Kittisak Kaewchalun /iStock via Getty Images

LSB Industries (NYSE:LXU) engages in the manufacture and sale of chemical products for the agricultural and industrial markets. They provide nitrogen-based fertilizers, such as ammonia, urea ammonia nitrate for fertilizers, and NPK fertilizer blend applications. They also provide high-purity and commercial-grade ammonia, sulfuric acids, carbon dioxide, and regular nitric acids for various applications; pulp and paper, water treatment, vanadium processing, refrigerants, exhaust steam additive, surface mining, and construction applications. They sell their products in the United States, Canada, and Mexico. LXU was incorporated in 1968. LXU recently posted its FY22 and Q4 FY22 results. In this thesis, I’ll examine their financial results and discuss their expansion prospects. Their income and revenue increased considerably in FY22, and I predict that FY23 will be another successful year for them. Therefore, I think now is the ideal time to buy LXU.

Financial Analysis

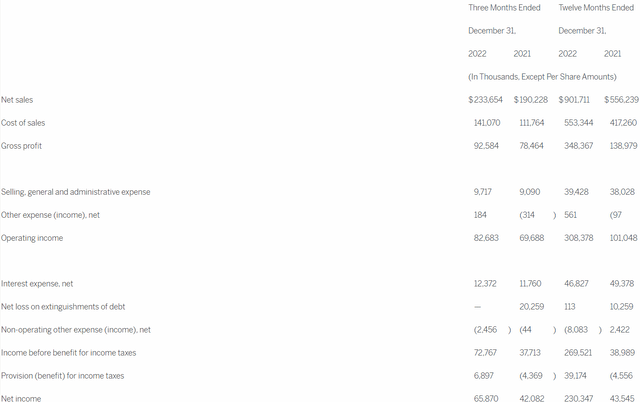

LXU recently posted its FY22 and Q4 FY22 results. They exceeded market expectations for EPS by 22.42% but fell short of expectations for sales by 3.57%. The net sales for FY22 were $901.7 million, a rise of 62.1% compared to FY21. The selling prices for their products in FY22 were higher than the historical selling price average, which, in my opinion, was the main reason for the increase in revenues. They also made strategic commercial efforts to sell their output at favorable margins. As a result, the year FY22 marked the company’s highest earnings. The net income for FY22 was $230.3 million, a rise of 429% compared to FY22. In my opinion, better expense management and the increase in demand for nitrogen fertilizers in FY22 were the primary drivers of the increase.

LXU’s Investor Relations

The reported net sales for Q4 FY22 were $233.6 million, a rise of 22.8% compared to Q4 FY21. I think the company’s investments in the EL Dorado and Pryor facilities, which helped them by raising their revenues, and a more effective pricing plan also contributed to the rise. The net income for Q4 FY22 was $65.8 million, a rise of 56.5% compared to Q4 FY21. The financial performance of LXU in FY22 was exceptional, in my view. They were still able to record strong results in 2022 despite the market’s weakness and high inflation.

Technical Analysis

Trading View

LXU is trading at the level of $13.75. The price has declined by about 55% since April 2022, when it reached a high of $27. Now that it has established a solid base at $12, it has also produced a double bottom pattern in a weekly time frame which is regarded as a bullish pattern. A double bottom pattern has a good chance of succeeding when it forms during a decline. It may be a sign of a trend reversal, and if we look at the downside risk, it is constrained because there is a significant support zone at $12. However, there is considerable upside potential. In three months, I believe it could rise up to 30%.

Should One Invest In LXU?

Seeking Alpha

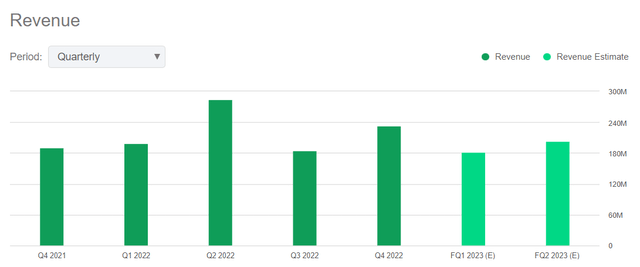

In terms of revenue, they did exceptionally well in Q4 FY22. Compared to Q3 FY22, Q4 FY22 had a 26.8% greater revenue. Now, if we examine the estimated Q1 FY23 revenue of about $181.6 million, we can see that it is smaller than the Q4 FY22 revenue. However, I am not concerned about the income decline because I think it will begin to rise in Q2 FY23. I think FY23 will be a wonderful year for the business, and the reason I say this is because corn is so scarce. The global corn stock-to-use ratios are at multi-year lows. It will take at least three years to get the numbers back to where they were historical. Therefore, I think farm profitability will continue to be appealing, and corn prices will remain high. As a result, more corn will be planted on acres. This might benefit the company as I believe the demand for nitrogen fertilizers will increase in the coming quarters. Therefore, I am confident that FY23 will be a successful financial year for them.

Talking about the company’s valuation. The first ratio which I will use to judge the valuation is the P/E ratio. The P/E ratio measures a company’s present share price in relation to its per-share earnings when valuing it. It is a reliable valuation metric. They have a P/E (FWD) ratio of 8.1x compared to the sector ratio of 14.37x. The second ratio is the EV / EBITDA. In this, the company’s enterprise value is measured against its earnings before interest, taxes, depreciation, and amortization. They have an EV / EBITDA (FWD) ratio of 4.89x compared to the sector ratio of 7.59x. After examining both ratios, I think they are undervalued, have a ton of space to grow, and could give shareholders sizable returns.

Risk

If seasonal demand is lower than anticipated, they might have extra inventory that needs to be either stored, in which case any resulting increase in storage costs will adversely affect their operating results, or liquidated, in which case the selling price might be lower than their production and storage costs. The volatility of natural gas and nitrogen fertilizer prices, as well as the comparatively limited window of time during which farmers can apply nitrogen fertilizers, increase the risks related to excess inventory and product shortages. If the cost of their goods falls sharply, they might have to write down inventory, which would hurt their financial results.

Bottom Line

I believe there is no valid cause not to invest in LXU after considering all the relevant factors. They appear to be fundamentally and technically sound, and I believe they are undervalued. Their income and sales both rose sharply in FY22. The technical chart of it is also displaying positive indicators. As a result, I think they might generate sizable returns in the future. I, therefore, give LXU a buy recommendation.