will also look at the valuations of each stock.

First, I provide an overview of Juniper’s portfolio with the intent of highlighting which aspect is appealing to HPE.

A Dotcom Era Networking Play with an AI Advantage

Founded in 1996 and operating in the IT sector, Juniper manufactures communications equipment such as routers both for data centers and branch offices and also offers security products like firewalls. Well, these are the sort of stuff you would normally expect from a networking play but what differentiates the company is its software-centric and AI approaches as I had elaborated in my thesis in June last year.

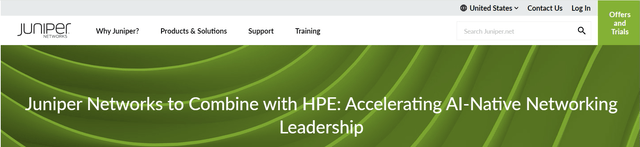

blogs.juniper.net

At that time, I also touched upon its AI-driven Enterprise segment together including Mist AI for reducing complexity by making administrative tasks simpler. Noteworthily, the company incorporates a high degree of artificial intelligence in its solutions, and this is well before the advent of ChatGPT and Generative AI which means that it can be appealing for any company looking to buy into innovation. This has been confirmed by HPE in its press release on January 9 where it is mentioned that the acquisition will help it align its portfolio to capitalize on AI as it is disrupting IT in most companies.

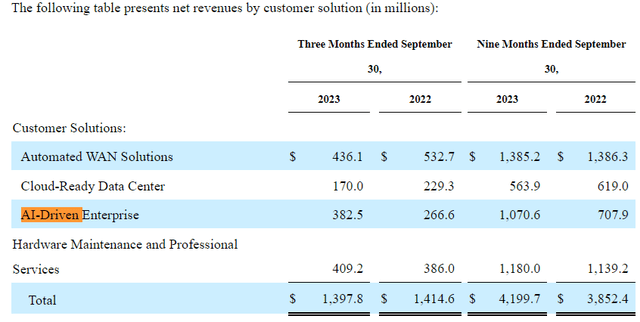

In this respect, when Juniper reported third-quarter 2023 financial results in October, AI-driven enterprise revenue for the first nine months increased by 51.2% (or from $707.9 million to $1,070.6 million) compared to the same period of 2022 as shown in the chart below.

s (seekingalpha.com)

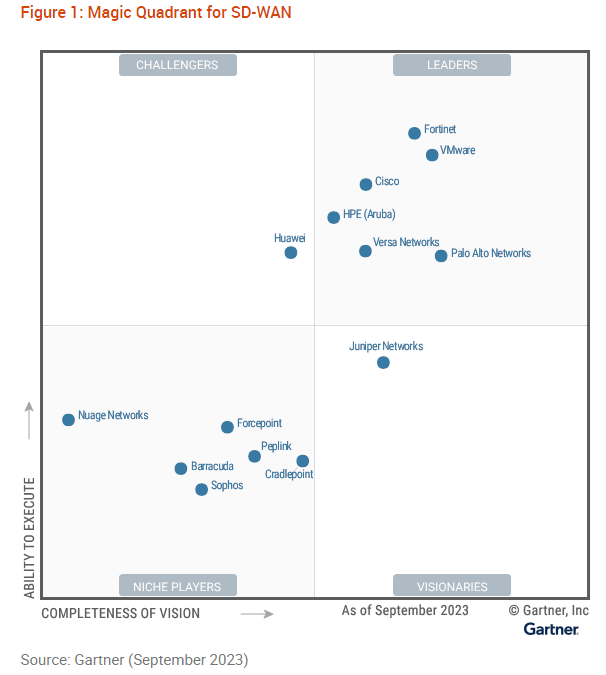

Therefore for the acquirer, this is the priority segment to get its hands on, especially since Juniper has been positioned as visionary in the Gartner Magic Quadrant in September 2023 for SD-WAN (software-defined wide area network) which means that it can potentially shape the market in key areas like AI networking and SASE (secure access service edge).

www.gartner.com

For investors, SASE is like providing combined networking and security services such as Firewall-as-a-service to devices in the cloud directly (instead of passing through a distant metro data center) and the related market is expected to grow by 20.48% CAGR from 2024 to 2029. Thus, the acquisition is not only about AI but also about product positioning and increasing the addressable market for HPE.

An Acquisition to Address HPE’s Growth Issue

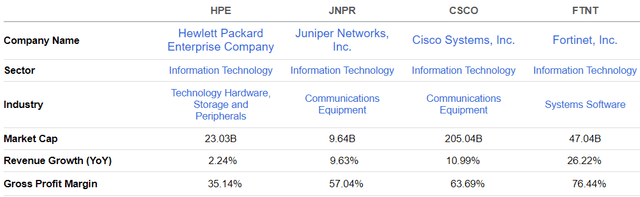

Now, the above diagram also shows that HPE is in the leaders quadrant meaning that it plays a leadership role in SD-WAN including SASE with its Aruba range of products. However, looking at its overall revenue growth figures which I had already flagged in my thesis in February last year, it is relatively low at only 2.24% YoY compared to peers Cisco Systems, Inc. (CSCO) and Fortinet, Inc. (FTNT) as tabled below.

Consequently, one of the objectives of the combination is to advance HPE’s portfolio mix to shift toward higher-growth solutions. Moreover looking at profitability, the margins of the merged entity should rise given Juniper’s gross profit margins of 57% which is 22% higher than the acquirer.

Comparison JNPR, CSCO, HPE, and FTNT (seekingalpha.com)

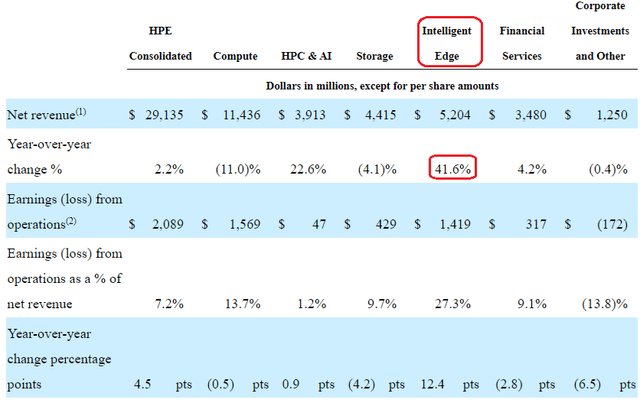

Diving deeper, the acquisition is anticipated to double HPE’s networking business labeled as Intelligent Edge as shown below which includes Aruba and generated $5.2 billion during fiscal year 2023 (ending in September 2023) as shown in the table below. Adding this to the $5.5 billion that Juniper is expected to generate for the fiscal year 2024, it should effectively double HPE’s networking business, but, I later apply a dose of moderation given integration realities.

In the meanwhile, delving further into HPE’s revenue structure, it has four segments as illustrated below with Compute being the largest one but it has seen a YoY revenue decline. This is in sharp contrast to the Intelligent Edge business which has grown by 41.6% YoY and provides networking, security, and edge computing solutions.

SEC filing (seekingalpha.com)

Therefore by directly integrating Juniper’s portfolio of products into its Intelligent Edge unit, HPE should drastically increase its revenue growth, thereby significantly improving its competitive position (as per Gartner’s Magic Quadrant) relative to Cisco Systems, Inc. (CSCO) and Fortinet, Inc. (FTNT). This all comes at a time of a resurgence in M&A deals since the fourth quarter of last year.

Using Moderation For the Valuation

In this context, this acquisition comes on the heels of Cisco’s deal to acquire data and security software company Splunk Inc. (SPLK) for $28 billion in September, or for around $157 per share. Earlier, Broadcom Inc. (AVGO) completed the VMWare for $69 billion or $142.5 per share. In these circumstances, the $14 billion that HPE is spending for Juniper, or $40 per share seems on the low side and there could be several reasons for this.

First, this could be explained by Juniper seeing declining growth for both its Automated WAN solutions and Cloud Ready Data Center businesses as shown in its revenue segment table above, and this, after key customers have pulled back purchases for new equipment. For this matter, analysts forecast revenue for fiscal 2024 (ending in December) to decline by -1.82% while expecting growth of 5.75% for fiscal 2023.

Second, the company announced a restructuring plan on October 5 to reduce operating costs, but this did not prevent its stock from sliding to the $25 level by the end of that month. Juniper’s shares eventually rose to around $30 but that was largely on the back of decreasing treasury yields as the Fed hit the pause button since October last year. Also, if one looks at the performance history, the stock never recovered to its 2000-2001 trading range of $50-$225. In these conditions, $40 is a fair price and given the current price of around $37.5, one can expect a profit of less than 10% per share which is not worth the effort at this time.

On the other hand, HPE deserves better given revenue and cost synergies.

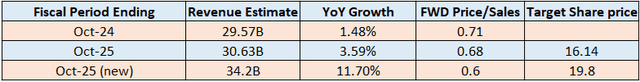

Assuming that the deal is closed in early calendar year 2025 at the maximum, the sales numbers from Juniper should impact its fiscal year ending in October next year. Currently, revenues of $30.63 billion are expected by analysts as shown in the table below. Now considering the $5.5 billion that Juniper is expected to bring to the table, it has to be moderated. The reason is that these two companies have overlapping networking businesses mainly about SASE and SD-WAN. Now, based on a rule of thumb by management consultancy Ernst and Young, a well-planned integration exercise can capture 60% to 70% (or a midpoint of 65%) of the run rate target within 12 months of deal completion. Thus, I obtain $3.575 billion (or 65% of 5.5 billion) as revenue synergies.

Thus adding $3.575 billion to the $30.63 billion expected for fiscal 2025, I obtained a new estimate of $34.2 billion or a growth of 11.6% which is higher than the initial expectation of 3.59% expected. This should in turn decrease the forward Price-to-sales ratio from 0.68x to 0.6x (0.68 x 0.883). This conversely results in a higher stock price, and my target is $19.8 (17.72 x 1.116) based on the share price of $17.72 or the unaffected closing price on January 8.

Revenue estimates (www.seekingalpha.com)

In addition to topline growth, $450 million of cost synergies are expected within 36 months of close which could be accelerated by HPE’s management attaching Juniper to its networking business which will be headed by Juniper’s CEO Rami Rahim.

However, the $19.8 price target is above HPE’s current value of $16.34 by over $3 and contrasts sharply with the price action.

HPE is a Buy, while Juniper is a Hold but there are Risks

In this case, the dip in its share price after the initial announcement of the deal shows a lukewarm market response, possibly due to HPE’s balance sheet which boasts cash of only $3.57 billion and means that to finance the deal, at least $10 billion of debt will have to be contracted, which may take the form of mandatory convertible preferred securities. These will then pile up to the $13.67 billion of existing debt. On top Juniper has a net debt (total debt – total cash) of $403.6 million which needs to be addressed too. Therefore, it looks like many risk-averse investors are not yet convinced and are waiting for the management to execute.

However, with a valuation grade of A-, HPE remains an undervalued company with the opportunity to accelerate the pace at which it is growing through the Juniper acquisition. Also, the $40 per share which represents a premium of about 32% to Juniper’s unaffected closing price is nearly equal to the 31% premium that Cisco proposed for Splunk, but is much less than the 49% paid by Broadcom for VMWare.

Additionally, HPE has a profitability grade of A and the $4.43 billion of cash generated during its last fiscal year is above the IT sector median by over 5.6K%. Furthermore, with strong FCF growth together with disciplined capital allocation, the intent is to decrease leverage to approximately 2x in two years post-close.

As for Juniper, for those who are contemplating a buy, it is better to wait for a dip which is likely taking example from the Broadcom-VMWare deal which took over one year to be completed as it was scrutinized by regulators from different parts of the world. Hence, there may be volatility risks associated with approval for the combination being delayed, especially from authorities in jurisdictions with which the U.S. is involved in geopolitical tensions.

In conclusion, this thesis has shown that this combination makes sense for HPE not only from the AI and product positioning perspectives but should also help it grow faster. Going a step further, newly gained networking strength could also drive HPE’s hybrid cloud (GreenLake) portfolio, but this will eventually depend on execution. As for Juniper, it has better growth prospects by benefiting from its acquirer’s massive network of channel partners.