Torsten Asmus

I not too long ago got here throughout the PIMCO Senior Mortgage Lively Change-Traded Fund (NYSEARCA:LONZ) whereas researching high-yielding investments.

The LONZ ETF is an actively managed fund targeted on the leveraged mortgage asset class. Whereas LONZ has outperformed a passive leveraged mortgage ETF, the outperformance seems to be a results of LONZ’s decrease credit score high quality investments and better leverage.

Trying ahead, with unemployment rising and an financial slowdown on the horizon, traders might need to high-grade their portfolios away from the non-investment-grade leveraged loans held in LONZ’s portfolio. Funding-grade CLO ETFs could also be viable options, paying comparable yields with higher credit score high quality.

Fund Overview

The PIMCO Senior Mortgage Lively Change-Traded Fund is a not too long ago launched ETF from the fixed-income consultants at PIMCO focusing on the financial institution mortgage asset class.

Financial institution loans, also referred to as senior loans or leveraged loans, are floating-rate debt securities issued by corporations with lower than pristine credit score histories. Traditionally, these loans have been prolonged by banks, therefore the time period financial institution loans, though in recent times, many non-bank entities corresponding to hedge funds have been extending leveraged loans to corporations.

The LONZ ETF primarily invests in an actively managed portfolio of leveraged loans and US collateralized mortgage obligations (“CLOs”). CLOs are artificial securities constructed from the securitization of baskets of leveraged loans.

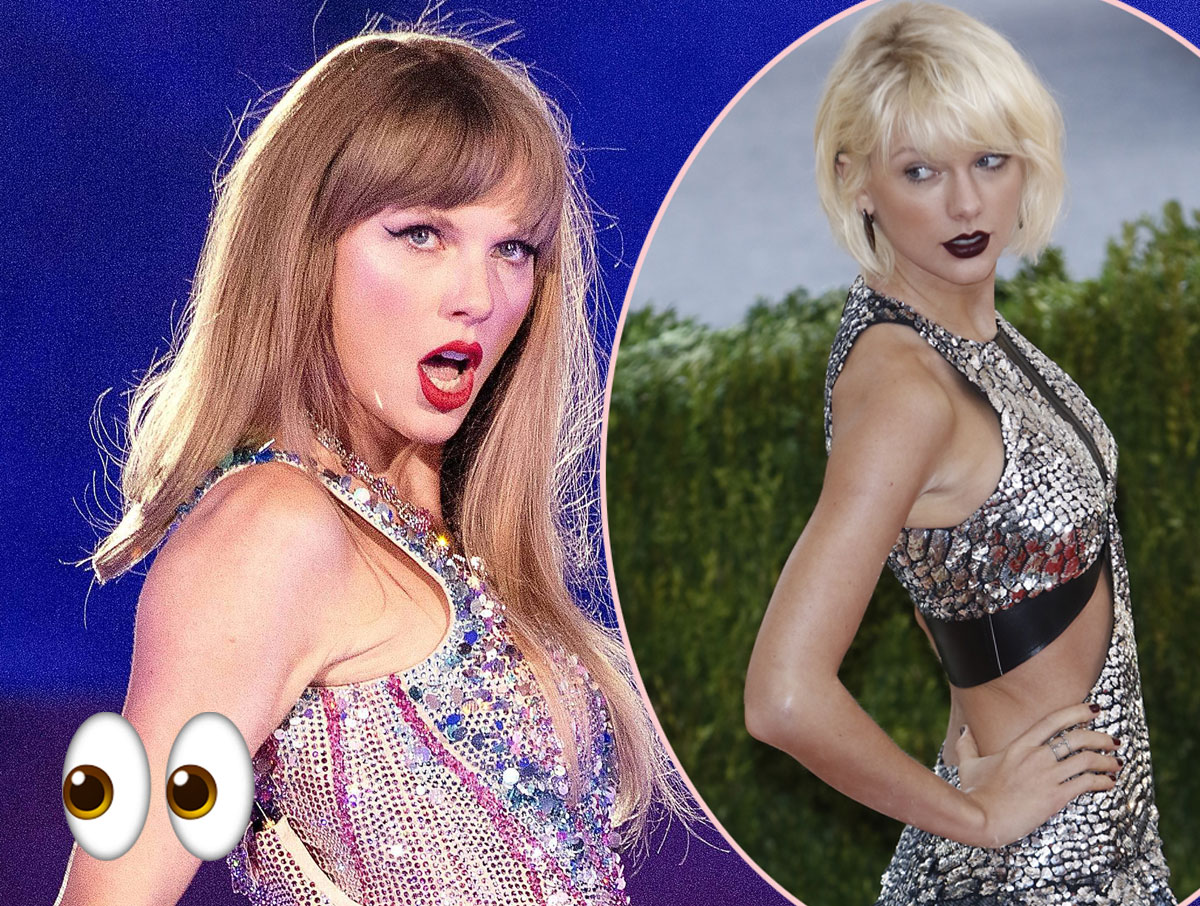

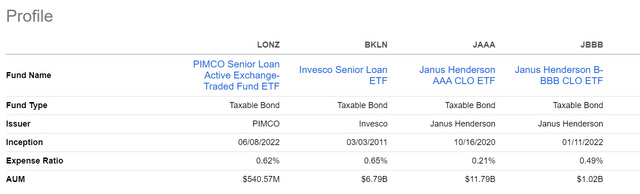

The LONZ ETF has $541 million in belongings (Determine 1) and expenses an adjusted expense ratio of 0.60% (charge waivers till October 2025; reverts to 0.72% thereafter).

Determine 1 – LONZ overview (pimco.com)

Portfolio Holdings

Trying by the fund’s disclosure, we see that the LONZ ETF has a 30-Day SEC yield of 6.5% whereas paying a distribution yield of 6.7% (Determine 2).

Determine 2 – LONZ yields and distribution (pimco.com)

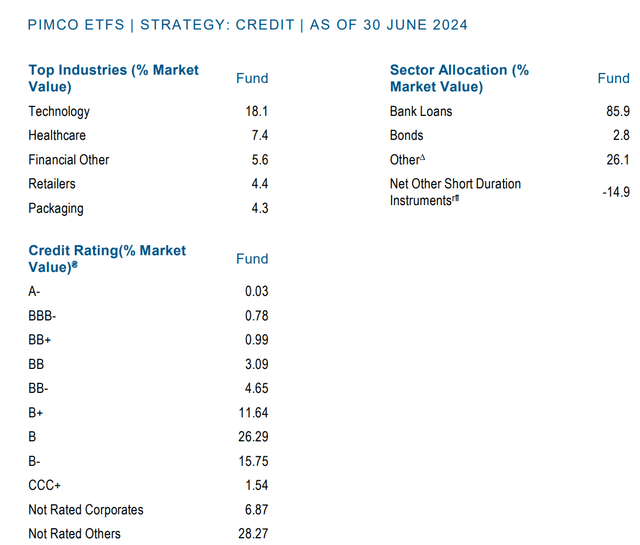

The fund holds 328 securities with 86% of the portfolio allotted to financial institution loans, 3% allotted to bonds, and 26% allotted to “Different” securities which presumably means CLOs (Determine 3). The LONZ ETF additionally has a -15% allocation to different short-duration devices, which implies the fund has inside leverage.

Determine 3 – LONZ portfolio allocations (LONZ factsheet)

By way of credit score high quality, the vast majority of LONZ’s portfolio is rated non-investment grade (CCC- to BB-rated), with 8.7% allotted to BB-rated securities, 53.7% allotted to B-rated securities, 1.5% CCC-rated, and 35.1% unrated.

Efficiency

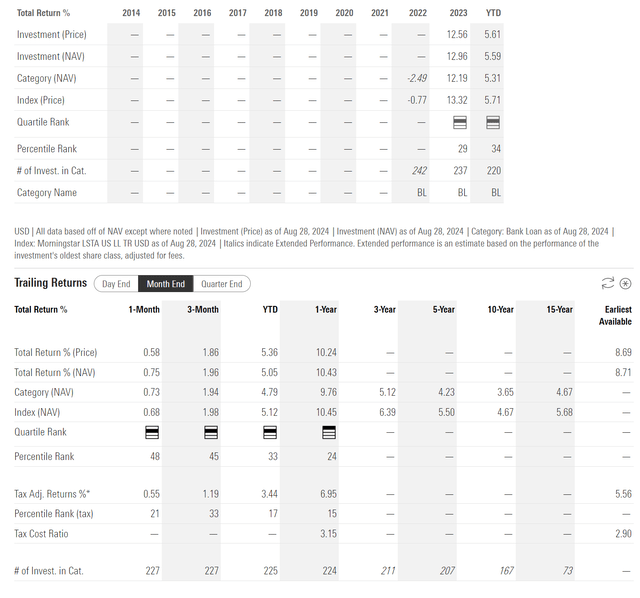

By way of historic efficiency, the LONZ ETF has executed nicely since its inception in June 2022, returning 13.0% in 2023 and 10.4% on a 1-year foundation to July 31, 2023 (Determine 4). Since inception, the fund has delivered common annual returns of 8.7%.

Determine 4 – LONZ historic returns (morningstar.com)

LONZ vs. BKLN

Nevertheless, it’s arduous to take a look at LONZ’s efficiency in isolation, since a fund can ship sturdy returns by taking extreme dangers or leverage. To evaluate whether or not the fund supervisor has added ‘alpha’, I often like to match a given fund’s efficiency towards passive ETFs that characterize its asset class.

For the LONZ ETF, I consider an appropriate passive ETF to match to is the Invesco Senior Mortgage ETF (BKLN). The BKLN ETF tracks the funding outcomes of the Morningstar LSTA US Leveraged Mortgage 100 Index (“Index”) and is the biggest passive ETF focusing on the leveraged mortgage asset class.

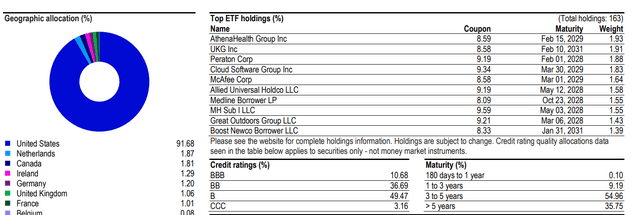

Determine 5 exhibits BKLN’s credit score high quality allocation. We will see that in comparison with the LONZ ETF, the BKLN ETF has greater credit score high quality, with 10.7% of its portfolio BBB-rated (in comparison with 0.8% for LONZ), 36.7% BB-rated (vs. 8.7%), 49.5% B-rated (vs. 53.7%), and solely 3.2% rated CCC or unrated (vs. 36.6% for LONZ).

Determine 5 – BKLN portfolio allocation (BKLN factsheet)

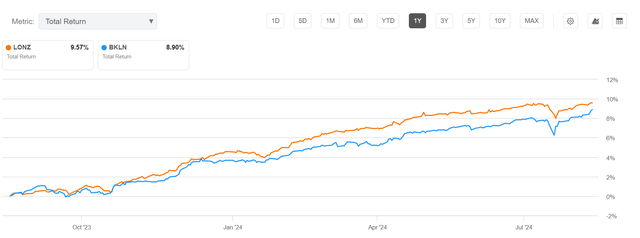

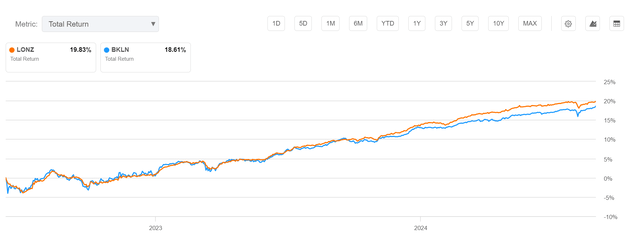

Evaluating LONZ towards BKLN, the LONZ has outperformed on a 1-year foundation, returning 9.6% towards BKLN’s 8.9% (Determine 6).

Determine 6 – LONZ vs. BKLN, 1-year returns (In search of Alpha)

Since its inception, LONZ has returned 19.8% vs. 18.6% for BKLN (Determine 7).

Determine 7 – LONZ vs. BKLN, since inception returns (In search of Alpha)

Whereas LONZ has outperformed BKLN traditionally, we have to take into account the truth that LONZ’s portfolio is significantly decrease high quality (decrease credit score scores) and LONZ employs leverage. Adjusted for leverage, LONZ might not have outperformed.

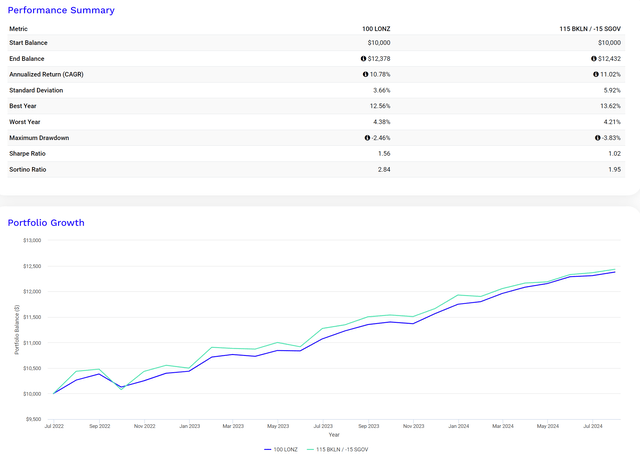

For instance, if we mannequin a portfolio that’s lengthy 115% BKLN whereas brief 15% the iShares 0-3 Month Treasury Bond ETF (SGOV) (approximating a 15% leveraged lengthy place in BKLN), we are able to see that this mannequin portfolio’s return since LONZ’s inception is just about equivalent to that of the LONZ ETF (Determine).

Determine 8 – LONZ vs. leveraged lengthy BKLN (Creator created with Portfolio Visualizer)

Think about CLOs As a substitute Of Financial institution Loans

Moreover, contemplating the credit score high quality of LONZ’s portfolio, I like to recommend traders take a look at various floating-rate funds just like the Janus Henderson AAA CLO ETF (JAAA) or the Janus Henderson B-BBB CLO ETF (JBBB).

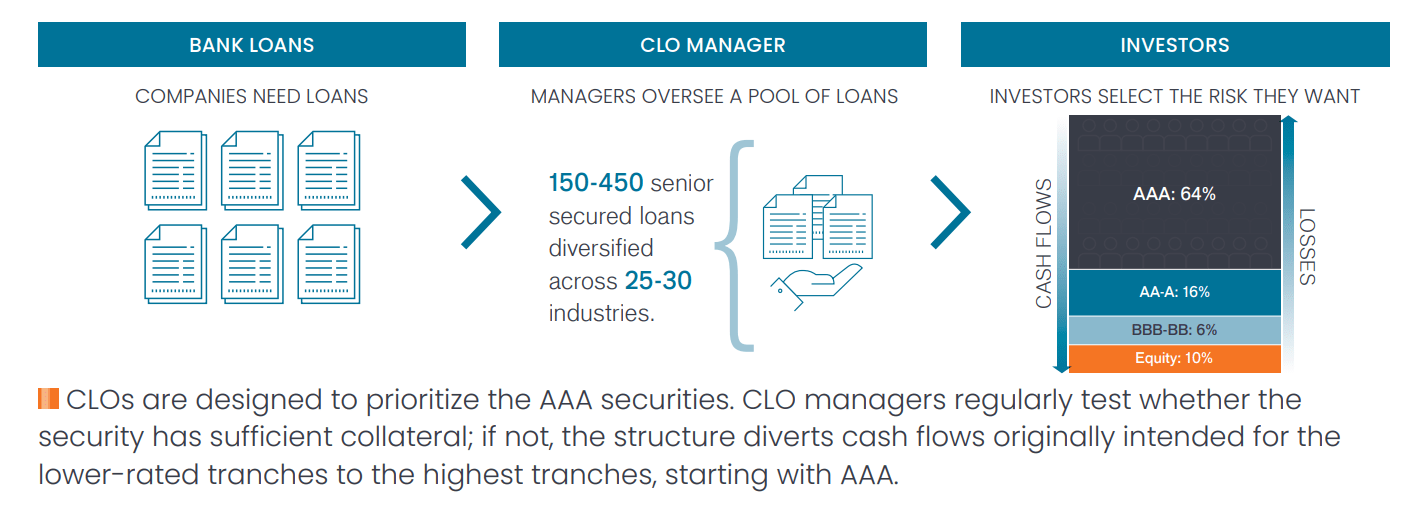

JAAA holds a portfolio of floating-rate AAA-rated Collateralized Mortgage Obligations (“CLO”) whereas JBBB holds BB- to B-rated CLOs. To know why CLOs could also be higher than leveraged loans, we first want to grasp the CLO construction and securitization course of.

As briefly talked about above, CLOs are securities created from baskets of underlying leveraged loans. By a securitization and tranching course of, CLO managers create extremely rated artificial investment-grade securities (BBB- to AAA-rated) from non-investment-grade leveraged loans (Determine 9).

Determine 9 – CLO overview (JAAA product transient)

Funding-grade CLO debt tranches are protected against credit score losses by structural enhancements like over-collateralization and curiosity diversion. Over-collateralization signifies that the CLO supervisor might pool collectively $120 million of loans to create $100 million of investment-grade debt securities plus $20 million of ‘fairness’ securities. When credit score defaults happen on this portfolio, the extra senior debt tranches of the safety (i.e., AAA) are protected against defaults by the fairness and junior debt tranches (i.e., the ‘fairness’ tranches take the primary loss, adopted by CCC, B, BB, and so on.).

Curiosity diversion means senior debt tranches have precedence on the cashflows collected from the pool of loans (i.e. AAA tranches are paid curiosity first, adopted by AA, and so on.).

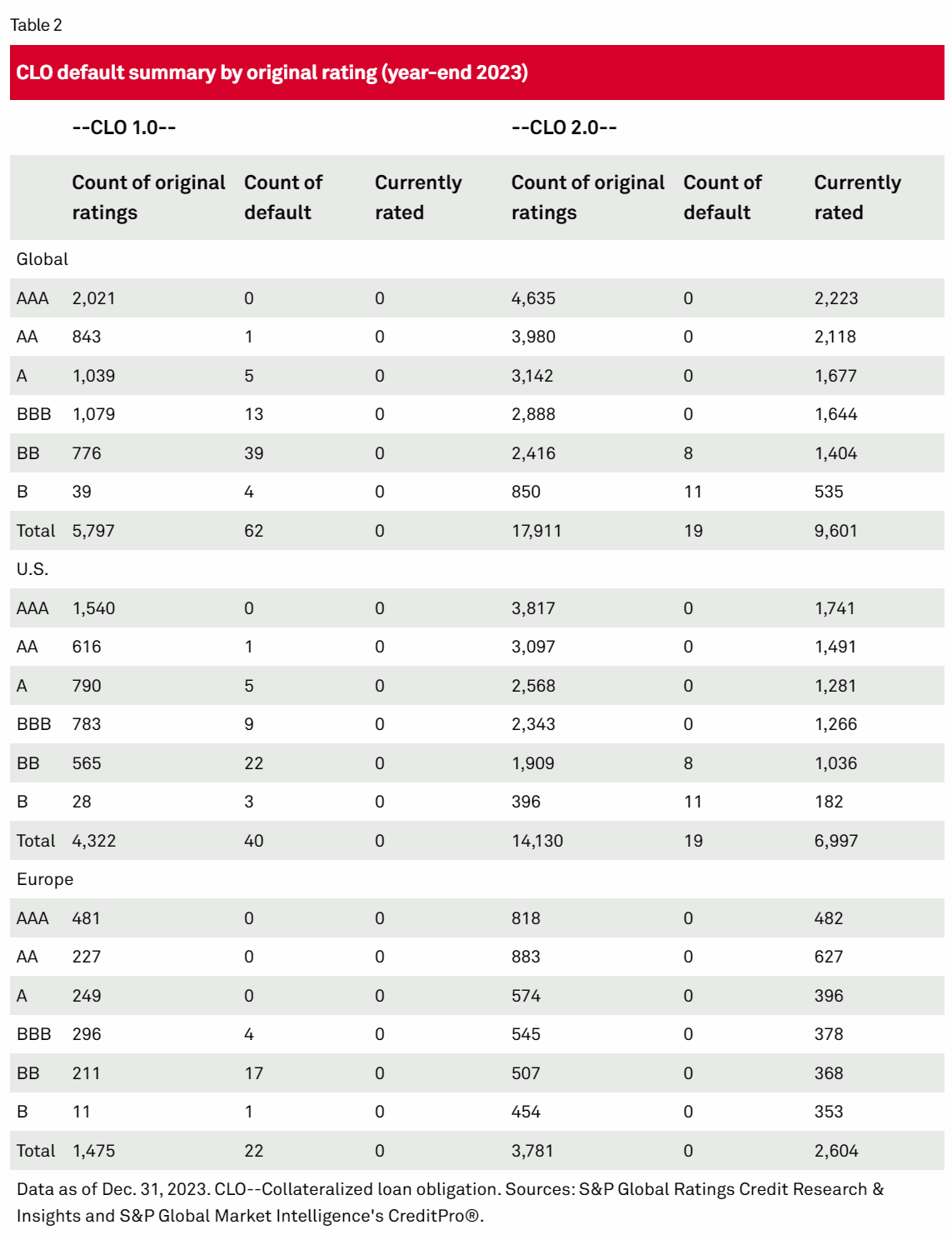

As a result of these structural enhancements, CLOs have traditionally skilled only a few credit score defaults, even by the 2008 Nice Monetary Disaster (Determine 10).

Determine 10 – CLO defaults by authentic credit standing (S&P World)

Evaluating the LONZ ETF towards BKLN, JAAA, and JBBB, we are able to see that the Janus Henderson CLO funds additionally cost materially decrease bills (Determine 11).

Determine 11 – LONZ vs. BKLN, JAAA, and JBBB fund buildings (In search of Alpha)

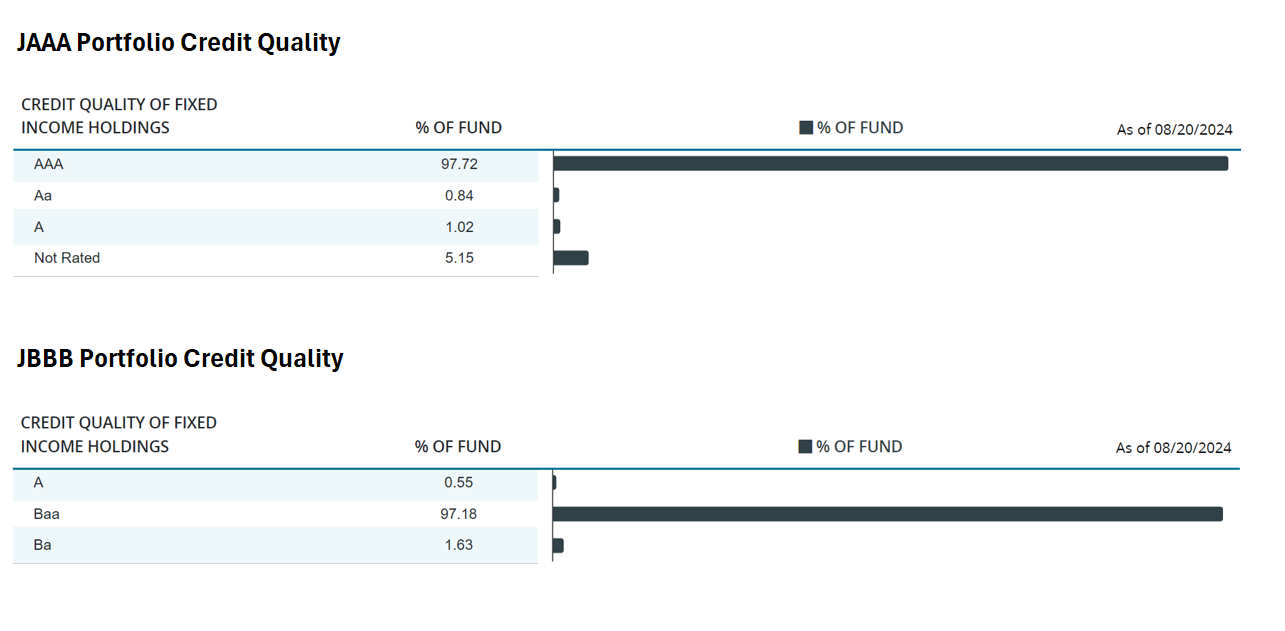

Moreover, when it comes to credit score high quality, the JAAA and JBBB ETFs maintain considerably higher-quality portfolios, with 97.8% of JAAA’s portfolio AAA-rated whereas 97.7% of JBBB’s portfolio is BBB-rated or above (Determine 12)

Determine 12 – JAAA and JBBB portfolio credit score high quality allocations (janushenderson.com)

Although credit score high quality is healthier, the JBBB ETF has traditionally outperformed the LONZ ETF, returning 21.0% since LONZ’s inception in June 2022 (Determine 13).

Determine 13 – LONZ vs. BKLN, JAAA, and JBBB, since inception returns (In search of Alpha)

Beware A Slowing Financial system

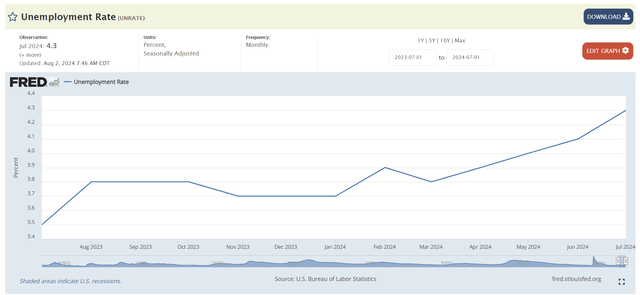

In current months, I’ve penned a number of articles warning of a slowing financial system. In my private opinion, with unemployment quickly rising from its cycle lows (Determine 14) and the Federal Reserve set to start an easing cycle within the coming months, traders ought to take the chance to high-grade their portfolios.

Determine 14 – Unemployment has been quickly rising in current months (St. Louis Fed)

Reasonably than chase the trailing 7.6% distribution yield of the LONZ ETF, a greater various could also be to clip a 6.4% yield from JAAA, which holds principally AAA-rated securities (Determine 15).

Determine 15 – LONZ vs. BKLN, JAAA, and JBBB ETF, distribution yields (In search of Alpha)

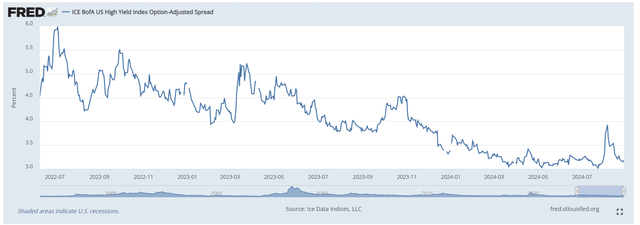

Whereas the LONZ ETF has definitely outperformed JAAA since June 2022, that is totally on the again of tightening high-yield credit score spreads, which have collapsed from near-6% in July 2022 to three.2% at present (Determine 16).

Determine 16 – Excessive-yield credit score spreads have collapsed to cycle-lows (St. Louis Fed)

If the financial system have been to proceed to weaken within the coming quarters, credit score spreads would inevitably widen and negatively influence the non-investment grade leveraged loans inside LONZ’s portfolio.

Conclusion

The LONZ ETF is an actively managed portfolio of leveraged loans and different floating-rate securities. Traditionally, the LONZ ETF has outperformed the passive BKLN ETF. Nevertheless, I consider LONZ’s outperformance is usually as a result of modest inside leverage employed by the supervisor and the upper credit score danger in its portfolio. Adjusted for leverage, LONZ’s efficiency is just about equivalent to the passive BKLN ETF.

With a potential financial slowdown on the horizon, I like to recommend traders high-grade their portfolios. As a substitute of the LONZ ETF, traders might need to take into account CLO ETFs just like the JAAA or JBBB ETFs which have structural credit score enhancements to guard traders. I charge LONZ a maintain.