SOPA Images/LightRocket via Getty Images

After warning investors months ago to not look back at an opportunity to invest in the beaten down Lumen Technologies (NYSE:LUMN), a positive move by the stock following Q4’24 results provided some hope the telecom had indeed turned around the business. After reviewing the results, this most definitely doesn’t appear the case with all key metrics in decline. My investment thesis remains Bearish on the stock, even down at only $1.

Source: Finviz

Major Cash Flow Problem

The biggest issue with the turnaround strategy of the new CEO was the additional restructuring of the business. Lumen Technologies has been in a perpetual restructuring for years now.

The stock has fallen to the $1 range due to the CEO again cutting business with the promise of eventually boosting the business in the future via new innovative products while cutting non-strategic problems. The problem is that the company just ends up in a perpetual race to the bottom.

Lumen beat Q4 estimates by $60 million in an encouraging sign, yet the company again guided to organic revenue declines in 2024. At this point, Lumen should hold onto every possible EBITDA positive business to build momentum, but each turnaround plan involves either cutting low calorie products or selling EBITDA positive business.

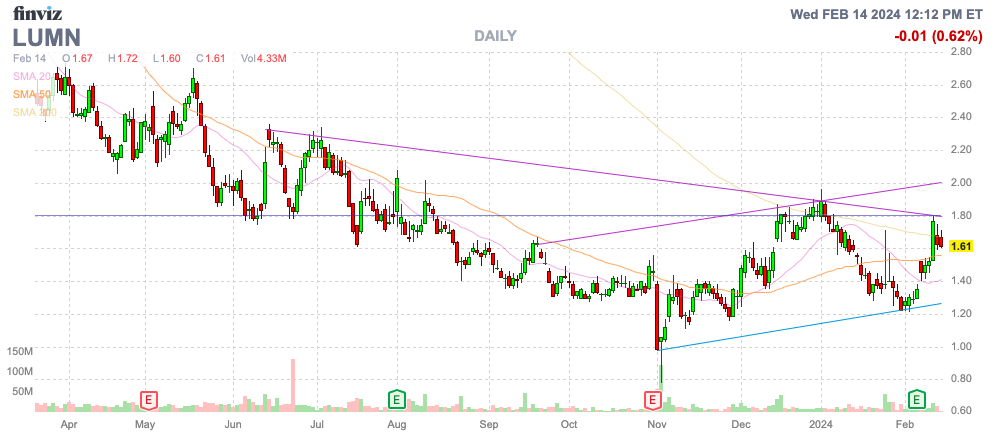

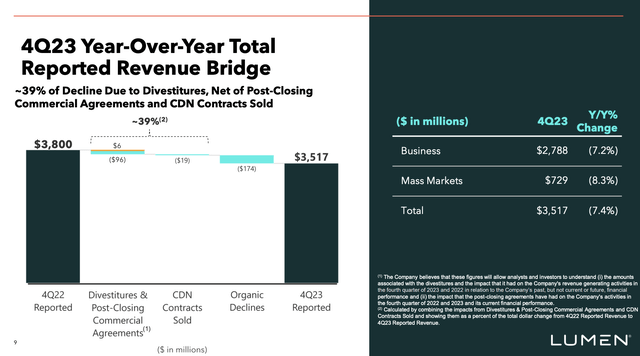

The company provided this slide for the Q4’23 revenue bridge again highlighted the constant slide. Organic revenues declined by $174 million while divestitures contributed a portion of the 7.4% decline in quarterly revenues to $3.5 billion.

Source: Lumen Tech. Q4’23 presentation

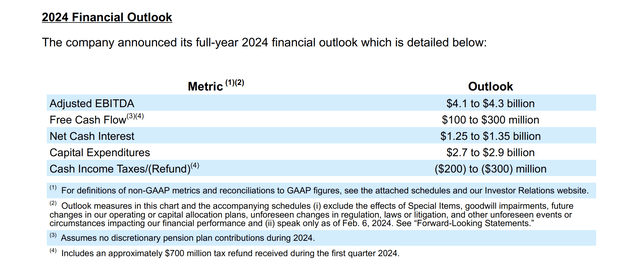

Lumen Technologies actually just reported another quarter where adjusted EBITDA plunged again. The picture remains bleak into the next year as well. The guidance is for adjusted EBITDA to dip 2% to 5% organically.

Management guided to positive cash flows of ~$200 million at the midpoint, but the number comes with a huge catch. The company claims free cash flows of $100 to $300 million, but the amount includes a massive $700 million tax refund received during Q1. In essence, the operating business will generate negative FCF to the tune to $400 to $600 million.

Source: Lumen Tech. Q4’23 earnings release

Lumen Technologies is even cutting the capex by ~$300 million from the 2023 levels of $3.1 billion and the FCF numbers are still massively negative. The company has seen adjusted EBITDA plunge over the year between divestitures, organic revenue declines and restructurings.

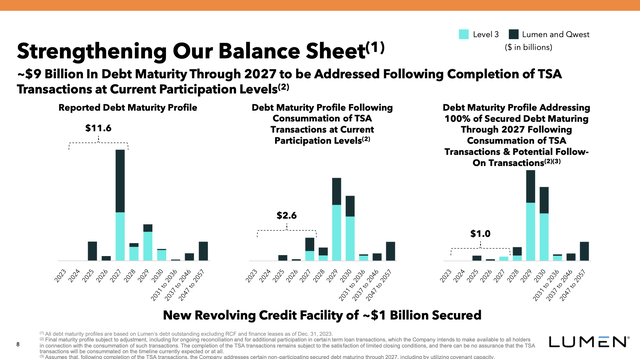

Debt Restructuring Didn’t Help

As with a lot of the supposedly positives for Lumen Technologies, the news typically come with huge negatives. In this case, the company famously restructured $9 billion in debt maturing out to 2027 to improve the maturity profile and give the management team longer to execute on the restructuring plan.

Source: Lumen Tech. Q4’23 presentation

The big negative were the far higher interest rates, though Lumen creditors committed to provide $1.2 billion of financing to the company through new long-term debt. The telecom just can’t afford higher interest expenses with cash flows under pressure

On the Q4’23 earnings call, CFO Chris Stansbury dropped this cash flow impact:

We expect free cash flow to be impacted by higher interest expense related to our new TSA agreement, and based on our initial analysis, we’ve included an incremental $125 million to $225 million of cash interest in 2024 versus 2023.

Lumen estimates an increase in interest expenses by $125 to $150 million in 2024, even with debt levels slightly lower than the 2023 levels. The company was only producing near breakeven cash flows entering the debt restructuring, so any outcome requiring additional costs is a huge negative.

The updated guidance for net interest expenses is to rise to ~$1.3 billion in 2024 is a huge negative. Lumen only predicts $1.0 in debt maturities left to pay through 2027, but the company will pay ~$175 million annually in higher interest expenses now.

Until the company can actually turnaround the business and return to revenue growth, Lumen is a stock to avoid. A company with nearly $18 billion in net debt can’t afford negative organic growth and FCFs turning negative.

The current analyst estimates have the company facing huge revenue declines in part due to the $1.8 billion divestiture of the EMEA business. The business was originally sold to Colt at ~11x adjusted EBITDA of $166 million from 2021.

Takeaway

The key investor takeaway is that Lumen Technologies remains a stock to avoid. Don’t make the mistake of looking back after the Q4 results beat estimates considering the forecast for horrible cash flows in 2024. The debt restructuring wasn’t a huge help either with the large boost to interest expenses when the company needs positive cash flows.

Investors should use the minor bump up to dump the stock.