Vertigo3d

Introduction

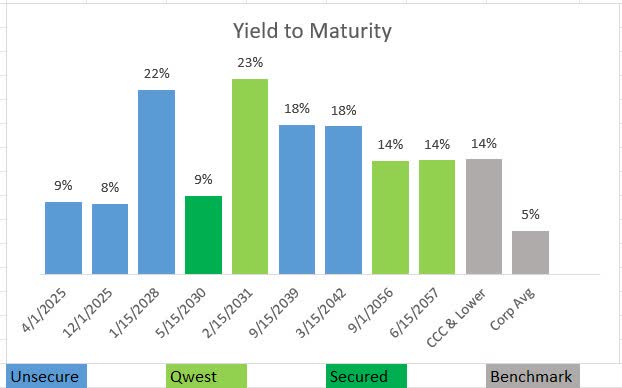

Lengthy-term fairness and debt traders of Lumen Applied sciences (NYSE:LUMN) have been on a wild experience. The corporate underwent monetary challenges, administration modifications, asset gross sales, and debt exchanges to stay solvent. Again in Could, I supplied an replace on Lumen’s progress on its turnaround plan. Since then, the corporate introduced $5 billion in AI-driven gross sales, with $7 billion in extra gross sales being negotiated. The information despatched shares skyrocketing and settling at over $5.50 per share on Friday. For traders who usually are not holding the fairness, there are different choices accessible for cheap entry into Lumen Applied sciences, together with the 22% yielding debt due in January of 2028.

FINRA

Lumen Second Quarter Outcomes

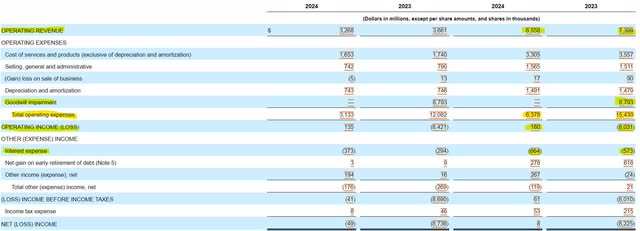

Lumen projected 2024 and 2025 to be difficult years, and the second quarter outcomes confirmed these headwinds. Working income decreased by $850 million to $6.5 billion within the first half of the 12 months in comparison with a 12 months in the past. Working bills dropped by $250 million (in case you take away the goodwill impairment expenses) to $6.4 billion. Because of the drop in income being better than the expense decline, working revenue fell to $180 million. Lumen’s working revenue within the first half of the 12 months was not ample to cowl the $664 million in curiosity expense.

SEC 10-Q

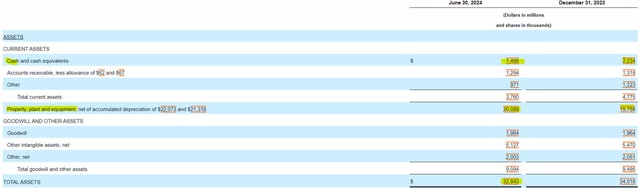

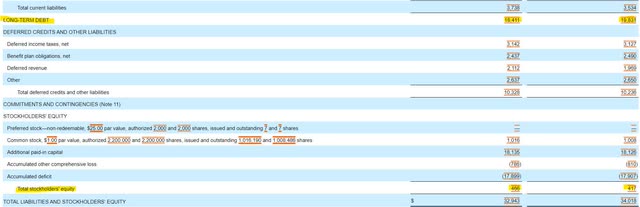

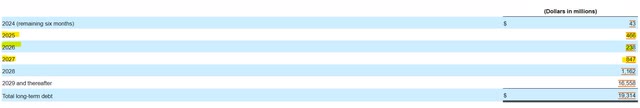

Lumen underwent a debt trade earlier this 12 months that modified its stability sheet. The corporate’s money stability has dropped by $750 million over the past six months, however nonetheless has good liquidity with $1.5 billion of money readily available. Lumen’s debt trade decreased long-term debt by $1.4 billion to $18.4 billion. The corporate had $466 million in shareholder fairness on the finish of the second quarter, up from $417 million in the beginning of the 12 months.

SEC 10-Q SEC 10-Q

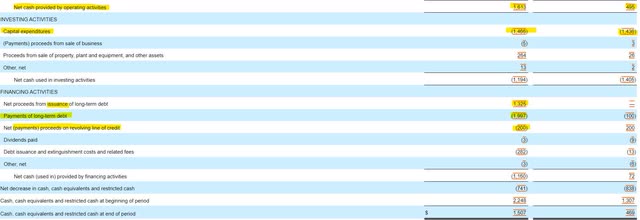

Lumen’s capacity to generate money is paramount to its capacity to scale back debt and stay solvent, subsequently, the assertion of money flows is necessary to each shareholders and noteholders. In the course of the first half of the 12 months, Lumen’s working money circulation surged from $500 million to $1.6 billion, partly as a consequence of tax modifications. The surge in working money circulation allowed free money circulation to swing to a optimistic $150 million. Lumen used a few of its additional money to pay down debt by $800 million throughout the first half of the 12 months.

SEC 10-Q

Transformation to Pace Up

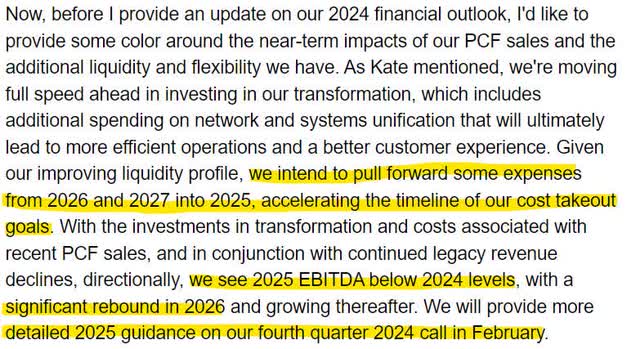

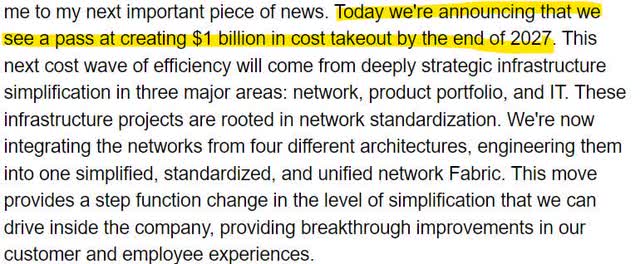

Whereas the outcomes don’t present something associated to the current gross sales bulletins, Lumen’s administration did present some context as to how these large gross sales will speed up the corporate’s transformation plans. First, because of the infusion of money that these new gross sales will generate, Lumen goes to hurry up its operational effectivity targets by bringing tasks scheduled for 2026 and 2027 into 2025. The results of these efficiencies will likely be $1 billion in value financial savings by 2027.

Earnings Name Transcript Earnings Name Transcript

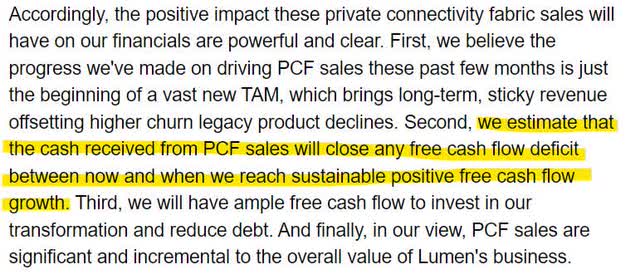

Secondly, the money coming in from these gross sales will formally shut the free money circulation gaps projected in Lumen’s turnaround plan. These free money circulation gaps had been anticipated to be coated by the extra liquidity generated by the debt trade deal, however now Lumen can deploy that additional money in any approach it sees match (extra capex, debt discount, and so on.). Primarily, administration is projecting that Lumen will likely be free money circulation optimistic going ahead.

Earnings Name Transcript

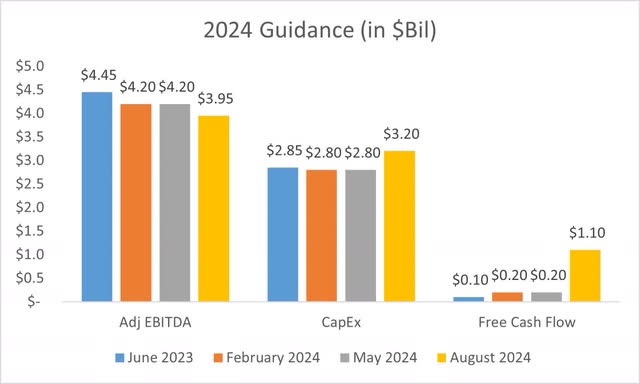

A Take a look at the Up to date 2024 Steerage

Administration supplied an up to date steerage outlook for 2024 which was principally optimistic. The corporate expects Adjusted EBITDA to be $3.95 billion, which is $500 million decrease than the unique turnaround plan. What’s necessary to notice is that Lumen’s free money circulation in 2024 is now projected to be $1.1 billion, 5 instances larger than beforehand estimated. Capital expenditures have additionally guided larger by $400 million to $3.2 billion. Lumen’s assortment of money upfront in its new gross sales offers has allowed for better capital expenditure and free money circulation.

Administration Steerage over Time Recorded in Excel

FOMO on Shares? Look to the Debt

I’m not a proponent of shopping for shares after a serious runup, and I used to be fortunate sufficient to purchase a small quantity of shares beneath present costs in early 2023, however the pricing of Lumen’s debt continues to spotlight alternative. Debt maturing in January of 2028 is buying and selling at over 20% yield to maturity, with a better than 10% coupon yield. The 2028 bond is engaging as a result of it represents the following maturity due of better than $1 billion. With nearly all of the debt exchanged to mature in 2029 or 2030, traders ought to anticipate boosted free money circulation to have the ability to cowl debt maturities as much as 2029.

SEC 10-Q

Dangers to Lumen Know-how

Lumen Know-how is leveraging the way forward for AI to fund the buildout of its transformative imaginative and prescient. Ought to the AI bubble pop, the corporate could also be challenged as soon as once more to generate money. The big maturity in 2028 is discounted in worth as a result of it’s unsecured, and secured debt holders are going to wish to see substantial progress in operations earlier than consenting to that quantity of capital leaving the company. If Lumen is acting at 2023 or early 2024 ranges when that debt comes due, secured noteholders could choose to power a restructuring to maintain that capital inside their grasp.

Conclusion

Whereas I didn’t envision the transformation of Lumen taking this diploma of flip, I’m definitely blissful for the shareholders and unsecured debt holders who’ve taken this experience for the previous few years. The corporate’s continued negotiation of as much as $7 billion in extra gross sales provides one other layer of pleasure that might repay sooner quite than later. For these nonetheless on the lookout for alternative, the 2028 notes present nice revenue with a strengthening chance of capital return.