Andrew Toth/Getty Images Entertainment

Strong Earnings Report

I wrote an article about Lululemon (NASDAQ:NASDAQ:LULU) in June and explained why the company is my favourite athletic apparel stock. There are three significant reasons: great employee and customer relations, excellent financials, and powerful growth potential. In this article, I will share my bullish view on Lululemon after the release of its Q2 2022 earnings report. However, I found the stock valuation less attractive than two months ago. In such case, I will give a “Buy” rating to the stock.

Lululemon delivered a strong Q2 2022 earnings report, which once again proved the company’s excellence. The stock surged 6.70% on 2 Sept 2022, its biggest gain in two months, reflecting the market’s positive reaction to its earnings result. Although we are in a dreadful macroeconomic environment, the momentum of Lululemon remained robust in the previous quarter. The company reported revenue of $1.87B (+29.0% Y/Y) and adjusted EPS at $2.20 (+33% Y/Y). Comparable sales increased by 25%, while the gain in digital channels is more significant, with a 32% increase. As CFO Meghan Frank summarised:

Despite the challenges around us in the macro-environment, guest traffic in our stores and on our e-commerce sites remains robust, which speaks to the strength of our multi-dimensional operating model.

The Power of Three x2 strategies continue to work well for the company. As product innovation weighs, LULU always adds innovative and attractive products to its sales rack. The company launched new footwear products earlier this year, including Blissfeel, Restfeel and Chargefeel. These products create promising results for the company. Response from guests and reviews by the media are positive.

Chargefeel (Independent)

Besides, LULU’s omnichannel business model brings a considerable traffic boom to stores, websites and apps. Store traffic has exceeded the 2019 pre-pandemic level, which was reported to be up 30% over last year’s incredible 150%. At the same time, e-commerce traffic grows 40%. The company has been rewarded with excellent results by investing in online channel advertisement.

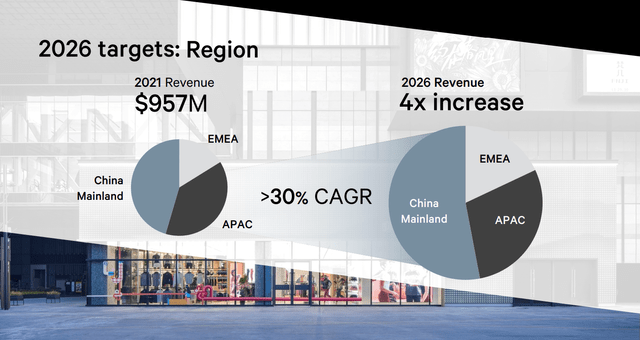

International results are also encouraging. Revenue increased 35% versus last year and 40% on a three-year CAGR basis. As one of the biggest overseas markets, mainland China will play a pivotal role in the company’s prospects in the overseas market. Despite the adverse impact of the pandemic lockdown persisting, there was a rebound in the region. Revenue in the Chinese market grew over 30% versus last year and a nearly 70% increase on a three-year CAGR basis. Plus, the Chinese Central government announced a blueprint for national fitness, which may boost the demand for sportswear in the region. LULU holds a very positive future in the Chinese market.

Lululemon Analyst Day

The positive results in product innovation, omnichannel experiences, and expanding international market provide good confidence to investors that the aggressive Power of Three x2 strategies are achievable given the company’s leading position in the athletic apparel market.

Improving supply chain and inventory levels

LULU’s supply chain and inventory position are in better shape than the previous year, contributing to the company’s promising results. In 2021, LULU experienced low inventory levels, and products were out of stock due to supply chain issues. Lululemon’s supply chain woes are now gradually easing as import and export restrictions due to the pandemic were lifted already in most countries, and Chinese factories resumed their productivity to a normal level in Q2 (factories were shut down due to Covid-19 development in China).

However, gross margin declined due to considerably elevated shipping costs, which is well above the pre-pandemic level. Fortunately, the delivery lead times are improving. The current ocean lead time has been improved to approximately 70 days from 90 days. It was expected that air freight usage, which is more expensive, would be ten basis points under 2021. But it was anticipated that the gross margin in Q3 would be down 50 to 70 basis points YoY. So, we believe the overall supply chain is gradually resuming.

Even though we witnessed earlier this year that Target (TGT) was accumulating too much stock, LULU is in a different class. In previous conference calls, the company reflected its inventory level could not catch the demand. With the improvement of the supply chain, LULU’s quarterly inventory increased by 85% YoY, and its inventory level was boosted to a record high of $1.5 billion. CEO reiterated his confidence that the company is in a much better position in the upcoming quarter. Inventory growth rate was expected to be slightly higher at the end of Q3.

Overall speaking, thanks to the improved supply chain and inventory level, LULU is in an improved position to meet its clients’ demands.

Will consumer spending be stronger in Q3?

Shares of LULU plummeted almost 50% to $250 from its all-time high in November 2021. Apart from the overhyped valuation due to the pandemic, the inflationary economic backdrop, which leads to declining consumer sentiment, is also a key contributor. However, things seem to turn around recently. U.S. Michigan Consumer Sentiment rebounded for two consecutive months (July and August), which recorded the first consecutive increases since April 2021. Together with retreating inflation measurement indexes like the Consumer Price Index and the FED’s favourite Core PCE Price Index, it creates an improving market atmosphere and benefits the consumer discretionary sector.

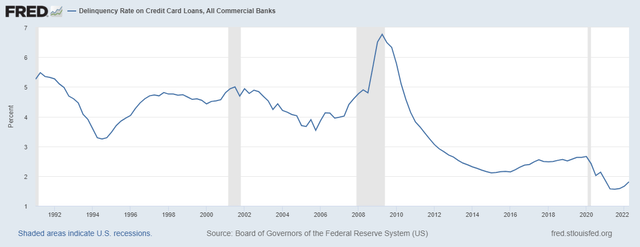

Besides, consumer spending remains robust. Credit card spending soared to $1.65 trillion in the past quarter. Mastercard recorded an 18% hike on its network. Meanwhile, the delinquency rate on credit card loans is at record low levels, hovering at around a high-one percent level.

Fred St. Louis

LULU delivered excellent results despite the challenging inflationary environment, and the company hasn’t witnessed any major shift in consumer behaviour. As one of the best in the field, LULU is expected to continue to deliver strong results in the second half of 2022. The company expects a three-year 26% CAGR growth in revenue and will open 75 net new company-operated stores in 2022.

Valuation and Conclusion

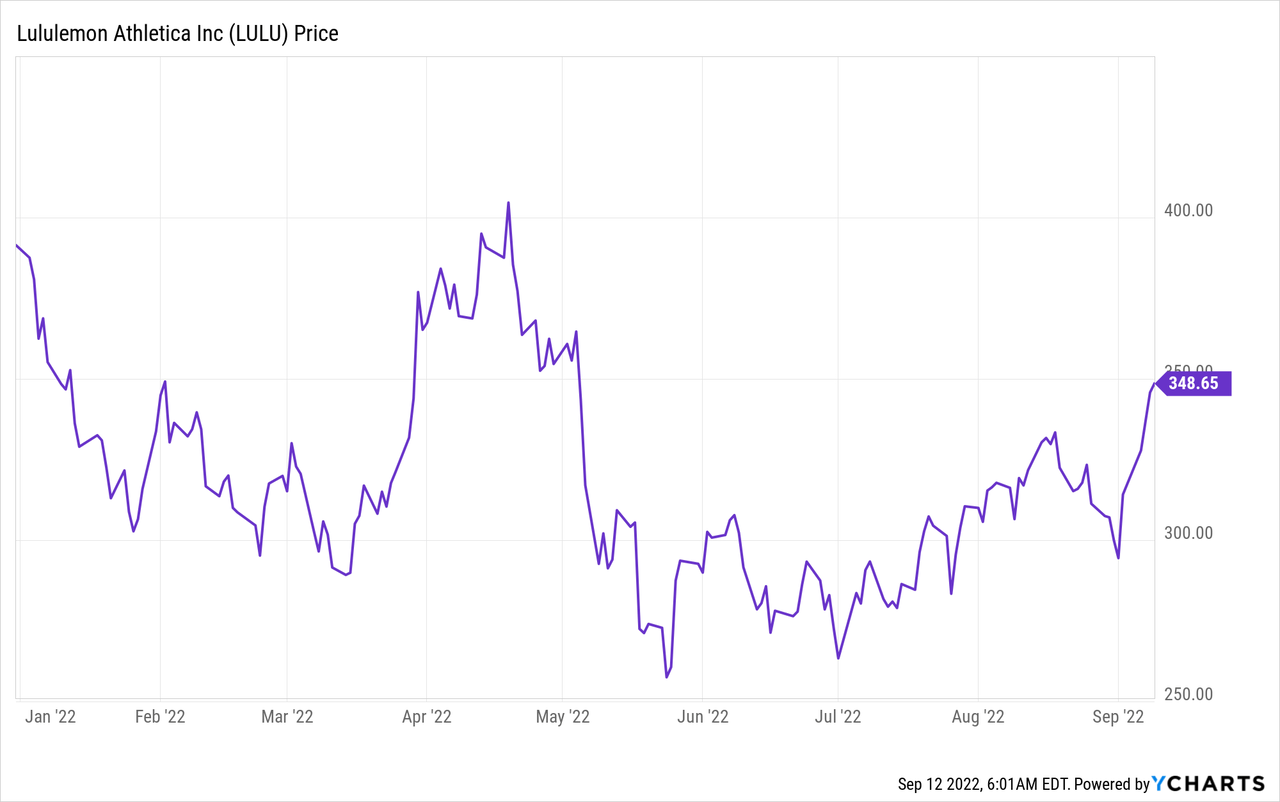

As of 9 September 2022, LULU traded at $348.65 with a P/E ratio of 40.87. Analysts anticipated the EPS of LULU to reach $9.90 in FY 2022, representing a 27% increase YoY. Meanwhile, the management expected it to be $9.75 to $9.90, representing a 25.2% to 27% boost.

LULU’s 5-year average P/E ratio is 52.77 (43.8 if excluding data in 2020). If we take a more conservative estimate (25.2% growth) and the stock returns to a 5-year average P/E ratio at the end of FY 2022, it will have a 22.5% to 47.6% upside towards the end of 2022.

The earnings report of LULU unfolded its strength and ability to navigate this tough macro backdrop. The company is better positioned to meet its customer’s demand for its innovative products given the improving supply chain. Consumers’ sentiment may have found the bottom, and spending is still robust.

All positives prove that LULU is a company worth buying now. With the current attractive discounted valuation, it should be a time to accumulate high-quality companies like LULU. However, we found the potential upsides have been cut significantly after the recent rally in the market. Having considered the above, we give a “Buy” rating for LULU after it released the Q2 2022 earnings result.

However, as the odds of a recession are high in the next year, we should closely monitor the macroeconomic environment and LULU’s future earnings results.

Please kindly note that all data in this article is abstracted from the company’s conference call transcript in 2022 Q2, unless otherwise specified.