sanjeri

Investment Summary

The share price for LSB Industries, Inc. (NYSE:LXU) has been contracting quite heavily over the last twelve months, down by around 30%. This seems to come as the interest rates are increasing and taking a slight toll on the margins of the business as interest expenses are rising. The company is also facing some challenges in the shape of volatility in commodity prices, as the war in Ukraine beginning in early 2022 shook the market and caused some prices to skyrocket and margins to expand quickly for companies in the material sector.

The shift in net income is evident for LSB, as the last quarter had it land at $166 million, as opposed to $285 million a year prior. Estimates for future earnings seem to suggest that LXU can recover somewhat, but I think the likelihood of quickly returning to price levels in 2022 is unlikely in the short term. The company is therefore still trading at a pretty high valuation in my opinion and can’t be reasonably justified as a buy. Instead, I think that the company is better suited as a hold for now, and potentially a buy if the valuation falls to around 12 – 13x earnings eventually.

Market Overview And Growth Drivers

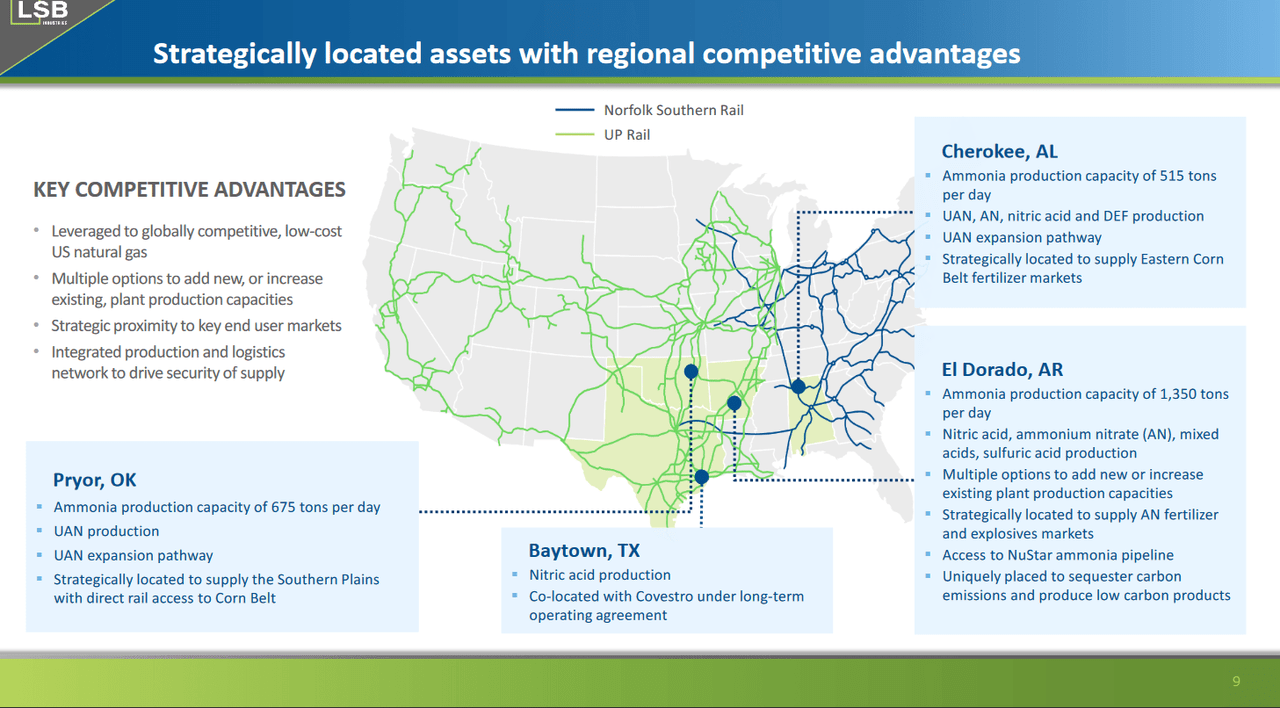

LXU operates in the chemical industry, specializing in the manufacturing, marketing, and sale of a diverse range of chemical products. Among its core product offerings, the company stands out as a provider of nitrogen-based fertilizers, playing a significant role in the agricultural sector. One of LXU’s key focus markets in the agricultural landscape is its production of ammonia, which serves as a foundational ingredient in various nitrogen-based fertilizers. This includes the manufacturing of fertilizer-grade ammonium nitrate (HDAN) and urea ammonia nitrate, both of which are vital components in the formulation of fertilizers designed to enhance crop growth and yield.

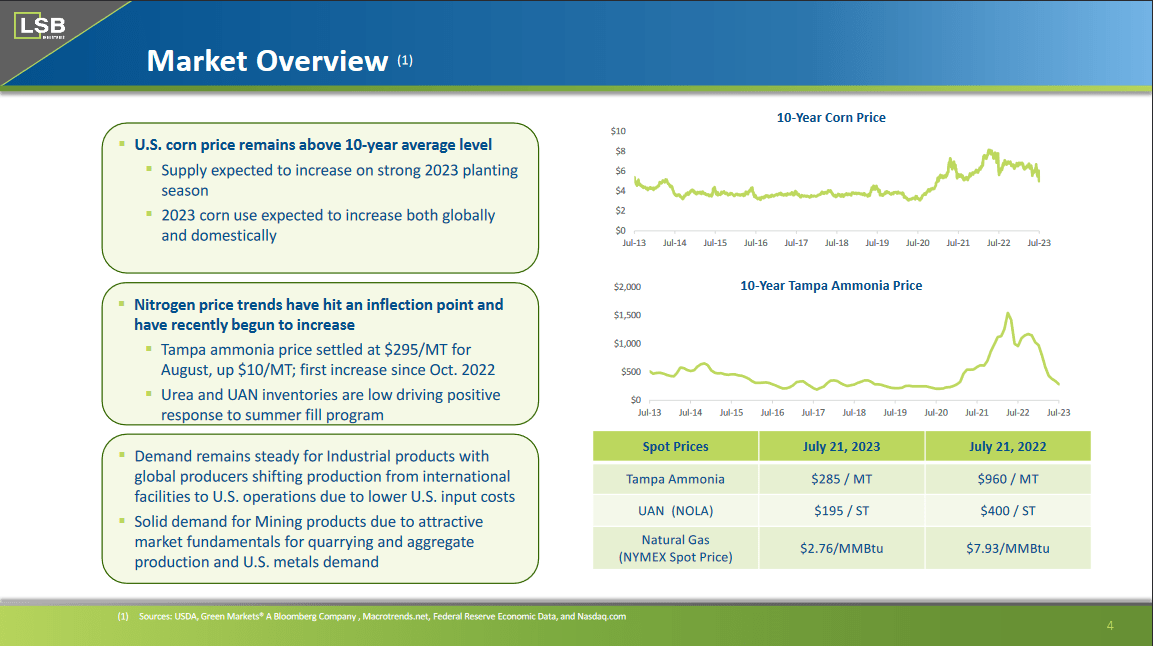

Market Overview (Investor Presentation)

The revenues and earnings for LXU are much more driven by strong commodity prices as that is further during growth and demand for the products and services that the company offers. As a result of the war starting in Ukraine, the price of a lot of commodities prices rose quickly in a short period. It has not fully returned to where they were before, as it became clear the need to secure strong and reliable food sources is crucial. For LXU this has meant strong demand as their fertilizer blends help erode some of the issues farmers face with diseases or pests entering the fields. This yields stronger harvests and makes farmers and producers reliant on LXU and their products. The prices may have not returned to where they were in early 2022, but the outlook remains very optimistic as LXU indicates they see 2023 being a strong planting season and that corn use is increasing not just in the US but also on a global scale.

Quarterly Result

The last quarter may have shown a significant decline in the bottom line, but that seems to have been expected somewhat, as the prices of many commodities aren’t where they used to be 12 months before. I think that LXU is going to experience some further declines on a YoY basis in the coming third quarter, but as 2023 seems like a good planting year, earnings may start increasing in Q1 of FY2024.

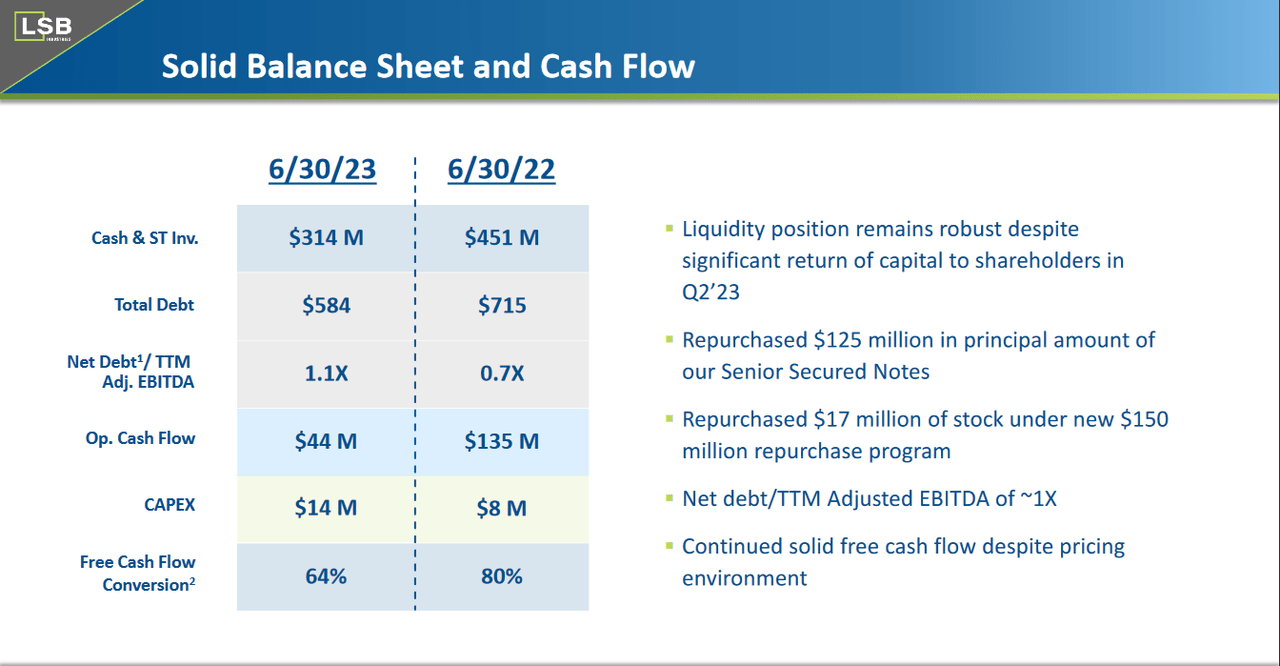

Balance Sheet (Investor Presentation)

The company did not hold back though on their spending for the quarter, as they repurchased shares worth $125 million. This has drastically reduced the outstanding shares, as the market cap of the company is just under $800 million. In my opinion, the company is still quite highly valued, and buying right now may perhaps not be the strongest move. Investing in bigger production capabilities would have been preferable, I think, especially if the company sees a decent outlook for the medium term with global corn use rising, for example. What makes me further say this is the fact the FCF conversion rate is decreasing and this is of course resulting in less capital available to distribute to shareholders, and a more constrained financial position to operate from. Going into the third quarter, I would like to see a slowdown in the buybacks and instead a build-up of the cash position or investments into new facilities, for example.

Risks

In 2015, the company embarked on a significant expansion project at its EL Dorado facility. Unfortunately, this endeavor turned out to be a major setback for LXU, ultimately leading to a legal dispute with its EPC contractor. The company openly communicated these challenges in its financial filings and earnings calls, providing a transparent view.

Market Overview (Investor Presentation)

However, it’s worth acknowledging that LXU’s management has demonstrated commendable efforts in enhancing the operational efficiency of its facilities. A notable shift occurred in the company’s operational performance over the years. In 2015, LXU’s onstream rates, which indicate the percentage of time a facility is operating at full capacity, were hovering in the high 70s, reflecting room for improvement.

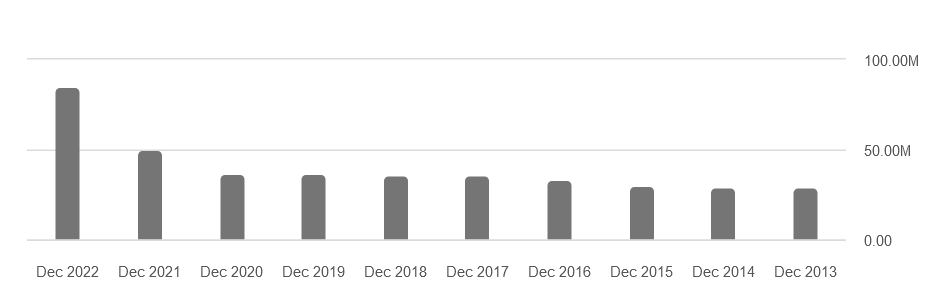

Shares Outstanding (Seeking Alpha)

Besides the challenges the company has had previously, looking more closely at investor risks, I think that the fact shares have diluted historically and quite recently too does paint the picture that investors may be faced with more dilution if interest rates increase further. The TTM thought the company has been buying back shares atleast, but they are still up far from 2021 when it was at 50 million outstanding, now sitting at 78 million instead.

Valuation & Wrap Up

What keeps me from rating LXU a buy right now, I think, comes down to the valuation the company is receiving. The fertilizer market has been incredibly volatile as the war in Ukraine shook the market. Now, though, I think that the company needs to consolidate and build up a strong cash position rather than buying back shares. The outlook remains strong, and I would have preferred to see spending go into new facilities. To give some valuation insight, LXU is based on FWD projected earnings trading at a near 40% premium to the sector, which has me worried there is a high probability of a correction if the market conditions worsen further.

Company Valuation (Yahoo Finance)

For this reason, I am instead of seeing LXU as a buy, rating it a hold instead. The fertilizer market remains strong based on fundamental demand in the long term, but for now, I still want to get in at a reasonable price.