Bryan Bedder/Getty Images Entertainment

The Lovesac Company (NASDAQ:LOVE) is a small-cap furniture stock with a market cap of $362.16 million that released its Q1 2024 earlier this month. It has been steadily increasing its top-line results amidst industry headwinds. Although EPS results have been less consistent, the company expects to produce between $1.83 and $2.24 earnings per share for FY2024. Since going public in 2018, it has rewarded investors with 12.90% returns.

Historic stock trend (SeekingAlpha.com)

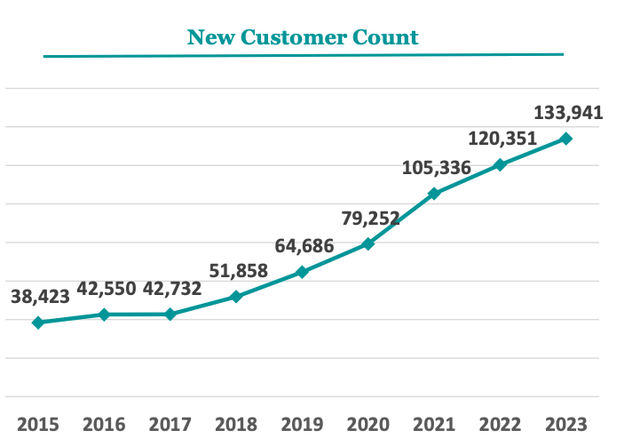

Lovesac is a niche furnishing business with a loyal customer following, which continues to grow year by year. One of the major highlights is that the products are reverse compatible, incentivising repeat and supplement purchases and ultimately developing loyal customers within a highly competitive industry. Lovesac is increasing its new customer count, has a healthy balance sheet, YoY sales have increased by 9% amidst furniture industry headwinds, and management expects positive EPS results for FY2024. Therefore investors may want to take a bullish stance on this creative and founder-run company.

New customer count (Investor presentation 2023)

Company overview

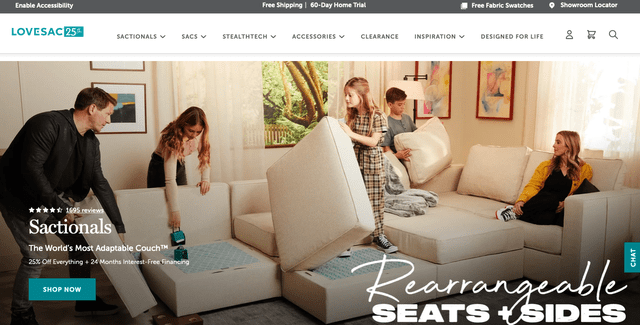

The Lovesac is a furniture company founded by current CEO Shawn Nelson in 1998, shortly after he built the original oversized beanbag chair in his parent’s basement. The company has had a non-traditional growth path from humble beginnings, including a million-dollar award to the CEO for winning Richard Branson’s Rebel Billionaire in 2004. Lovesac went public in 2018 and has increased its range to include sactionals, adaptable couches priced between $2,840 to $10,000, making up most of the total revenue, 90.58% of sales in Q1 2024.

Lovesac offerings (lovesac.com)

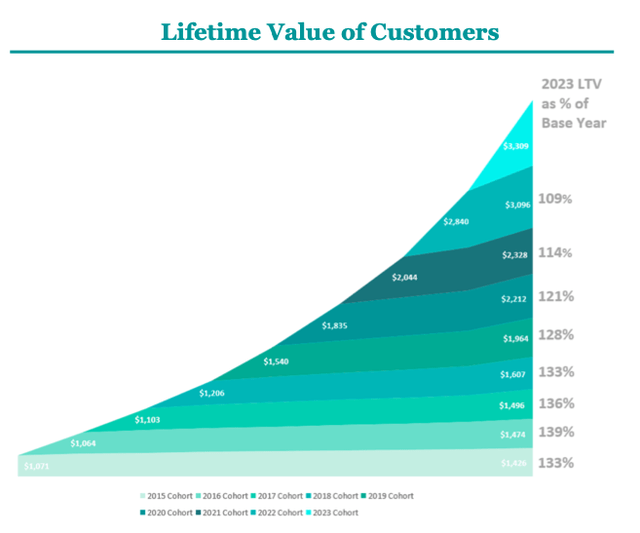

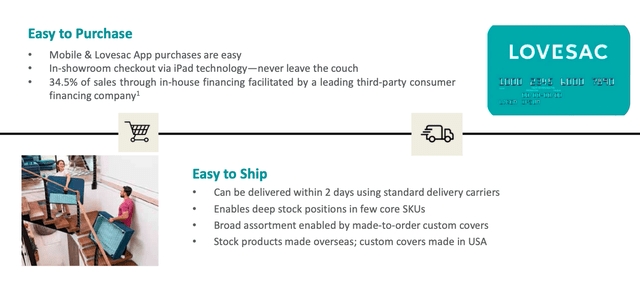

One of the business’s key strengths is its products’ practical nature. The products are designed easy-to-ship, every part of the furniture is replaceable, and offerings are reverse compatible. This incentivises repeat and supplement purchases that have continued increasing the lifetime value of Lovesac’s customers.

Lifetime value of customers (Investor presentation 2023)

The company benefits from its direct-to-consumer market strategy by tailoring its showrooms for quick, easy and independent sales and increasing its investment in its digital platform and distribution methods.

Technological advancements and shipping (Investor presentation 2023)

Q1 2024 Earnings

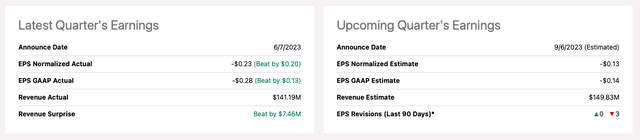

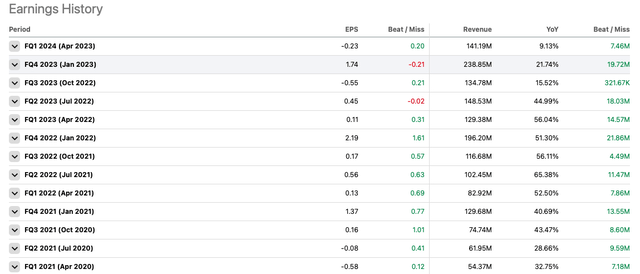

Earlier this month, Lovesac reported its Q1 2024 Earnings. Though EPS exceeded expectations, it was still negative at $0.28 per share. For Q2 2024, management predicts a per share loss between $0.12 and $0.16. This estimate is lower than the previous year’s Q2 due to increased industry headwinds, leading to a more competitive promotional environment.

Q1 2024 Earnings (SeekingAlpha.com)

When we examine the EPS performance per quarter, we notice that while there has been a YoY decrease, it has actually increased over a two-year span.

EPS per quarter history (SeekingAlpha.com)

Management has predicted that the total sales for the year will be within the range of $700 million to $740 million, with the EPS expected to be between $1.83 and $2.24. The EPS for FY2023 was $1.77.

Financials and valuation

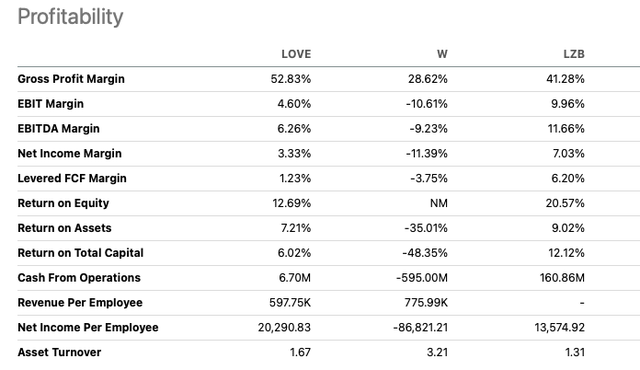

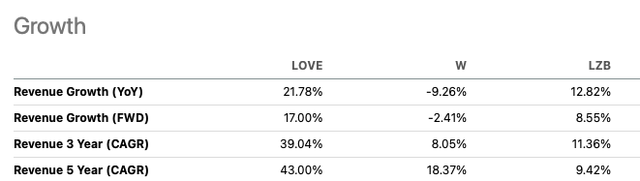

The company has successfully increased its top line YoY since its IPO in 2018. Although its gross profit margin has been reducing since FY2017 from 55.20% to 52.83% TTM, its margin remains very high within the furniture industry, with its products aimed at attracting higher-end customers.

Annual revenue and gross profit trend (SeekingAlpha.com)

If we compare it to some of its larger peers, such as Wayfair (W) and La-Z-Boy (LZB), we see Lovesac maintaining a healthy margin at 52.83% compared to 28.62% for Wayfair and 41.28% for La-Z-Boy. We can also see that Lovesac has produced double-digit top-line growth over the short and long term.

Profitability versus peers (SeekingAlpha.com) Revenue growth versus peers (SeekingAlpha.com)

The company generated $8.2 million in positive levered free cash flow in the past year, but it had negative free cash flow in the previous two financial years. The balance sheet shows that the company currently has $45.1 million in cash and a revolving credit line of $36 million available with no borrowings for Q1 2024.

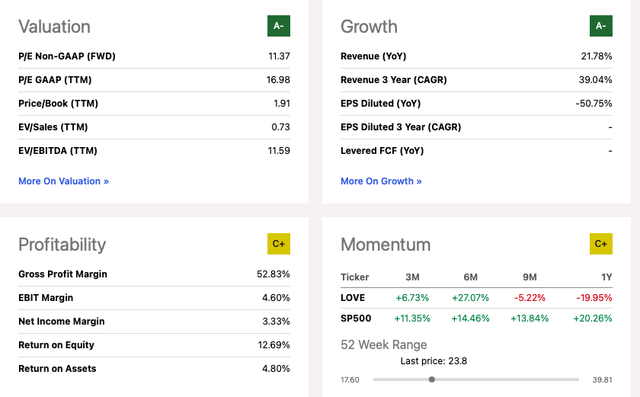

Although the release of Lovesac’s Q1 2024 results had a positive impact on its stock price, investors should be cautious of the high short interest at 32.39%, which suggests a negative sentiment towards the stock. The stock has only outperformed the S&P over the last 6 months, but it has an attractive price to earnings ratio of 11.37 and shows attractive growth of 21.78% YoY despite a challenging market.

Quant rating (SeekingAlpha.com)

Risks

Lovesac is a minor player in a large and fiercely competitive furniture industry. While the company has benefitted from its online and offline direct-to-consumer approach and maintained customer loyalty through its reverse-compatible products, larger peers benefit from economies of scale and could offer more competitively priced alternatives. It is a consumer discretionary stock which is impacted by the health of the economy; while consumers continue to be cautious of what they spend their money on, competitive markets such as furnishings continue to cut into gross margins through its promotional market, which impacts the growth of the business. Lovesac does not have a large variety of products; its lack of diversification could affect the company’s long-term development.

Final thoughts

Lovesac is a niche furnishing company with an attractive business model focusing on creating long-term and repeat customers through its reverse-compatible product selection. It has been delivering consistent upward-trending top-line results, increasing the number of new customers year on year, and increasing customer lifetime value through repeat purchases and upgrades. Although cautious of the competitive nature of the business, Lovesac continues to deliver solid fundamentals and has a positive outlook for FY2024. Therefore investors may want to take a bullish stance on this company.