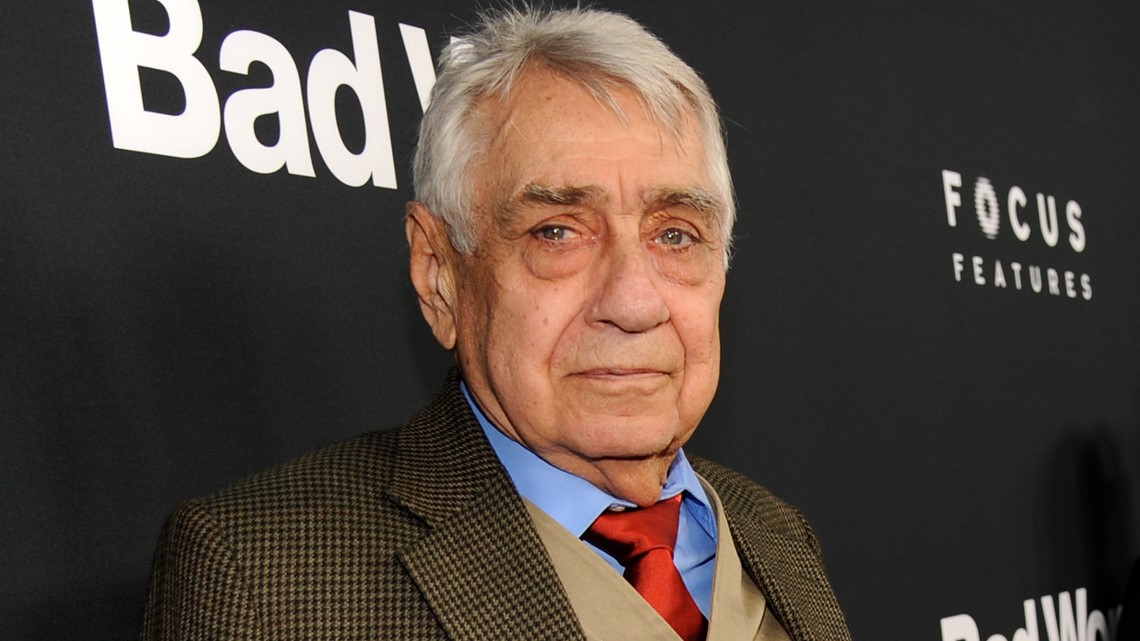

Federal Reserve Chairman Jerome Powell adjusts his tie as he arrives to testify earlier than a Senate Banking, Housing and City Affairs Committee listening to on “The Semiannual Financial Coverage Report back to the Congress” on Capitol Hill in Washington, July 15, 2021.

Kevin Lamarque | Reuters

Wall Avenue and the Federal Reserve appeared to enter a brand new actuality this week, and the outcome for traders was massive losses with no apparent finish level in sight.

The S&P 500 posted its tenth down week within the final 11, and is now properly right into a bear market. On Thursday, all 11 of its sectors closed greater than 10% beneath their current highs. The Dow Jones Industrial Common fell beneath 30,000 for the primary time since January 2021 this previous week.

Not like current drawdowns for shares, nevertheless, the central financial institution is not going to be placing a backside available in the market. As an alternative, the Fed raised rates of interest by three-quarters of a proportion level on Wednesday — its largest since 1994 — and signaled continued tightening forward. Chair Jerome Powell will testify earlier than Congress subsequent week and is predicted to carry agency on his plan for a extra aggressive Fed till inflation is delivered to heel.

Financial institution of America fairness strategist Ajay Singh Kapur mentioned in a word to purchasers on Friday that it’s time for traders to cease preventing the Fed and quit the buy-the-dip mentality.

“In a bear market, heroism is punished. Valor is pointless, and cowardice is known as for in portfolio building — that’s the strategy to protect capital and reside to battle one other day, ready for the following central financial institution panic, and higher valuations and a brand new earnings upcycle,” Kapur wrote.

Tech shares, that are delicate to rates of interest, have been hit significantly arduous, as have cyclical performs similar to airways and cruise traces.

However the dramatic declines haven’t been restricted to shares. Bitcoin dropped greater than 30% in every week amid stories about blowups of crypto-focused buying and selling companies. Treasury yields, which transfer reverse of bond costs, have spiked.

Markets briefly rallied on Wednesday afternoon after the Fed’s announcement, however that optimism was rapidly dashed and the beneficial properties reversed on Thursday. Many strategists are warning that markets and sentiment might have additional to fall, pointing to Wall Avenue earnings estimates that curiously nonetheless present strong progress within the coming yr.

“These folks have to battle inflation as quick as potential and as arduous as potential. And the market has persistently been behind the curve on attempting to grasp how aggressive this Fed was going to be,” mentioned Andrew Smith, chief funding strategist at Delos Capital Advisors.

Recession forward?

The influence of the Fed’s fee hikes in the marketplace has been magnified by deteriorating financial knowledge, as traders and strategists look like shedding confidence within the central financial institution’s potential to attain a mushy touchdown.

The housing market seems to be cooling quickly, with housing begins and mortgage purposes plummeting. Client sentiment is plumbing report lows. Jobless claims are starting to pattern increased as stories of layoffs at tech companies develop. And all oil costs present no indicators of falling again beneath $100 per barrel because the summer season journey season kicks off.

In a word to purchasers on Friday, Financial institution of America world economist Ethan Harris described the U.S. economic system as “one revision away from recession.”

“Our worst fears across the Fed have been confirmed: they fell means behind the curve and are actually enjoying a harmful recreation of catch up. We search for GDP progress to sluggish to nearly zero, inflation to settle at round 3% and the Fed to hike charges above 4%,” Harris wrote.

Even amongst extra optimistic economists, the outlook requires a somewhat bumpy touchdown. JPMorgan’s Michael Feroli mentioned in a word Friday that he anticipated Powell to be “largely profitable” in balancing preventing inflation with financial progress, however a recession is a definite chance.

“This desired mushy touchdown is just not assured, and Fed chair Powell himself has famous that reaching this purpose is probably not solely easy. And with a decent labor market and the economic system coping with the shocks of tighter monetary situations and better meals and vitality costs, recession dangers are notable as we take into consideration the following few years,” Feroli wrote. “Our fashions level to 63% likelihood of recession over the following two years and 81% odds {that a} recession begins over the following three.”

Developing

Powell shall be within the sizzling seat once more subsequent week, as he returns to Capitol Hill to testify earlier than each homes of Congress, and he’s unlikely to melt his stance over the weekend.

The Fed Chair mentioned on Wednesday that he and his committee members had been “completely decided” to maintain inflation expectations from rising. The central financial institution mentioned in a report back to Congress on Friday forward of the hearings that its dedication to cost stability is “unconditional.”

Inflation has risen to a high political difficulty, in addition to an financial one, and the Fed’s raised forecast for unemployment might additionally come underneath scrutiny from lawmakers.

“As they’ll 2.5%, 3.5% [Fed funds rate], if the economic system is slowing towards a recession, I do not suppose they’ll stand on the throat of the economic system to get inflation to go down,” mentioned Robert Tipp, chief funding strategist for PGIM Fastened Earnings. “…In any other case, as a way to get inflation down from 3.5% to 2%, you are going to must lose your job. That is going to be the message: We will must get some job losses and recession. And I do not suppose that trade-off goes to be value it for them.”

On Friday, traders will get an up to date client sentiment studying from the College of Michigan. That measure has now taken on elevated significance after Powell pointed to it this week as one of many causes the Fed determined to boost its fee hike this month.

The survey’s preliminary studying for June confirmed a report low for sentiment, and affirmation of that quantity — and even additional deterioration — would doubtless function additional proof that the Fed is not going to waver within the coming months. The inflation expectations a part of the survey, which rose within the preliminary studying, shall be watched carefully.

Outdoors of these occasions, subsequent week is comparatively gentle for financial occasions, with U.S. inventory markets closed on Monday for Juneteenth. Traders shall be searching for perception into the U.S. economic system in earnings stories from just a few bellwether shares, similar to Lennar on Tuesday and FedEx on Thursday.

Week forward calendar

Monday

Earnings: Kanzhun

U.S. inventory market closed for Juneteenth

Tuesday

Earnings: Lennar

8:30 a.m. Chicago Fed Nationwide Exercise Index

10:00 a.m. Present dwelling gross sales

Wednesday

Earnings: Korn Ferry, Winnebago

9:30 a.m.: Fed Chair Jerome Powell testifies to the U.S. Senate Banking Committee

Thursday

Earnings: Accenture, FedEx, Darden Eating places, FactSet Analysis Programs

8:30 a.m. Jobless claims

10:00 a.m. Fed Chair Jerome Powell testifies to the U.S. Home Committee on Monetary Companies

Friday

Earnings: CarMax

8:00 a.m. Constructing permits

10:00 a.m. Michigan Sentiment

10:00 a.m. New dwelling gross sales